General Auto Insurance Quote

Auto insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. Obtaining an auto insurance quote is a crucial step in ensuring you have adequate coverage for your vehicle and understanding the associated costs. In this comprehensive guide, we will delve into the world of auto insurance quotes, exploring the factors that influence rates, the steps involved in the quoting process, and strategies to secure the best coverage at an affordable price.

Understanding Auto Insurance Quotes

An auto insurance quote is an estimate of the cost of insuring your vehicle for a specific period, typically a year. It serves as a guide for drivers to assess the financial implications of different coverage options and make informed decisions about their insurance needs. Insurance companies use a variety of factors to calculate quotes, aiming to accurately assess the risk associated with insuring a particular vehicle and driver.

Factors Influencing Auto Insurance Quotes

Numerous factors come into play when determining auto insurance quotes. These include:

- Driver’s Age and Gender: Younger drivers, especially males, often face higher premiums due to their perceived higher risk of accidents. Age and gender play a significant role in risk assessment.

- Driving History: Your past driving record is a crucial factor. A clean driving history with no accidents or traffic violations can lead to lower premiums, while a history of accidents or moving violations may result in higher rates.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its primary usage (e.g., commuting, business, or pleasure), can impact insurance costs. High-performance or luxury vehicles may require more expensive coverage.

- Location and Mileage: Where you live and the number of miles you drive annually are important considerations. Urban areas with higher traffic density and accident rates often result in higher premiums.

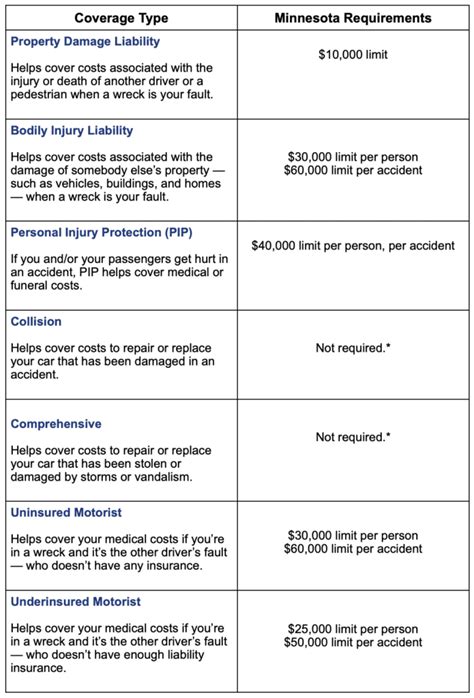

- Coverage and Deductibles: The level of coverage you choose (liability, collision, comprehensive) and the associated deductibles can significantly affect your quote. Higher deductibles typically lead to lower premiums.

- Credit Score: In many cases, your credit score can influence your insurance rates. A higher credit score may result in lower premiums, as it is seen as an indicator of financial responsibility.

- Discounts and Bundles: Insurance companies offer various discounts, such as safe driver discounts, good student discounts, and multi-policy bundles. Taking advantage of these can reduce your overall insurance costs.

The Quoting Process: Step-by-Step

Obtaining an auto insurance quote is a straightforward process that can be done online or by contacting insurance providers directly. Here’s a step-by-step guide:

Step 1: Gather Information

Before requesting a quote, gather the necessary information, including:

- Personal details: Name, date of birth, driver’s license number, and Social Security number.

- Vehicle information: Make, model, year, VIN (Vehicle Identification Number), and odometer reading.

- Driving history: Details of any accidents, traffic violations, or claims made in the past 5-10 years.

- Current or previous insurance: Information about your current or previous auto insurance policy, if applicable.

Step 2: Choose Your Insurance Provider

Research and compare different insurance companies to find the ones that offer the coverage and pricing that align with your needs. Consider factors such as financial stability, customer service ratings, and policy features.

Step 3: Request a Quote

You can request a quote online, over the phone, or in person at an insurance agent’s office. Provide the necessary information and select the coverage options you desire. Be as accurate as possible to ensure an accurate quote.

Step 4: Review the Quote

Once you receive the quote, carefully review it to understand the coverage limits, deductibles, and any additional fees or discounts applied. Ensure that the quote aligns with your expectations and needs.

Step 5: Compare and Negotiate (if necessary)

If you’re obtaining quotes from multiple providers, compare the coverage, premiums, and overall value offered. You may find that certain providers offer better rates for your specific situation. Don’t hesitate to negotiate with your chosen provider to see if they can offer a more competitive rate.

Step 6: Purchase the Policy

Once you’ve found the right insurance provider and quote, finalize the purchase. Pay the initial premium and provide any necessary documentation to activate your policy.

Tips for Securing the Best Auto Insurance Quote

Here are some strategies to help you get the most favorable auto insurance quote:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates. Online comparison tools can be a convenient way to do this.

- Improve Your Driving Record: Maintain a clean driving history by avoiding accidents and traffic violations. This can significantly reduce your insurance premiums over time.

- Increase Your Deductible: Opting for a higher deductible can lower your insurance premiums. However, ensure that you can afford the deductible in the event of a claim.

- Bundle Policies: If you have multiple insurance needs (e.g., auto, home, or renters insurance), consider bundling your policies with the same provider. This can lead to substantial savings.

- Explore Discounts: Insurance companies offer a variety of discounts, so ask about any applicable discounts based on your age, profession, vehicle safety features, or good student status.

- Maintain a Good Credit Score: A strong credit score can positively impact your insurance rates. Focus on improving your credit if it’s an area of concern.

- Consider Usage-Based Insurance: Some insurers offer usage-based insurance programs that track your driving habits and provide discounts for safe driving. These programs can be a great option for low-mileage drivers.

Future Implications and Considerations

The auto insurance landscape is constantly evolving, and it’s important to stay informed about potential changes that may impact your coverage and rates. Here are some key considerations for the future:

- Technology and Telematics: Usage-based insurance and telematics devices are gaining popularity. These technologies can provide real-time data on driving behavior, potentially leading to more accurate risk assessment and personalized insurance rates.

- Autonomous Vehicles: As self-driving cars become more prevalent, insurance coverage for these vehicles will need to adapt. Liability and coverage considerations may shift as the responsibility for accidents changes.

- Regulatory Changes: Keep an eye on any regulatory changes in your region that may impact auto insurance. Changes in laws and regulations can influence coverage requirements and premium structures.

- Emerging Risks: Stay aware of emerging risks, such as cyber threats to connected vehicles. As technology advances, new risks may emerge, and insurance coverage will need to adapt accordingly.

Frequently Asked Questions

What is the difference between liability coverage and collision coverage in auto insurance?

+Liability coverage is the most basic type of auto insurance, protecting you financially if you cause an accident that results in bodily injury or property damage to others. Collision coverage, on the other hand, covers damage to your own vehicle, regardless of fault, in the event of a collision with another vehicle or object.

How does my credit score affect my auto insurance rates?

+Insurance companies often use credit scores as a factor in determining insurance rates. A higher credit score is generally associated with lower insurance premiums, as it indicates financial responsibility and a lower risk of filing claims.

Can I get auto insurance without a driver’s license?

+Obtaining auto insurance without a valid driver’s license can be challenging. Most insurance companies require proof of a valid driver’s license to issue a policy. However, some insurers may offer coverage for specific situations, such as non-driving vehicle owners or individuals with restricted licenses.

What factors can cause my auto insurance rates to increase over time?

+Several factors can lead to an increase in auto insurance rates, including: accidents or traffic violations, changes in your driving record, moving to a higher-risk area, adding a young or inexperienced driver to your policy, or making a claim on your policy.