Free Quotes For Car Insurance

In today's digital age, finding car insurance has become more accessible and convenient than ever before. With just a few clicks, you can compare various insurance providers and get free quotes tailored to your needs. This process not only saves you time but also ensures that you make an informed decision about your car insurance coverage. In this article, we will delve into the world of free car insurance quotes, exploring how they work, the benefits they offer, and the key considerations to keep in mind when seeking the best coverage for your vehicle.

The Convenience of Free Car Insurance Quotes

Gone are the days of spending hours on the phone or visiting multiple insurance agencies to compare car insurance rates. Thanks to the advent of online platforms and insurance aggregators, obtaining free quotes for car insurance has become a seamless and efficient process. These online tools allow you to input your basic information, such as your vehicle details, driving history, and desired coverage, and within minutes, you receive a range of quotes from multiple insurance providers.

The convenience of free car insurance quotes extends beyond the initial comparison. Many insurance companies now offer online applications, allowing you to complete the entire insurance purchasing process from the comfort of your home. This digital transformation has made it easier for individuals to switch insurance providers, seek better rates, and ensure they are adequately covered without the hassle of traditional paperwork.

Understanding the Quote Process

When you request a free car insurance quote, insurance providers use a combination of factors to determine the cost of your premium. These factors include your age, gender, marital status, driving record, and the type and make of your vehicle. Additionally, the level of coverage you require, such as liability-only, collision, comprehensive, or a combination of these, will impact the quote you receive.

Insurance companies also consider your location and the associated risk factors. For instance, if you live in an area with a high crime rate or frequent natural disasters, your insurance premium may be higher to account for the increased likelihood of claims. Similarly, if you have a history of accidents or traffic violations, your quotes may reflect a higher risk profile.

Key Factors Influencing Car Insurance Quotes

- Driving Record: A clean driving history can significantly impact your insurance rates. Insurance companies view drivers with a history of accidents or violations as higher risk, resulting in higher premiums.

- Vehicle Type: The make, model, and age of your vehicle play a role in determining your insurance costs. Sports cars and luxury vehicles, for example, often come with higher insurance premiums due to their higher repair costs and potential for theft.

- Coverage Level: The level of coverage you choose directly affects your insurance quote. Basic liability coverage is typically less expensive than comprehensive plans that include collision, medical payments, and uninsured motorist coverage.

- Location: Your geographical location is a critical factor in insurance quotes. Areas with high crime rates or frequent natural disasters may result in higher premiums to account for the increased risk of claims.

- Personal Information: Factors such as your age, gender, and marital status are considered when calculating insurance quotes. Younger drivers, especially males, are often viewed as higher risk, leading to higher premiums.

Benefits of Comparing Free Car Insurance Quotes

Comparing free car insurance quotes offers several advantages that can help you make an informed decision about your insurance coverage.

Saving Money

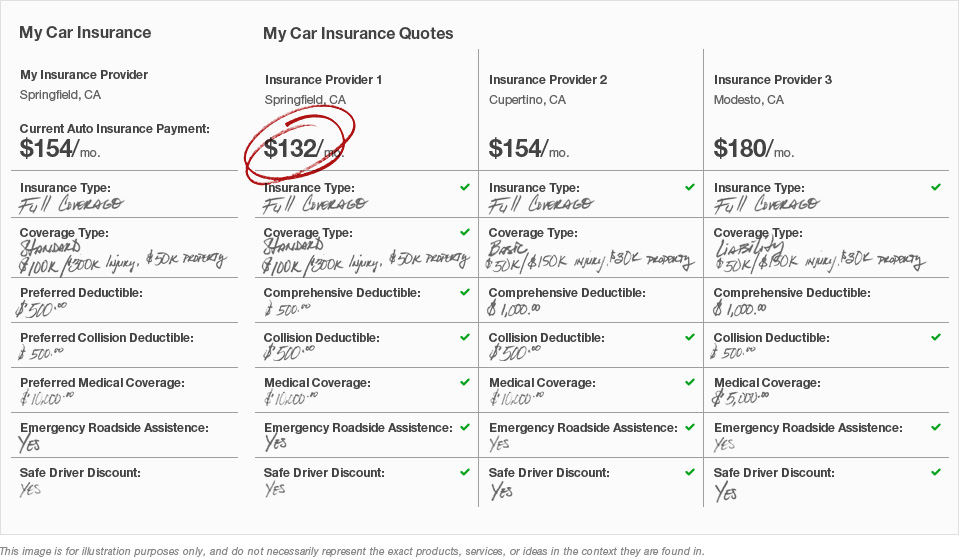

One of the most significant benefits of comparing quotes is the potential for substantial savings. By evaluating multiple quotes, you can identify the insurance provider that offers the best coverage at the most competitive price. This comparison can lead to hundreds or even thousands of dollars in savings annually.

For instance, let's consider a hypothetical scenario where you reside in a metropolitan area. You have a clean driving record, a mid-range sedan, and are seeking comprehensive coverage. By comparing quotes from various insurance providers, you might discover that Provider A offers the best combination of coverage and price, while Provider B, although slightly more expensive, provides additional benefits like roadside assistance.

Customized Coverage

Free car insurance quotes allow you to explore different coverage options and tailor your insurance plan to your specific needs. Whether you require basic liability coverage or comprehensive protection, comparing quotes helps you understand the various coverage types and their associated costs.

Moreover, many insurance providers offer additional coverage options, such as rental car reimbursement, gap insurance, or custom equipment coverage. By reviewing quotes from multiple providers, you can identify the ones that offer the add-ons that align with your preferences and budget.

Understanding Coverage Gaps

Comparing quotes can also help you identify potential coverage gaps in your existing insurance plan. For example, if you’ve had the same insurance provider for several years, your coverage may not have kept up with changes in your life or the evolving insurance landscape. By reviewing new quotes, you can assess whether your current coverage is sufficient or if you need to make adjustments.

Key Considerations When Getting Free Car Insurance Quotes

While free car insurance quotes are a valuable tool, there are several considerations to keep in mind to ensure you make the right decision for your insurance needs.

Understanding Quote Estimates

It’s essential to understand that the quotes you receive are estimates based on the information you provide. Insurance companies may require additional documentation or verify your details before finalizing your insurance policy and premium. Always review the fine print and understand the terms and conditions associated with the quote.

Comparing Apples to Apples

When comparing quotes, ensure that you’re evaluating similar coverage levels. For instance, if you’re comparing liability-only quotes from one provider with comprehensive coverage quotes from another, the comparison may not be accurate. Take the time to understand the coverage types and their associated costs to make an informed decision.

Consider Long-Term Savings

While it’s tempting to choose the lowest quote, it’s crucial to consider the long-term savings and value of the insurance plan. Some insurance providers may offer introductory discounts or low initial rates but increase premiums significantly after the initial term. Look for providers that offer stable rates and competitive pricing over the long term.

Read Reviews and Ratings

Before finalizing your insurance choice, research the insurance providers you’re considering. Read customer reviews and ratings to understand their reputation, claim settlement process, and customer service quality. A company with excellent quotes but poor customer service may not be the best choice in the long run.

The Future of Car Insurance Quotes

The car insurance industry is continuously evolving, and the way we obtain quotes is no exception. With advancements in technology, we can expect even more efficient and personalized quote processes in the future.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance are emerging trends in the car insurance industry. These technologies use sensors and data analytics to monitor driving behavior and offer insurance rates based on actual driving habits. By incentivizing safe driving, these programs have the potential to revolutionize the way insurance premiums are calculated.

Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning are already transforming the insurance landscape. These technologies can analyze vast amounts of data, including driving patterns, weather conditions, and even social media activity, to predict risks and offer personalized insurance quotes. As these technologies advance, we can expect more accurate and tailored insurance quotes.

Digital Transformation and Customer Experience

The digital transformation of the insurance industry is not just about online quotes; it’s about enhancing the overall customer experience. Insurance providers are investing in digital tools and platforms to streamline the insurance process, from quote comparisons to claims management. This digital shift promises faster, more efficient, and more personalized insurance services.

Conclusion

Free car insurance quotes have revolutionized the way we shop for insurance, offering convenience, savings, and personalized coverage. By understanding the quote process, the factors that influence rates, and the key considerations when comparing quotes, you can make an informed decision about your car insurance coverage.

As the car insurance industry continues to evolve, embracing new technologies and digital innovations, the future of car insurance quotes looks promising. With more accurate, personalized, and efficient quote processes, finding the right insurance coverage will become even more accessible and beneficial for drivers.

How often should I compare car insurance quotes?

+It’s a good practice to compare car insurance quotes annually, especially if your circumstances have changed. Changes in your driving record, vehicle, or location can impact your insurance rates, so regular comparisons ensure you’re getting the best deal.

Can I negotiate car insurance rates with providers?

+While insurance rates are largely based on statistical data and risk assessments, some providers may offer discounts or negotiated rates for certain circumstances. It’s worth inquiring about potential discounts or promotions when obtaining quotes.

What factors can I control to reduce my car insurance costs?

+You can take steps to reduce your car insurance costs by maintaining a clean driving record, shopping around for quotes, and considering higher deductibles. Additionally, some providers offer discounts for safe driving habits, loyalty, or certain vehicle safety features.