Go Insurance Quote

In the ever-evolving landscape of digital services, insurance has emerged as one of the most sought-after sectors for online accessibility. Go Insurance, a leading provider, has revolutionized the way people access and manage their insurance policies, offering a seamless and efficient online experience. With its innovative Go Insurance Quote tool, customers can now obtain accurate and personalized insurance quotes in a matter of minutes, marking a significant shift in the traditional insurance procurement process.

Understanding Go Insurance Quote

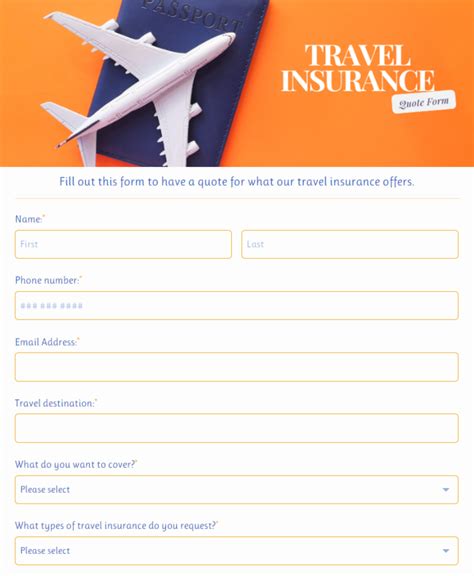

Go Insurance Quote is a sophisticated online platform designed to simplify the insurance quote process. It employs advanced algorithms and real-time data to provide users with precise and tailored insurance quotes. The tool's user-friendly interface guides individuals through a straightforward process, making it accessible to a wide range of users, from tech-savvy millennials to those less familiar with digital tools.

The Quote Process

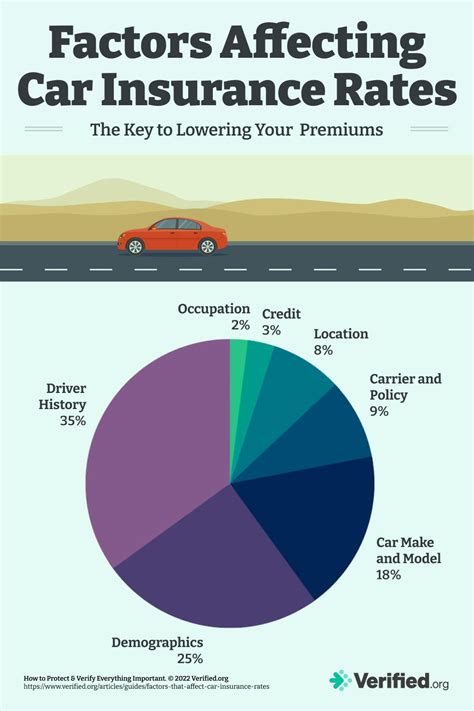

Obtaining a quote through Go Insurance is a straightforward and intuitive process. Users begin by providing basic information about themselves and their insurance needs. This data is then processed through the platform's algorithms, which consider various factors such as the user's age, location, and the type of coverage desired. The system then generates a personalized quote, detailing the coverage, premium, and any additional features or benefits included in the policy.

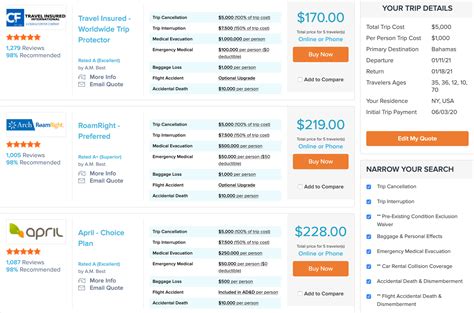

One of the standout features of Go Insurance Quote is its ability to provide multiple quotes tailored to the user's specific needs. Whether an individual is seeking auto, home, health, or life insurance, the platform can offer comprehensive quotes for each, allowing users to make informed decisions about their insurance coverage.

| Insurance Type | Coverage Highlights |

|---|---|

| Auto Insurance | Comprehensive coverage, accident forgiveness, and customizable options for different driving profiles. |

| Home Insurance | Protection for various home types, including apartments, condos, and single-family homes, with options for additional coverage for high-value items. |

| Health Insurance | A range of plans to suit different healthcare needs, with options for individual, family, and specialized coverage. |

| Life Insurance | Flexible term and permanent life insurance policies with options for additional riders to enhance coverage. |

Benefits and Advantages

Go Insurance Quote offers a host of benefits that set it apart from traditional insurance quote methods. Firstly, the platform's speed and efficiency are unparalleled, allowing users to obtain quotes in a matter of minutes, a significant improvement over the time-consuming process of manual quote requests.

Secondly, the personalized nature of the quotes ensures that users receive coverage options that align perfectly with their unique needs. This level of customization is a result of the platform's ability to consider a wide range of factors, providing a more accurate and beneficial quote.

Additionally, Go Insurance Quote's user-friendly interface and comprehensive coverage options make it an attractive choice for individuals seeking a simple and effective way to manage their insurance needs. The platform's accessibility and transparency build trust and confidence, making it a preferred choice for many insurance shoppers.

Exploring Go Insurance Quote's Features

Go Insurance Quote is more than just a quote generator; it's a comprehensive tool designed to enhance the insurance experience. Let's delve into some of its key features that make it a preferred choice for many insurance seekers.

Real-Time Quotes

One of the standout features of Go Insurance Quote is its ability to provide real-time quotes. As users input their information, the platform instantly generates quotes, offering a swift and accurate overview of their insurance options. This real-time feedback ensures that users can make informed decisions without the wait, a significant advantage over traditional quote processes.

Customizable Coverage

Go Insurance Quote understands that every individual's insurance needs are unique. That's why the platform offers customizable coverage options. Users can tailor their quotes to include specific features and benefits, ensuring they receive a policy that aligns perfectly with their requirements. Whether it's additional liability coverage, rental car reimbursement, or roadside assistance, Go Insurance Quote allows users to create a policy that's uniquely theirs.

Comparative Analysis

Go Insurance Quote doesn't stop at providing individual quotes; it goes a step further by offering a comparative analysis feature. This tool allows users to compare quotes side by side, making it easier to identify the best policy for their needs. By presenting quotes in a clear and concise manner, users can quickly assess the differences in coverage, premiums, and benefits, ensuring they make an informed choice.

Instant Policy Application

Once users have found the perfect policy through Go Insurance Quote, the platform streamlines the application process. With just a few clicks, users can complete their policy application, providing a seamless transition from quote to coverage. This instant application feature saves time and effort, making the insurance procurement process more efficient and user-friendly.

24/7 Accessibility

Go Insurance Quote is designed with convenience in mind. The platform is accessible 24/7, allowing users to obtain quotes and manage their insurance needs at their own pace. Whether it's late at night or during the weekend, users can access the platform from the comfort of their homes, making insurance quotes and management a flexible and convenient process.

Go Insurance Quote: A Case Study in Digital Innovation

Go Insurance Quote's impact on the insurance industry cannot be overstated. Its launch and subsequent success have not only revolutionized the way insurance quotes are obtained but have also set a new standard for digital innovation in the sector. Let's explore a case study that highlights the real-world impact of this innovative platform.

Case Study: Mr. Johnson's Journey to Insurance

Mr. Johnson, a 35-year-old professional, was in the market for a new auto insurance policy. As a busy individual with a demanding career, he valued his time and sought an efficient and convenient way to obtain insurance quotes. After hearing about Go Insurance Quote from a colleague, he decided to give it a try.

Using the platform, Mr. Johnson was impressed by the simplicity and speed of the quote process. Within minutes, he had obtained several quotes tailored to his needs, including options for comprehensive coverage and accident forgiveness. The platform's real-time feedback allowed him to quickly assess his options and make an informed decision.

What particularly stood out for Mr. Johnson was the platform's ability to offer a personalized experience. He appreciated the flexibility to customize his quote, adding features like rental car reimbursement and roadside assistance, which aligned perfectly with his frequent travel requirements. The comparative analysis feature further enhanced his experience, allowing him to easily compare quotes and identify the best value.

With Go Insurance Quote, Mr. Johnson not only saved time but also gained a deeper understanding of his insurance options. The platform's user-friendly interface and comprehensive coverage options made the entire process seamless and enjoyable. He felt confident in his choice, knowing he had selected a policy that suited his needs and provided the best value.

Mr. Johnson's experience with Go Insurance Quote is a testament to the platform's success. By offering a modern, efficient, and personalized insurance quote experience, Go Insurance has not only met but exceeded the expectations of users like Mr. Johnson, solidifying its position as a leader in digital insurance services.

The Future of Insurance: Go Insurance Quote's Impact

As we look ahead, Go Insurance Quote's impact on the future of insurance is evident. Its success and innovative features have paved the way for a new era of digital insurance services, offering a glimpse into the potential of technology-driven solutions in the sector.

Enhancing Customer Experience

Go Insurance Quote's focus on enhancing the customer experience has been a key driver of its success. By prioritizing user-friendly interfaces, personalized quotes, and efficient processes, the platform has set a new standard for customer satisfaction. As the insurance industry continues to evolve, the emphasis on customer experience is expected to grow, with more providers adopting digital tools and platforms to meet the needs of modern insurance shoppers.

Data-Driven Decision Making

The use of advanced algorithms and real-time data in Go Insurance Quote has revolutionized the way insurance quotes are generated. This data-driven approach allows for more accurate and tailored quotes, benefiting both customers and providers. In the future, we can expect to see further integration of data analytics in insurance services, leading to more efficient and effective decision-making processes.

Streamlined Processes

Go Insurance Quote's streamlined quote and application processes have simplified the insurance journey for many. The platform's ability to provide instant quotes and facilitate seamless policy applications saves time and effort for users. As the industry moves forward, we can anticipate further streamlining of processes, making insurance services more accessible and convenient for all.

Customized Coverage Options

Go Insurance Quote's customizable coverage options have empowered users to create policies that suit their unique needs. This level of customization is expected to become a key feature in the future of insurance. As providers recognize the value of personalized coverage, we can expect to see more innovative products and services that cater to the diverse needs of insurance consumers.

Digital Accessibility

Go Insurance Quote's 24/7 accessibility has made insurance services more convenient and flexible for users. In the future, we can expect to see continued advancements in digital accessibility, with insurance providers offering a wider range of online services and tools to meet the needs of modern consumers. This shift towards digital accessibility will enhance the overall insurance experience, making it more efficient and user-friendly.

Frequently Asked Questions (FAQ)

How accurate are the quotes provided by Go Insurance Quote?

+

Go Insurance Quote utilizes advanced algorithms and real-time data to generate quotes, ensuring a high level of accuracy. However, it’s important to note that quotes are estimates and may vary slightly when you officially apply for coverage.

Can I obtain quotes for multiple insurance types on Go Insurance Quote?

+

Absolutely! Go Insurance Quote offers quotes for a range of insurance types, including auto, home, health, and life insurance. You can obtain multiple quotes tailored to your specific needs.

Is my personal information secure on Go Insurance Quote?

+

Yes, Go Insurance Quote prioritizes data security. The platform employs advanced encryption technologies to protect your personal information, ensuring a safe and secure quote process.

How do I know which quote is the best option for me?

+

Go Insurance Quote provides a comparative analysis feature that allows you to easily compare quotes side by side. Consider factors like coverage, premiums, and additional benefits to determine the best option for your needs.

Can I speak to an insurance agent if I have questions about my quote?

+

Absolutely! Go Insurance Quote provides access to a team of insurance professionals who can answer your questions and provide guidance. You can connect with an agent via live chat, email, or phone for personalized assistance.