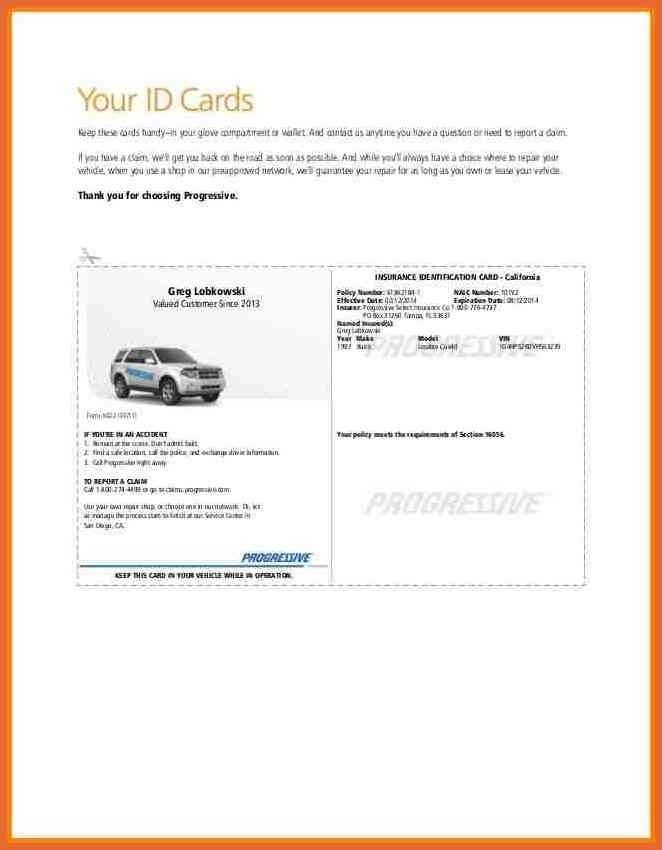

Free Online Quote For Car Insurance

Welcome to a comprehensive guide on the world of car insurance, where we delve into the intricacies of obtaining free online quotes. In today's digital age, the process of securing insurance has evolved, offering convenience and transparency to potential policyholders. This article aims to explore the various aspects of acquiring free car insurance quotes online, shedding light on the benefits, considerations, and potential pitfalls. By understanding the ins and outs of this modern approach, you'll be empowered to make informed decisions and navigate the path to adequate coverage with ease.

The Evolution of Car Insurance Quotes

Gone are the days of relying solely on traditional insurance agents and brokers for car insurance quotes. The digital revolution has ushered in a new era, where consumers can now access a plethora of information and services at their fingertips. The introduction of online car insurance quotes has not only streamlined the process but has also opened up a world of opportunities for comparison and customization.

In the past, obtaining a car insurance quote often involved lengthy meetings with insurance representatives, sifting through pages of paperwork, and relying on their expertise to guide you through the maze of coverage options. While these methods still have their merits, the rise of online quotes has brought about a paradigm shift, empowering individuals to take control of their insurance journey.

By harnessing the power of the internet, prospective policyholders can now compare multiple insurance providers, explore a wide range of coverage options, and tailor their policies to meet their specific needs. This level of accessibility and transparency has not only increased competition among insurance companies but has also resulted in a more informed and engaged consumer base.

The Benefits of Free Online Quotes

The allure of free online car insurance quotes lies in the numerous advantages they offer. First and foremost, convenience takes center stage. With just a few clicks, you can access a plethora of quotes from various insurance providers, eliminating the need for tedious phone calls or in-person meetings. This digital approach saves valuable time and effort, allowing you to make informed decisions from the comfort of your home.

Moreover, the availability of multiple quotes provides an unprecedented level of comparison. You can easily scrutinize different policies, coverage limits, and premium costs, ensuring you find the best value for your money. This transparency not only empowers you to make confident choices but also fosters a competitive environment, driving insurance providers to offer more attractive deals.

Another significant benefit of free online quotes is the customization they afford. Unlike traditional insurance quotes, which often come as a one-size-fits-all solution, online platforms allow you to tailor your policy to your specific needs. Whether you require comprehensive coverage, liability-only insurance, or additional add-ons, you can easily adjust your quote to reflect your preferences.

Convenience and Accessibility

One of the most notable advantages of acquiring car insurance quotes online is the unparalleled convenience it offers. The ability to obtain multiple quotes from the comfort of your home or office is a game-changer. No more waiting for appointments or navigating through complicated paperwork. With just a few clicks, you can have a comprehensive overview of various insurance options at your disposal.

Imagine sitting down with a cup of coffee, logging into a trusted insurance comparison website, and within minutes, having access to a plethora of quotes tailored to your needs. This level of accessibility not only saves time but also eliminates the hassle associated with traditional insurance quote processes.

Furthermore, the accessibility of online quotes extends beyond convenience. It provides an opportunity for individuals with busy schedules or limited mobility to explore their insurance options without any barriers. Whether you're a working professional with a tight schedule or an individual with physical limitations, the online realm offers an inclusive and accessible approach to insurance.

| Key Advantages | Description |

|---|---|

| Time Efficiency | Quickly compare multiple quotes in a matter of minutes. |

| Wide Coverage Options | Explore a diverse range of insurance providers and policies. |

| Personalized Experience | Tailor quotes to your specific needs and preferences. |

Comparing Quotes and Finding the Best Deal

The beauty of online car insurance quotes lies in the ability to compare a myriad of options side by side. With a simple click, you can access detailed information about various insurance providers, their coverage offerings, and most importantly, their premium rates. This transparency empowers you to make an informed decision, ensuring you find the best deal that suits your budget and requirements.

When comparing quotes, pay close attention to the coverage limits and additional benefits offered by each provider. Look for comprehensive packages that not only provide adequate protection but also include valuable add-ons such as roadside assistance or rental car coverage. Remember, the goal is to strike a balance between cost-effectiveness and comprehensive coverage.

Additionally, take advantage of the online tools and resources available. Many insurance comparison websites offer helpful articles, guides, and calculators to assist you in understanding the intricacies of car insurance. These resources can provide valuable insights, helping you make educated choices and navigate the sometimes complex world of insurance.

Considerations When Getting Free Online Quotes

While the benefits of free online car insurance quotes are undeniable, it’s important to approach the process with a discerning eye. Here are some key considerations to keep in mind as you navigate the world of online insurance quotes.

Understanding Your Coverage Needs

Before diving into the sea of online quotes, it’s crucial to have a clear understanding of your coverage needs. Take the time to assess your driving habits, the value of your vehicle, and any specific requirements or circumstances that may impact your insurance needs. This self-evaluation will guide you in selecting the appropriate coverage limits and add-ons to ensure you’re adequately protected.

Consider factors such as your daily commute, the likelihood of accidents or theft in your area, and any personal preferences you may have. For instance, if you frequently travel long distances or reside in an area prone to natural disasters, you may want to prioritize comprehensive coverage that includes additional benefits like rental car reimbursement or emergency roadside assistance.

By taking a proactive approach and evaluating your unique circumstances, you can make more informed decisions when comparing online quotes. This step ensures that you not only find the most affordable policy but also one that provides the necessary protection for your specific needs.

Scrutinizing the Fine Print

While online quotes provide a wealth of information, it’s essential to delve deeper and scrutinize the fine print. Pay close attention to the coverage details, exclusions, and any potential limitations outlined in the policy. This thorough examination will help you identify any hidden pitfalls or restrictions that may impact your coverage.

Look for key terms and conditions that define the scope of your coverage. Understand the differences between liability, collision, and comprehensive coverage, and ensure that the policy aligns with your expectations. Be mindful of any exclusions or limitations that may apply to specific situations, such as driving under the influence or participating in high-risk activities.

Additionally, consider the reputation and financial stability of the insurance provider. Research their track record, customer reviews, and claims handling processes to ensure they are a reliable and trustworthy partner. By thoroughly evaluating the fine print and conducting background research, you can make confident decisions and avoid any unpleasant surprises down the road.

Potential Pitfalls and How to Avoid Them

While free online car insurance quotes offer numerous advantages, it’s essential to remain vigilant and aware of potential pitfalls. By understanding these challenges and implementing best practices, you can navigate the online quote process with confidence and avoid any unwanted surprises.

Avoiding Impulsive Decisions

In the excitement of exploring various insurance options, it’s easy to make impulsive decisions. However, it’s crucial to resist the urge to rush into a policy without careful consideration. Take the time to thoroughly review and compare multiple quotes, ensuring you understand the coverage, terms, and conditions associated with each.

Avoid the temptation of choosing the first quote that appears appealing. Instead, adopt a strategic approach by evaluating the quotes based on your specific needs and preferences. Consider factors such as coverage limits, deductibles, and additional benefits to find the policy that offers the best value and aligns with your requirements.

Remember, car insurance is a long-term commitment, and making a hasty decision can lead to regrets later on. By exercising patience and conducting a comprehensive comparison, you can make an informed choice that provides the necessary protection and peace of mind.

Beware of Hidden Costs and Fees

While free online quotes are a valuable tool, it’s important to be aware of potential hidden costs and fees that may arise during the insurance process. Some insurance providers may advertise low premiums but tack on additional fees or surcharges, which can significantly impact your overall expenses.

To avoid unexpected costs, scrutinize the quote carefully and pay attention to any fine print or disclaimers. Look for indications of potential fees, such as administrative charges, policy issuance fees, or surcharge information. Additionally, inquire about any potential surcharges that may apply based on your driving history or specific circumstances.

By being proactive and transparent about potential fees, you can make more accurate comparisons and ensure that the quote you select provides a true reflection of the overall cost of the policy. This awareness empowers you to make financially sound decisions and avoid any unpleasant surprises when it comes to your car insurance expenses.

The Future of Car Insurance: Personalized Experiences

As technology continues to advance, the future of car insurance promises a more personalized and tailored experience. Insurance providers are leveraging data analytics and artificial intelligence to offer customized policies that cater to individual needs. This shift towards personalization ensures that policyholders receive coverage that aligns with their unique circumstances, resulting in more efficient and cost-effective insurance solutions.

Imagine a future where your car insurance policy is dynamically adjusted based on your driving behavior and preferences. With the integration of telematics and advanced data analysis, insurance companies can offer real-time adjustments to your coverage, providing incentives for safe driving and rewarding responsible behavior. This innovative approach not only encourages safer driving practices but also empowers individuals to take control of their insurance costs.

Additionally, the rise of connected car technology and the Internet of Things (IoT) is transforming the way insurance providers gather data. By leveraging IoT sensors and devices, insurance companies can gain valuable insights into vehicle usage, maintenance, and even driver behavior. This wealth of data enables insurers to offer highly personalized policies, ensuring that policyholders receive coverage that is tailored to their specific needs and driving habits.

Data-Driven Personalization

In the realm of car insurance, data-driven personalization is set to revolutionize the industry. Insurance providers are harnessing the power of advanced analytics and machine learning algorithms to create highly tailored policies. By analyzing vast amounts of data, including driving behavior, vehicle usage patterns, and even external factors such as weather conditions, insurers can offer precise coverage options that address individual needs.

Imagine a scenario where your insurance policy adapts dynamically based on your driving habits. If you consistently exhibit safe driving practices, your policy can reflect this by offering reduced premiums or additional incentives. On the other hand, if certain risky behaviors are identified, your policy can provide targeted interventions and suggestions to improve your driving habits, ultimately leading to safer roads and lower insurance costs.

This level of personalization not only benefits policyholders by providing them with coverage that aligns with their unique circumstances but also allows insurance providers to offer more accurate risk assessments. By leveraging data-driven insights, insurers can make more informed decisions, resulting in fairer and more equitable pricing structures. The future of car insurance lies in this symbiotic relationship between data analytics and personalized coverage.

Connected Car Technology and IoT Integration

The integration of connected car technology and the Internet of Things (IoT) is set to revolutionize the car insurance industry. With the increasing adoption of smart devices and sensors, insurance providers can gain unprecedented access to real-time data, allowing for more accurate risk assessments and personalized coverage options.

Connected car technology enables insurers to monitor various aspects of vehicle usage, such as mileage, driving behavior, and even maintenance records. By analyzing this data, insurance companies can offer tailored policies that incentivize safe driving practices and reward responsible vehicle ownership. For example, if your vehicle is equipped with advanced safety features and you consistently demonstrate safe driving habits, your insurance policy may offer discounted rates or additional benefits.

Furthermore, IoT integration extends beyond just vehicle-related data. Insurance providers can leverage IoT sensors and devices to gather information about external factors that impact driving conditions, such as weather patterns, road conditions, and even traffic congestion. By incorporating this data into their risk assessments, insurers can offer more accurate and dynamic coverage options, ensuring that policyholders receive the right level of protection for their specific circumstances.

Conclusion: Empowering Your Insurance Journey

The world of car insurance has evolved, and with it, the way we obtain quotes. Free online car insurance quotes offer a convenient, accessible, and transparent approach to finding the right coverage. By leveraging the power of the internet, you can compare multiple quotes, tailor policies to your needs, and make informed decisions. Remember to consider your coverage needs, scrutinize the fine print, and avoid impulsive decisions or hidden costs.

As we embrace the future of car insurance, personalized experiences and data-driven approaches will shape the industry. Insurance providers will continue to innovate, utilizing technology to offer tailored policies that meet individual needs. Embrace this digital transformation and take control of your insurance journey. With the right knowledge and tools, you can navigate the online quote process with confidence, securing the best coverage at the most competitive rates.

So, are you ready to embark on your insurance journey? With the wealth of information and resources available online, the power is in your hands. Compare, customize, and choose wisely, and you'll be well on your way to a seamless and satisfying insurance experience.

How accurate are online car insurance quotes?

+Online car insurance quotes provide a good estimate of the cost of your policy. However, the final premium may vary slightly based on additional factors evaluated during the application process.

Can I get multiple quotes from different providers on one platform?

+Yes, many insurance comparison websites allow you to obtain multiple quotes from different providers in one go, making the process more efficient and convenient.

What factors influence the cost of car insurance quotes?

+Various factors impact the cost of car insurance quotes, including your driving record, age, gender, vehicle type, location, and the level of coverage you choose.