Florida Dept Of Insurance License Lookup

The Florida Department of Insurance is an essential regulatory body responsible for overseeing the insurance industry within the state. Its primary mission is to protect consumers and ensure a fair and competitive marketplace for insurance services. One of the crucial tools at its disposal is the Florida Insurance Agent and Agency Search, a comprehensive online database that allows the public to verify the legitimacy and licensure status of insurance professionals and companies operating in Florida.

Understanding the Florida Insurance Agent and Agency Search

The Florida Insurance Agent and Agency Search is a publicly accessible platform designed to empower consumers with the information they need to make informed decisions about their insurance needs. It serves as a vital resource for anyone seeking to verify the credentials of insurance agents, brokers, and companies, ensuring that they are dealing with licensed and reputable entities.

This online search tool is particularly beneficial for individuals who want to:

- Verify the license status of an insurance agent or company.

- Check for any disciplinary actions or complaints against a licensee.

- Ensure that an insurance professional is properly qualified to offer advice on specific types of insurance coverage.

- Research and compare different insurance companies and agents before making a purchase decision.

Key Features of the Florida Insurance Agent and Agency Search

The search platform offers a user-friendly interface, making it easy for individuals to conduct their inquiries. Here are some of its notable features:

- Licensee Search: Users can search by licensee name, license number, or company name to quickly find and verify the licensure status of insurance professionals and companies.

- Detailed Licensee Information: The search results provide comprehensive details about each licensee, including their license type, status, expiration date, and any endorsements or appointments they hold.

- Disciplinary Actions: The platform discloses any disciplinary actions taken against licensees, offering transparency to consumers.

- License Renewal Dates: Users can check the renewal dates of licenses to ensure they are dealing with active and up-to-date professionals.

- Complaint History: Access to information about complaints filed against licensees, including their resolution, helps consumers make informed choices.

Step-by-Step Guide to Using the Florida Insurance Agent and Agency Search

Using the Florida Insurance Agent and Agency Search is straightforward and accessible to all. Here’s a detailed guide to help you navigate the platform effectively:

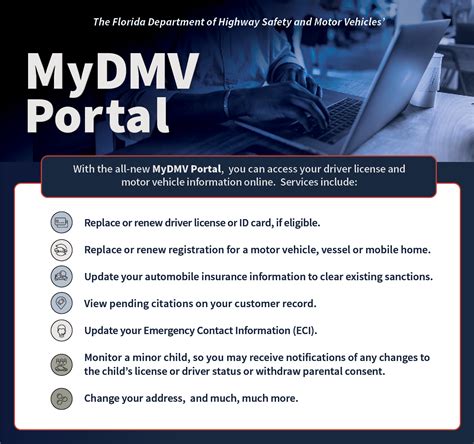

- Access the Search Platform: Visit the official Florida Department of Insurance website and navigate to the Agent and Agency Search page. You can also use the direct link: https://myfloridacfo.com/division/agentsearch.

- Select Your Search Type: On the search page, you'll see two main search options:

- Individual Licensees: Choose this option if you want to search for an insurance agent or broker.

- Companies: Select this if you're looking for information about an insurance company.

- Enter Your Search Criteria: Depending on your selected search type, you'll be prompted to enter specific details:

- For Individual Licensees, you can search by last name, first name, license number, or National Producer Number (NPN).

- For Companies, you can search by company name, company code, or company identification number.

- Review Search Results: Once you've entered your search criteria and clicked Search, the platform will display a list of matching results.

- Each result will provide essential details about the licensee or company, including their name, license type, status, and any additional relevant information.

- You can click on the Details link to access more comprehensive information about the licensee or company.

- View Licensee Details: By clicking on the Details link, you'll be directed to a comprehensive profile of the licensee or company. This profile includes:

- License Information: Details about the license, such as type, status, expiration date, and any appointments or endorsements.

- Disciplinary Actions: A history of any disciplinary actions taken against the licensee, including the action taken and the date.

- Complaint History: Information about any complaints filed against the licensee, including the complaint type, date, and status.

- Additional Details: Other relevant information, such as the licensee's mailing address, appointment date, and more.

- Print or Save Results: If you need to retain the information for future reference, you can print or save the search results or licensee profile by using your browser's built-in print or save options.

Tips for Effective Searches

To ensure accurate and efficient searches, consider the following tips:

- Use as many specific details as possible when entering your search criteria, such as full names or license numbers.

- If you're unsure of the exact spelling or details, try different variations or use wildcard characters (* or %).

- Review the search results carefully, as multiple individuals or companies may have similar names or details.

- If you can't find the information you need, consider contacting the Florida Department of Insurance for further assistance.

The Importance of License Verification

Verifying the licensure and credibility of insurance professionals and companies is a critical step in safeguarding your insurance needs. Here’s why it’s essential:

- Consumer Protection: By checking license statuses and disciplinary actions, you can ensure that you're dealing with legitimate and reputable individuals or companies, reducing the risk of fraud or unscrupulous practices.

- Legal Compliance: Working with licensed professionals ensures that your insurance policies and transactions are legally compliant, protecting you from potential legal issues.

- Peace of Mind: Knowing that your insurance agent or company is licensed and has a clean disciplinary record provides peace of mind, allowing you to focus on your insurance coverage needs without worry.

- Informed Decisions: Access to comprehensive information about licensees empowers you to make informed choices about your insurance, ensuring that you receive the best possible coverage and service.

Conclusion: Empowering Consumers with Knowledge

The Florida Insurance Agent and Agency Search is a powerful tool that puts the power of information directly into the hands of consumers. By leveraging this resource, individuals can take an active role in protecting their insurance interests, ensuring that they receive the best possible service and coverage from licensed and reputable professionals.

As the insurance landscape continues to evolve, the ability to verify the legitimacy of insurance agents and companies remains a crucial aspect of consumer empowerment and protection. With the Florida Insurance Agent and Agency Search, Floridians can navigate the insurance marketplace with confidence, making informed decisions that safeguard their financial well-being.

FAQ

How often should I check the license status of my insurance agent or company?

+It’s a good practice to verify the license status of your insurance agent or company at least annually, especially before any significant policy changes or renewals. This ensures that you are dealing with a current and active licensee.

What should I do if I find disciplinary actions against my insurance agent or company?

+If you discover disciplinary actions against your insurance agent or company, it’s important to carefully review the details. Depending on the severity and nature of the actions, you may want to consider seeking advice from an independent insurance professional or legal expert. You can also contact the Florida Department of Insurance for guidance.

Can I trust insurance agents or companies with a history of complaints?

+While a history of complaints does not necessarily mean an agent or company is unreliable, it’s important to approach such situations with caution. Carefully review the details of the complaints and consider seeking additional information from independent sources. If you have concerns, you may want to explore alternative insurance options.