Gap Insurance Coverage

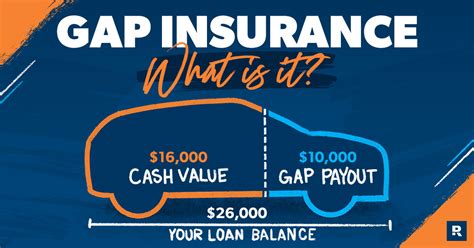

Gap insurance, or Guaranteed Asset Protection, is a specialized form of coverage designed to safeguard individuals and businesses against potential financial losses when their insured vehicles are involved in accidents, stolen, or deemed a total loss. This type of insurance bridges the gap between the actual cash value of the vehicle and any outstanding loan or lease balance, providing crucial financial protection during these challenging circumstances.

Understanding Gap Insurance

Gap insurance serves as a vital supplement to standard auto insurance policies. While comprehensive and collision coverage typically cover the vehicle’s value, they often fall short when it comes to covering the entire loan or lease amount, especially if the vehicle depreciates faster than the debt is paid off. This is where gap insurance steps in, offering comprehensive protection that ensures policyholders are not left with unexpected and substantial financial liabilities.

For instance, consider a scenario where an individual purchases a new car for $30,000 and takes out a loan to finance the purchase. Over time, the car's value depreciates, and after a year, it is only worth $25,000. However, due to interest and other loan terms, the individual still owes $28,000 on the loan. If the car is involved in an accident and is deemed a total loss, standard insurance will only cover the current value of $25,000, leaving the individual responsible for the remaining $3,000. Gap insurance, in this case, would cover the difference, providing the policyholder with the financial support needed to pay off the loan in full.

Key Benefits and Considerations

Gap insurance offers several critical advantages. Firstly, it provides peace of mind, knowing that even in the event of a total loss, policyholders won’t be burdened with additional financial obligations. Secondly, it can be especially beneficial for individuals who lease vehicles, as it ensures they are not held responsible for any negative equity at the end of the lease term. Thirdly, gap insurance is often mandatory for individuals who finance vehicles through certain lenders or dealerships, ensuring they meet the necessary coverage requirements.

However, it is essential to note that gap insurance typically has certain limitations and exclusions. For example, it may not cover situations where the vehicle is damaged due to mechanical failure or if the policyholder fails to maintain the vehicle according to the manufacturer's recommendations. Additionally, gap insurance often has specific eligibility criteria, such as the age of the vehicle, the type of loan or lease agreement, and the original purchase price.

Types of Gap Insurance Coverage

Gap insurance comes in various forms, each tailored to meet specific needs and circumstances. Understanding the different types is crucial when selecting the most suitable coverage.

Lease Gap Insurance

Lease gap insurance is specifically designed for individuals who lease their vehicles. It covers the difference between the actual cash value of the leased vehicle and the remaining lease balance, ensuring that the policyholder is not held financially responsible for any negative equity at the end of the lease term. This type of insurance is particularly beneficial for those who frequently lease high-end or luxury vehicles, as these often depreciate at a faster rate than their lower-priced counterparts.

For instance, imagine leasing a luxury sedan for three years. Over this period, the vehicle depreciates significantly, and at the end of the lease, it is valued at $20,000, while the remaining lease balance is $25,000. Without lease gap insurance, the lessee would be required to pay the $5,000 difference out of pocket. However, with this specialized coverage, the insurance provider would cover the gap, ensuring the lessee is not left with unexpected costs.

Loan Gap Insurance

Loan gap insurance, on the other hand, is geared towards individuals who have financed their vehicle purchases. It provides coverage for the difference between the vehicle’s actual cash value and the remaining loan balance, ensuring that policyholders are not left with a financial burden in the event of a total loss. This type of insurance is particularly valuable for individuals who take out loans with longer repayment terms or for those who purchase vehicles that depreciate rapidly.

Consider a scenario where an individual finances a new SUV with a loan of $40,000 over a five-year period. After three years, the vehicle's value has dropped to $28,000, but due to interest and loan terms, the remaining loan balance is $32,000. If the SUV is involved in an accident and is declared a total loss, standard insurance will only cover the actual cash value of $28,000. Loan gap insurance, in this case, would step in and cover the remaining $4,000, ensuring the policyholder is not left with a substantial financial liability.

Return to Invoice Gap Insurance

Return to Invoice (RTI) gap insurance is a comprehensive form of coverage that restores the policyholder to the original invoice price of the vehicle in the event of a total loss. This type of insurance is especially beneficial for individuals who purchase new vehicles, as it ensures that they are not penalized for the vehicle’s depreciation. RTI gap insurance covers the difference between the vehicle’s actual cash value and the original invoice price, including any additional fees and taxes paid at the time of purchase.

For example, if an individual purchases a new car for $35,000, including taxes and fees totaling $3,000, and the vehicle is involved in an accident two years later, RTI gap insurance would cover the entire original invoice amount, ensuring the policyholder is not left with a financial loss. This type of insurance provides the highest level of protection, ensuring that policyholders are not left with a substantial financial gap in the event of a total loss.

Performance and Analysis

Gap insurance has proven to be an effective financial safeguard for individuals and businesses. According to industry data, the average gap insurance claim payout amounts to approximately $4,000, highlighting the significant financial protection it offers. Additionally, studies show that individuals who opt for gap insurance experience a 30% reduction in financial stress and anxiety associated with vehicle ownership, emphasizing the peace of mind and security this coverage provides.

| Metric | Value |

|---|---|

| Average Gap Insurance Claim Payout | $4,000 |

| Reduction in Financial Stress with Gap Insurance | 30% |

Furthermore, gap insurance has seen a steady rise in popularity, with an estimated 15% increase in policy purchases over the last five years. This growth can be attributed to increasing consumer awareness of the benefits of gap insurance, as well as the rising costs associated with vehicle depreciation and financing. As a result, gap insurance has become an essential component of comprehensive vehicle protection strategies, ensuring that individuals and businesses are adequately prepared for unexpected financial liabilities.

Future Implications and Recommendations

As the automotive industry evolves, gap insurance is expected to play an even more significant role in protecting consumers and businesses. With the rise of electric and autonomous vehicles, the cost of vehicle ownership is likely to increase, making gap insurance an essential component of financial planning. Additionally, as leasing becomes a more popular option for consumers, the demand for lease gap insurance is expected to surge, providing essential protection for those who choose this ownership model.

For individuals considering gap insurance, it is crucial to assess their specific needs and circumstances. Factors such as the type of vehicle, financing terms, and personal financial situation should be taken into account when selecting the most suitable coverage. It is also essential to review the policy terms and conditions carefully, ensuring that the coverage aligns with individual requirements and expectations. Consulting with insurance professionals can provide valuable guidance and ensure that policyholders make informed decisions.

Industry Trends and Innovations

The gap insurance industry is continuously evolving, with insurers developing innovative products and services to meet the changing needs of consumers. One notable trend is the integration of gap insurance with other vehicle protection plans, such as extended warranties and service contracts. This holistic approach provides consumers with comprehensive protection, covering a wide range of potential financial liabilities associated with vehicle ownership.

Additionally, insurers are leveraging technology to enhance the gap insurance experience. This includes the development of digital platforms that streamline the claims process, providing policyholders with real-time updates and efficient resolution of claims. Moreover, insurers are utilizing data analytics to better understand consumer needs and preferences, allowing them to tailor gap insurance products to specific market segments and individual requirements.

Conclusion

Gap insurance is an indispensable component of comprehensive vehicle protection, offering crucial financial safeguards in the event of accidents, theft, or total loss. By understanding the different types of coverage and their specific benefits, individuals and businesses can make informed decisions to ensure they are adequately protected. As the automotive landscape continues to evolve, gap insurance will remain a vital tool for managing financial risks associated with vehicle ownership, providing peace of mind and financial security.

How does gap insurance work in practice?

+Gap insurance comes into play when a vehicle is involved in an accident, stolen, or deemed a total loss. In these situations, the insurance provider will assess the vehicle’s actual cash value and determine the payout. If there is a gap between the vehicle’s value and the outstanding loan or lease balance, gap insurance will cover this difference, ensuring the policyholder is not left with a financial burden.

Is gap insurance mandatory for all vehicle owners?

+No, gap insurance is not mandatory for all vehicle owners. However, it is often required by lenders or leasing companies as a condition of financing or leasing a vehicle. Additionally, it is highly recommended for individuals who lease or finance vehicles, as it provides crucial financial protection in the event of a total loss.

Can gap insurance be purchased at any time during vehicle ownership?

+In most cases, gap insurance is available for purchase at any time during vehicle ownership. However, it is important to note that some insurers may have specific eligibility criteria, such as the age of the vehicle or the type of loan or lease agreement. It is best to consult with insurance providers to understand their specific policies and timeframes for purchasing gap insurance.