Good Cheap Dental Insurance

In today's world, maintaining good oral health is essential, but the cost of dental care can be a significant concern for many individuals and families. That's why finding affordable and reliable dental insurance options is crucial. This article aims to provide an in-depth guide to help you navigate the world of dental insurance, focusing on budget-friendly plans that offer quality coverage.

Understanding the Importance of Dental Insurance

Regular dental check-ups and timely treatments are vital for maintaining a healthy smile and overall well-being. Neglecting dental health can lead to various issues, from cavities and gum disease to more complex problems like tooth loss and systemic health conditions. Dental insurance plays a crucial role in making these necessary services more accessible and affordable.

With the right dental insurance plan, you can:

- Access preventive care services at a discounted rate, promoting early detection and treatment of oral health issues.

- Save significantly on costly procedures like root canals, dental implants, or orthodontic treatments.

- Avoid financial strain and unexpected expenses associated with emergency dental procedures.

- Ensure your family's oral health is protected, especially for children who are prone to cavities and dental injuries.

Key Factors to Consider When Choosing Dental Insurance

When searching for an affordable dental insurance plan, several factors come into play. Here are some key considerations to help you make an informed decision:

Monthly Premiums

The premium is the amount you pay monthly to maintain your dental insurance coverage. While it’s tempting to opt for the lowest premium, consider your long-term needs and the overall value of the plan. A slightly higher premium might offer better coverage and savings in the long run.

Deductibles and Copayments

Dental insurance plans often have deductibles, which are the amounts you pay out of pocket before the insurance coverage kicks in. Copayments, on the other hand, are the fixed amounts you pay for specific services. Understanding these costs can help you budget effectively.

Coverage and Benefits

Each dental insurance plan offers a unique set of coverage and benefits. Some plans might focus more on preventive care, while others offer comprehensive coverage for major procedures. Assess your dental needs and prioritize the services you require the most.

Network of Providers

Check if the insurance plan has a network of preferred providers in your area. Out-of-network providers may cost more, so it’s essential to ensure your preferred dentists and specialists are included.

Waiting Periods

Most dental insurance plans have waiting periods before certain procedures are covered. These periods can range from a few months to a year. If you anticipate needing specific treatments soon, consider plans with shorter waiting periods.

Renewability and Lifetime Maximums

Inquire about the plan’s renewability and whether there are any lifetime maximum limits on benefits. Some plans might offer lifetime coverage with no maximums, providing long-term peace of mind.

Top Affordable Dental Insurance Plans

Now, let’s explore some of the most popular and affordable dental insurance plans available in the market, complete with their features and benefits.

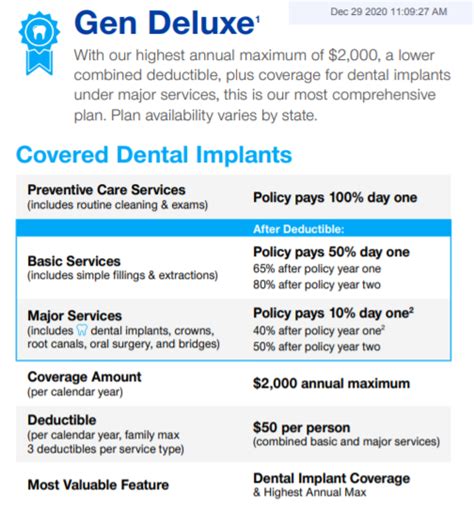

Delta Dental PPO

Delta Dental PPO plans offer a wide range of benefits at affordable rates. With a network of over 150,000 dentists nationwide, you can easily find an in-network provider. The plans cover preventive care, basic procedures, and major services, with copayments varying based on the type of treatment.

| Plan Type | Monthly Premium | Deductible | Copayments |

|---|---|---|---|

| Individual | $25 | $50 | 20% - 50% |

| Family | $75 | $150 | 25% - 55% |

MetLife Dental Plans

MetLife provides a range of dental insurance options, including PPO and indemnity plans. These plans offer flexibility and a choice between in-network and out-of-network providers. Preventive care is typically covered at 100%, with deductibles and copayments for other services.

| Plan Type | Monthly Premium | Deductible | Copayments |

|---|---|---|---|

| PPO - Individual | $30 | $75 | 20% - 50% |

| PPO - Family | $90 | $200 | 25% - 55% |

| Indemnity - Individual | $20 | $50 | 80% - 100% |

Cigna Dental Plans

Cigna Dental plans are known for their extensive network and generous coverage. The plans cover a wide range of services, including orthodontics and implants, with varying copayments. Cigna also offers plans with no waiting periods for certain procedures.

| Plan Type | Monthly Premium | Deductible | Copayments |

|---|---|---|---|

| Basic - Individual | $22 | $50 | 20% - 40% |

| Basic - Family | $65 | $150 | 25% - 45% |

| Enhanced - Individual | $35 | $75 | 15% - 35% |

| Enhanced - Family | $100 | $250 | 20% - 40% |

Aetna Dental Access

Aetna Dental Access plans offer a simple and affordable option for dental insurance. With a focus on preventive care, these plans cover routine check-ups, cleanings, and X-rays at 100%. Other services are covered with varying copayments.

| Plan Type | Monthly Premium | Deductible | Copayments |

|---|---|---|---|

| Individual | $18 | $50 | 20% - 50% |

| Family | $55 | $150 | 25% - 55% |

Humana Dental Plans

Humana offers a variety of dental plans, including PPO and DHMO (Dental Health Maintenance Organization) options. The plans cover a comprehensive range of services, with varying copayments and deductibles.

| Plan Type | Monthly Premium | Deductible | Copayments |

|---|---|---|---|

| PPO - Individual | $28 | $75 | 20% - 50% |

| PPO - Family | $85 | $200 | 25% - 55% |

| DHMO - Individual | $20 | N/A | 10% - 20% |

| DHMO - Family | $60 | N/A | 15% - 25% |

Tips for Maximizing Your Dental Insurance Benefits

Now that you have a better understanding of the available dental insurance plans, here are some tips to make the most of your coverage:

- Choose a plan with a network of providers that includes your preferred dentists and specialists.

- Opt for plans with shorter waiting periods if you anticipate needing specific treatments soon.

- Understand the coverage limits and restrictions to avoid unexpected out-of-pocket expenses.

- Utilize preventive care services regularly to catch and treat oral health issues early.

- Consider adding supplemental insurance or savings plans for major procedures not covered by your primary plan.

Conclusion

Finding affordable and comprehensive dental insurance is essential for maintaining good oral health. By considering the factors discussed and exploring the top plans outlined, you can make an informed decision that suits your needs and budget. Remember, a healthy smile is an investment in your overall well-being.

FAQ

Can I switch dental insurance plans mid-year if I find a better option?

+Yes, you can typically switch dental insurance plans during open enrollment periods or if you experience a qualifying life event, such as a job change or marriage.

Are there any government-sponsored dental insurance programs for low-income individuals?

+Yes, some states offer Medicaid or Children’s Health Insurance Program (CHIP) that provide dental coverage for eligible low-income individuals and families.

What should I do if my preferred dentist is not in-network with my chosen plan?

+You can either choose an in-network provider or pay out-of-network fees. Some plans offer reimbursement for out-of-network visits, so check your policy details.