Get Covered Renters Insurance

Renters insurance is a crucial aspect of financial planning for anyone living in a rented space, be it an apartment, house, or condominium. While it is often overlooked, renters insurance provides essential protection for your belongings and can offer peace of mind in various unforeseen circumstances. In this comprehensive guide, we will delve into the world of renters insurance, exploring its benefits, coverage options, and how it can safeguard your personal property. Whether you're a student, a young professional, or a seasoned renter, understanding the importance of renters insurance is vital to protecting your financial well-being.

The Significance of Renters Insurance

Renters insurance serves as a safety net for individuals who do not own the property they reside in. Unlike homeowners insurance, which covers the structure and its contents, renters insurance focuses primarily on the personal belongings and liabilities of the tenant. Here’s a closer look at why renters insurance is a necessity:

Protection Against Unforeseen Events

Life is unpredictable, and renters insurance provides coverage for a range of unexpected events that could potentially leave you with significant financial losses. These events may include:

- Fire: A fire can break out due to various reasons, from cooking accidents to electrical malfunctions. Renters insurance can cover the cost of replacing your belongings damaged or destroyed by fire.

- Water Damage: Plumbing issues, burst pipes, or natural disasters like floods can lead to water damage. Renters insurance often includes coverage for water-related incidents.

- Theft: Unfortunately, theft is a common occurrence. Renters insurance provides financial assistance to replace stolen items, helping you recover faster.

- Liability: If a guest is injured in your rental property, renters insurance can protect you from potential liability claims, covering medical expenses and legal fees.

Affordable Peace of Mind

One of the most appealing aspects of renters insurance is its affordability. Policies are typically much more cost-effective than homeowners insurance, making it an accessible option for renters across various financial backgrounds. With renters insurance, you can secure comprehensive coverage for a relatively small monthly premium.

Coverage Options and Customization

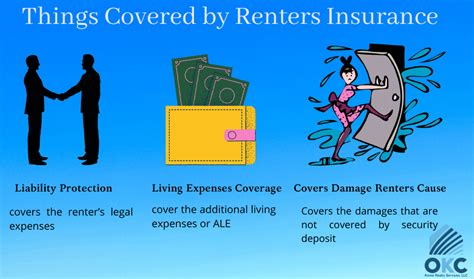

Renters insurance policies can be tailored to meet your specific needs. Different coverage options are available to suit various lifestyles and budgets. Here’s a breakdown of some key coverage types:

- Personal Property Coverage: This is the cornerstone of renters insurance, providing coverage for your belongings, such as furniture, electronics, clothing, and jewelry.

- Liability Coverage: Protects you from lawsuits and covers legal fees if someone is injured on your rental property or if your actions result in property damage to others.

- Additional Living Expenses: If your rental property becomes uninhabitable due to a covered event, this coverage helps cover the costs of temporary housing and additional living expenses.

- Medical Payments Coverage: Covers medical expenses for guests injured on your rental property, regardless of fault.

| Coverage Type | Description |

|---|---|

| Personal Property | Protects your belongings against damage or theft. |

| Liability | Covers legal and medical expenses resulting from accidents or injuries on your property. |

| Additional Living Expenses | Provides financial support for temporary housing and increased costs during property repairs. |

| Medical Payments | Covers medical bills for guests injured on your property, regardless of fault. |

Real-Life Scenarios and Benefits

Consider these real-life scenarios where renters insurance could prove invaluable:

- Apartment Fire: If a fire breaks out in your apartment, renters insurance can cover the cost of replacing your furniture, electronics, and clothing, helping you rebuild your life after the disaster.

- Water Damage from a Storm: Heavy rains can lead to water damage in your rental property. Renters insurance can help cover the costs of repairs and temporary accommodation while your property is being restored.

- Theft of Valuable Items: Imagine your laptop, camera, or jewelry being stolen. Renters insurance can provide financial support to replace these items, reducing the financial burden.

- Guest Injury: If a friend slips and falls while visiting your rental property, renters insurance can cover their medical expenses and protect you from potential liability.

How to Choose the Right Renters Insurance

When selecting a renters insurance policy, it’s crucial to consider your specific needs and circumstances. Here are some key factors to keep in mind:

Assess Your Valuables

Take inventory of your personal belongings and their approximate value. This will help you determine the appropriate level of coverage you require. Consider the cost of replacing high-value items like jewelry, electronics, or musical instruments.

Understand Coverage Limits

Renters insurance policies often come with coverage limits for different categories of items. Ensure that the limits provided by your policy align with the value of your belongings. For example, if you have valuable artwork, you may need additional coverage to adequately protect it.

Review Policy Exclusions

Every renters insurance policy has exclusions, which are situations or items not covered by the policy. Familiarize yourself with these exclusions to avoid any surprises. Some common exclusions include damage caused by earthquakes, floods, or nuclear incidents.

Consider Additional Coverage Options

Beyond the standard coverage types, you may have the option to add endorsements or riders to your policy. These additional coverages can provide protection for specific items or situations. For instance, you might want to add coverage for high-value items like expensive musical instruments or collectibles.

Compare Quotes and Providers

Obtain quotes from multiple insurance providers to compare prices and coverage options. Consider factors such as the insurer’s financial stability, customer service reputation, and claim handling processes. Look for providers that offer comprehensive coverage at competitive rates.

Understand Deductibles and Premiums

Renters insurance policies often have deductibles, which are the amounts you must pay out of pocket before the insurance coverage kicks in. Higher deductibles can result in lower premiums, so find a balance that suits your financial situation. Additionally, consider the overall cost of the policy and whether it fits within your budget.

The Process of Getting Covered

Securing renters insurance is a straightforward process. Here’s a step-by-step guide to help you get started:

Step 1: Research and Compare

Begin by researching different insurance providers and their renters insurance offerings. Compare quotes, coverage options, and customer reviews to find the best fit for your needs.

Step 2: Obtain Quotes

Reach out to your preferred insurance providers and request quotes. Provide accurate information about your rental property, personal belongings, and any additional coverage you may require.

Step 3: Review Policy Details

Carefully review the policy documents, paying close attention to coverage limits, exclusions, and any endorsements or riders. Ensure that the policy aligns with your specific requirements.

Step 4: Choose Your Coverage and Provider

Based on your research and quote comparisons, select the insurance provider and policy that best meets your needs and budget. Consider factors such as coverage, price, and the insurer’s reputation.

Step 5: Complete the Application

Provide the necessary information and documentation to complete the application process. This may include details about your rental property, personal belongings, and any additional coverage you’ve opted for.

Step 6: Receive Your Policy

Once your application is approved, you will receive your renters insurance policy. Review the policy carefully to ensure it aligns with your expectations. Keep the policy documents in a safe place for future reference.

The Bottom Line

Renters insurance is an essential safeguard for individuals who rent their living spaces. It provides financial protection for your personal belongings and offers peace of mind in the face of unexpected events. By understanding the coverage options, assessing your needs, and choosing the right policy, you can ensure that your valuables are adequately protected.

Remember, renters insurance is an affordable and accessible way to secure your financial well-being. Don't wait until an unforeseen event occurs to realize the importance of this vital coverage. Take the time to explore your options and invest in a policy that suits your lifestyle and budget.

FAQ

How much does renters insurance typically cost?

+The cost of renters insurance can vary based on factors such as location, the value of your belongings, and the coverage limits you choose. On average, renters insurance policies range from 15 to 30 per month, making it an affordable option for most renters.

What is the difference between renters insurance and homeowners insurance?

+Renters insurance covers the personal belongings and liabilities of tenants, while homeowners insurance covers the structure of the home and its contents, as well as providing liability coverage for the property owner.

Does renters insurance cover my roommate’s belongings too?

+Renters insurance typically covers the personal property of the policyholder. If your roommate wants their belongings covered, they should obtain their own renters insurance policy. However, some policies may offer options to extend coverage to roommates for an additional premium.

Can I customize my renters insurance policy to fit my specific needs?

+Yes, renters insurance policies can be customized to suit your individual requirements. You can choose the coverage limits, add endorsements for specific items, and select additional coverage options to ensure your policy aligns with your lifestyle and valuables.

What should I do if I need to file a claim under my renters insurance policy?

+In the event of a covered loss, contact your insurance provider as soon as possible to initiate the claims process. Provide them with all relevant information, including details of the incident, any police reports, and a list of damaged or stolen items. Your insurer will guide you through the steps to receive the benefits you’re entitled to.