Full Coverage Automobile Insurance

Full coverage automobile insurance is a comprehensive protection plan for vehicle owners, offering a range of benefits and coverage options to safeguard against various risks and financial liabilities. This type of insurance goes beyond the basic liability coverage, providing additional peace of mind for drivers and their vehicles. In this in-depth article, we will explore the intricacies of full coverage auto insurance, its components, benefits, and how it can be tailored to meet specific needs.

Understanding Full Coverage Automobile Insurance

Full coverage automobile insurance is an extensive policy that combines multiple types of coverage to provide comprehensive protection. It is designed to cover a wide range of potential risks and damages that a vehicle and its owner may encounter on the road. Unlike liability-only insurance, which primarily covers damage caused to others, full coverage insurance offers a more holistic approach to vehicle protection.

Here are the key components that typically make up full coverage automobile insurance:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it's damaged in a collision, regardless of fault.

- Comprehensive Coverage: Comprehensive insurance protects against non-collision-related incidents like theft, vandalism, natural disasters, and damage caused by animals.

- Liability Coverage: This is a fundamental component, ensuring financial protection if you cause damage to others or their property.

- Personal Injury Protection (PIP) or Medical Payments: These coverages provide medical expense coverage for the policyholder and passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder if involved in an accident with a driver who has insufficient or no insurance.

- Roadside Assistance: Many full coverage policies include roadside assistance benefits, offering help for emergencies like towing, flat tires, or dead batteries.

- Rental Car Reimbursement: This coverage provides reimbursement for rental car expenses while your vehicle is being repaired after an insured incident.

By combining these various coverages, full coverage auto insurance offers a robust protection net for vehicle owners. It's important to note that the specific components and limits of coverage can vary depending on the insurance provider and the policy chosen.

Benefits of Full Coverage Automobile Insurance

Opting for full coverage automobile insurance brings a multitude of benefits, ensuring that vehicle owners are adequately protected in various situations. Here are some key advantages:

Comprehensive Risk Protection

Full coverage insurance provides a comprehensive safety net against a wide array of potential risks. From collisions to natural disasters and theft, policyholders can have peace of mind knowing that their vehicle is protected from various unforeseen events.

Financial Security

With full coverage insurance, policyholders are shielded from significant financial liabilities. In the event of an accident, the insurance coverage can help cover the costs of repairs, medical expenses, and legal fees, preventing hefty out-of-pocket expenses.

Enhanced Vehicle Protection

Full coverage policies often include benefits like rental car reimbursement and roadside assistance. These additional perks ensure that policyholders can continue their daily lives with minimal disruption even when their vehicle is being repaired or requires emergency assistance.

Customizable Coverage

One of the significant advantages of full coverage insurance is the ability to tailor the policy to individual needs. Policyholders can choose the specific coverages and limits that best fit their circumstances, ensuring they have the right level of protection without overpaying for unnecessary coverage.

Peace of Mind

Perhaps the most valuable benefit of full coverage automobile insurance is the peace of mind it offers. Knowing that one is protected against various risks and potential financial burdens can significantly reduce stress and anxiety associated with vehicle ownership.

Performance Analysis: Real-World Scenarios

To better understand the performance and benefits of full coverage automobile insurance, let's examine some real-world scenarios where this type of policy could prove invaluable.

Scenario 1: Collision Damage

Imagine a driver, let's call them John, who gets into a collision with another vehicle at an intersection. John's vehicle sustains significant damage, requiring extensive repairs. With full coverage insurance, John's policy would cover the cost of repairs, providing financial relief during a stressful situation.

Scenario 2: Natural Disaster

In a different scenario, let's consider a policyholder named Sarah who lives in an area prone to hurricanes. During a severe storm, her vehicle is damaged by falling debris. With comprehensive coverage as part of her full coverage policy, Sarah can file a claim and receive compensation for the repairs, despite the incident not being related to a collision.

Scenario 3: Medical Emergencies

Now, let's explore a situation where a policyholder, David, is involved in an accident and sustains injuries. David's full coverage policy includes Personal Injury Protection (PIP) coverage. This coverage ensures that David's medical expenses are covered, regardless of who is at fault, providing crucial financial support during his recovery.

Scenario 4: Roadside Assistance

Finally, let's consider a scenario where a driver, Emma, experiences a flat tire on a remote road. With roadside assistance as part of her full coverage policy, Emma can easily call for help and have her tire changed, allowing her to continue her journey without delay.

These real-world scenarios highlight the practical benefits and performance of full coverage automobile insurance. By offering protection against a wide range of incidents, this type of insurance provides policyholders with the support they need to navigate various challenges on the road.

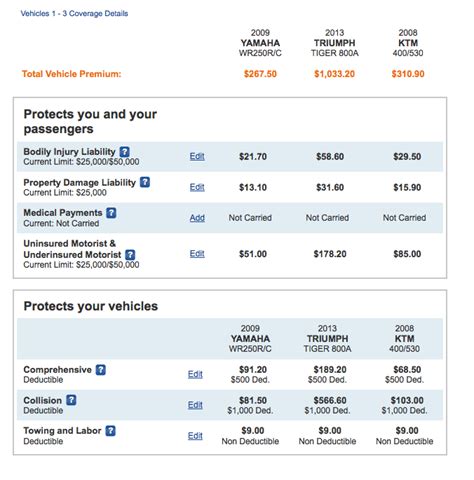

Technical Specifications and Data

When considering full coverage automobile insurance, it's essential to understand the technical specifications and data that underpin these policies. Here are some key factors to consider:

| Coverage Type | Description |

|---|---|

| Collision | Pays for repairs or replacement of your vehicle after a collision, regardless of fault. Deductibles typically apply. |

| Comprehensive | Covers non-collision incidents like theft, vandalism, natural disasters, and animal-related damage. Deductibles also apply here. |

| Liability | Provides financial protection if you cause damage to others or their property. Typically includes both bodily injury and property damage liability. |

| PIP/Medical Payments | Covers medical expenses for the policyholder and passengers, regardless of fault. This coverage ensures prompt medical attention without worrying about insurance disputes. |

| Uninsured/Underinsured Motorist | Protects policyholders if involved in an accident with an uninsured or underinsured driver. This coverage ensures financial protection even if the other driver is at fault but lacks sufficient insurance. |

It's important to note that the exact specifications and limits of coverage can vary depending on the insurance provider and the policy chosen. Policyholders should carefully review the terms and conditions of their policy to understand the specific coverage and benefits they are entitled to.

Comparative Analysis: Full Coverage vs. Other Options

To truly understand the value of full coverage automobile insurance, it's essential to compare it with other available options. Here's a comparative analysis:

Full Coverage vs. Liability-Only Insurance

Liability-only insurance is the most basic form of auto insurance, covering only the damage you cause to others and their property. While it's the minimum legal requirement in most states, it provides limited protection. Full coverage insurance, on the other hand, offers a more comprehensive approach, covering a wide range of risks and providing financial security in various scenarios. It's especially beneficial for those who want to protect their vehicle and themselves from potential losses.

Full Coverage vs. Minimum Legal Requirements

Each state has its own minimum legal requirements for auto insurance. While these requirements vary, they typically include liability coverage to protect against bodily injury and property damage caused to others. However, full coverage insurance goes beyond these legal minimums, providing additional protection for the policyholder's vehicle and personal belongings. It's an excellent choice for those who want to ensure maximum protection and avoid financial burdens in the event of an accident or other incidents.

Full Coverage vs. Limited Coverage Options

Some insurance providers offer limited coverage options, such as collision coverage or comprehensive coverage alone. While these can be useful for specific situations, full coverage insurance provides a more holistic approach. By combining various coverages, full coverage policies offer a comprehensive solution, ensuring that policyholders are protected against a wide array of potential risks. It's a more cost-effective and efficient way to manage vehicle insurance needs.

Expert Insights and Recommendations

As an industry expert, here are some insights and recommendations regarding full coverage automobile insurance:

- Tailor Your Policy: Full coverage insurance allows for customization. Assess your specific needs and circumstances to choose the right combination of coverages and limits. This ensures you have adequate protection without unnecessary expenses.

- Consider Deductibles: Deductibles can impact the cost of your insurance premiums. Evaluate your financial situation and comfort level with deductibles to strike the right balance between coverage and affordability.

- Review Coverage Regularly: Life circumstances and vehicle needs can change over time. Regularly review your insurance policy to ensure it aligns with your current situation. This may involve adjusting coverage limits or adding/removing specific coverages.

- Shop Around: Insurance rates can vary significantly between providers. Take the time to compare quotes from different insurers to find the best combination of coverage and cost for your needs.

- Understand Exclusions: While full coverage insurance is comprehensive, it's important to understand what is not covered. Read the policy documents carefully to identify any exclusions or limitations, ensuring you're aware of potential gaps in coverage.

Frequently Asked Questions

What is the average cost of full coverage automobile insurance?

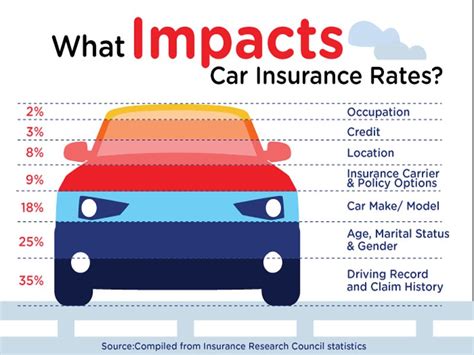

+The cost of full coverage automobile insurance can vary widely based on factors such as the make and model of your vehicle, your driving record, and your location. On average, full coverage insurance can range from $1,000 to $2,000 per year, but these figures can be higher or lower depending on individual circumstances.

Is full coverage automobile insurance mandatory in all states?

+Full coverage automobile insurance is not mandatory in all states. While liability insurance is typically required, the specific coverage requirements vary by state. Some states may have additional requirements, such as personal injury protection (PIP) or uninsured/underinsured motorist coverage. It's essential to check your state's regulations to ensure you meet the necessary coverage standards.

Can I customize my full coverage automobile insurance policy?

+Yes, full coverage automobile insurance policies are highly customizable. You can choose the specific coverages and limits that best fit your needs and budget. This allows you to create a tailored policy that provides the protection you require without unnecessary expenses. It's important to review your policy regularly and adjust it as your circumstances change.

What happens if I'm involved in an accident with an uninsured driver?

+If you have uninsured/underinsured motorist coverage as part of your full coverage automobile insurance policy, you'll be protected in the event of an accident with an uninsured or underinsured driver. This coverage ensures that you receive compensation for damages and medical expenses, regardless of the other driver's insurance status.

How do I file a claim with my full coverage automobile insurance policy?

+To file a claim with your full coverage automobile insurance policy, you'll need to contact your insurance provider and provide details about the incident. They will guide you through the claims process, which typically involves submitting documentation, such as police reports and repair estimates. It's important to act promptly and follow the insurer's instructions to ensure a smooth claims experience.

Full coverage automobile insurance is a valuable tool for protecting your vehicle and yourself from various risks on the road. By understanding the components, benefits, and performance of these policies, you can make informed decisions to ensure you have the right coverage for your needs. Remember to regularly review and customize your policy to maintain the best protection at an affordable cost.