Get Health Insurance Now

In today's fast-paced and uncertain world, health insurance has become an essential financial safeguard for individuals and families. With rising healthcare costs and unexpected medical emergencies, having adequate coverage is more crucial than ever. In this comprehensive guide, we will delve into the world of health insurance, exploring the key considerations, benefits, and steps to ensure you get the right coverage for your needs. Whether you're a young professional, a family planning for the future, or an individual with unique health requirements, this article will provide you with expert insights and practical advice to navigate the complex landscape of health insurance.

Understanding Health Insurance: A Comprehensive Overview

Health insurance is a contract between an individual or a group and an insurance company, where the insurer agrees to provide financial protection for covered medical expenses in exchange for regular premium payments. It acts as a safety net, ensuring that individuals can access necessary medical care without facing devastating financial burdens.

The concept of health insurance has evolved significantly over the years, with various types and plans available to cater to different demographics and needs. Understanding the fundamentals of health insurance is the first step towards making informed decisions and securing your financial well-being.

Types of Health Insurance Plans

Health insurance plans can be broadly categorized into several types, each with its own features and coverage options. Here are some of the most common types:

- Indemnity Plans: Also known as fee-for-service plans, these allow you to choose your healthcare providers and cover a wide range of services. You pay a portion of the costs through deductibles, copayments, and coinsurance, while the insurance company covers the rest.

- Managed Care Plans: These plans aim to control costs by managing the delivery of healthcare services. They typically include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Point-of-Service (POS) plans. Each type has its own network of providers and specific rules for coverage.

- High-Deductible Health Plans (HDHPs): HDHPs have higher deductibles, which means you pay a larger portion of your healthcare costs upfront before the insurance coverage kicks in. These plans often come with Health Savings Accounts (HSAs), allowing you to save for future medical expenses on a tax-advantaged basis.

- Short-Term Health Insurance Plans: These are temporary coverage options designed to bridge gaps in insurance coverage. They offer limited benefits and may not cover pre-existing conditions or certain essential health benefits.

- Catastrophic Health Insurance Plans: These plans provide coverage for major medical expenses but have high deductibles and limited benefits for routine care. They are suitable for individuals who want basic coverage for unexpected emergencies.

Each type of plan has its own advantages and considerations. It's essential to evaluate your specific needs, budget, and health requirements to choose the plan that best suits you.

Evaluating Your Health Insurance Needs

When it comes to health insurance, one size does not fit all. Assessing your unique needs is crucial to selecting the right coverage. Consider the following factors:

Individual vs. Family Coverage

If you're single, you may prioritize affordability and flexibility. Indemnity plans or high-deductible plans with HSAs could be suitable options. However, if you have a family, you'll need to consider the health needs of each family member and choose a plan that provides comprehensive coverage for everyone.

Pre-Existing Conditions

Pre-existing conditions are medical issues that you had before enrolling in a new health insurance plan. Some plans may have waiting periods or exclusions for pre-existing conditions, so it's essential to understand how they are treated in your chosen plan. Look for plans that offer coverage for pre-existing conditions without lengthy waiting periods.

Prescription Drug Coverage

Prescription medications can be costly, so evaluating the prescription drug coverage in your plan is crucial. Check the plan's formulary, which lists the medications covered and their tiers. Ensure that your essential medications are included and consider the cost-sharing structure for prescription drugs.

Healthcare Provider Networks

Managed care plans often have networks of preferred providers. It's important to confirm that your preferred doctors, specialists, and hospitals are included in the plan's network. Out-of-network care can be more expensive and may not be fully covered.

Essential Health Benefits

The Affordable Care Act (ACA) requires most health insurance plans to cover essential health benefits. These include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more. Ensure that your chosen plan provides these essential benefits.

Cost-Sharing Structures

Understand the cost-sharing aspects of your plan, including deductibles, copayments, and coinsurance. Deductibles are the amounts you pay out-of-pocket before your insurance coverage begins. Copayments are fixed amounts you pay for specific services, while coinsurance is a percentage of the cost that you share with the insurance company.

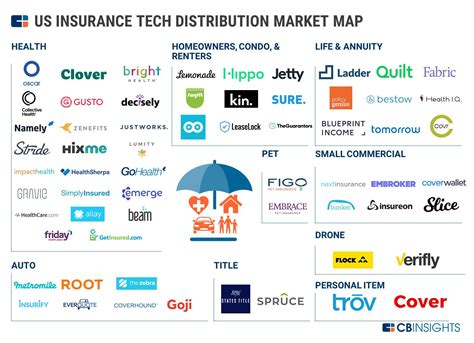

Choosing the Right Health Insurance Provider

With numerous insurance companies offering a wide range of plans, selecting the right provider can be challenging. Here are some key considerations to guide your decision:

Reputation and Financial Stability

Choose an insurance company with a solid reputation and financial stability. Look for companies that have been in business for a considerable time and have a history of paying claims promptly. Check customer reviews and ratings to gauge their reliability.

Network of Providers

As mentioned earlier, the network of healthcare providers is crucial. Ensure that the insurance company's network includes your preferred doctors and hospitals. Check if they have a broad network of specialists and if there are any limitations or exclusions.

Customer Service and Support

Excellent customer service can make a significant difference in your experience with an insurance provider. Look for companies that offer easy-to-reach customer support, provide clear and concise explanations of coverage, and assist you in understanding your benefits and rights.

Digital Tools and Resources

In today's digital age, insurance providers should offer convenient online platforms and mobile apps for managing your insurance. Look for companies that provide user-friendly interfaces for viewing claims, accessing benefits, and finding in-network providers.

Enrolling in a Health Insurance Plan

Once you've evaluated your needs and chosen the right insurance provider, it's time to enroll in a plan. Here's a step-by-step guide to help you through the process:

Open Enrollment Period

Most health insurance plans have an annual open enrollment period, typically lasting a few months. During this time, you can enroll in a new plan or make changes to your existing coverage. If you miss the open enrollment period, you may need to qualify for a special enrollment period due to specific life events, such as losing your job or getting married.

Gathering Necessary Information

Before enrolling, gather all the required information, including personal details, income, and any existing health conditions. Have your social security number, birthdate, and other relevant documents ready.

Comparing Plans

Use online tools and resources provided by insurance companies or independent websites to compare different plans. Consider factors like premiums, deductibles, copayments, and coverage limits. Look for plans that align with your needs and budget.

Applying for Coverage

Once you've found the right plan, complete the application process. This typically involves filling out an online form or submitting a paper application. Provide accurate and complete information to avoid delays in processing your application.

Reviewing Your Policy

After enrolling, carefully review your policy documents. Understand the coverage limits, exclusions, and any waiting periods. Ensure that all your personal information is correct and make note of important dates, such as when your coverage starts and ends.

Maximizing Your Health Insurance Benefits

Health insurance is a valuable asset, but to fully utilize its benefits, you need to understand how to navigate the system effectively. Here are some tips to maximize your coverage:

Stay Informed

Keep yourself updated on any changes to your plan, such as updates to the provider network or coverage limits. Regularly review your policy documents and reach out to your insurance provider if you have any questions or concerns.

Utilize Preventive Care

Many health insurance plans offer free or low-cost preventive care services, such as annual check-ups, immunizations, and screenings. Take advantage of these services to maintain your health and catch any potential issues early on.

Understand Your Coverage Limits

Be aware of your plan's coverage limits, including annual and lifetime maximums. Some plans may have limits on specific services or treatments. Understanding these limits can help you budget and plan for any out-of-pocket expenses.

Use In-Network Providers

Whenever possible, use healthcare providers within your plan's network. Out-of-network care can be significantly more expensive and may not be fully covered by your insurance.

Negotiate Medical Bills

If you receive a medical bill that seems excessive, don't hesitate to negotiate. Contact your insurance company and the healthcare provider to understand the charges and explore options for reducing the amount you owe.

Health Insurance and Financial Planning

Health insurance is an integral part of your overall financial planning. Here's how it fits into the bigger picture:

Budgeting for Health Insurance

Include health insurance premiums in your monthly budget. Consider setting aside funds for deductibles and other out-of-pocket expenses. Plan for unexpected medical costs by building an emergency fund.

Tax Benefits

Certain health insurance plans, such as HDHPs with HSAs, offer tax advantages. Contributions to HSAs are tax-deductible, and the funds grow tax-free. When used for qualified medical expenses, withdrawals from HSAs are also tax-free. Consult a tax professional to understand the full extent of these benefits.

Long-Term Financial Security

Health insurance provides peace of mind and financial protection in the event of major medical emergencies. By having adequate coverage, you can avoid financial strain and focus on your health and well-being.

Future Trends in Health Insurance

The health insurance landscape is constantly evolving, and staying informed about emerging trends can help you make better decisions. Here are some trends to watch:

Telehealth and Virtual Care

Telehealth services have gained popularity, especially during the COVID-19 pandemic. Many insurance plans now cover virtual doctor visits, allowing you to receive medical advice and prescriptions from the comfort of your home.

Value-Based Care

Value-based care models focus on providing high-quality, cost-effective healthcare. Insurance companies are increasingly partnering with healthcare providers to implement these models, which can lead to better patient outcomes and reduced costs.

Consumer-Directed Health Plans

Consumer-directed health plans, such as HDHPs with HSAs, are becoming more popular. These plans empower individuals to take control of their healthcare spending and encourage them to be more mindful of their health choices.

Data-Driven Decisions

Insurance companies are leveraging data analytics to improve risk assessment and pricing. This can lead to more accurate premiums and tailored coverage options.

Frequently Asked Questions

How much does health insurance typically cost?

+The cost of health insurance varies widely based on factors such as your age, location, plan type, and coverage level. On average, monthly premiums for an individual plan range from $200 to $800, while family plans can cost upwards of $1,000 per month. However, these averages can be significantly higher or lower depending on your specific circumstances.

Can I get health insurance if I have a pre-existing condition?

+Yes, thanks to the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums based solely on pre-existing conditions. However, some plans may have waiting periods or exclusions for specific conditions. It's important to carefully review the plan's coverage for pre-existing conditions before enrolling.

What happens if I need emergency medical care while traveling abroad?

+Most health insurance plans provide limited coverage for emergency medical care while traveling abroad. It's crucial to check your plan's coverage and consider purchasing additional travel insurance to ensure comprehensive protection during your trip. Some plans may have specific provisions for international emergency care, so review your policy carefully.

How can I save money on health insurance premiums?

+There are several strategies to reduce your health insurance premiums. One option is to choose a plan with a higher deductible, which typically results in lower monthly premiums. You can also consider plans with narrower provider networks, as they often have lower costs. Additionally, some employers offer premium subsidies or flexible spending accounts to help offset the cost of premiums.

Can I change my health insurance plan during the year?

+In most cases, you can only change your health insurance plan during the open enrollment period, which typically occurs once a year. However, certain life events, such as losing your job, getting married, or having a baby, may qualify you for a special enrollment period. During this time, you can enroll in a new plan or make changes to your existing coverage.

In conclusion, health insurance is a critical aspect of financial planning and personal well-being. By understanding the different types of plans, evaluating your needs, and choosing the right provider, you can secure comprehensive coverage that meets your unique requirements. Remember to stay informed, utilize preventive care, and make the most of your health insurance benefits. With the right plan in place, you can face the future with confidence, knowing that you have the financial protection you need to maintain your health and peace of mind.