Good Medical Insurance Policy

In today's world, having a comprehensive medical insurance policy is not just a necessity but a vital aspect of financial planning. With rising healthcare costs, unexpected illnesses, and the ever-evolving nature of medical treatments, it is crucial to be well-prepared and protected. A good medical insurance policy can provide peace of mind, ensuring that you and your loved ones have access to quality healthcare without incurring significant financial burdens.

Understanding the Basics of Medical Insurance

Medical insurance, often referred to as health insurance, is a contractual agreement between an individual (or a group) and an insurance company. This agreement ensures that the insurance provider will cover a portion or the entirety of the policyholder’s medical expenses, subject to the terms and conditions outlined in the policy. It acts as a financial safety net, safeguarding individuals from the potentially devastating costs associated with medical treatments, hospitalization, and other healthcare services.

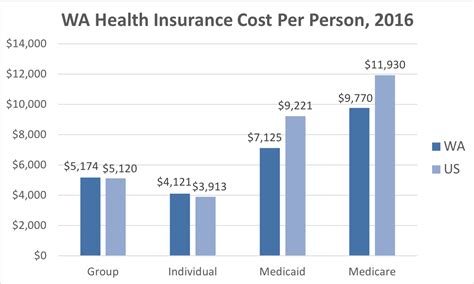

The primary goal of medical insurance is to provide coverage for a wide range of medical expenses, including doctor visits, diagnostic tests, surgeries, medications, and more. By spreading the financial risk across a large pool of policyholders, insurance companies can offer affordable premiums, making healthcare more accessible and manageable for individuals and families.

Key Components of a Medical Insurance Policy

When evaluating a medical insurance policy, several crucial components should be considered:

- Coverage Scope: The breadth of coverage is essential. It should include a comprehensive range of medical services, from routine check-ups and preventive care to specialized treatments and surgeries. Policies with limited coverage may leave policyholders exposed to unexpected costs.

- Network of Healthcare Providers: A robust network of hospitals, clinics, and medical professionals is vital. This ensures that policyholders have access to quality healthcare facilities and specialists within their network, often at discounted rates.

- Premium and Deductibles: The premium is the amount paid regularly (usually monthly) to maintain the policy. It is essential to find a balance between affordable premiums and adequate coverage. Additionally, understanding deductibles (the amount paid out-of-pocket before insurance coverage kicks in) is crucial, as it affects the overall cost of the policy.

- Co-payments and Co-insurance: Co-payments are fixed amounts paid by the policyholder for certain services, while co-insurance is a percentage of the total cost that the policyholder shares with the insurance company. These aspects impact the overall cost of healthcare services.

- Pre-existing Conditions: Many policies have provisions for pre-existing conditions, which are health issues present before the policy's effective date. Understanding how these conditions are covered (or excluded) is critical to choosing the right policy.

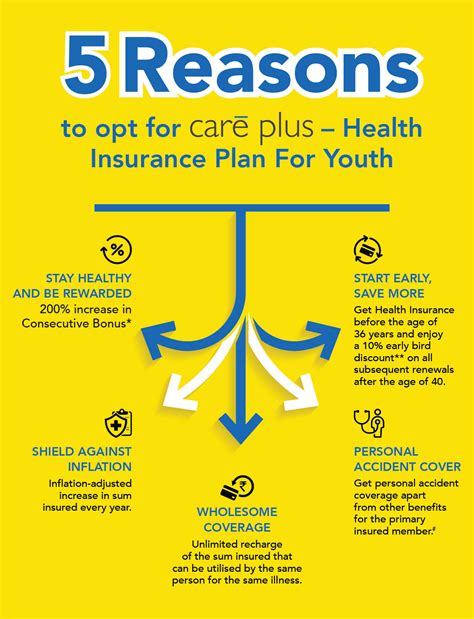

- Renewability and Lifetime Benefits: A good policy should offer renewability, allowing individuals to maintain coverage as they age. Additionally, lifetime benefit limits should be considered, as some policies may have caps on the total amount payable over the policy's lifetime.

- Add-on Benefits: Some insurance providers offer additional benefits such as critical illness coverage, accidental death and disability coverage, or maternity benefits. These add-ons can enhance the policy's overall value.

Selecting the Right Medical Insurance Policy

Choosing a medical insurance policy that aligns with your specific needs and circumstances is crucial. Here are some key considerations to guide your decision-making process:

Assess Your Healthcare Needs

Start by evaluating your current and potential future healthcare needs. Consider factors such as your age, existing health conditions, family medical history, and the likelihood of requiring specialized treatments. If you have pre-existing conditions, ensure that the policy provides adequate coverage for these conditions.

Research Insurance Providers

Do thorough research on reputable insurance companies. Look into their financial stability, customer reviews, and the range of policies they offer. Check for any complaints or issues associated with claim settlements. A stable and well-regarded insurance provider can provide peace of mind and ensure timely claim settlements.

Compare Policy Features

Compare different policies side by side to identify the best fit. Pay attention to coverage limits, network providers, deductibles, and any exclusions. Look for policies that offer flexibility and customization to suit your needs. Some providers may offer customized plans tailored to specific demographics or lifestyles.

Consider Your Budget

While it’s essential to have comprehensive coverage, it’s equally important to ensure that the policy is affordable. Assess your financial capabilities and set a realistic budget for premiums. Remember that lower premiums may result in higher out-of-pocket expenses, so strike a balance that works for your financial situation.

Review Policy Documents

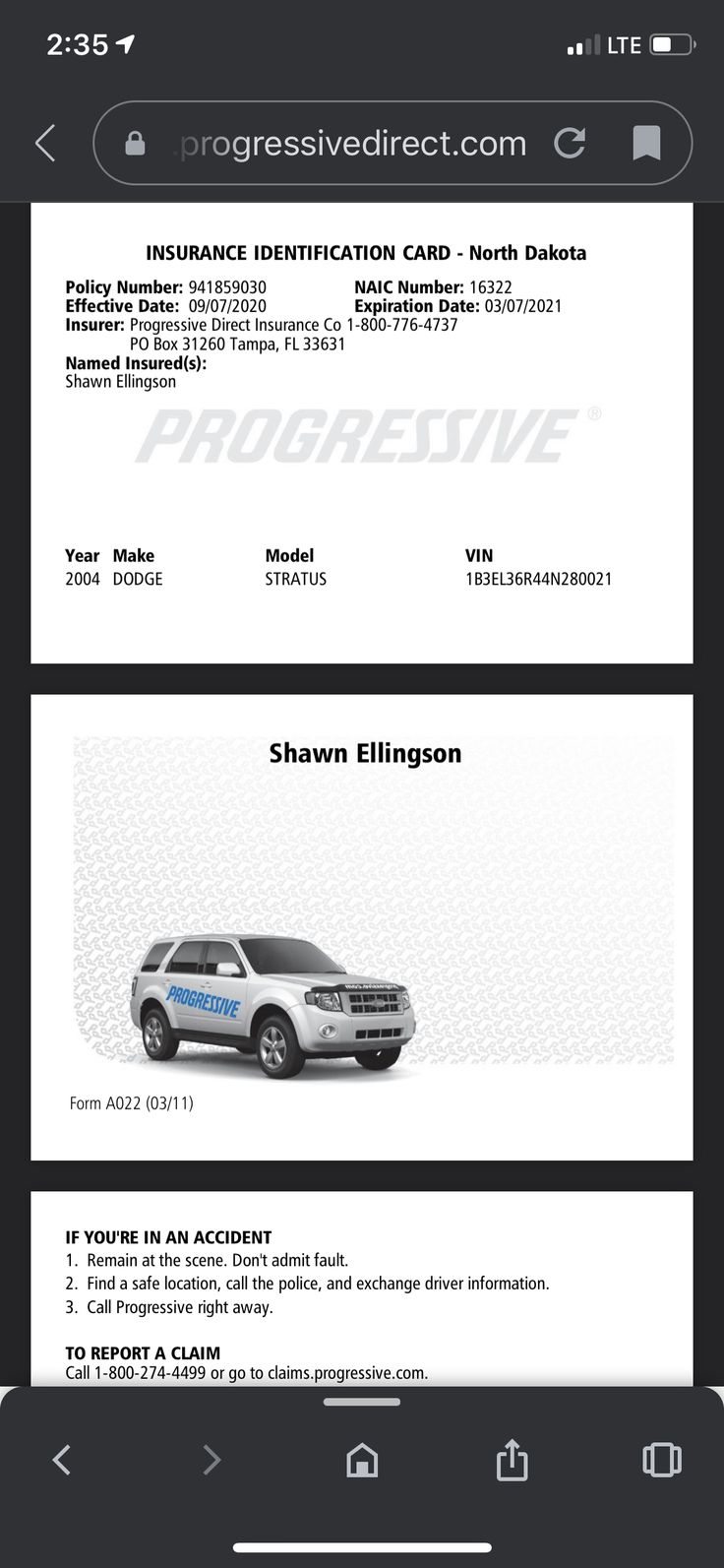

Before finalizing your choice, carefully review the policy document. Understand the terms and conditions, including any exclusions, limitations, and waiting periods. Ensure that you are comfortable with the policy’s language and that it aligns with your expectations. Seek clarification on any confusing terms or provisions.

Maximizing Your Medical Insurance Benefits

Once you’ve selected a suitable medical insurance policy, there are strategies to maximize its benefits and ensure you receive the most value from your coverage.

Stay Informed and Engaged

Stay updated on your policy’s features, coverage limits, and any changes or additions. Regularly review your policy documents and ask your insurance provider about any enhancements or modifications to your plan. Being informed allows you to make the most of your coverage.

Utilize Preventive Care Services

Many insurance policies encourage preventive care by offering coverage for routine check-ups, vaccinations, and screenings. Take advantage of these services to maintain your health and catch potential issues early on. Preventive care can lead to early detection and treatment, often resulting in better health outcomes and lower healthcare costs.

Choose In-Network Providers

Whenever possible, opt for healthcare providers within your insurance network. In-network providers offer discounted rates and typically have streamlined claim processes. Utilizing out-of-network providers may result in higher out-of-pocket costs and more complex claim procedures.

Understand Claim Procedures

Familiarize yourself with the claim process outlined by your insurance provider. Know the required documentation, claim forms, and any specific procedures for different types of claims. Being prepared and organized can expedite the claim settlement process, ensuring you receive your benefits promptly.

Review and Update Your Policy Regularly

As your life circumstances change, your healthcare needs may evolve as well. Review your policy annually and make adjustments as necessary. Changes in family size, income, or health conditions may require modifications to your coverage. Regular reviews ensure that your policy remains aligned with your current needs.

The Future of Medical Insurance

The landscape of medical insurance is continually evolving, driven by advancements in healthcare, changing demographics, and evolving consumer expectations. Here’s a glimpse into the future of medical insurance and how it may impact policyholders:

Technological Innovations

The integration of technology in the healthcare industry is revolutionizing medical insurance. Digital platforms and mobile apps are streamlining claim processes, making it easier for policyholders to submit claims and track their status. Telemedicine and remote monitoring technologies are also gaining traction, offering convenient and cost-effective healthcare options.

Focus on Wellness and Prevention

Insurance providers are increasingly shifting their focus from treating illnesses to promoting wellness and preventing diseases. Policies with incentives for healthy lifestyles, such as discounts for gym memberships or fitness tracking programs, are becoming more common. This shift aims to reduce long-term healthcare costs and improve overall population health.

Personalized Medicine

Advancements in genomics and precision medicine are paving the way for highly personalized healthcare. Insurance policies may adapt to offer tailored coverage based on individual genetic profiles, allowing for more targeted and effective treatments. This approach could lead to improved health outcomes and more efficient use of healthcare resources.

Value-Based Care

The concept of value-based care, which emphasizes quality over quantity, is gaining traction. Insurance providers may incentivize healthcare providers to deliver high-quality, cost-effective care by rewarding them based on patient outcomes rather than the volume of services provided. This shift could lead to more efficient healthcare delivery and better patient experiences.

Global Healthcare Trends

As healthcare becomes more interconnected globally, insurance policies may adapt to accommodate international travel and medical treatments. Policies with global coverage and emergency assistance can provide peace of mind for individuals traveling abroad. Additionally, cross-border healthcare collaborations may lead to more diverse and specialized treatment options.

| Key Takeaways | Summary |

|---|---|

| Understanding Medical Insurance | Medical insurance is a vital financial tool, offering coverage for a range of healthcare expenses. Key components include coverage scope, network providers, premiums, deductibles, and add-on benefits. |

| Selecting the Right Policy | Assess your healthcare needs, research providers, compare policy features, consider your budget, and thoroughly review policy documents. |

| Maximizing Benefits | Stay informed, utilize preventive care, choose in-network providers, understand claim procedures, and regularly review and update your policy. |

| Future Trends | The future of medical insurance includes technological advancements, a focus on wellness and prevention, personalized medicine, value-based care, and global healthcare trends. |

How do I know if my current medical insurance policy is adequate for my needs?

+Evaluating your current policy involves assessing its coverage scope, network of providers, and whether it aligns with your healthcare needs. Consider your age, health conditions, and potential future medical requirements. If you have concerns, consult with your insurance provider or seek professional advice to ensure your policy is comprehensive and suitable.

What happens if I have a pre-existing condition? Can I still get medical insurance coverage?

+Many insurance providers offer coverage for pre-existing conditions, but it may involve waiting periods or specific provisions. It’s crucial to disclose all pre-existing conditions when applying for a policy. Some providers may offer specialized plans for individuals with specific health issues. Always review the policy documents carefully to understand the coverage for pre-existing conditions.

How can I reduce my medical insurance premiums without sacrificing coverage?

+To lower premiums while maintaining adequate coverage, consider increasing your deductible (the amount you pay before insurance coverage kicks in). You can also explore family or group plans, which often offer discounted rates. Additionally, maintaining a healthy lifestyle and utilizing preventive care services can lead to reduced premiums over time.

What are some common exclusions in medical insurance policies?

+Common exclusions may include cosmetic procedures, pre-existing conditions (within a certain timeframe), specific types of injuries (e.g., self-inflicted), and certain mental health treatments. It’s essential to review the policy’s exclusions list to understand what is not covered. Some policies may offer add-ons or riders to cover specific exclusions.

How can I ensure a smooth claim process when making a medical insurance claim?

+To ensure a smooth claim process, familiarize yourself with the claim procedures outlined by your insurance provider. Gather all necessary documentation, such as medical reports and bills, and submit your claim promptly. Stay in communication with your insurance provider, and if needed, seek assistance from healthcare professionals or insurance brokers to navigate the process effectively.