Gap Insurance On Car

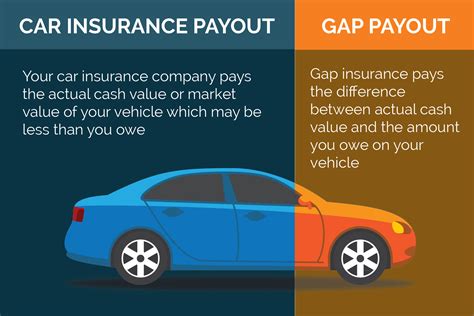

Gap insurance, or Guaranteed Asset Protection insurance, is a specialized form of coverage designed to protect vehicle owners in specific financial scenarios. This insurance type bridges the gap between a vehicle's actual cash value and the remaining balance on a loan or lease, ensuring that policyholders are not left with a significant financial burden should their vehicle be written off or stolen. While it may not be a mandatory insurance type in all jurisdictions, gap insurance plays a crucial role in safeguarding individuals and businesses from potential financial losses, especially in the context of rapidly depreciating vehicle values.

Understanding the Role of Gap Insurance

Gap insurance serves as a crucial safeguard for vehicle owners who have taken out a loan or are leasing their vehicle. In the unfortunate event of a total loss, such as an accident or theft, the insurance provider will typically pay out the actual cash value of the vehicle. However, this value often falls short of the outstanding loan or lease balance, leaving the policyholder responsible for the remaining amount. This is where gap insurance steps in, covering the difference, or “gap,” between the vehicle’s value and the loan or lease balance.

Consider the example of purchasing a new car for $30,000, with a loan of the same amount. Over time, the car's value depreciates, and after a year, it is worth only $25,000. Should an accident occur that totals the car, the insurance company would typically pay the actual cash value of $25,000. However, the loan balance remains at $30,000, leaving a gap of $5,000. This is where gap insurance would step in, covering the entire $5,000 gap, ensuring the policyholder is not left with a financial burden.

Who Needs Gap Insurance?

Gap insurance is particularly beneficial for individuals who have purchased a new vehicle and are making loan repayments, as well as those who have leased a car. This is because new vehicles often experience rapid depreciation in their initial years, and the loan or lease balance can quickly exceed the vehicle’s actual cash value.

For instance, imagine purchasing a brand-new sedan for $40,000 with a 5-year loan. Within the first year, the vehicle's value might drop to $35,000, but the loan balance remains at $40,000. In the event of a total loss, without gap insurance, the policyholder would be responsible for paying the remaining $5,000, even though the vehicle no longer exists.

| Vehicle Age | Vehicle Value | Loan Balance | Potential Gap |

|---|---|---|---|

| 1 Year | $35,000 | $40,000 | $5,000 |

| 2 Years | $30,000 | $40,000 | $10,000 |

| 3 Years | $25,000 | $40,000 | $15,000 |

Key Considerations and Benefits of Gap Insurance

Financial Protection

The primary benefit of gap insurance is the financial protection it offers. By covering the difference between the vehicle’s value and the loan or lease balance, policyholders are shielded from having to pay thousands of dollars out of pocket in the event of a total loss. This is particularly crucial for individuals who have just purchased a new vehicle and are still in the early stages of paying off their loan or lease.

Rapid Depreciation of Vehicles

Vehicles, especially new ones, can depreciate rapidly in the first few years of ownership. This means that the loan or lease balance can quickly outpace the vehicle’s actual cash value. Gap insurance bridges this gap, ensuring that policyholders are not left with a financial burden should their vehicle be written off.

Peace of Mind

Knowing that you have gap insurance provides peace of mind. Policyholders can rest assured that, in the event of a total loss, they will not be financially responsible for the full loan or lease balance. This peace of mind can be especially valuable for individuals or businesses relying on their vehicles for daily operations or personal use.

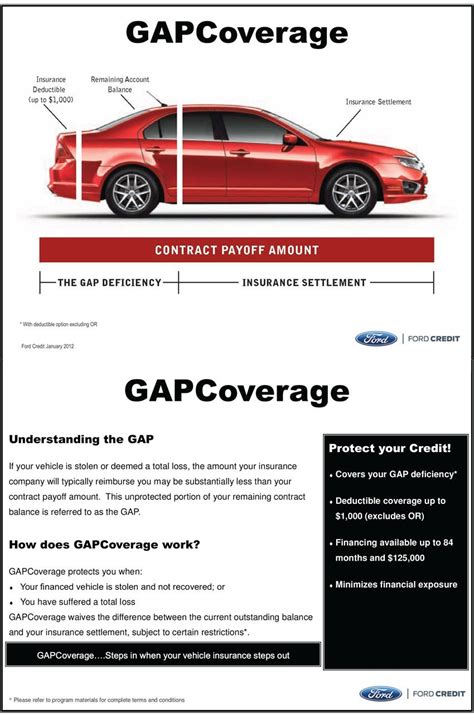

How Gap Insurance Works

Gap insurance is typically offered as an add-on to standard car insurance policies. It can be purchased from insurance companies, dealerships, or finance companies. The cost of gap insurance varies depending on several factors, including the type of vehicle, the value of the vehicle, and the policyholder’s location.

When is Gap Insurance Needed?

Gap insurance is most commonly needed when a vehicle is financed or leased. In these scenarios, the vehicle’s value depreciates over time, and the loan or lease balance can quickly exceed the vehicle’s actual cash value. Gap insurance ensures that, in the event of a total loss, the policyholder is not left with a financial burden.

Who Provides Gap Insurance?

Gap insurance is typically provided by insurance companies, dealerships, or finance companies. Some vehicle manufacturers also offer gap insurance as an optional add-on when purchasing a new car.

Cost of Gap Insurance

The cost of gap insurance varies depending on several factors. These include the type of vehicle, the value of the vehicle, the policyholder’s location, and the provider of the insurance. In some cases, gap insurance can be included in the cost of a car loan or lease, while in others, it may be purchased separately.

Frequently Asked Questions

Is gap insurance mandatory for all vehicle owners?

+

Gap insurance is not mandatory for all vehicle owners. However, it is highly recommended for those who have financed or leased their vehicles, as it provides crucial financial protection in the event of a total loss.

How much does gap insurance typically cost?

+

The cost of gap insurance varies depending on factors such as the type and value of the vehicle, the policyholder’s location, and the provider of the insurance. It can range from a few hundred to a few thousand dollars.

Can gap insurance be purchased separately, or is it only available as an add-on to standard car insurance policies?

+

Gap insurance can be purchased separately from insurance companies, dealerships, or finance companies. It is also often available as an add-on to standard car insurance policies, providing a convenient and cost-effective option for policyholders.

Does gap insurance cover all types of vehicles, or is it limited to certain makes and models?

+

Gap insurance is typically available for all types of vehicles, including cars, motorcycles, and commercial vehicles. However, some insurance providers may have specific restrictions or requirements, so it’s essential to check with your provider.

What happens if I have gap insurance and my vehicle is involved in an accident or is stolen?

+

If you have gap insurance and your vehicle is involved in an accident or is stolen, and it is declared a total loss, the gap insurance will cover the difference between the vehicle’s actual cash value and the outstanding loan or lease balance. This ensures that you are not left with a financial burden.