General Auto Insurance

The world of automobile insurance is vast and often confusing, with various policies, coverage options, and terms that can leave many drivers feeling overwhelmed. Understanding the ins and outs of auto insurance is crucial, as it not only provides financial protection in the event of accidents or vehicle-related incidents but also ensures compliance with legal requirements. This comprehensive guide aims to shed light on the complexities of general auto insurance, offering an in-depth analysis of its key components, benefits, and considerations to help you make informed decisions.

Unraveling the Complexity: An Overview of General Auto Insurance

General auto insurance is a fundamental type of coverage that forms the backbone of most insurance policies for vehicle owners. It encompasses a range of protection options designed to safeguard policyholders from financial losses resulting from various incidents involving their vehicles. These incidents can include accidents, theft, natural disasters, and other perils outlined in the policy.

The primary goal of general auto insurance is to provide comprehensive coverage, offering peace of mind to drivers and vehicle owners. This type of insurance typically includes liability coverage, which protects policyholders from claims arising from accidents they cause, as well as collision and comprehensive coverage for damages to the insured vehicle itself.

Moreover, general auto insurance often extends to cover medical expenses for injuries sustained in accidents, regardless of fault. This aspect is particularly crucial, as it ensures that policyholders and their passengers can access necessary medical care without incurring significant out-of-pocket expenses.

Key Components and Coverage Options

General auto insurance is a multifaceted coverage plan, consisting of several essential components that work together to provide comprehensive protection. These components can be tailored to meet the specific needs and preferences of policyholders, ensuring that their unique circumstances are taken into account.

Liability Coverage

Liability coverage is a cornerstone of general auto insurance policies. It provides protection against claims arising from accidents caused by the policyholder. This coverage is crucial, as it safeguards policyholders from potential financial ruin in the event of a serious accident. Liability coverage typically includes both bodily injury and property damage liability, ensuring that the insured is covered for a wide range of potential claims.

| Bodily Injury Liability | Property Damage Liability |

|---|---|

| Covers medical expenses and lost wages for injured individuals in accidents caused by the policyholder. | Provides compensation for damage to the other party's vehicle or property in an accident caused by the insured. |

Collision and Comprehensive Coverage

Collision and comprehensive coverage are essential components of general auto insurance, providing protection for the insured vehicle itself. Collision coverage comes into play when the insured vehicle is involved in an accident, regardless of fault. It covers the cost of repairing or replacing the vehicle, up to the vehicle’s actual cash value, minus any applicable deductibles.

On the other hand, comprehensive coverage offers protection against damages caused by incidents other than collisions. This includes theft, vandalism, natural disasters, and other perils. Comprehensive coverage is vital for protecting the insured vehicle from a wide range of potential risks, ensuring that policyholders can get their vehicle repaired or replaced if it's damaged or destroyed.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, is an optional coverage that provides additional protection for medical expenses. It covers the cost of medical treatment for the policyholder and their passengers, regardless of fault in an accident. MedPay can be particularly beneficial, as it provides quick and easy access to medical care without the need for lengthy legal processes.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage is another crucial component of general auto insurance. This coverage protects policyholders when involved in an accident with a driver who has little or no insurance. It provides compensation for bodily injury and property damage caused by an uninsured or underinsured driver, ensuring that the insured is not left financially vulnerable in such situations.

Factors Influencing Auto Insurance Rates

Auto insurance rates are determined by a multitude of factors, each playing a significant role in the overall cost of coverage. Understanding these factors is essential for policyholders, as it allows them to make informed decisions about their coverage and potentially find ways to save on their insurance premiums.

Driver Profile and History

One of the most critical factors influencing auto insurance rates is the driver’s profile and history. Insurers consider various aspects of a driver’s record, including their age, gender, driving experience, and accident history. Younger drivers, particularly those under 25, are often considered higher risk and may face higher premiums. Similarly, drivers with a history of accidents or traffic violations may also see increased insurance costs.

Vehicle Type and Usage

The type of vehicle insured and its intended usage are significant factors in determining insurance rates. High-performance sports cars, for instance, often carry higher premiums due to their increased risk of accidents and higher repair costs. Additionally, vehicles used for business purposes or those driven frequently may also result in higher insurance rates, as they are exposed to more risk on the road.

Location and Mileage

The policyholder’s location and estimated annual mileage are also crucial factors. Areas with higher crime rates or a history of frequent accidents may see increased insurance rates. Similarly, drivers who commute long distances or frequently use their vehicles for personal travel may also face higher premiums, as they are on the road more often and therefore exposed to a greater risk of incidents.

Credit Score and Payment History

An individual’s credit score and payment history can also impact their auto insurance rates. Many insurers use credit-based insurance scores to assess a policyholder’s financial responsibility and predict their likelihood of filing a claim. A higher credit score can often lead to lower insurance rates, as it indicates a lower risk profile.

Maximizing Coverage and Minimizing Costs

Navigating the complexities of auto insurance requires a delicate balance between maximizing coverage and minimizing costs. While comprehensive coverage is essential for financial protection, policyholders can employ various strategies to find the right balance between the two.

Understanding Coverage Needs

The first step in maximizing coverage is understanding one’s unique coverage needs. Policyholders should assess their specific circumstances, including their vehicle’s value, their driving habits, and their financial situation. This assessment can help determine the appropriate levels of coverage, ensuring that policyholders are not paying for unnecessary protection while also not leaving themselves vulnerable to financial risk.

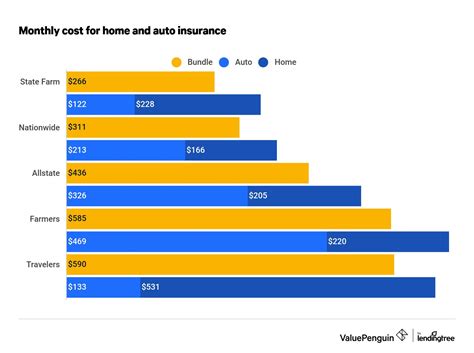

Comparing Quotes and Bundling Policies

Shopping around for auto insurance quotes is a crucial step in finding the best coverage at the most competitive rates. Policyholders should obtain quotes from multiple insurers to compare coverage options and prices. Additionally, bundling auto insurance with other types of insurance, such as home or renters’ insurance, can often result in significant savings, as insurers may offer discounts for multiple policies.

Utilizing Discounts and Rewards

Insurers often offer a range of discounts and rewards to policyholders, which can help reduce insurance costs. These discounts may be based on factors such as good driving records, safe vehicle features, multi-policy discounts, or even educational achievements. Policyholders should inquire about these discounts and ensure they are taking advantage of all applicable savings opportunities.

Maintaining a Safe Driving Record

Maintaining a safe driving record is perhaps the most effective way to minimize auto insurance costs. A clean driving record demonstrates responsibility and lowers the risk of accidents, which can result in lower insurance premiums. Policyholders should focus on safe driving practices, obey traffic laws, and avoid distractions while on the road.

Future Trends and Innovations in Auto Insurance

The auto insurance industry is evolving rapidly, with technological advancements and changing consumer needs driving significant innovations. These changes are shaping the future of auto insurance, offering new opportunities for policyholders to access more personalized and efficient coverage.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance (UBI) are emerging trends in the auto insurance industry. These technologies use data collected from vehicles to assess driving behavior and determine insurance rates. By installing a small device or using a smartphone app, insurers can track driving habits such as mileage, speed, and braking patterns. This data-driven approach allows for more accurate risk assessment and potentially lower insurance rates for safe drivers.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are transforming the auto insurance landscape. These technologies are being used to automate various processes, from claims handling to risk assessment. AI-powered chatbots, for instance, can provide instant support to policyholders, answering common queries and guiding them through the claims process. Additionally, machine learning algorithms can analyze vast amounts of data to identify patterns and predict risks, leading to more accurate pricing and coverage recommendations.

Connected Car Technology

The rise of connected car technology is also impacting the auto insurance industry. Connected cars, equipped with advanced sensors and communication systems, can provide real-time data on vehicle performance and driver behavior. This data can be used to enhance safety features and provide valuable insights for insurers. Connected car technology has the potential to revolutionize auto insurance, offering more precise risk assessment and personalized coverage options.

Conclusion: Navigating the Future of Auto Insurance

General auto insurance is a critical aspect of vehicle ownership, providing essential financial protection and peace of mind. By understanding the key components of auto insurance, policyholders can make informed decisions about their coverage, ensuring they have the protection they need without paying for unnecessary extras. As the industry continues to evolve with technological advancements, policyholders can look forward to more personalized and efficient coverage options, further enhancing the value of auto insurance.

What is the difference between liability and collision coverage in auto insurance?

+Liability coverage protects policyholders from claims arising from accidents they cause, covering bodily injury and property damage liability. Collision coverage, on the other hand, provides protection for the insured vehicle itself, covering damages caused by collisions regardless of fault.

How does credit score impact auto insurance rates?

+Credit score is used to assess a policyholder’s financial responsibility and predict their likelihood of filing a claim. A higher credit score often leads to lower insurance rates, as it indicates a lower risk profile.

What is the benefit of usage-based insurance (UBI) in auto insurance?

+UBI uses data collected from vehicles to assess driving behavior and determine insurance rates. It allows for more accurate risk assessment, potentially lowering insurance rates for safe drivers who demonstrate responsible driving habits.