Good Insurance Companies In Texas

When it comes to choosing an insurance provider in the state of Texas, there are several reputable options to consider. The Lone Star State is home to a diverse range of insurance companies, each offering unique benefits and coverage plans. This article will delve into the world of Texas insurance, providing an in-depth analysis of some of the top-rated companies and the factors that make them stand out.

A Comprehensive Guide to Texas’ Premier Insurance Providers

Texas is renowned for its vast landscapes, thriving cities, and diverse population, making it a bustling hub for insurance companies to cater to a wide array of needs. Whether you’re a resident of Houston, Dallas, or a small town in the heart of Texas, finding the right insurance provider is crucial for protecting your assets and ensuring peace of mind.

Understanding the Texas Insurance Landscape

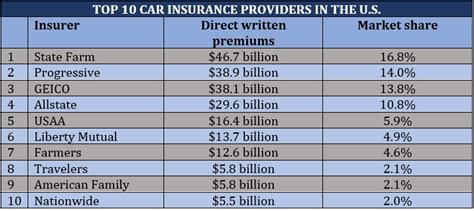

The insurance market in Texas is highly competitive, with numerous companies vying for customers. This competition often leads to innovative products, competitive pricing, and a range of coverage options. Here’s a closer look at some of the key players in the Texas insurance scene and the unique value they bring to the table.

Allstate Insurance: A Trusted Name in Texas

Allstate is a household name in the insurance industry, and its presence in Texas is no exception. With a strong focus on customer service and a wide range of coverage options, Allstate has established itself as a go-to choice for many Texans. One of the standout features of Allstate is its Flexible Coverage plans, which allow customers to tailor their policies to their specific needs.

For instance, Allstate’s Auto Insurance offers optional coverage for new car replacement, ensuring that policyholders can get a brand-new vehicle if their current car is totaled within the first year of ownership. This unique feature provides added peace of mind for car enthusiasts and those who prioritize having the latest safety features.

| Coverage Type | Allstate's Benefits |

|---|---|

| Home Insurance | Personalized protection plans with optional endorsements for specific needs. |

| Life Insurance | A range of term and permanent life insurance options with competitive rates. |

| Business Insurance | Comprehensive coverage for small businesses, including cyber liability protection. |

State Farm: A Local Favorite with National Reach

State Farm is another insurance giant that has made a significant impact in the Texas market. With a strong emphasis on community involvement and personalized service, State Farm has earned a reputation as a reliable and trustworthy insurer. Their Local Agent model ensures that customers receive tailored advice and support from knowledgeable professionals who understand the unique needs of Texans.

One of State Farm’s standout offerings is its Auto Insurance Safe Driver Discount, which rewards policyholders with significant savings for maintaining a clean driving record. This incentive not only encourages safe driving but also makes State Farm an attractive option for responsible drivers looking to save on their insurance premiums.

| Policy Type | State Farm's Key Benefits |

|---|---|

| Auto Insurance | Accident forgiveness and safe driver discounts for responsible drivers. |

| Homeowners Insurance | Personalized coverage options with flexible deductibles and replacement cost protection. |

| Renters Insurance | Affordable coverage for renters, including liability protection and additional living expenses. |

USAA: Serving the Military Community in Texas

USAA, or United Services Automobile Association, is a unique insurance provider that specializes in serving current and former military members and their families. With a strong presence in Texas, USAA has built a reputation for exceptional customer service and tailored coverage options for those who have served our country.

One of USAA’s standout features is its Military Discounts on various insurance policies. For instance, active-duty military personnel and their spouses can benefit from reduced rates on Auto Insurance, providing significant savings during their service. This appreciation for military sacrifice is a core value of USAA and sets it apart from other insurance providers.

| Policy Category | USAA's Military Benefits |

|---|---|

| Auto Insurance | Discounts for active-duty military and their spouses, as well as accident forgiveness. |

| Homeowners Insurance | Competitive rates and specialized coverage for military housing, including rental properties. |

| Life Insurance | Low-cost term life insurance options with simplified underwriting for military members. |

GEICO: Competitive Rates and Digital Convenience

GEICO, or Government Employees Insurance Company, is a well-known insurer that has made its mark in Texas with competitive rates and a strong focus on digital convenience. GEICO’s online platform allows customers to easily manage their policies, file claims, and access their insurance information from anywhere, making it a popular choice for tech-savvy Texans.

One of GEICO’s key advantages is its Multi-Policy Discounts, which provide significant savings for customers who bundle their auto, homeowners, and renters insurance policies. This incentive encourages customers to centralize their insurance needs with GEICO, making it a cost-effective option for those looking to streamline their coverage.

| Policy Type | GEICO's Key Features |

|---|---|

| Auto Insurance | Discounts for safe driving, military service, and vehicle safety features. Also offers accident forgiveness and rental car coverage. |

| Homeowners Insurance | Flexible coverage options with replacement cost protection and optional endorsements for specific needs. |

| Renters Insurance | Affordable coverage with personal property protection and liability coverage, plus optional add-ons for specific risks. |

Texas Farm Bureau Insurance: Tailored Coverage for Rural Texans

Texas Farm Bureau Insurance is a trusted provider that specializes in serving the unique needs of rural Texans. With a deep understanding of the challenges and risks faced by those living in agricultural and rural communities, Texas Farm Bureau Insurance offers tailored coverage options that provide comprehensive protection.

One of their standout offerings is the Farm and Ranch Package, which combines multiple coverages into one policy, including Farm and Ranch Liability, Farm and Ranch Personal Property, and Farm and Ranch Dwelling insurance. This package provides a cost-effective solution for farmers and ranchers, ensuring their operations, homes, and personal belongings are adequately protected.

| Policy Category | Texas Farm Bureau's Rural Coverage |

|---|---|

| Farm and Ranch Insurance | Comprehensive coverage for agricultural operations, including liability, personal property, and dwelling protection. |

| Auto Insurance | Specialized coverage for farm vehicles and equipment, with optional endorsements for unique risks faced by rural residents. |

| Life Insurance | Flexible term and whole life insurance options, with additional riders for agricultural business needs. |

The Bottom Line: Choosing the Right Insurance Provider in Texas

The insurance landscape in Texas is diverse and competitive, offering a range of options to suit the unique needs of its residents. Whether you’re seeking comprehensive coverage for your home, auto, or business, or specialized protection for your agricultural operations, there’s an insurance provider in Texas that can cater to your specific requirements.

When selecting an insurance company, it’s essential to consider factors such as coverage options, competitive rates, customer service, and the company’s reputation. By researching and comparing different providers, you can make an informed decision that ensures you and your assets are adequately protected. Remember, insurance is a crucial aspect of financial planning, and choosing the right provider can provide peace of mind and security for years to come.

FAQ

What are the average insurance rates in Texas?

+

Insurance rates in Texas can vary based on several factors, including location, age, driving record, and the type of coverage chosen. On average, Texans pay around 1,200 annually for car insurance and 1,500 for homeowners insurance. However, these rates can be significantly influenced by individual circumstances.

How do I find the best insurance rates in Texas?

+

To find the best insurance rates in Texas, it’s recommended to compare quotes from multiple providers. You can use online comparison tools or contact insurance agents directly to obtain quotes tailored to your needs. Additionally, consider the coverage options and any discounts you may be eligible for to get the most value for your money.

Are there any specific insurance requirements in Texas?

+

Yes, Texas has specific insurance requirements. For instance, all drivers are required to carry liability insurance with minimum coverage limits of 30/60/25 (bodily injury/per accident/property damage). Additionally, homeowners insurance is not mandatory, but it is highly recommended to protect your property and belongings.