Gap Insurance State Farm

When it comes to vehicle insurance, understanding the different coverage options is crucial for ensuring you have adequate protection. Gap insurance, offered by various providers, is a type of coverage that addresses the financial gap between the actual cash value of your vehicle and any remaining loan or lease balance in the event of a total loss. State Farm, a leading insurance provider in the United States, offers gap insurance as an add-on to its auto insurance policies. In this comprehensive guide, we will delve into the specifics of Gap Insurance by State Farm, exploring its benefits, coverage details, and how it can provide peace of mind for vehicle owners.

Understanding Gap Insurance and Its Significance

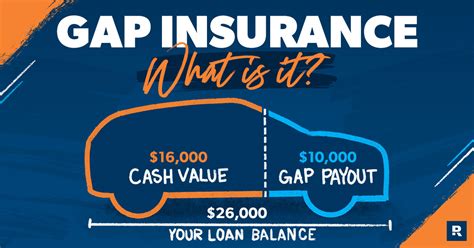

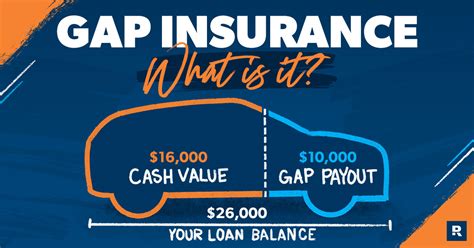

Gap insurance, also known as Guaranteed Asset Protection, is designed to cover the difference between the amount owed on a vehicle loan or lease and the vehicle’s actual cash value (ACV) at the time of a total loss. This difference, often referred to as the “gap,” can occur due to depreciation, especially in the early years of a loan or lease. Without gap insurance, vehicle owners may be responsible for paying the entire loan or lease balance, even after receiving compensation for the ACV from their primary insurance policy.

Consider a scenario where you've purchased a new car for $30,000 and financed it with a loan. After a year, your car is involved in an accident and deemed a total loss. At this point, your primary insurance policy will pay out the ACV, which might be $25,000 due to depreciation. However, you still owe the full loan amount of $30,000. This is where gap insurance steps in to bridge the financial gap, ensuring you're not left with a substantial financial burden.

State Farm’s Gap Insurance Coverage

State Farm’s Gap Insurance is an optional coverage that can be added to your existing auto insurance policy. Here’s an in-depth look at how it works and the benefits it provides:

Coverage Details

- Loan/Lease Balance Coverage: Gap Insurance by State Farm covers the difference between the primary insurance settlement and the outstanding loan or lease balance. This ensures that you’re not personally responsible for paying off the remaining debt.

- Depreciation Protection: Vehicles typically depreciate rapidly in the first few years of ownership. Gap Insurance accounts for this depreciation, ensuring that you’re not left with a financial gap if your vehicle is totaled or stolen.

- Lease Protection: If you’re leasing a vehicle, Gap Insurance can be especially valuable. It covers the difference between the lease payoff amount and the primary insurance settlement, providing protection against costly lease-end penalties.

Benefits of State Farm’s Gap Insurance

By adding Gap Insurance to your State Farm auto policy, you gain several advantages:

- Financial Security: Gap Insurance provides peace of mind, knowing that you won't be left with unexpected financial obligations if your vehicle is totaled or stolen.

- Comprehensive Coverage: It complements your primary auto insurance, ensuring that you're fully protected against financial losses due to depreciation.

- Leaseholder Protection: If you're leasing, Gap Insurance is essential for avoiding lease-end penalties and ensuring a smooth transition if you decide to upgrade to a new vehicle.

Eligibility and Cost

State Farm’s Gap Insurance is available to policyholders who have comprehensive and collision coverage on their auto insurance policies. The cost of gap insurance varies depending on several factors, including the value of your vehicle, the length of your loan or lease, and your personal insurance profile. It’s generally an affordable addition to your policy, providing significant financial protection.

Who Should Consider Gap Insurance?

Gap insurance is particularly beneficial for individuals in the following situations:

- New Vehicle Owners: Vehicles depreciate rapidly in the first few years of ownership. If you've recently purchased a new car, gap insurance can protect you from the financial gap caused by depreciation.

- Leasing a Vehicle: Lease agreements often have strict mileage and wear-and-tear requirements. Gap insurance ensures you're not held financially responsible for any lease-end penalties.

- Financing with a Loan: If you've financed your vehicle with a loan, gap insurance provides protection against the financial gap that can occur due to depreciation.

How to Obtain State Farm’s Gap Insurance

Adding Gap Insurance to your State Farm auto policy is a straightforward process. You can discuss your options with a State Farm agent, who can provide personalized advice based on your vehicle and financial situation. It’s important to note that gap insurance is typically most beneficial when added early in the life of your loan or lease, as it covers the period when depreciation is most significant.

Real-World Examples and Testimonials

To illustrate the value of Gap Insurance, consider the following real-world scenario:

"I recently totaled my car in an accident, and I was grateful to have Gap Insurance through State Farm. My loan balance was significantly higher than the actual cash value of my vehicle, but with Gap Insurance, I didn't have to worry about paying the difference. It was a huge relief and allowed me to focus on getting back on the road safely."

- John D., Satisfied State Farm Customer

Testimonials like John's highlight the real-world impact of Gap Insurance. It provides a safety net for vehicle owners, ensuring that financial setbacks don't accompany the stress of an accident or theft.

FAQs

Can I add Gap Insurance to my existing State Farm auto policy?

+Yes, you can add Gap Insurance to your State Farm auto policy if you have comprehensive and collision coverage. Contact your State Farm agent to discuss your options and eligibility.

How much does Gap Insurance cost through State Farm?

+The cost of Gap Insurance varies based on factors like your vehicle’s value, loan or lease terms, and your insurance profile. It’s an affordable add-on that provides significant financial protection.

Is Gap Insurance necessary if I have comprehensive and collision coverage?

+While comprehensive and collision coverage protect against physical damage, they may not cover the entire loan or lease balance in the event of a total loss. Gap Insurance bridges this gap, ensuring you’re not left with unexpected financial obligations.

When is the best time to add Gap Insurance to my policy?

+It’s generally recommended to add Gap Insurance early in the life of your loan or lease when depreciation is most significant. This ensures you have maximum protection throughout the duration of your agreement.

Does Gap Insurance cover any additional fees or penalties beyond the loan/lease balance?

+Gap Insurance primarily covers the difference between the loan/lease balance and the actual cash value of your vehicle. It may also cover certain additional fees or penalties, depending on the terms of your policy and the circumstances of your claim.

Gap Insurance by State Farm is a valuable addition to your auto insurance portfolio, providing essential protection against the financial gap that can arise from vehicle depreciation, accidents, or theft. By understanding the benefits and coverage details, you can make an informed decision to safeguard your financial well-being.