Get Pet Insurance

Pet insurance has become an increasingly popular topic of discussion among pet owners, and for good reason. With the rising costs of veterinary care and the unpredictability of pet health issues, having a solid insurance plan can provide peace of mind and financial security. In this comprehensive guide, we will delve into the world of pet insurance, exploring its benefits, coverage options, and how to choose the right policy for your furry companion. Whether you're a first-time pet owner or considering an upgrade to your existing plan, this article will equip you with the knowledge to make informed decisions.

Understanding the Importance of Pet Insurance

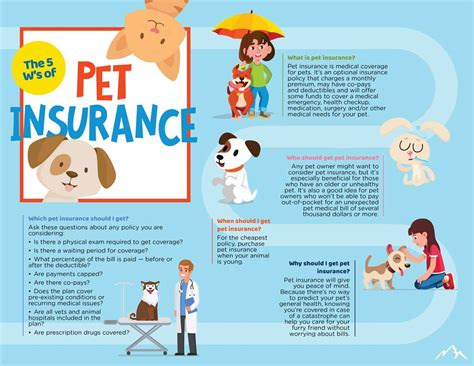

Pet insurance is a type of health insurance designed specifically for animals, providing coverage for a range of veterinary expenses. It offers a safety net for pet owners, ensuring that unexpected medical emergencies or chronic conditions don’t become a financial burden. Here’s why pet insurance is an essential consideration for responsible pet owners:

Financial Protection for Veterinary Care

Veterinary medicine has advanced significantly, offering a wide array of treatments and procedures to improve the health and longevity of our pets. However, these advanced treatments often come with a hefty price tag. Pet insurance helps alleviate the financial strain by covering a portion or all of the costs associated with veterinary care, including:

- Emergency treatments for accidents or sudden illnesses.

- Routine check-ups, vaccinations, and preventive care.

- Surgical procedures, such as spaying or neutering.

- Medications and specialized diets prescribed by veterinarians.

- Diagnostic tests, including X-rays and blood work.

Peace of Mind for Pet Owners

Unforeseen health issues can arise at any time, and pets, like humans, can require immediate medical attention. With pet insurance, you can make crucial decisions about your pet’s health without being limited by financial concerns. This peace of mind is invaluable, allowing you to focus on your pet’s well-being rather than worrying about the associated costs.

Coverage for Chronic Conditions

Many pet insurance plans offer coverage for chronic conditions, which can be a significant relief for pet owners. Conditions like diabetes, arthritis, or certain types of cancer often require ongoing treatment and medications. Pet insurance can help manage the financial burden of these long-term illnesses, ensuring your pet receives the care they need without straining your budget.

Types of Pet Insurance Coverage

Pet insurance policies come in various forms, each offering different levels of coverage and benefits. Understanding the types of coverage available is crucial in choosing the right plan for your pet’s unique needs. Here are the primary types of pet insurance coverage:

Accident-Only Coverage

As the name suggests, accident-only coverage provides protection for your pet in the event of an accident. This type of policy covers the costs associated with injuries resulting from accidents, such as broken bones, lacerations, or poisoning. It typically does not cover illnesses or routine care.

Accident and Illness Coverage

This is the most comprehensive type of pet insurance, offering coverage for both accidents and illnesses. Accident and illness policies provide protection for a wide range of health issues, including congenital conditions, chronic diseases, and unexpected injuries. These policies often include coverage for:

- Veterinary exams and consultations.

- Diagnostic tests and lab work.

- Medications and treatments.

- Surgical procedures.

- Hospitalization and emergency care.

Wellness Plans

Wellness plans, also known as routine care coverage, focus on preventive care and routine procedures. These plans typically cover:

- Annual check-ups and wellness exams.

- Vaccinations and parasite control.

- Spaying or neutering.

- Teeth cleaning and oral care.

- Flea and tick prevention.

Wellness plans are an excellent option for pet owners looking to manage the costs of routine veterinary care and ensure their pets receive the necessary preventive treatments.

Euthanasia and Cremation Coverage

Some pet insurance policies include coverage for end-of-life care, including euthanasia and cremation expenses. While this coverage may not be for everyone, it can provide an added layer of financial protection during an emotionally challenging time.

Factors to Consider When Choosing Pet Insurance

Selecting the right pet insurance policy involves careful consideration of various factors. Here are some key aspects to evaluate when comparing different plans:

Breed and Age of Your Pet

Certain breeds are predisposed to specific health conditions, and older pets are generally more prone to illnesses. When choosing a policy, consider your pet’s breed and age, as some insurance providers offer breed-specific coverage or age-related discounts.

Coverage Limits and Deductibles

Understand the coverage limits and deductibles associated with each policy. Coverage limits refer to the maximum amount an insurance provider will pay out for a specific condition or annually. Deductibles are the portion of the bill you must pay before the insurance coverage kicks in. Choose a plan with coverage limits and deductibles that align with your financial capabilities and expected veterinary costs.

Pre-Existing Conditions

Pre-existing conditions are health issues that your pet had prior to enrolling in a pet insurance plan. Most insurance providers have specific guidelines regarding pre-existing conditions. Some may exclude coverage for these conditions entirely, while others may offer limited coverage after a waiting period. Ensure you understand the policy’s stance on pre-existing conditions before making a decision.

Reputation and Financial Stability of the Provider

Research the reputation and financial stability of the insurance provider. Choose a reputable company with a solid track record of paying claims promptly and efficiently. A financially stable provider ensures that your insurance coverage will be reliable and sustainable in the long term.

Customizable Plans

Consider whether you prefer a standardized plan or one that can be tailored to your pet’s specific needs. Some providers offer customizable plans, allowing you to choose the level of coverage and benefits that best suit your budget and preferences.

The Process of Claiming with Pet Insurance

Understanding the claims process is essential to maximize the benefits of your pet insurance policy. Here’s a step-by-step guide to claiming insurance coverage for your pet’s medical expenses:

Step 1: Verify Coverage

Before seeking veterinary treatment, verify that the specific condition or procedure is covered by your insurance policy. Review the policy documents or contact your insurance provider to clarify any uncertainties.

Step 2: Obtain Treatment

Take your pet to a licensed veterinarian for the necessary treatment. Ensure that the veterinarian’s clinic accepts insurance claims or is willing to work with your insurance provider.

Step 3: Collect and Submit Documents

During your visit, ask the veterinarian’s office to provide you with a detailed invoice and any relevant medical records. These documents are crucial for submitting a claim. Some insurance providers may also require a claim form to be completed.

Step 4: Submit the Claim

Follow the instructions provided by your insurance company to submit the claim. This typically involves mailing or uploading the required documents to the provider’s website. Ensure that all information is accurate and complete to avoid delays in processing.

Step 5: Wait for Processing

Once your claim is submitted, it will be reviewed and processed by the insurance provider. The timeframe for processing claims can vary, so be patient and keep track of the status through your insurance provider’s online portal or by contacting their customer support.

Step 6: Receive Reimbursement

If your claim is approved, you will receive reimbursement for the covered portion of the veterinary expenses. The method of reimbursement may vary, but it often involves a direct deposit into your bank account or a check sent via mail.

Maximizing the Benefits of Pet Insurance

To make the most of your pet insurance policy, consider the following strategies:

Choose a Policy Early

Enroll your pet in insurance coverage as early as possible. Many providers have waiting periods for certain conditions, and enrolling early can ensure that your pet is covered from the get-go.

Keep Detailed Records

Maintain a comprehensive record of your pet’s medical history, including all veterinary visits, treatments, and medications. This documentation can be invaluable when making insurance claims and may simplify the claims process.

Utilize Preventive Care

Take advantage of the preventive care benefits offered by your insurance plan. Regular check-ups, vaccinations, and parasite control can help detect potential health issues early on and prevent more serious conditions from developing.

Compare and Negotiate

Don’t be afraid to shop around and compare different pet insurance providers. You may find better coverage or more competitive pricing by exploring various options. Additionally, some providers offer discounts or promotions, so it’s worth inquiring about potential savings.

Conclusion: Securing Your Pet’s Future

Pet insurance is an invaluable tool for pet owners, offering financial protection and peace of mind. By understanding the types of coverage available, considering the various factors when choosing a policy, and following the proper claims process, you can ensure your pet receives the best possible care without breaking the bank. Remember, investing in pet insurance is an investment in your pet’s health and your own financial well-being.

What is the average cost of pet insurance per month?

+The cost of pet insurance can vary widely based on factors such as your pet’s breed, age, and the level of coverage you choose. On average, pet insurance policies range from 20 to 100 per month. However, it’s important to note that the price can increase as your pet ages and may also depend on the specific plan and provider you select.

Can I get insurance for my pet if they already have a pre-existing condition?

+Most pet insurance providers have guidelines regarding pre-existing conditions. Some may exclude coverage for these conditions, while others may offer limited coverage after a waiting period. It’s essential to review the policy’s terms and conditions or consult with the insurance provider to understand their stance on pre-existing conditions.

Are there any discounts available for pet insurance policies?

+Yes, many pet insurance providers offer discounts. These can include multi-pet discounts if you insure more than one pet, breed-specific discounts for certain breeds, and age-related discounts for older pets. Additionally, some providers may have promotional offers or loyalty programs that can further reduce the cost of your insurance policy.

What is the difference between reimbursement and direct payment plans in pet insurance?

+Reimbursement plans require you to pay for veterinary expenses upfront and then submit a claim to the insurance provider for reimbursement. Direct payment plans, on the other hand, allow the insurance company to pay the veterinarian directly, reducing the out-of-pocket costs for you. However, not all providers offer direct payment plans, and some may have specific requirements or limitations for this option.