Gm Financial Lienholder Address For Insurance

The process of ensuring accurate and timely communication with your lienholder, GM Financial, is an essential aspect of vehicle ownership. This comprehensive guide will walk you through the steps to ensure your insurance documentation reaches the right destination, maintaining a seamless relationship with your lienholder.

Understanding the Role of a Lienholder

A lienholder, in the context of vehicle ownership, is an individual or entity that holds a legal claim or lien on your vehicle. This claim provides the lienholder with certain rights and responsibilities, including the right to receive updates and information regarding the vehicle’s status, especially in cases of insurance claims or incidents.

For vehicle owners, maintaining an accurate and updated record of the lienholder's information is crucial. This ensures that any insurance-related communications, such as policy changes, claims, or certificate of insurance, reach the right party promptly. Delayed or misdirected communications can lead to unnecessary complications and delays in processing, potentially impacting your coverage and financial responsibilities.

GM Financial: A Leading Lienholder

GM Financial is a prominent financial services company specializing in automotive finance. As a lienholder, they play a critical role in facilitating the smooth operation of vehicle ownership, especially when it comes to insurance matters. Ensuring that your insurance documentation reaches GM Financial is essential to maintaining a positive and efficient relationship with them.

With a focus on customer service and efficiency, GM Financial has established a dedicated process for receiving and managing insurance-related communications. Understanding and adhering to this process is key to avoiding any potential issues or delays.

Addressing Your Insurance Documentation

When it comes to sending insurance-related documents to GM Financial, accuracy and specificity are of utmost importance. Here’s a step-by-step guide to ensure your documentation reaches the right destination:

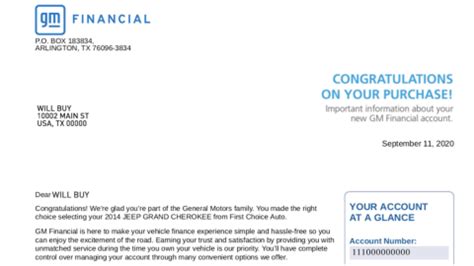

Step 1: Obtain the Correct Address

The first step is to obtain the correct mailing address for GM Financial. While they have multiple offices and locations, it’s crucial to use the specific address designated for insurance documentation. This address is typically provided in your loan or financing documents. If you’re unable to locate it, you can contact GM Financial directly or refer to their official website for the most up-to-date information.

| GM Financial Insurance Address | GM Financial Official Website |

|---|---|

| P.O. Box 183853, Arlington, TX 76096 | https://www.gmfinancial.com |

Step 2: Prepare Your Documentation

Once you have the correct address, it’s time to prepare your insurance-related documentation. This may include a copy of your insurance policy, a certificate of insurance, or any other relevant documents requested by GM Financial. Ensure that all documents are clear, legible, and complete.

If you're submitting multiple documents, consider organizing them in a logical order and using paper clips or staples to keep them together. This will make it easier for GM Financial to review and process your submission efficiently.

Step 3: Send via Certified Mail

To ensure your documentation reaches GM Financial securely and with proof of delivery, it’s recommended to send it via certified mail. This service provides you with a mailing receipt and a delivery confirmation, ensuring that your documents have been received by GM Financial. It also allows you to track the progress of your mail, providing peace of mind and ensuring timely delivery.

When sending your documents, include a clear and concise cover letter. This letter should include your name, loan or account number (if available), and a brief explanation of the purpose of your submission. This helps GM Financial quickly identify and process your documents, streamlining the overall process.

Step 4: Follow Up if Necessary

After sending your insurance documentation, it’s a good practice to follow up with GM Financial to ensure they have received and processed your submission. You can do this by checking the status of your certified mail online or by contacting their customer service team directly.

If you encounter any issues or delays, such as missing documentation or incorrect address information, reach out to GM Financial promptly. Their customer service team is trained to handle such situations and can guide you through the necessary steps to resolve any issues.

Maintaining an Efficient Relationship with GM Financial

Beyond the initial process of sending insurance documentation, maintaining an efficient relationship with GM Financial is key to a smooth vehicle ownership experience. Here are some additional tips to consider:

- Keep Your Information Updated: Ensure that GM Financial has your most current contact information, including your address, phone number, and email. This allows them to reach out to you promptly if any issues arise.

- Review Your Loan or Financing Documents: Familiarize yourself with the terms and conditions of your loan or financing agreement with GM Financial. This includes understanding your responsibilities regarding insurance coverage and the timely submission of relevant documents.

- Utilize Online Services: GM Financial often provides online portals or customer accounts where you can manage your loan, make payments, and upload or submit documents electronically. This can streamline the process and provide a convenient way to stay on top of your responsibilities.

- Stay Informed about Insurance Requirements: Stay updated on the insurance requirements for your vehicle and state. This includes understanding the minimum coverage limits, any additional coverages recommended by GM Financial, and the potential consequences of not maintaining adequate insurance.

Conclusion: A Seamless Partnership for Vehicle Ownership

By following these steps and maintaining an open line of communication with GM Financial, you can ensure a seamless and efficient partnership throughout your vehicle ownership journey. Remember, accurate and timely communication is key to avoiding potential issues and maintaining a positive relationship with your lienholder.

Whether it's sending insurance documentation, updating your contact information, or staying informed about your financial responsibilities, each step contributes to a smooth and stress-free experience. With a dedicated approach to managing your loan and insurance obligations, you can focus on enjoying the freedom and convenience of vehicle ownership.

What is a lienholder and why is their address important for insurance purposes?

+A lienholder is an entity that holds a legal claim or lien on a vehicle. Their address is crucial for insurance purposes as it ensures that any insurance-related communications, such as policy changes or claims, reach the right party promptly. This timely communication is essential for maintaining coverage and avoiding potential delays or complications.

How can I obtain the correct address for GM Financial to send my insurance documentation?

+You can obtain the correct mailing address for GM Financial by referring to your loan or financing documents. If you’re unable to locate it there, you can contact GM Financial directly or visit their official website, where they often provide the dedicated address for insurance documentation.

What documents should I send to GM Financial regarding insurance?

+The specific documents to send may vary depending on your situation and the requirements of GM Financial. Typically, this includes a copy of your insurance policy, a certificate of insurance, or any other relevant documents requested by GM Financial. Always ensure that your documents are clear, legible, and complete.