Free Insurance Quotes Car

The process of obtaining free insurance quotes for your car can be a daunting task, especially with the myriad of options available in the market. However, with the right approach and knowledge, you can navigate the process efficiently and find the best coverage for your vehicle. This comprehensive guide will walk you through the steps to get free insurance quotes, providing valuable insights and tips to make informed decisions about your car insurance.

Understanding the Need for Car Insurance Quotes

Car insurance is a crucial aspect of vehicle ownership, providing financial protection in case of accidents, theft, or other unforeseen events. Obtaining quotes allows you to compare different insurance providers, their coverage options, and premium costs. This comparison ensures you find a policy that suits your specific needs and budget without compromising on essential coverage.

Factors Influencing Car Insurance Quotes

Several factors play a role in determining the cost of your car insurance. These include your driving history, the make and model of your vehicle, the area you live in, and any additional features or endorsements you wish to include in your policy. Understanding these factors can help you tailor your insurance search and potentially negotiate better rates.

For instance, a clean driving record with no accidents or violations can lead to lower insurance premiums. Similarly, newer vehicles with advanced safety features may be eligible for discounts. By being aware of these influences, you can make strategic choices when obtaining quotes.

| Factor | Impact on Insurance |

|---|---|

| Driving Record | Affects premiums; clean record may lead to discounts. |

| Vehicle Type | Make and model influence rates; newer cars with safety features may offer discounts. |

| Location | Rates vary by area; urban areas may have higher premiums due to increased risk. |

| Endorsements | Additional coverage options can impact the overall cost of the policy. |

Step-by-Step Guide to Getting Free Insurance Quotes

To ensure you receive accurate and comprehensive quotes, follow these steps:

Step 1: Research and Prepare

Before you begin, gather the necessary information about your vehicle, driving history, and any specific coverage requirements. This preparation will streamline the quote process and ensure you provide accurate details to insurance providers.

Additionally, familiarize yourself with the different types of car insurance coverage available. This includes liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Understanding these options will help you choose the right level of protection for your needs.

Step 2: Utilize Online Comparison Tools

Numerous online platforms offer free insurance quote comparisons. These tools allow you to input your details once and receive multiple quotes from various providers. This saves time and provides a convenient way to assess different options side by side.

When using these platforms, pay attention to the details provided in each quote. Look for the coverage limits, deductibles, and any additional features or exclusions. Compare these aspects across different quotes to identify the best value for your money.

Step 3: Contact Insurance Providers Directly

While online comparison tools are convenient, it’s also beneficial to reach out to insurance providers directly. This allows you to ask specific questions, clarify any doubts, and negotiate potential discounts. Many providers offer discounts for bundling multiple policies or for certain professions or affiliations.

When contacting insurance providers, have your driving record and vehicle information ready. Be transparent about your needs and any specific concerns you may have. This open communication can lead to tailored recommendations and potential cost savings.

Step 4: Evaluate and Compare Quotes

Once you’ve gathered a few quotes, it’s time to evaluate and compare them. Look beyond just the premium costs; consider the coverage limits, deductibles, and any additional benefits or discounts offered. Assess the financial strength and reputation of the insurance providers to ensure they are reliable and capable of meeting your claims.

Create a spreadsheet or use a comparison tool to organize the quotes. List the key details such as coverage limits, deductibles, and premium costs. This visual comparison will help you identify the best overall value and make an informed decision.

Step 5: Review Policy Details and Fine Print

Before finalizing your choice, carefully review the policy details and fine print. Ensure that the coverage you believe you’re receiving is indeed included in the policy. Pay attention to any exclusions or limitations that may impact your coverage in specific situations.

If you have any doubts or questions about the policy, don't hesitate to reach out to the insurance provider for clarification. Understanding the policy inside and out will help you avoid any surprises later on.

Benefits of Obtaining Multiple Car Insurance Quotes

Seeking multiple quotes offers several advantages. Firstly, it allows you to compare prices and coverage options, ensuring you get the best value for your money. Additionally, it provides an opportunity to negotiate better rates or identify unique discounts that may not be readily apparent.

Furthermore, obtaining multiple quotes can help you understand the market and the range of options available. This knowledge empowers you to make informed decisions and choose a policy that aligns with your specific needs and budget.

Common Misconceptions about Car Insurance Quotes

There are several misconceptions surrounding car insurance quotes that can lead to confusion or misunderstandings. Addressing these myths can help you approach the quote process with clarity and confidence.

Myth 1: All Car Insurance Policies Are the Same

Contrary to popular belief, car insurance policies vary significantly between providers. Each insurer offers unique coverage options, endorsements, and discounts. It’s essential to compare these differences to find the policy that best suits your specific needs.

Myth 2: Cheaper Quotes Always Mean Better Value

While a lower premium may be appealing, it’s important to consider the coverage provided. Sometimes, cheaper quotes may have higher deductibles or limited coverage. Assess the overall value of the policy, considering both the premium and the coverage limits.

Myth 3: Quotes Are Final and Cannot Be Negotiated

Many people believe that insurance quotes are set in stone and cannot be negotiated. However, this is not always the case. By discussing your specific needs and circumstances with the insurance provider, you may be able to negotiate better rates or identify additional discounts that apply to your situation.

Tips for Negotiating Better Car Insurance Rates

Negotiating better car insurance rates is possible, and it often comes down to understanding your options and being proactive. Here are some tips to help you secure the best deal:

-

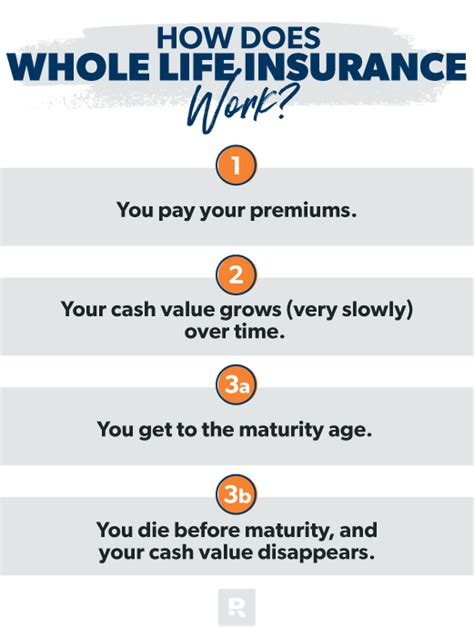

Bundle Policies: Insuring multiple vehicles or combining car insurance with other policies like home or life insurance can lead to significant discounts.

-

Safe Driver Discounts: If you have a clean driving record, inquire about safe driver discounts. These discounts can substantially reduce your premium.

-

Loyalty Rewards: Staying with the same insurance provider for an extended period may qualify you for loyalty discounts or rewards.

-

Membership or Affiliation Discounts: Some insurance providers offer discounts for specific professions, alumni associations, or membership organizations.

-

Telematics or Usage-Based Insurance: Consider insurance programs that use telematics or track your driving behavior. These programs can offer discounts for safe driving practices.

The Future of Car Insurance: Trends and Innovations

The car insurance industry is evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of car insurance:

Usage-Based Insurance (UBI)

UBI programs use telematics devices or smartphone apps to monitor driving behavior and offer personalized insurance rates based on actual driving habits. This innovative approach rewards safe drivers with lower premiums.

Connected Car Technology

As vehicles become more connected, insurance providers are exploring ways to utilize this data. Connected car technology can provide real-time driving data, offering more accurate risk assessments and potentially leading to better insurance rates for safer drivers.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning are transforming the insurance industry. These technologies can analyze vast amounts of data to identify patterns and trends, improving risk assessment and claims handling processes. This leads to more efficient and accurate insurance quotes.

Conclusion: Empowering Your Car Insurance Decision

Obtaining free insurance quotes for your car is a critical step in ensuring you have adequate and affordable coverage. By following the steps outlined in this guide and staying informed about the latest trends and innovations, you can make confident decisions about your car insurance.

Remember, car insurance is not a one-size-fits-all proposition. By researching, comparing, and negotiating, you can find a policy that provides the right level of protection for your vehicle and your budget. Stay proactive, and don't hesitate to reach out to insurance providers for guidance and personalized recommendations.

How often should I review my car insurance quotes and coverage?

+It’s recommended to review your car insurance quotes and coverage annually, or whenever your circumstances change significantly. This ensures your coverage remains up-to-date and reflects any new factors that may impact your insurance needs.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time, but be mindful of any cancellation fees or penalties that may apply. It’s a good idea to compare quotes and understand the full cost of switching before making a decision.

What factors can lead to my car insurance rates changing over time?

+Car insurance rates can be influenced by various factors, including changes in your driving record, the age and value of your vehicle, changes in your location, and even fluctuations in the insurance market. Regularly reviewing your policy and staying informed about these factors can help you anticipate and manage any rate changes.