Foremost Insurance Payments

Welcome to a comprehensive guide on the Foremost Insurance company's payment options and processes. In today's fast-paced world, efficient and convenient payment methods are essential, especially when it comes to insurance. Foremost Insurance understands this and offers a range of payment options to cater to its customers' needs. This article will delve into the various payment methods, their benefits, and how they streamline the insurance experience for policyholders.

The Importance of Convenient Payment Options

Convenience and flexibility are key factors when choosing an insurance provider. Foremost Insurance recognizes this and strives to provide its customers with a seamless and hassle-free payment experience. By offering multiple payment options, the company ensures that policyholders can choose the method that suits them best, making insurance payments a breeze.

Foremost Insurance’s Payment Methods

Foremost Insurance has implemented a diverse range of payment methods to cater to the preferences and needs of its diverse customer base. Here’s an in-depth look at each of these options, complete with their advantages and how they enhance the overall customer experience.

Online Payments: The Digital Advantage

In the digital age, online payments have become the go-to choice for many individuals and businesses. Foremost Insurance understands the convenience and security that online payments offer and has thus developed a user-friendly online platform for its customers.

With the Foremost Insurance online payment system, policyholders can access their accounts and manage their payments with just a few clicks. The platform provides a secure and encrypted environment, ensuring that sensitive financial information remains protected. Here are some key features and benefits of online payments:

- 24/7 Accessibility: Policyholders can make payments at any time, from anywhere, eliminating the need to wait for business hours.

- Real-Time Updates: Online payments provide immediate updates, allowing customers to view their payment status and account balance instantly.

- Paperless Transactions: Online payments reduce the reliance on paper statements and checks, promoting a more sustainable and eco-friendly approach.

- Flexible Payment Options: Customers can choose from various payment methods, including credit/debit cards, electronic checks, and even digital wallets, providing ultimate convenience.

- Automated Reminders: Foremost Insurance's online system sends automated reminders and notifications, ensuring that policyholders never miss a payment.

Mobile Payments: Convenience on the Go

Foremost Insurance understands that its customers lead busy lives and often require payment options that fit into their on-the-go lifestyles. This is where mobile payments come into play. The company has developed a mobile app specifically designed to cater to the needs of mobile users.

The Foremost Insurance mobile app offers a seamless and secure payment experience, allowing policyholders to manage their insurance payments directly from their smartphones. Here's what you can expect from mobile payments:

- Quick and Easy Transactions: With just a few taps, policyholders can make payments, view their policy details, and access important documents.

- Push Notifications: The app sends push notifications to remind users of upcoming payments, ensuring timely transactions.

- Touch ID/Face ID: For added security, the app supports biometric authentication, making it convenient and secure to access account information.

- Location-Based Services: The app can provide location-specific services, offering tailored insurance options and discounts based on the user's location.

- Real-Time Customer Support: The app integrates a live chat feature, providing instant assistance and resolving any payment-related queries.

Automatic Payments: Set and Forget

For those who prefer a hands-off approach to insurance payments, Foremost Insurance offers automatic payment options. This feature allows policyholders to set up recurring payments, ensuring that their insurance premiums are paid on time without any manual intervention.

Automatic payments are a great way to avoid late fees and maintain a consistent payment schedule. Here's how the process works:

- Authorization: Policyholders provide authorization for Foremost Insurance to deduct payments from their chosen account (e.g., bank account, credit/debit card) on a specified date.

- Flexibility: Customers can choose the frequency of payments, such as monthly, quarterly, or annually, depending on their preference.

- Notification: Prior to each payment, Foremost Insurance sends a notification to the policyholder, providing details of the upcoming transaction.

- Paperless Convenience: Automatic payments eliminate the need for paper checks and manual processes, making it an eco-friendly and efficient option.

- Peace of Mind: With automatic payments, policyholders can focus on other aspects of their lives, knowing that their insurance payments are taken care of.

Mail-In Payments: A Traditional Approach

While digital and automated payments are the preferred choices for many, some individuals still prefer the traditional method of mail-in payments. Foremost Insurance acknowledges this preference and provides a simple and straightforward process for mailing in payments.

Policyholders can send their payments via mail to the designated address, along with the necessary payment stubs and information. Here's what you need to know about mail-in payments:

- Payment Options: Customers can pay via personal checks, money orders, or even cash (although cash payments are not recommended due to security concerns).

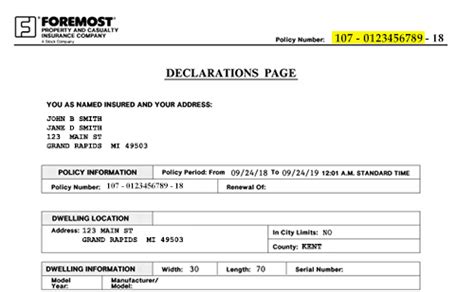

- Payment Stubs: It's important to include the correct payment stub or invoice with your payment to ensure that it is processed accurately.

- Timely Delivery: To avoid late fees, it's recommended to send your payment at least 7-10 days before the due date, allowing for processing time.

- Tracking: For added security, consider using a trackable mailing service to ensure that your payment reaches its destination.

- Confirmation: Once your payment is received and processed, Foremost Insurance will send a confirmation notice to your registered email address.

Phone Payments: Personalized Assistance

For those who prefer a more personalized approach, Foremost Insurance offers phone payment options. Policyholders can contact the company’s customer service team and make payments over the phone.

The phone payment process provides a human touch, allowing customers to discuss their payment options and receive guidance from trained professionals. Here's what you can expect:

- Customer Service Hotline: Foremost Insurance provides a dedicated customer service hotline, which is accessible during business hours.

- Payment Methods: Customers can pay via credit/debit cards or electronic checks over the phone.

- Real-Time Assistance: Trained customer service representatives guide policyholders through the payment process, answering any queries and providing support.

- Payment Confirmation: Upon completion of the payment, the representative will provide a confirmation number and send a confirmation email to the policyholder.

- Payment Receipt: Policyholders can request a payment receipt to be sent via email or regular mail, providing a physical record of the transaction.

Paying at a Foremost Insurance Office: Face-to-Face Convenience

Foremost Insurance understands that some customers prefer face-to-face interactions when it comes to financial matters. To cater to this preference, the company maintains physical offices across various locations.

Policyholders can visit their nearest Foremost Insurance office and make payments in person. This option provides a personalized experience and allows for direct communication with insurance experts. Here's what you need to know about paying at a Foremost Insurance office:

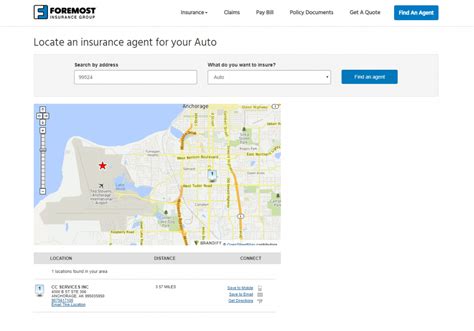

- Office Locator: Foremost Insurance's website provides an office locator tool, making it easy to find the nearest branch.

- Payment Options: Customers can pay via cash, check, or credit/debit card at the office.

- Expert Assistance: Insurance professionals are available to provide guidance and answer any payment-related questions.

- Payment Receipt: Upon making a payment, customers receive a physical receipt as proof of transaction.

- Extended Hours: Some Foremost Insurance offices offer extended hours, providing added convenience for customers with busy schedules.

The Benefits of Foremost Insurance’s Payment Options

Foremost Insurance’s diverse range of payment options offers numerous benefits to its policyholders. Here’s a summary of the advantages that make these payment methods stand out:

- Convenience: Policyholders can choose the payment method that best fits their lifestyle, whether it's online, mobile, automatic, or traditional mail-in payments.

- Flexibility: The variety of payment options ensures that customers can pay when and how they prefer, with multiple payment frequencies and methods available.

- Security: Foremost Insurance prioritizes security, offering encrypted online and mobile platforms, secure automatic payment processes, and safe in-office transactions.

- Peace of Mind: With timely reminders, confirmation notices, and personalized assistance, policyholders can rest assured that their insurance payments are managed efficiently and accurately.

- Eco-Friendliness: The digital payment options reduce reliance on paper statements and checks, contributing to a more sustainable and environmentally conscious approach.

The Impact of Efficient Payment Methods on Insurance Experience

Foremost Insurance’s commitment to providing a wide range of payment options has a significant impact on the overall insurance experience for its policyholders. Here’s how efficient payment methods enhance the customer journey:

- Customer Satisfaction: By offering multiple payment options, Foremost Insurance ensures that customers can choose the method that suits their preferences and needs, leading to higher satisfaction levels.

- Reduced Late Fees: The various payment options, especially automatic payments and timely reminders, help policyholders avoid late fees, ensuring a more positive financial experience.

- Efficient Policy Management: The online and mobile platforms provide easy access to policy details, allowing customers to manage their insurance policies effectively and make informed decisions.

- Enhanced Customer Engagement: The personalized assistance and real-time support offered through phone and in-office payments foster stronger customer relationships and increase engagement.

- Brand Reputation: Foremost Insurance's commitment to customer convenience and satisfaction contributes to a positive brand reputation, attracting new customers and retaining existing ones.

Future Implications and Innovations

As technology continues to advance, Foremost Insurance remains committed to staying at the forefront of payment innovations. The company is constantly exploring new methods and technologies to enhance the payment experience for its customers.

Here's a glimpse into the future of Foremost Insurance's payment options:

- Biometric Authentication: Foremost Insurance may introduce more advanced biometric authentication methods, such as fingerprint or facial recognition, to enhance security and provide a seamless login experience for online and mobile payments.

- Blockchain Integration: The company is exploring the potential of blockchain technology to further secure and streamline payment processes, ensuring faster and more transparent transactions.

- Chatbots and AI Assistance: Foremost Insurance aims to integrate chatbots and artificial intelligence into its customer service platforms, providing 24/7 assistance and resolving common payment-related queries instantly.

- Digital Currency Acceptance: With the rise of digital currencies, Foremost Insurance may consider accepting cryptocurrencies as a payment method, catering to the preferences of tech-savvy customers.

- Personalized Payment Plans: The company is working towards developing personalized payment plans based on individual customer needs, offering flexible and tailored payment options to suit different financial situations.

Foremost Insurance's dedication to innovation ensures that its payment methods will continue to evolve, providing customers with the most advanced and convenient options in the insurance industry.

Conclusion

Foremost Insurance’s comprehensive range of payment options showcases its commitment to customer convenience and satisfaction. Whether it’s the digital convenience of online and mobile payments, the peace of mind offered by automatic payments, or the traditional approach of mail-in and in-office payments, Foremost Insurance ensures that policyholders can choose the method that works best for them.

By providing a diverse set of payment options, Foremost Insurance enhances the overall insurance experience, fostering stronger customer relationships and a positive brand reputation. As the company continues to innovate and adapt to technological advancements, policyholders can look forward to an even more seamless and secure payment experience in the future.

How do I set up automatic payments for my Foremost Insurance policy?

+

To set up automatic payments, you can visit the Foremost Insurance website and log into your online account. From there, you can navigate to the payment section and choose the automatic payment option. You will be prompted to provide your bank account or credit/debit card details and select the payment frequency. Once set up, Foremost Insurance will automatically deduct the premium amount on the specified due date.

Are there any fees associated with online or mobile payments?

+

No, Foremost Insurance does not charge any additional fees for online or mobile payments. These payment methods are designed to provide convenience and ease of use without any extra costs.

Can I make a partial payment for my Foremost Insurance policy?

+

Yes, Foremost Insurance allows policyholders to make partial payments. This option is especially useful for those who prefer to manage their payments in installments. You can contact Foremost Insurance’s customer service team to discuss the partial payment process and any associated terms.

What security measures does Foremost Insurance implement for online and mobile payments?

+

Foremost Insurance takes the security of its customers’ financial information very seriously. The online and mobile platforms are protected by advanced encryption technologies, ensuring that all data transmitted is secure. Additionally, the company regularly monitors its systems for any potential vulnerabilities and implements robust security protocols to safeguard customer information.