General Commercial Liability Insurance

General Commercial Liability Insurance is a crucial aspect of risk management for businesses of all sizes. In an ever-changing business landscape, unforeseen circumstances and potential liabilities can arise, impacting a company's operations and financial stability. This type of insurance acts as a safety net, providing coverage for various claims and legal expenses that a business may encounter.

In today's complex world, where lawsuits and claims can come from multiple directions, having comprehensive general liability insurance is not just a wise choice but a necessary one. It offers protection against a wide range of risks, ensuring that businesses can operate with confidence, knowing they have the support they need to navigate unexpected challenges.

Understanding the Scope: What is General Commercial Liability Insurance?

General Commercial Liability Insurance, often simply referred to as General Liability Insurance, is a broad form of business insurance that protects against a variety of claims that may arise from daily operations. It provides coverage for bodily injury, property damage, personal and advertising injury, and medical expenses. The primary purpose of this insurance is to safeguard businesses from the financial burdens that can result from accidents, negligence, or other covered events.

This type of insurance is tailored to meet the unique needs of different businesses. It can be customized with various endorsements and limits to ensure that the coverage aligns with the specific risks and operations of the insured entity. For instance, a restaurant might need higher limits for food-related incidents, while a tech startup might focus more on advertising and personal injury claims.

General Liability Insurance is particularly beneficial for small businesses and startups, which often operate with limited resources and may not have the financial capacity to absorb unexpected costs. By providing a financial safety net, this insurance allows these enterprises to focus on their core operations and growth strategies without the constant worry of potential liabilities.

Key Coverage Areas

Bodily Injury and Property Damage

General Liability Insurance covers bodily injury and property damage claims that may occur due to the business’s operations. This includes incidents that happen on the business premises, as well as off-site, such as at a client’s location or during a business-related event.

For instance, if a customer slips and falls in a retail store, the insurance would cover the medical expenses and any legal fees associated with the claim. Similarly, if a business's delivery vehicle accidentally damages a client's property, the insurance would step in to handle the repairs and any related costs.

Personal and Advertising Injury

This aspect of General Liability Insurance covers claims arising from defamation, copyright infringement, or other forms of personal injury caused by the business’s advertising or marketing activities. It provides protection against lawsuits that may result from false advertising, trademark infringement, or other forms of intellectual property violations.

For a marketing agency, this coverage is crucial. It ensures that if a client sues for false advertising or trademark infringement, the agency has the necessary financial support to defend itself and resolve the issue.

Medical Payments

General Liability Insurance also includes medical payments coverage, which provides quick payment for minor injuries sustained on the business premises. This coverage is designed to cover medical expenses up to a certain limit, regardless of who is at fault. It helps businesses provide immediate assistance to injured individuals, demonstrating a proactive and caring approach.

For example, if a visitor trips over a loose cable in the office and sustains a minor injury, the medical payments coverage would cover the cost of their medical treatment without the need for a lengthy claim process.

Benefits and Real-World Applications

General Commercial Liability Insurance offers a multitude of benefits to businesses. Firstly, it provides financial protection, ensuring that businesses can manage unexpected expenses related to accidents, injuries, or legal claims. This is especially crucial for small businesses, as it allows them to avoid potential bankruptcy due to a single major incident.

Secondly, this insurance enhances a business's credibility and trustworthiness. Many clients and partners prefer to work with insured businesses, knowing that they have the necessary coverage to manage potential risks. This can be a deciding factor in winning contracts or establishing long-term business relationships.

Furthermore, General Liability Insurance can help businesses maintain a positive public image. In the event of an accident or incident, the insurance can assist in managing the situation effectively, minimizing negative publicity and potential damage to the business's reputation.

Real-world examples of the benefits of this insurance abound. For instance, a construction company might face a lawsuit due to an accident at one of its job sites. General Liability Insurance would step in to cover the legal costs and any compensation awarded, allowing the company to continue its operations without significant financial strain.

Customization and Endorsements

One of the strengths of General Commercial Liability Insurance is its flexibility and ability to be tailored to the unique needs of different businesses. Insurance providers offer a range of endorsements and coverage options that allow businesses to customize their policies.

For example, a business operating in a high-risk industry might opt for increased limits on certain types of coverage. A tech company dealing with sensitive data might choose to add a cyber liability endorsement to their policy. These customizations ensure that the insurance policy aligns perfectly with the business's specific risks and operations.

Specialty Endorsements

Insurance providers offer a wide array of specialty endorsements that can be added to General Liability Insurance policies. These endorsements cater to specific industries and situations, providing additional protection beyond the standard coverage.

Some common specialty endorsements include:

- Employment Practices Liability: Covers claims of workplace harassment, discrimination, or wrongful termination.

- Cyber Liability: Provides coverage for data breaches, cyber extortion, and other cyber-related risks.

- Professional Liability (Errors and Omissions): Protects against claims of negligence or errors in professional services.

- Products Liability: Covers claims arising from defective products sold by the business.

By adding these endorsements, businesses can strengthen their insurance coverage, ensuring they are protected against a wider range of potential liabilities.

Claim Process and Resolution

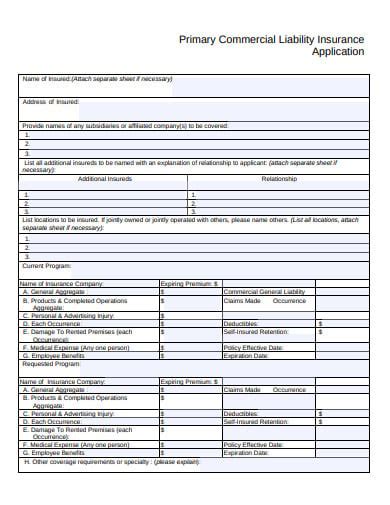

In the event of a claim, the General Commercial Liability Insurance policy holder is required to notify their insurance provider promptly. The insurer will then initiate an investigation to determine the validity and scope of the claim. This process may involve gathering evidence, interviewing witnesses, and reviewing relevant documentation.

Once the claim is verified, the insurance provider will manage the legal and financial aspects, including hiring legal representation if necessary. The insurer's goal is to resolve the claim efficiently and effectively, minimizing the impact on the insured business. This often involves negotiating settlements or defending the business in court, depending on the nature of the claim.

It's important for businesses to maintain open communication with their insurance provider throughout the claim process. This ensures that all relevant information is shared and that the business can actively participate in the resolution process, helping to achieve a favorable outcome.

Conclusion: The Importance of General Commercial Liability Insurance

General Commercial Liability Insurance is a cornerstone of business risk management. It provides a vital layer of protection, safeguarding businesses from a wide range of potential liabilities. By understanding the scope and benefits of this insurance, businesses can make informed decisions to ensure they have adequate coverage for their unique operations and risks.

With the right General Liability Insurance policy, businesses can operate with confidence, knowing they are protected against unexpected events and can focus on their core mission without the fear of financial ruin. This insurance is not just a legal requirement or a necessary expense; it is a strategic investment in the long-term health and sustainability of the business.

How much does General Commercial Liability Insurance typically cost?

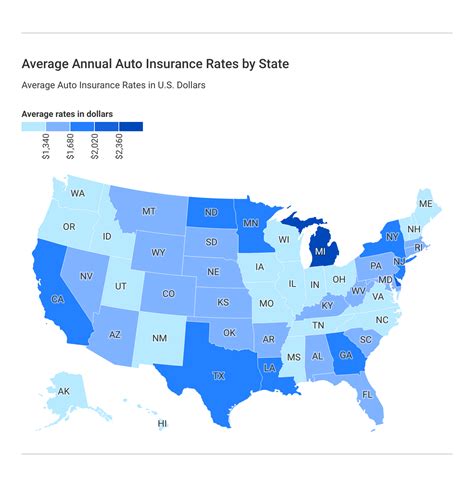

+The cost of General Commercial Liability Insurance can vary significantly based on factors such as the business’s industry, size, location, and claims history. On average, small businesses can expect to pay anywhere from 500 to 2,000 annually for a standard policy. However, this range can increase or decrease depending on the specific circumstances and coverage needs of the business.

What happens if I have a claim and my General Liability Insurance policy doesn’t cover it?

+If your claim is not covered by your General Liability Insurance policy, you will be responsible for covering the costs yourself. This is why it’s crucial to thoroughly review your policy and understand its coverage limits and exclusions. You may also consider adding endorsements or increasing your policy limits to ensure you have the necessary protection for your specific risks.

Can I customize my General Liability Insurance policy to fit my business’s specific needs?

+Absolutely! One of the key advantages of General Liability Insurance is its flexibility. You can customize your policy by adding endorsements or increasing coverage limits to align with your business’s unique risks and operations. This ensures that you have the right level of protection without paying for coverage you don’t need.