Gap Insurance Automobile

Gap insurance, also known as Guaranteed Asset Protection insurance, is a vital coverage option for vehicle owners. It plays a crucial role in ensuring financial protection for motorists, particularly in instances where the vehicle's market value is less than the remaining loan or lease balance. This comprehensive guide aims to delve into the intricacies of Gap insurance, exploring its benefits, how it works, and its significance in the context of automobile ownership.

Understanding Gap Insurance

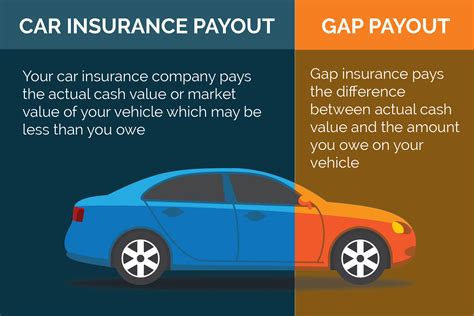

Gap insurance is designed to cover the difference, or gap, between the actual cash value of a vehicle and the amount owed on its loan or lease. This gap can arise due to several factors, including depreciation, accident-related damage, or total loss. It is especially relevant for new car buyers, as vehicles tend to depreciate rapidly in the first few years of ownership.

The primary purpose of Gap insurance is to provide financial relief to policyholders in scenarios where their vehicle is declared a total loss or stolen and not recovered. In such cases, the insurance company pays out the full amount owed on the vehicle, rather than just the current market value. This coverage ensures that the policyholder is not left with a significant financial burden, as they would not have to pay the difference between the insurance payout and the outstanding loan or lease balance.

How Gap Insurance Works

When an insured vehicle is involved in an accident that results in a total loss, the insurance company assesses the vehicle’s value at the time of the incident. This value is often based on factors like the vehicle’s make, model, mileage, and current market conditions. If the assessed value is lower than the remaining loan or lease balance, Gap insurance steps in to cover the difference.

For instance, if a policyholder owes $25,000 on their car loan, but the insurance company assesses the vehicle's value at $20,000 after an accident, Gap insurance would cover the $5,000 difference. This ensures that the policyholder is not held responsible for paying the remaining $5,000 out of pocket.

Benefits of Gap Insurance

Financial Protection

The most significant benefit of Gap insurance is the financial protection it offers. By covering the gap between the vehicle’s value and the loan balance, it prevents policyholders from incurring substantial debt in the event of a total loss or theft. This protection is particularly valuable for individuals who have financed or leased their vehicles, as it ensures they can replace their vehicle without the added stress of a large financial burden.

Peace of Mind

Gap insurance provides peace of mind to vehicle owners. Knowing that they are protected in the event of a total loss or theft can alleviate the anxiety associated with vehicle ownership. It allows policyholders to focus on their daily lives and driving experiences without worrying about the potential financial consequences of an unexpected vehicle loss.

Enhanced Resale Value

Gap insurance can indirectly enhance the resale value of a vehicle. By including this coverage in a vehicle’s insurance package, potential buyers may perceive the vehicle as a safer investment. This perception can lead to higher resale values and a more competitive market position for the vehicle.

When to Consider Gap Insurance

Gap insurance is most beneficial for individuals who have recently purchased a new vehicle and are still making payments on their loan or lease. This is because new vehicles tend to depreciate rapidly, and the gap between their value and the loan balance can widen quickly. As a result, Gap insurance provides crucial financial protection during this period.

Additionally, Gap insurance is highly recommended for individuals who have financed a significant portion of their vehicle's value. The larger the loan-to-value ratio, the more beneficial Gap insurance becomes. It is also beneficial for those who have taken out loans with longer repayment terms, as the extended loan period can increase the likelihood of a vehicle's value dropping below the loan balance.

Cost and Availability

The cost of Gap insurance varies depending on several factors, including the type of vehicle, the loan or lease terms, and the insurer. Generally, Gap insurance is relatively affordable, with premiums ranging from 100 to 600 per year. However, it is important to note that the exact cost can only be determined by the specific insurance company and the individual’s policy.

Gap insurance is typically offered by insurance companies as an add-on to comprehensive or collision coverage. It is often included in new car insurance packages, as it provides additional protection for vehicles that are more susceptible to depreciation. Policyholders can usually add Gap insurance to their policy at any time, but it is advisable to do so as soon as possible to ensure coverage for the entire loan or lease term.

Performance Analysis and Real-World Examples

Gap insurance has proven its worth in numerous real-world scenarios. Take, for example, a driver who purchases a new car for 30,000 and finances it over a 60-month period. After just 18 months, the car is involved in an accident and is declared a total loss. The insurance company assesses the vehicle's value at 22,000, leaving the policyholder with a $8,000 gap between the value and the remaining loan balance.

Without Gap insurance, the policyholder would be responsible for paying off the $8,000 difference, which could be a significant financial burden. However, with Gap insurance in place, the policyholder's insurance company would cover this difference, ensuring they are not left with unexpected debt. This real-world example highlights the critical role Gap insurance plays in protecting vehicle owners from financial hardship.

Future Implications and Industry Insights

The importance of Gap insurance is expected to grow as the automotive industry continues to evolve. With the increasing popularity of electric vehicles and autonomous driving technologies, the depreciation patterns of vehicles may shift, potentially leading to more rapid depreciation in certain segments of the market. This could make Gap insurance even more valuable for vehicle owners, as it would provide a safety net against the financial consequences of these evolving depreciation trends.

Furthermore, as consumer awareness of financial protection products increases, there is a growing demand for comprehensive insurance solutions like Gap insurance. Insurance companies are recognizing this trend and are likely to continue offering innovative products to meet these evolving consumer needs. This trend highlights the industry's commitment to providing tailored protection for modern vehicle owners.

Frequently Asked Questions

Is Gap insurance necessary for all vehicle owners?

+Gap insurance is particularly beneficial for individuals who have recently purchased a new vehicle and are still making payments on their loan or lease. It is also recommended for those who have financed a significant portion of their vehicle’s value. However, the necessity of Gap insurance depends on individual circumstances and financial risk tolerance.

How long does Gap insurance coverage typically last?

+Gap insurance coverage typically lasts for the duration of the loan or lease term. It is designed to protect policyholders throughout the entire period of their vehicle financing, ensuring they are not left with a gap in coverage.

Can Gap insurance be added to an existing vehicle insurance policy?

+Yes, Gap insurance can usually be added to an existing vehicle insurance policy. Policyholders can contact their insurance provider to inquire about adding this coverage to their existing policy. It is important to note that the availability and cost of adding Gap insurance may vary depending on the insurance company and the policyholder’s specific circumstances.

Does Gap insurance cover all types of vehicle losses?

+Gap insurance primarily covers total losses, which occur when a vehicle is deemed unrepairable or is stolen and not recovered. It does not cover partial losses, such as those resulting from minor accidents or damage. Policyholders should carefully review their insurance policy to understand the specific coverage and limitations of their Gap insurance.