Get Liability Insurance

Liability insurance is a crucial aspect of financial protection for individuals and businesses alike. In an increasingly litigious world, understanding and acquiring the right liability coverage is essential to safeguard your assets and ensure peace of mind. This article aims to provide an in-depth guide on the intricacies of liability insurance, offering expert insights and practical advice to help you navigate this complex but vital area of risk management.

Understanding Liability Insurance: The Essentials

Liability insurance, at its core, is a form of coverage that protects you from the financial risks associated with claims made against you or your business. These claims can arise from a variety of situations, including accidents, property damage, bodily injury, or even professional errors and omissions. The primary purpose of liability insurance is to provide a financial safety net, covering the costs of legal defense and any compensation awarded to the claimant, up to the limits specified in your insurance policy.

The significance of liability insurance cannot be overstated, especially in today's environment where lawsuits are becoming more common. Whether you're an individual concerned about the potential risks of daily life, a business owner aiming to protect your company's assets, or a professional in a high-risk industry, liability insurance is a cornerstone of your financial and operational strategy.

Key Types of Liability Insurance

Liability insurance comes in various forms, each tailored to specific needs and scenarios. Here’s a breakdown of some common types:

- General Liability Insurance: This broad category of insurance covers a wide range of risks, including bodily injury, property damage, and personal and advertising injury. It's particularly beneficial for businesses that interact with the public or have a physical location, providing protection against common slip-and-fall accidents, product liability claims, and more.

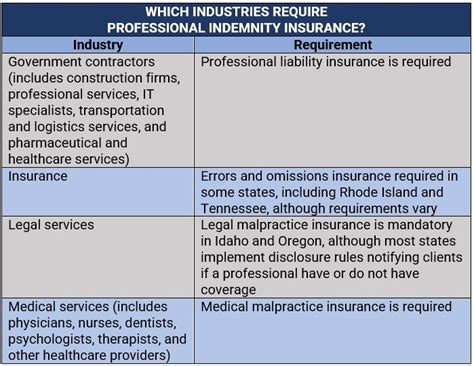

- Professional Liability Insurance (also known as Errors and Omissions Insurance): Aimed at professionals like consultants, accountants, lawyers, and healthcare providers, this insurance covers claims arising from professional services. It's crucial for industries where advice or services, if rendered incorrectly, could lead to financial losses for clients.

- Product Liability Insurance: Manufacturers, distributors, and retailers can benefit from this type of insurance, which covers claims related to defective products. It's an essential safeguard against the potential risks associated with producing, selling, or distributing goods.

- Cyber Liability Insurance: In an era where digital interactions are prevalent, this insurance covers risks associated with cyber attacks, data breaches, and online security threats. It's vital for businesses operating in the digital space, offering protection against potential lawsuits arising from such incidents.

- Umbrella Insurance: This policy provides additional coverage above and beyond your existing liability policies, offering an extra layer of protection for catastrophic losses or situations where multiple claims are made.

Assessing Your Liability Risks: A Tailored Approach

Every individual and business has unique liability risks. Assessing these risks is a critical step in determining the right type and level of liability insurance coverage. Here’s a strategic approach to evaluating your specific liability landscape:

Identify Potential Risks

Start by understanding the various scenarios that could lead to liability claims. For individuals, this might include accidents in your home or while driving, or even personal injury claims arising from your hobbies or recreational activities. Businesses, on the other hand, should consider a broader range of risks, such as product liability, workplace accidents, cyber threats, and more.

| Risk Category | Potential Scenarios |

|---|---|

| Physical Injury | Slip and fall accidents, sports injuries, assault, etc. |

| Property Damage | Fire, flood, vandalism, natural disasters, etc. |

| Professional Negligence | Errors in service, faulty advice, missed deadlines, etc. |

| Product Liability | Defective products, manufacturing errors, incorrect labeling, etc. |

| Cyber Risks | Data breaches, hacking, online defamation, etc. |

Evaluate Likelihood and Impact

Not all risks are equally likely or impactful. Assess the probability of each identified risk materializing, as well as the potential financial and reputational consequences. This evaluation will help prioritize your liability insurance needs and guide your decision-making process.

Consider Industry-Specific Risks

Different industries come with their own set of unique risks. For instance, a construction company faces distinct liability risks compared to a software development firm or a retail store. Understanding these industry-specific risks is crucial for tailoring your liability insurance coverage to your business’s unique needs.

Choosing the Right Liability Insurance: Expert Considerations

With a clear understanding of your liability risks, the next step is to select the appropriate insurance coverage. Here are some expert considerations to guide your decision:

Policy Limits and Deductibles

Policy limits refer to the maximum amount your insurance company will pay for a covered claim. Deductibles, on the other hand, are the portion of the claim that you must pay out of pocket before your insurance coverage kicks in. Both of these factors significantly impact the cost and effectiveness of your liability insurance.

When choosing policy limits, consider the potential severity of claims in your industry or personal situation. For instance, a small business with a limited budget might opt for lower policy limits, but this could leave them vulnerable to significant out-of-pocket expenses in the event of a catastrophic loss. On the other hand, higher policy limits offer more comprehensive protection but come with a higher premium.

Deductibles, similarly, play a crucial role in balancing cost and coverage. A higher deductible can lead to lower premiums, but it means you'll have to pay more out of pocket before your insurance coverage starts. It's essential to strike a balance that aligns with your financial capabilities and risk appetite.

Coverage Exclusions and Endorsements

All liability insurance policies come with a list of exclusions – specific situations or claims that are not covered. It’s crucial to carefully review these exclusions to ensure you’re not inadvertently leaving yourself vulnerable. For example, some general liability policies exclude professional services, which could be a significant gap for consultants or other professionals.

Endorsements, or policy amendments, can be added to your insurance policy to either broaden coverage or exclude specific risks. These can be particularly useful for tailoring your policy to your unique needs. For instance, a business might add an endorsement for cyber liability coverage if their operations involve significant online interactions.

Reputation and Financial Stability of the Insurer

When selecting an insurance provider, it’s essential to consider their reputation and financial stability. You want to ensure that the insurer will be able to pay out claims, even in large or catastrophic situations. Look for companies with a strong financial rating from reputable agencies like AM Best or Moody’s. Additionally, consider the insurer’s customer service reputation and their track record in handling claims.

Navigating the Insurance Landscape: Practical Tips

Understanding liability insurance is just the first step. Effectively navigating the insurance landscape to secure the right coverage at the best price requires a strategic approach. Here are some practical tips to guide you through the process:

Shop Around and Compare Quotes

Insurance premiums can vary significantly between providers, even for the same level of coverage. It’s crucial to shop around and compare quotes from multiple insurers. Online insurance marketplaces can be a great starting point, providing a quick and convenient way to get multiple quotes. However, be sure to also seek quotes from local or regional insurers, as they may offer more competitive rates or specialized coverage for your area.

Work with an Insurance Broker

An insurance broker can be an invaluable resource when navigating the complex world of liability insurance. Brokers have extensive knowledge of the insurance market and can help you identify the best coverage options for your needs. They can also negotiate with insurers on your behalf, often securing better rates or more comprehensive coverage. Additionally, brokers can provide ongoing support, assisting with policy management and claim handling.

Understand Your Policy

Once you’ve selected an insurance policy, take the time to thoroughly understand its terms and conditions. This includes not just the coverage limits and exclusions, but also the claims process, any potential discounts or incentives, and any additional services or benefits offered by the insurer. A clear understanding of your policy ensures you’re getting the coverage you need and can navigate the claims process with confidence.

Regularly Review and Update Your Coverage

Your liability risks are not static; they can change over time as your personal circumstances or business operations evolve. It’s important to regularly review your insurance coverage to ensure it continues to meet your needs. This might involve adjusting policy limits, adding or removing endorsements, or even switching insurers if your needs have significantly changed. Regular reviews also provide an opportunity to take advantage of any new discounts or incentives offered by your insurer.

The Impact of Liability Insurance: Real-World Scenarios

Liability insurance is not just a theoretical concept; it has a profound impact on the lives and businesses of those who rely on it. Here are some real-world scenarios that highlight the critical role of liability insurance:

Small Business Protection

Consider a small cafe owner who faces a slip-and-fall accident claim from a customer. Without adequate liability insurance, the owner might have to pay for legal fees and any compensation awarded out of pocket, potentially putting their business at risk. However, with the right general liability insurance, the policy covers these costs, allowing the business to continue operating without financial strain.

Professional Services Coverage

A web development firm is sued for a website they designed that caused data loss for their client. Without professional liability insurance, the firm could face significant financial losses and damage to their reputation. However, with this coverage in place, the insurance policy pays for the legal defense and any compensation, protecting the firm’s financial stability and professional standing.

Product Liability Protection

A toy manufacturer discovers a defect in one of their products that could potentially cause harm to children. Without product liability insurance, the costs of recalling the product and compensating affected families could be devastating. However, with this insurance, the policy covers these expenses, allowing the manufacturer to manage the situation effectively and continue operating.

The Future of Liability Insurance: Emerging Trends

The landscape of liability insurance is constantly evolving, influenced by technological advancements, changing legal environments, and shifting societal norms. Here are some emerging trends and considerations for the future:

Cyber Liability and Digital Risks

As our lives become increasingly digital, cyber liability insurance is becoming an essential component of risk management. With the rise of remote work, online transactions, and data-driven business models, the risks of cyber attacks, data breaches, and online defamation are growing. Insurers are developing more comprehensive cyber liability policies to address these emerging risks, offering coverage for a wide range of cyber incidents.

Climate Change and Environmental Risks

Climate change is leading to an increased frequency and severity of natural disasters, from hurricanes and floods to wildfires and extreme weather events. This trend is prompting insurers to reassess their exposure to environmental risks and adjust their underwriting practices accordingly. For policyholders, this may mean higher premiums or more stringent risk management requirements, particularly in high-risk areas.

Emerging Technologies and New Risks

The rapid advancement of technologies like artificial intelligence, autonomous vehicles, and the Internet of Things (IoT) is introducing new risks and liability considerations. Insurers are actively researching and developing insurance products to address these emerging risks, but it remains a challenging and evolving landscape. Policyholders should stay informed about these developments and work closely with their insurers to ensure their coverage remains up-to-date.

Conclusion: Empowering Your Financial Protection

Liability insurance is a powerful tool for managing financial risks, offering peace of mind and safeguarding your assets. By understanding your liability risks, choosing the right coverage, and staying informed about emerging trends, you can effectively navigate the insurance landscape and secure the protection you need. Whether you’re an individual, a small business owner, or a large corporation, liability insurance is an essential component of your financial strategy, providing the stability and security to thrive in an uncertain world.

What is the average cost of liability insurance for individuals or small businesses?

+The cost of liability insurance can vary significantly based on factors like the type of coverage, policy limits, deductibles, and the specific risks associated with your industry or personal situation. On average, general liability insurance for small businesses can range from a few hundred to a few thousand dollars per year, while professional liability insurance can be more expensive, often starting at around $500 per year for basic coverage. For individuals, the cost of liability insurance can be lower, with homeowners or renters insurance policies often including some level of liability coverage.

How often should I review and update my liability insurance coverage?

+It’s recommended to review your liability insurance coverage at least once a year, or whenever there are significant changes to your personal circumstances or business operations. This ensures that your coverage remains aligned with your evolving needs and risks. Regular reviews also provide an opportunity to take advantage of any new discounts or incentives offered by your insurer.

Can I customize my liability insurance policy to meet my specific needs?

+Absolutely! Most liability insurance policies can be customized through endorsements or policy amendments. These allow you to add or remove coverage for specific risks, adjust policy limits, or tailor the policy to your unique needs. Working with an insurance broker can be particularly helpful in customizing your policy to ensure it provides the right level of protection for your situation.