Gap Coverage Insurance

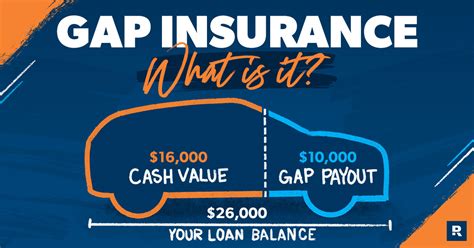

Gap coverage insurance, often referred to as "gap insurance," is a specialized form of protection that steps in to cover the financial gap between the actual cash value of a vehicle and the remaining balance owed on its loan or lease. This type of insurance is particularly relevant for drivers who find themselves in a situation where their vehicle's worth has depreciated more rapidly than expected, leaving them with a potentially significant financial burden if their vehicle is totaled or stolen.

Understanding the Importance of Gap Coverage Insurance

When you purchase a new vehicle, its value starts depreciating from the moment you drive it off the dealership lot. This depreciation can be significant over time, especially for the first few years of ownership. While comprehensive and collision insurance policies cover the repair or replacement costs of your vehicle, they are typically based on the vehicle’s current market value, which may be substantially lower than the amount you still owe on your loan or lease.

This disparity between the vehicle's market value and the loan balance can lead to what is known as a "gap." In the unfortunate event of a total loss, theft, or write-off, this gap represents the difference between the insurance payout and the remaining loan or lease balance. Gap coverage insurance is designed to bridge this financial gap, ensuring that policyholders are not left with a large, unexpected debt.

Key Scenarios Where Gap Coverage is Essential

Gap coverage is especially crucial for drivers who have financed or leased their vehicles. In the following situations, gap insurance can provide significant financial relief:

- New Vehicle Ownership: New vehicles tend to depreciate rapidly in the first few years. Gap coverage can protect you from the potential financial loss if your new vehicle is involved in an accident.

- Leased Vehicles: Lease contracts often require the lessee to pay for any gap between the vehicle’s residual value and the amount owed. Gap insurance can shield you from this additional expense.

- Negative Equity Situations: If you’ve rolled over the remaining balance from a previous vehicle loan into your new loan, you may find yourself in a negative equity position. Gap insurance can help cover this negative equity in the event of a total loss.

How Gap Coverage Insurance Works

Gap coverage insurance is an optional add-on to your comprehensive or collision insurance policy. It pays the difference between the insurance company’s settlement amount (based on the vehicle’s actual cash value) and the outstanding balance on your loan or lease. Here’s a simplified breakdown of how it operates:

Step 1: Total Loss or Write-Off

In the event that your vehicle is deemed a total loss or is stolen and not recovered, your comprehensive or collision insurance policy will typically cover the current market value of the vehicle. This value may not be enough to cover the full amount you owe on your loan or lease.

Step 2: Gap Coverage Steps In

If you have gap coverage insurance, it will step in to pay the difference between the insurance settlement and the remaining loan or lease balance. This ensures that you are not left with a large, unexpected financial obligation.

| Insurance Settlement | Remaining Loan Balance | Gap Coverage |

|---|---|---|

| $15,000 | $20,000 | Covers the $5,000 gap |

Who Needs Gap Coverage Insurance?

While gap coverage is beneficial for all vehicle owners, certain groups can especially benefit from this type of insurance:

Financed Vehicles

If you’ve purchased your vehicle with a loan, especially if it’s a new or slightly used vehicle, gap coverage is highly recommended. The rapid depreciation of new vehicles can quickly lead to a situation where the loan balance exceeds the vehicle’s market value.

Leased Vehicles

Leasing a vehicle often comes with a predetermined residual value, which is the estimated value of the vehicle at the end of the lease term. If your vehicle depreciates more than expected, you may be responsible for covering the difference between the residual value and the actual market value. Gap coverage can protect you from this unexpected expense.

Negative Equity Situations

Individuals who have rolled over negative equity from a previous vehicle into their new loan are at a higher risk of facing a gap in coverage. Gap insurance can provide a safety net in such scenarios.

Factors Affecting Gap Coverage

The need for gap coverage can be influenced by several factors, including the type of vehicle, its age, and the length of the loan or lease term. Here are some key considerations:

Vehicle Type and Age

Newer vehicles tend to depreciate more rapidly than older ones. If you own a new or slightly used vehicle, the risk of depreciation exceeding your insurance coverage is higher, making gap coverage a more critical consideration.

Loan or Lease Term

Longer loan or lease terms can increase the likelihood of a gap developing between the vehicle’s value and the loan balance. This is especially true if you’ve financed a substantial portion of the vehicle’s value or if interest rates are high.

Market Conditions

Economic factors and market trends can also impact the need for gap coverage. During periods of economic downturn or high inflation, vehicle depreciation rates may accelerate, increasing the risk of a gap.

Obtaining Gap Coverage Insurance

Gap coverage insurance is typically offered by dealerships, lenders, and insurance companies. Here are some key steps to obtaining gap coverage:

Dealerships

When purchasing a new or used vehicle, dealerships often offer gap coverage as an add-on to your vehicle purchase or lease contract. It’s essential to carefully review the terms and conditions of this coverage to ensure it aligns with your needs.

Lenders

If you’ve financed your vehicle through a bank or credit union, they may also offer gap coverage. This coverage is often included in the loan agreement, so it’s crucial to read the fine print to understand the terms and any potential limitations.

Insurance Companies

Many insurance providers offer gap coverage as an optional add-on to your comprehensive or collision insurance policy. You can discuss your options with your insurance agent to find the best coverage for your specific needs and circumstances.

The Benefits of Gap Coverage Insurance

Gap coverage insurance provides several key benefits to policyholders:

Financial Protection

The primary benefit of gap coverage is financial protection. It ensures that policyholders are not left with a large, unexpected debt if their vehicle is totaled or stolen. This protection can provide significant peace of mind, especially for those who have financed or leased their vehicles.

Peace of Mind

Knowing that you have gap coverage can reduce the stress and anxiety associated with vehicle ownership. It allows you to focus on enjoying your vehicle without the worry of potential financial pitfalls.

Enhanced Safety Net

Gap coverage acts as an additional layer of protection, complementing your comprehensive and collision insurance policies. It ensures that you’re fully covered in the event of a total loss, providing a more comprehensive safety net.

Potential Limitations and Considerations

While gap coverage is an invaluable form of insurance, it’s essential to be aware of certain limitations and considerations:

Policy Exclusions

Gap coverage policies often have specific exclusions and limitations. It’s crucial to read the fine print to understand what situations are covered and what may be excluded. For instance, some policies may not cover vehicles that are substantially modified or those used for commercial purposes.

Policy Duration

Gap coverage policies typically have a defined duration, often aligned with the loan or lease term. It’s important to ensure that your gap coverage remains valid throughout the duration of your loan or lease.

Cost of Coverage

Gap coverage comes at an additional cost, which can vary depending on the provider, the type of vehicle, and the loan or lease terms. It’s essential to weigh the cost against the potential benefits to determine if gap coverage is a worthwhile investment for your specific situation.

Conclusion: The Value of Gap Coverage Insurance

Gap coverage insurance is an essential form of protection for vehicle owners, especially those who have financed or leased their vehicles. It provides a crucial safety net, ensuring that policyholders are not left with a substantial financial burden in the event of a total loss, theft, or write-off. By understanding the benefits, limitations, and availability of gap coverage, drivers can make informed decisions to protect their financial well-being.

What is gap coverage insurance and why is it important?

+Gap coverage insurance, also known as gap insurance, is designed to cover the financial gap between the actual cash value of a vehicle and the remaining balance owed on its loan or lease. It is particularly important for drivers who have financed or leased their vehicles, as it protects them from potential financial loss in the event of a total loss, theft, or write-off.

How does gap coverage insurance work?

+In the event of a total loss or theft, your comprehensive or collision insurance policy will typically cover the current market value of your vehicle. However, this amount may not be sufficient to cover the remaining loan or lease balance. Gap coverage steps in to pay the difference, ensuring you are not left with a large, unexpected debt.

Who needs gap coverage insurance?

+Gap coverage is beneficial for all vehicle owners, but it is especially crucial for those who have financed or leased their vehicles. Newer vehicles tend to depreciate rapidly, which can lead to a situation where the loan balance exceeds the vehicle’s market value. Gap coverage protects against this potential financial loss.

How can I obtain gap coverage insurance?

+Gap coverage is typically offered by dealerships, lenders, and insurance companies. When purchasing a vehicle, you can inquire about gap coverage options from the dealership. Lenders may also offer gap coverage as part of your loan agreement. Additionally, you can discuss adding gap coverage to your existing comprehensive or collision insurance policy with your insurance provider.