Full Auto Insurance

In the world of automotive insurance, the concept of Full Auto Insurance is a crucial aspect that every vehicle owner should be aware of. It is a comprehensive insurance coverage option that provides extensive protection for your vehicle and can offer peace of mind to drivers. This article will delve into the intricacies of Full Auto Insurance, exploring its benefits, coverage, and how it differs from other insurance plans. We will also examine real-world scenarios and provide valuable insights to help you make informed decisions about your vehicle's insurance coverage.

Understanding Full Auto Insurance: The Ultimate Protection

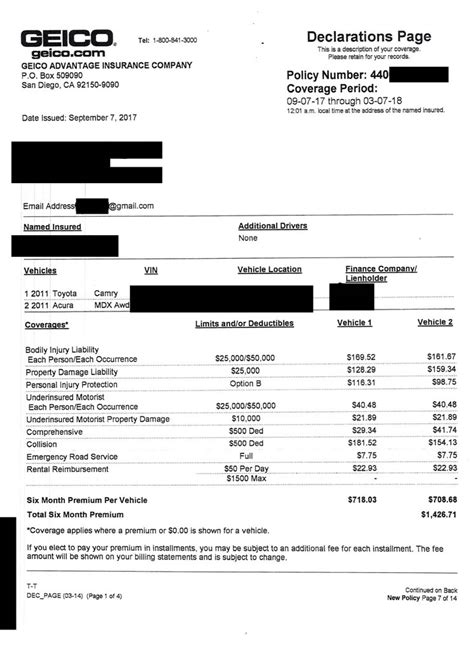

Full Auto Insurance, often referred to as comprehensive car insurance, is a policy designed to offer the highest level of coverage for your vehicle. Unlike basic liability insurance, which primarily covers damage you cause to others, Full Auto Insurance extends its protection to cover a wide range of incidents and risks associated with owning and operating a vehicle.

What Does Full Auto Insurance Cover?

Full Auto Insurance typically includes the following coverage options:

- Comprehensive Coverage: This protects your vehicle against damage caused by non-collision events, such as vandalism, theft, fire, natural disasters, and even damage caused by animals. It provides a safety net for your vehicle against unexpected and potentially costly incidents.

- Collision Coverage: Collision coverage is a vital component of Full Auto Insurance. It covers the cost of repairs or replacements if your vehicle is involved in an accident, regardless of who is at fault. This coverage ensures that you are not left financially burdened after an unfortunate collision.

- Liability Coverage: Full Auto Insurance includes liability coverage, which is essential for protecting you against claims arising from accidents you cause. This coverage pays for bodily injury and property damage claims made against you, ensuring you are financially secure even in the event of an at-fault accident.

- Personal Injury Protection (PIP): PIP is a vital addition to Full Auto Insurance, as it provides coverage for medical expenses, lost wages, and other related costs incurred by you or your passengers in an accident. It offers financial support during challenging times and can be a lifesaver in severe accidents.

- Uninsured/Underinsured Motorist Coverage: This coverage is designed to protect you in the event of an accident with a driver who lacks sufficient insurance coverage. It ensures that you are not left with the financial burden of damages caused by an uninsured or underinsured driver.

Full Auto Insurance policies often include additional benefits and perks, such as rental car coverage, roadside assistance, and even gap insurance, which covers the difference between your vehicle's actual value and the amount you still owe on your loan or lease.

| Coverage Type | Description |

|---|---|

| Comprehensive | Covers non-collision damages like theft, fire, and natural disasters. |

| Collision | Provides coverage for accidents and collisions. |

| Liability | Protects against claims arising from accidents you cause. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers. |

| Uninsured/Underinsured Motorist | Protects you financially when involved in an accident with an uninsured/underinsured driver. |

The Benefits of Full Auto Insurance

Choosing Full Auto Insurance comes with a multitude of benefits. Here are some key advantages:

- Comprehensive Protection: As the name suggests, Full Auto Insurance offers a comprehensive approach to safeguarding your vehicle. It ensures that you are covered for a wide range of incidents, providing financial security and peace of mind.

- Peace of Mind: With Full Auto Insurance, you can drive with confidence, knowing that you are protected against various risks. It alleviates the stress and financial burden associated with unexpected accidents or incidents.

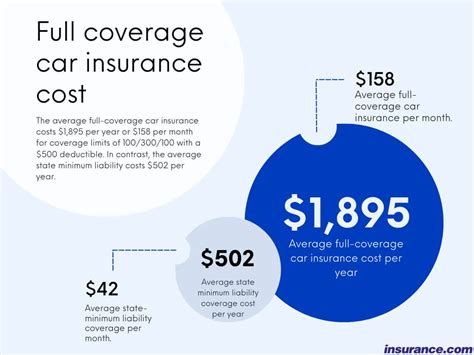

- Cost-Effective in the Long Run: While Full Auto Insurance policies may have higher premiums compared to basic liability coverage, they can be more cost-effective in the long term. The extensive coverage reduces the risk of large, unexpected expenses, making it a wise investment for vehicle owners.

- Customizable Options: Full Auto Insurance policies often allow for customization. You can choose the level of coverage that suits your needs and budget, ensuring that you receive the protection that is right for you.

Real-World Scenarios and Coverage Analysis

To better understand the value of Full Auto Insurance, let’s explore some real-world scenarios and analyze how this type of coverage would benefit drivers:

Scenario 1: Natural Disaster Strikes

Imagine you live in an area prone to severe weather conditions, such as hurricanes or tornadoes. During a storm, a fallen tree branch damages your vehicle’s windshield and roof. Without Full Auto Insurance, you would be responsible for the costly repairs. However, with comprehensive coverage, your insurance provider would cover the repairs, allowing you to get back on the road quickly.

Scenario 2: Collision with an Uninsured Driver

You’re driving home from work when an uninsured driver runs a red light and collides with your vehicle. In this scenario, Full Auto Insurance’s uninsured motorist coverage would kick in. It would cover the repairs to your vehicle and provide financial support for any medical expenses incurred as a result of the accident.

Scenario 3: Vandalism and Theft

Unfortunately, your car becomes a target for vandalism, and its windows are shattered. Additionally, the vehicle is stolen from your driveway. Without Full Auto Insurance, you would face significant financial losses. However, with comprehensive coverage, your insurance provider would compensate you for the cost of repairs and even replace the vehicle if necessary.

Differences Between Full Auto Insurance and Other Plans

While Full Auto Insurance provides extensive coverage, it is essential to understand how it differs from other insurance plans available in the market:

Full Auto Insurance vs. Basic Liability Insurance

Basic liability insurance is the minimum coverage required by law in many regions. It primarily covers damages you cause to others’ property or injuries you inflict on others. In contrast, Full Auto Insurance offers a more comprehensive approach, covering a wider range of incidents, including damage to your own vehicle.

Full Auto Insurance vs. Collision-Only Insurance

Collision-only insurance, as the name suggests, provides coverage solely for accidents and collisions. While it offers some protection, it lacks the comprehensive coverage of Full Auto Insurance. Full Auto Insurance includes collision coverage but also extends to other risks, making it a more comprehensive and beneficial option.

Full Auto Insurance vs. Customized Coverage

Some drivers opt for customized insurance plans, choosing specific coverages based on their needs and budget. While this approach can be cost-effective, it may leave certain risks uncovered. Full Auto Insurance provides a balanced and comprehensive solution, ensuring that you are protected against a wide array of potential incidents.

Choosing the Right Full Auto Insurance Policy

When selecting a Full Auto Insurance policy, it is essential to consider your specific needs and circumstances. Here are some factors to keep in mind:

- Vehicle Value: Assess the value of your vehicle and choose a policy that provides adequate coverage. Higher-value vehicles may require more comprehensive coverage to ensure they are fully protected.

- Risk Profile: Evaluate your driving habits and the risks associated with your location. If you live in an area prone to natural disasters or high crime rates, Full Auto Insurance becomes even more crucial.

- Budget: While Full Auto Insurance offers extensive coverage, it is essential to find a policy that fits your budget. Compare quotes from different providers and consider the long-term financial benefits of the coverage.

- Additional Perks: Look for insurance providers that offer additional benefits, such as rental car coverage or roadside assistance. These perks can enhance your overall experience and provide added convenience.

The Future of Full Auto Insurance

As the automotive industry evolves, so too does the world of insurance. Full Auto Insurance is likely to adapt to emerging trends and technologies. Here are some potential future implications:

- Autonomous Vehicles: With the rise of self-driving cars, insurance policies may need to adapt to cover the unique risks associated with this technology. Full Auto Insurance policies may evolve to include coverage for autonomous driving-related incidents.

- Electric Vehicles: As electric vehicles gain popularity, insurance providers may offer specialized coverage for these environmentally friendly options. Full Auto Insurance policies could incorporate unique coverage for electric vehicle owners.

- Usage-Based Insurance: Usage-based insurance, which calculates premiums based on driving behavior, may become more prevalent. Full Auto Insurance policies could integrate this technology to offer tailored coverage based on individual driving habits.

Conclusion: Empowering Drivers with Full Auto Insurance

Full Auto Insurance is a powerful tool for vehicle owners, providing extensive coverage and peace of mind. By understanding the benefits, coverage, and real-world scenarios, drivers can make informed decisions about their insurance needs. With the right Full Auto Insurance policy, you can drive confidently, knowing that you are protected against a wide range of risks and incidents.

Is Full Auto Insurance the best option for all drivers?

+While Full Auto Insurance offers comprehensive coverage, it may not be the best choice for every driver. Factors such as vehicle value, driving habits, and budget should be considered. Some drivers may opt for more customized coverage to suit their specific needs.

How do I choose the right insurance provider for Full Auto Insurance?

+Research and compare different insurance providers. Look for reputable companies with a track record of providing excellent customer service and comprehensive coverage. Consider their financial stability and read reviews from existing customers to make an informed decision.

Are there any discounts available for Full Auto Insurance policies?

+Yes, many insurance providers offer discounts for Full Auto Insurance policies. These discounts may include multi-policy discounts (if you bundle your auto insurance with other policies), safe driver discounts, loyalty discounts, and even discounts for certain occupations or affiliations. It’s worth inquiring about potential savings when obtaining quotes.

Can I customize my Full Auto Insurance policy to fit my specific needs?

+Absolutely! Full Auto Insurance policies often allow for customization. You can choose the level of coverage you desire, add optional coverage for specific needs (such as rental car coverage or roadside assistance), and even adjust deductibles to fit your budget. Work with your insurance agent to tailor the policy to your requirements.

What should I do if I’m involved in an accident and have Full Auto Insurance coverage?

+If you’re involved in an accident, it’s important to remain calm and follow these steps: first, ensure your safety and the safety of others involved. Then, contact the police to file a report. Take photos of the accident scene and any damage to your vehicle. Finally, notify your insurance company as soon as possible to initiate the claims process. They will guide you through the necessary steps to receive the coverage you’re entitled to.