Florida Flood Insurance

As the sun-soaked state of Florida is renowned for its beautiful beaches, vibrant cities, and diverse ecosystems, it is also no stranger to the threat of flooding. From tropical storms to heavy rainfall, the region's unique geography makes it susceptible to water-related disasters. This article delves into the world of Florida flood insurance, exploring its necessity, the coverage it provides, and the steps you can take to ensure your property and belongings are protected.

Understanding the Flood Risk in Florida

Florida's geography presents a unique set of challenges when it comes to flooding. With its low-lying coastal areas, abundant wetlands, and network of rivers and lakes, the state is inherently vulnerable to water accumulation. Add to this the frequent occurrence of tropical storms and hurricanes, and you have a recipe for potential flooding disasters.

The impact of flooding can be devastating. Not only does it pose a risk to human life and property, but it can also disrupt ecosystems, infrastructure, and the economy. The financial implications of flooding are significant, with damage to homes, businesses, and public facilities often running into the millions. This is where flood insurance steps in as a crucial safety net.

The Importance of Florida Flood Insurance

Flood insurance is a specialized form of coverage that protects property owners and renters from the financial losses incurred due to flooding. Unlike standard homeowners or renters insurance policies, which typically exclude flood damage, Florida flood insurance is specifically designed to cover this unique risk.

The importance of flood insurance in Florida cannot be overstated. The state's history is riddled with devastating floods, from the historic floods of 1947 and 1948 to more recent events like Hurricane Irma in 2017. These incidents highlight the reality that flooding is not a distant possibility but a very real threat that can strike at any time.

By investing in flood insurance, property owners and renters can safeguard their financial well-being. This insurance provides coverage for a wide range of flood-related damages, including damage to the structure of a home, its contents, and additional living expenses if the property becomes uninhabitable due to flooding.

The National Flood Insurance Program (NFIP)

The primary provider of flood insurance in the United States is the National Flood Insurance Program (NFIP), which is administered by the Federal Emergency Management Agency (FEMA). The NFIP offers flood insurance to property owners, renters, and businesses located in participating communities, which includes most areas of Florida.

The NFIP is designed to provide an affordable and accessible way for individuals to protect their properties from flood damage. It offers two main types of policies: the Standard Flood Insurance Policy (SFIP) and Preferred Risk Policies (PRPs). The SFIP is suitable for high-risk areas, while PRPs are available for low-to-moderate risk areas and offer a more affordable premium.

Why Florida Residents Need Flood Insurance

Given the state's geographical characteristics and its history of flooding, Florida residents face a significantly higher risk of flood damage compared to many other regions. Here are some key reasons why Florida flood insurance is a necessity:

- Frequency of Flooding: Florida experiences frequent heavy rainfall and tropical storms, which often lead to flooding. The state's flat topography means that water has nowhere to drain quickly, increasing the risk of flooding.

- Low-Lying Coastal Areas: Many of Florida's most populous cities and residential areas are located along the coast, making them susceptible to storm surges and coastal flooding.

- Hurricane Threats: The state is regularly hit by hurricanes and tropical storms, which can cause extensive flooding and damage. Hurricane season in Florida runs from June to November, and the potential for devastating floods is always present.

- Environmental Factors: Florida's unique environment, including its wetlands and river systems, can contribute to flooding. For example, heavy rainfall can cause rivers to overflow, and wetlands can become saturated, leading to water backing up into residential areas.

Without flood insurance, property owners and renters in Florida face the risk of incurring substantial financial losses in the event of a flood. The cost of repairing flood damage can be prohibitive, and many standard insurance policies do not cover this type of damage. This is why Florida flood insurance is a critical investment for those who call the Sunshine State home.

What Does Florida Flood Insurance Cover?

Florida flood insurance policies typically cover a wide range of damages and losses that result from flooding. The specific coverage details can vary depending on the type of policy and the insurance provider, but here are some of the key elements:

Building Coverage

Building coverage, also known as structural coverage, protects the physical structure of your home or building. This includes the walls, floors, ceilings, foundations, and any permanent fixtures such as built-in cabinets or appliances. It covers damage caused by flooding, including water damage to the structure itself and the cost of repairs or replacements.

| Building Coverage | Coverage Details |

|---|---|

| Walls | Covers damage to interior and exterior walls due to floodwaters. |

| Floors | Protects against flooding that damages floors, including hardwood, tile, or carpet. |

| Ceilings | Provides coverage for ceiling damage caused by water intrusion. |

| Foundations | Covers foundation cracks, shifting, or other structural damage from flooding. |

| Fixtures | Protects built-in fixtures like cabinets, permanent lighting, and plumbing. |

Contents Coverage

Contents coverage, also known as personal property coverage, protects your personal belongings within the insured property. This includes furniture, clothing, electronics, appliances, and other items you own. It covers damage or loss of these items due to flooding.

| Contents Coverage | Coverage Details |

|---|---|

| Furniture | Protects sofas, beds, chairs, tables, and other furniture items. |

| Clothing | Covers damage or loss of clothing, including expensive designer items. |

| Electronics | Protects TVs, computers, gaming consoles, and other electronic devices. |

| Appliances | Covers refrigerators, washing machines, dryers, and other large appliances. |

| Valuables | Provides coverage for jewelry, artwork, collectibles, and other valuable items. |

Additional Living Expenses (ALE)

If your home becomes uninhabitable due to flood damage and you need to temporarily relocate, additional living expenses (ALE) coverage can help. It reimburses you for the cost of temporary housing, meals, and other necessary expenses until your home is repaired or you find a new permanent residence.

| Additional Living Expenses (ALE) | Coverage Details |

|---|---|

| Temporary Housing | Covers the cost of renting a temporary residence, including apartments or hotels. |

| Meals | Reimburses the cost of meals consumed away from home during the temporary relocation. |

| Other Expenses | Provides coverage for other necessary expenses, such as transportation costs or storage fees. |

Business Interruption Coverage

For businesses, Florida flood insurance often includes business interruption coverage. This type of coverage helps businesses recover from financial losses incurred during a flood. It can cover lost income, additional expenses incurred due to the flood, and the cost of relocating or restarting the business.

| Business Interruption Coverage | Coverage Details |

|---|---|

| Lost Income | Reimburses the business for income lost during the period of disruption caused by the flood. |

| Additional Expenses | Covers extra costs incurred due to the flood, such as renting temporary office space or hiring temporary staff. |

| Relocation and Restart Costs | Provides coverage for the costs associated with relocating the business or restarting operations after a flood. |

How to Obtain Florida Flood Insurance

Obtaining Florida flood insurance is a straightforward process, but it does require some research and planning. Here's a step-by-step guide to help you navigate the process:

Step 1: Understand Your Flood Risk

The first step is to assess your flood risk. FEMA maintains a Flood Insurance Rate Map (FIRM) that outlines flood zones and risk levels for different areas. You can access this map through FEMA's website or by contacting your local floodplain management office. Understanding your flood risk will help you determine the level of coverage you need.

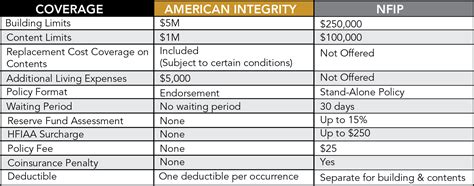

Step 2: Choose the Right Insurance Provider

Florida is served by a variety of insurance providers that offer flood insurance policies. It's important to compare different providers based on their coverage options, pricing, and customer service. You can research and request quotes from multiple providers to find the best fit for your needs.

Step 3: Apply for a Policy

Once you've chosen an insurance provider, you can apply for a flood insurance policy. The application process typically involves providing personal information, details about your property, and any additional coverage options you wish to include. It's essential to provide accurate information to ensure your policy is valid and provides the right level of coverage.

Step 4: Review and Understand Your Policy

After receiving your policy, take the time to review it carefully. Understand the coverage limits, deductibles, and any exclusions or limitations. Ensure that you are comfortable with the terms and conditions and that the policy meets your specific needs. If you have any questions or concerns, don't hesitate to reach out to your insurance provider for clarification.

Step 5: Maintain Your Policy

Flood insurance is an ongoing commitment. To ensure continuous coverage, it's important to maintain your policy by paying your premiums on time. Regularly review your policy to ensure it remains up-to-date and aligned with your needs. Consider reviewing your coverage annually, especially if you make significant changes to your property or if your flood risk assessment changes.

FAQs

What is the National Flood Insurance Program (NFIP)?

+The NFIP is a federal program that provides flood insurance to property owners and renters in the United States. It is administered by FEMA and offers affordable flood insurance to communities that participate in the program.

<div class="faq-item">

<div class="faq-question">

<h3>Is flood insurance mandatory in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While flood insurance is not legally mandatory for all property owners in Florida, it is highly recommended. The state's high flood risk makes flood insurance a crucial investment to protect your financial well-being.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How much does Florida flood insurance cost?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The cost of Florida flood insurance varies depending on several factors, including the location of your property, its flood risk, the coverage limits you choose, and the insurance provider. On average, flood insurance policies in Florida can range from a few hundred dollars to several thousand dollars annually.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I get flood insurance if I live in a high-risk flood zone?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, flood insurance is available for properties located in high-risk flood zones. The NFIP offers Standard Flood Insurance Policies (SFIPs) specifically designed for these areas. While the premiums may be higher, it's essential to have adequate coverage to protect your property.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What should I do if my property is damaged by flooding and I have flood insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If your property is damaged by flooding and you have flood insurance, you should take the following steps: Contact your insurance provider as soon as possible to report the claim. Document the damage by taking photos and videos. Create a detailed inventory of damaged items. Follow the instructions provided by your insurance company for filing the claim and providing necessary documentation.</p>

</div>

</div>