Get Insurance Quote For Car

Securing the right insurance coverage for your vehicle is a crucial step in responsible car ownership. In today's digital age, the process of obtaining an insurance quote has become more streamlined and accessible. However, with numerous insurance providers and variables to consider, finding the best quote for your specific needs can be a complex task. This comprehensive guide aims to provide you with an in-depth understanding of the car insurance quote process, shedding light on the factors that influence premiums and offering strategies to secure the most competitive rates. By the end of this article, you'll have the knowledge and tools to navigate the world of car insurance quotes with confidence and expertise.

Understanding Car Insurance Quotes: A Comprehensive Overview

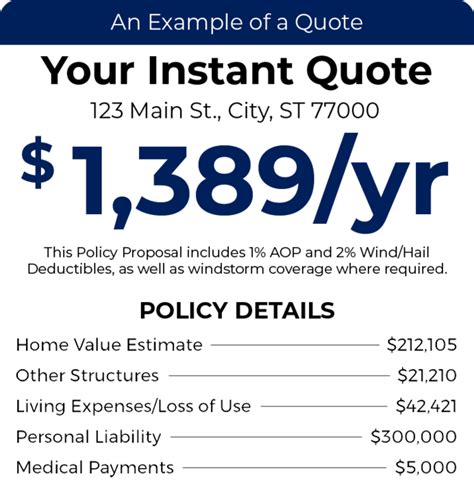

A car insurance quote is a detailed proposal from an insurance company, outlining the cost of insuring your vehicle. This quote is based on a range of factors that assess the risk associated with your driving habits, vehicle, and personal circumstances. It's important to note that quotes can vary significantly between insurance providers, even for the same level of coverage, making it essential to shop around and compare quotes.

The quote process typically involves an online or in-person consultation, during which you'll provide information about yourself, your vehicle, and your driving history. This information is then used to calculate your premium, which represents the cost of your insurance policy. The premium is influenced by a variety of factors, each of which plays a role in determining the level of risk the insurance company assumes by insuring you.

Factors Affecting Your Car Insurance Quote

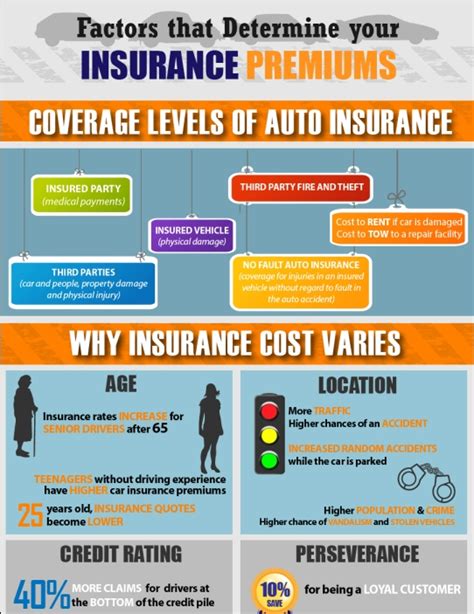

There are numerous factors that can impact the cost of your car insurance quote. Understanding these factors can help you make informed decisions when choosing an insurance policy and potentially save you money. Here are some key elements that influence your quote:

- Vehicle Type and Usage: The make, model, and year of your vehicle can significantly impact your insurance quote. More expensive or luxury vehicles often have higher premiums due to their cost to repair or replace. Additionally, the primary use of your vehicle, whether for personal, business, or pleasure, can also affect your quote.

- Driving History: Your driving record is a critical factor in determining your insurance quote. A clean driving record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or traffic offenses may result in higher costs.

- Age and Gender: In some jurisdictions, age and gender are considered when calculating insurance quotes. Younger drivers, especially those under 25, often pay higher premiums due to their perceived higher risk of accidents. Similarly, gender may also be a factor, with some insurers charging different rates based on statistical differences in accident rates between genders.

- Location: The area where you live and drive plays a role in determining your insurance quote. Urban areas with higher traffic and crime rates may result in higher premiums compared to rural areas.

- Coverage Level: The level of coverage you choose also affects your quote. Comprehensive coverage, which includes protection against a wide range of risks, will generally cost more than basic liability coverage.

- Deductible Amount: Your deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, as you're assuming more financial responsibility in the event of a claim.

Strategies to Secure the Best Car Insurance Quote

Now that we've explored the factors that influence car insurance quotes, let's delve into some strategies to help you secure the most competitive rates:

- Shop Around: Don't settle for the first quote you receive. Compare quotes from multiple insurance providers to ensure you're getting the best rate for your specific circumstances. Online comparison tools can be a valuable resource for this.

- Bundle Policies: If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurers offer discounts for customers who bundle their policies, which can result in significant savings.

- Increase Your Deductible: As mentioned earlier, opting for a higher deductible can lower your premium. However, be sure to choose a deductible amount that you're comfortable paying out-of-pocket in the event of a claim.

- Take Advantage of Discounts: Many insurance providers offer a range of discounts, such as safe driver discounts, loyalty discounts, or discounts for certain professions or affiliations. Be sure to inquire about these discounts when obtaining quotes.

- Maintain a Good Driving Record: A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid traffic violations and accidents to keep your record clean and your premiums affordable.

The Future of Car Insurance Quotes

The car insurance industry is evolving, and the way quotes are calculated is also changing. With advancements in technology, insurers are now able to gather more data points about drivers and their vehicles, leading to more accurate risk assessments and potentially more tailored quotes. For instance, usage-based insurance (UBI) programs, also known as pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD), use telematics devices to track driving behavior and reward safe drivers with lower premiums.

Additionally, the rise of electric vehicles (EVs) and autonomous driving technology is set to impact the car insurance landscape. Insurers are already exploring new pricing models that take into account the reduced risk associated with these innovative vehicles. As these technologies become more prevalent, we can expect to see further shifts in how insurance quotes are calculated.

| Insurance Provider | Average Annual Premium |

|---|---|

| Provider A | $1,200 |

| Provider B | $1,450 |

| Provider C | $1,100 |

| Provider D | $1,350 |

Frequently Asked Questions

How often should I review my car insurance policy and quotes?

+It's generally recommended to review your car insurance policy and obtain new quotes annually, or whenever your circumstances change significantly. This ensures that your coverage and premium remain aligned with your needs and that you're not overpaying.

<div class="faq-item">

<div class="faq-question">

<h3>What is a telematics device, and how does it impact my insurance quote?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>A telematics device is a small gadget that collects data about your driving habits, such as speed, braking, and mileage. This data is then used by some insurance providers to offer more personalized quotes, often rewarding safe drivers with lower premiums.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I negotiate my car insurance quote with the provider?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While car insurance quotes are typically based on standard rates and formulas, you can sometimes negotiate certain aspects of your policy. For instance, you may be able to discuss and adjust your coverage limits or deductible to find a more suitable premium.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any additional factors that could impact my car insurance quote?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are several other factors that can influence your quote, including your credit score, the number of miles you drive annually, and even your marital status. These factors are considered in the risk assessment process and can vary between insurance providers.</p>

</div>

</div>

</div>