Florida Auto Insurance Rate

In the Sunshine State, Florida, auto insurance rates are a topic of great interest and importance for both residents and visitors alike. With a unique no-fault insurance system and a highly regulated market, understanding the factors that influence rates can be crucial for individuals seeking affordable coverage. This comprehensive guide aims to delve into the intricacies of Florida auto insurance rates, shedding light on the key elements that shape the cost of car insurance in this vibrant state.

Unraveling the Complexities of Florida Auto Insurance Rates

Florida’s auto insurance landscape is complex, shaped by a combination of state regulations, market forces, and unique regional factors. Understanding these intricacies is essential for drivers to navigate the system effectively and secure the best coverage at the most competitive rates.

The Influence of Florida’s No-Fault System

One of the defining features of Florida’s auto insurance market is its no-fault system. Implemented to streamline the claims process and reduce litigation, this system requires drivers to carry Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages after an accident, regardless of fault. While this system has its advantages, it also introduces complexities that can impact insurance rates.

For instance, the mandatory PIP coverage adds a fixed cost to every policy, influencing the overall rate structure. Moreover, the no-fault system can lead to higher claims frequencies, as it encourages individuals to seek medical attention and file claims for minor injuries. This increased claims activity can drive up insurance costs for all drivers in the state.

Regional Variations in Rates

Florida’s diverse geography and population distribution result in significant regional variations in auto insurance rates. Urban areas like Miami, Tampa, and Orlando often have higher rates due to factors such as dense traffic, higher accident rates, and a greater prevalence of fraud. In contrast, rural areas may enjoy lower rates due to reduced traffic and fewer claims.

For instance, a study by InsuranceQuotes revealed that Miami had the highest average annual premium in Florida, at around $2,500, while rural areas like Madison County had significantly lower rates, averaging around $1,200 annually. These variations highlight the importance of understanding regional factors when shopping for auto insurance in Florida.

The Role of Personal Factors in Rate Determination

Beyond regional considerations, personal factors play a pivotal role in determining auto insurance rates in Florida. Insurance companies use a variety of criteria to assess risk and set premiums, including:

- Driving History: A clean driving record with no accidents or violations can lead to lower rates. Conversely, a history of accidents or traffic citations can significantly increase premiums.

- Age and Gender: Younger drivers, particularly males, often face higher rates due to their higher propensity for accidents. Older, more experienced drivers may enjoy lower rates.

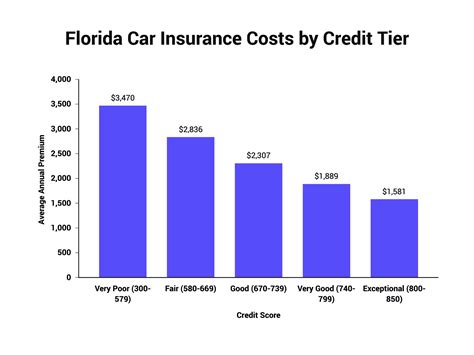

- Credit Score: In Florida, insurance companies are allowed to consider credit-based insurance scores when setting rates. A good credit score can lead to lower premiums, while a poor score may result in higher costs.

- Vehicle Type: The make, model, and year of a vehicle can impact rates. Sports cars and luxury vehicles, for instance, often carry higher premiums due to their higher repair costs and increased risk of theft.

It's important to note that while these personal factors are significant, Florida law prohibits insurance companies from considering race, religion, or marital status when setting rates.

Comparing Coverage Options and Providers

With a highly competitive auto insurance market, Florida drivers have a plethora of coverage options and insurance providers to choose from. It’s crucial to compare policies and providers to find the best fit for your needs and budget.

When comparing coverage options, consider the minimum required coverage in Florida, which includes $10,000 in PIP coverage, $10,000 in property damage liability, and $10,000 in bodily injury liability per person/$20,000 per accident. However, many experts recommend carrying higher limits to provide adequate protection in the event of a serious accident.

Additionally, Florida drivers can choose from a variety of optional coverages, such as collision, comprehensive, uninsured/underinsured motorist coverage, and medical payments coverage. These coverages can provide added protection and peace of mind but also increase the overall cost of the policy.

When selecting an insurance provider, consider factors such as reputation, financial stability, customer service, and claims handling. Online reviews and ratings can provide valuable insights, but it's also important to seek recommendations from friends, family, and local agents.

Strategies for Securing Lower Rates

While auto insurance rates in Florida can be influenced by various factors beyond individual control, there are strategies that drivers can employ to potentially secure lower rates:

- Shop Around: Compare quotes from multiple insurance providers to find the best rate for your specific circumstances. Online comparison tools can be a valuable resource.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance.

- Maintain a Clean Driving Record: Avoid accidents and violations to keep your rates low. A single traffic citation can increase your rates significantly.

- Improve Your Credit Score: A higher credit score can lead to lower insurance rates. Focus on timely bill payments and reducing debt to improve your score over time.

- Choose a Higher Deductible: Opting for a higher deductible can reduce your premium, but ensure you can afford the out-of-pocket expense in the event of a claim.

The Future of Auto Insurance Rates in Florida

Looking ahead, the future of auto insurance rates in Florida is likely to be influenced by a range of factors, including technological advancements, regulatory changes, and shifts in the insurance market.

The Rise of Telematics and Usage-Based Insurance

One of the most significant trends shaping the future of auto insurance rates is the adoption of telematics and usage-based insurance (UBI). Telematics devices, which track driving behavior and transmit data to insurance companies, allow insurers to more accurately assess risk and set premiums based on actual driving habits.

With UBI, drivers who exhibit safe driving behaviors, such as maintaining a steady speed, avoiding sudden stops, and driving during low-risk hours, can potentially receive discounts on their insurance premiums. Conversely, those who engage in risky behaviors may see their rates increase. This pay-as-you-drive model has the potential to revolutionize the auto insurance industry, offering a more fair and accurate assessment of risk.

Regulatory Changes and Market Dynamics

Florida’s auto insurance market is subject to ongoing regulatory changes and market dynamics that can impact rates. For instance, changes to the state’s no-fault system or reforms aimed at reducing fraud could lead to more stable and affordable insurance rates.

Additionally, the competitive nature of the market can drive insurers to offer more innovative products and services, potentially leading to increased customer satisfaction and more competitive rates. However, market consolidation or changes in the economic landscape could also impact the balance of power between insurers and consumers, influencing the overall cost of auto insurance.

The Impact of Autonomous Vehicles and Electric Cars

The advent of autonomous vehicles (AVs) and the growing popularity of electric cars (EVs) are likely to have a significant impact on auto insurance rates in the future. AVs, with their advanced safety features and reduced accident rates, could lead to lower insurance premiums as the risk of human error is minimized.

Similarly, EVs, which are often equipped with advanced safety technologies and have lower maintenance costs, could also result in reduced insurance rates over time. However, the initial cost of insuring these vehicles may be higher due to their expensive repair and replacement parts.

Conclusion: Navigating the Florida Auto Insurance Landscape

Florida’s auto insurance market is complex and influenced by a myriad of factors, from regional variations and personal circumstances to regulatory frameworks and technological advancements. Understanding these factors is crucial for drivers seeking to navigate this landscape and secure the best coverage at the most competitive rates.

By staying informed about the latest trends, comparing coverage options, and employing strategies to reduce rates, Florida drivers can take control of their auto insurance costs and make informed decisions that align with their needs and budget. As the future of auto insurance unfolds, with the rise of telematics, autonomous vehicles, and electric cars, the landscape is likely to become even more dynamic, offering both challenges and opportunities for drivers and insurers alike.

How often should I review my auto insurance policy in Florida?

+It’s generally recommended to review your auto insurance policy at least once a year. This allows you to stay up-to-date with any changes in your personal circumstances, such as a clean driving record or a new vehicle, which could lead to lower rates. Additionally, reviewing your policy annually gives you the opportunity to compare rates and coverage options from different providers, ensuring you’re getting the best value for your money.

Can I get auto insurance in Florida if I have a poor driving record?

+Yes, even with a poor driving record, you can still obtain auto insurance in Florida. However, your rates are likely to be higher due to the increased risk associated with your driving history. It’s important to shop around and compare quotes from multiple insurers, as rates can vary significantly between providers. Additionally, consider taking steps to improve your driving record, such as completing a defensive driving course, which may help reduce your premiums over time.

What are some common discounts available for auto insurance in Florida?

+Florida drivers can take advantage of a variety of discounts to reduce their auto insurance premiums. Common discounts include those for good driving records, multiple vehicles insured with the same provider, policy renewals, and safety features installed in the vehicle, such as anti-theft devices or advanced driver assistance systems. Additionally, some insurers offer discounts for completing defensive driving courses or maintaining a good credit score.