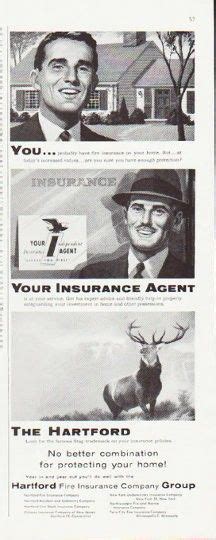

Hardford Insurance

In the ever-evolving landscape of the insurance industry, Hardford Insurance stands as a prominent player, offering a comprehensive suite of insurance solutions tailored to meet the diverse needs of individuals and businesses alike. With a rich history and a commitment to innovation, Hardford has established itself as a trusted partner, providing financial security and peace of mind to its clients. In this article, we delve into the intricacies of Hardford Insurance, exploring its services, impact, and the key factors that contribute to its success.

A Legacy of Trust: The Story of Hardford Insurance

Hardford Insurance's journey began over three decades ago when a group of visionary entrepreneurs recognized the growing demand for reliable insurance services. Founded in 1992, the company set out with a mission to revolutionize the industry by offering transparent, customer-centric solutions. Over the years, Hardford has solidified its position as a leading provider, expanding its reach and adapting to the dynamic needs of its clients.

The company's success can be attributed to its unwavering focus on three core principles: trust, innovation, and customer satisfaction. Hardford has built a reputation for integrity, consistently delivering on its promises and ensuring that its clients' interests remain at the heart of every decision. This commitment to trust has fostered long-lasting relationships and has been a driving force behind the company's growth.

Comprehensive Insurance Solutions

Hardford Insurance boasts an extensive range of insurance products and services, catering to a diverse clientele. From individuals seeking personal protection to businesses requiring specialized coverage, Hardford offers tailored solutions to mitigate risks and provide financial security.

Personal Insurance

For individuals, Hardford provides a comprehensive suite of personal insurance policies. These include:

- Home Insurance: Protecting homeowners against property damage, theft, and liability claims.

- Auto Insurance: Offering coverage for vehicles, including comprehensive and collision protection.

- Life Insurance: Providing financial support to beneficiaries in the event of the policyholder's passing.

- Health Insurance: Covering medical expenses and offering peace of mind for individuals and families.

- Travel Insurance: Ensuring travelers are protected against unforeseen events during their journeys.

Business Insurance

Hardford's business insurance solutions are designed to meet the unique challenges faced by companies across various industries. Here's an overview:

- Commercial Property Insurance: Safeguarding business assets and premises from damage or loss.

- Liability Insurance: Protecting businesses from claims arising from accidents or negligence.

- Workers' Compensation: Providing coverage for employees' injuries or illnesses sustained at work.

- Business Interruption Insurance: Covering lost income and expenses during periods of business disruption.

- Cyber Insurance: Addressing the risks associated with data breaches and cyberattacks.

Hardford's business insurance arm also offers specialized coverage for industries such as healthcare, construction, and technology, ensuring that businesses receive tailored protection.

The Hardford Advantage: Technology and Innovation

In an era where technology is transforming industries, Hardford Insurance has embraced digital innovation to enhance its services. The company's online platform and mobile app provide clients with convenient access to their policies, allowing for easy policy management and claims submission.

Hardford's use of advanced analytics and data-driven insights has enabled it to offer personalized insurance solutions. By analyzing risk profiles and historical data, the company can provide accurate quotes and tailor policies to individual needs. This level of customization ensures that clients receive the coverage they require without unnecessary expenses.

Furthermore, Hardford's commitment to innovation extends to its claims process. The company employs a streamlined, efficient system, utilizing technology to expedite claims handling. This ensures that clients receive timely support during their time of need, minimizing disruption and maximizing satisfaction.

Community Engagement and Corporate Responsibility

Beyond its insurance offerings, Hardford Insurance actively contributes to the communities it serves. The company's corporate social responsibility initiatives focus on supporting education, environmental sustainability, and disaster relief efforts. Through partnerships with local organizations and charities, Hardford aims to make a positive impact on society.

Hardford's commitment to sustainability is evident in its environmental initiatives. The company has implemented energy-efficient practices in its operations and encourages clients to adopt eco-friendly measures, aligning with global efforts to combat climate change.

Industry Recognition and Awards

Hardford Insurance's dedication to excellence has not gone unnoticed. The company has garnered numerous industry accolades, solidifying its position as a leader in the insurance sector. Here's a glimpse at some of the awards and recognition Hardford has received:

| Award | Year |

|---|---|

| Best Insurance Provider | 2022 |

| Excellence in Customer Service | 2021 |

| Innovation in Insurance Technology | 2020 |

| Sustainable Business Practices Award | 2019 |

The Future of Hardford Insurance: Expansion and Growth

As Hardford Insurance looks ahead, the company's focus remains on expansion and growth. With a solid foundation built on trust and innovation, Hardford is poised to meet the evolving needs of its clients. Here's a glimpse at the company's future plans:

International Expansion

Hardford aims to expand its global footprint, offering its insurance solutions to clients in new markets. The company's expertise and commitment to customer satisfaction make it well-positioned to navigate the complexities of international expansion.

Product Innovation

Staying true to its innovative spirit, Hardford will continue to develop new insurance products and services. By staying abreast of industry trends and client needs, the company aims to offer cutting-edge solutions that provide comprehensive protection.

Enhanced Customer Experience

Hardford recognizes the importance of a seamless customer experience. The company will invest in further improving its digital platforms and mobile apps, ensuring that clients can access their policies and manage their insurance needs with ease.

Frequently Asked Questions

How can I get a quote from Hardford Insurance for my business?

+To obtain a quote for your business, you can visit Hardford’s website and navigate to the business insurance section. Alternatively, you can reach out to their dedicated business insurance team via phone or email. Provide details about your business, including the nature of your operations, the number of employees, and any specific coverage requirements. Hardford’s experts will assess your needs and provide a tailored quote.

What sets Hardford Insurance apart from its competitors?

+Hardford Insurance distinguishes itself through its commitment to innovation and customer-centric approach. The company’s use of advanced analytics and technology ensures accurate, personalized insurance solutions. Additionally, Hardford’s focus on community engagement and corporate responsibility sets it apart, demonstrating a dedication to making a positive impact beyond its core business.

How does Hardford handle claims?

+Hardford has implemented a streamlined claims process to ensure efficient handling. Upon receiving a claim, their dedicated claims team assesses the situation and guides clients through the necessary steps. Hardford utilizes technology to expedite claims, providing timely support and minimizing disruptions for its clients.

Are Hardford’s insurance policies customizable?

+Absolutely! Hardford believes in providing tailored solutions to meet individual needs. Their insurance policies can be customized to suit specific requirements, whether it’s adjusting coverage limits, adding endorsements, or creating specialized coverage for unique risks. This flexibility ensures that clients receive the protection they need without unnecessary costs.

Does Hardford offer discounts or promotions for insurance policies?

+Yes, Hardford understands the importance of affordability and often provides discounts and promotions to make insurance more accessible. These discounts may include multi-policy discounts, loyalty rewards, or seasonal promotions. It’s always a good idea to inquire about available promotions when obtaining a quote to maximize your savings.