Hartford Insurance Quote

When it comes to insurance, having accurate and affordable coverage is essential for individuals and businesses alike. Obtaining an insurance quote is the first step towards ensuring peace of mind and financial protection. In this comprehensive guide, we will delve into the world of Hartford Insurance quotes, exploring the factors that influence pricing, the process of obtaining a quote, and the benefits of choosing Hartford as your insurance provider.

Hartford Insurance, a leading provider in the industry, offers a wide range of insurance products tailored to meet the diverse needs of its customers. From auto and home insurance to business and life insurance, Hartford strives to provide comprehensive coverage at competitive rates. Understanding the quote process and the unique advantages of Hartford Insurance can help you make informed decisions about your insurance needs.

Understanding Hartford Insurance Quotes

A Hartford Insurance quote is a personalized estimate of the cost of your insurance coverage based on various factors. These factors include your personal information, the type of insurance you require, and the level of coverage you desire. The quote provides an overview of the potential cost and allows you to assess whether the coverage and price align with your expectations and budget.

Factors Influencing Hartford Insurance Quotes

- Personal Information: Your age, gender, marital status, and occupation can impact your insurance quote. For instance, younger individuals may pay higher premiums for auto insurance, while certain occupations may qualify for specialized coverage options.

- Location: The area where you reside or operate your business plays a significant role in determining your insurance quote. Factors such as crime rates, weather conditions, and local regulations can affect the cost of your coverage.

- Type of Insurance: Hartford Insurance offers a vast array of insurance products. The type of insurance you require, such as auto, home, business, or life insurance, will impact the quote you receive. Each type of insurance has its own set of considerations and coverage options.

- Coverage Level: The level of coverage you choose directly affects your insurance quote. Higher coverage limits and additional benefits will generally result in a higher premium. It's essential to find the right balance between the coverage you need and the cost you can afford.

- Claims History: Your claims history is a crucial factor in determining your insurance quote. A clean claims record may lead to more favorable rates, while multiple claims in the past could result in higher premiums.

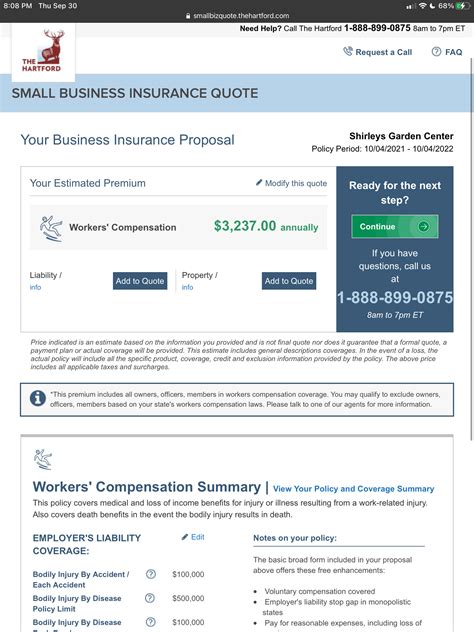

The Hartford Insurance Quote Process

Obtaining a Hartford Insurance quote is a straightforward process designed to be user-friendly and efficient. Here's a step-by-step breakdown of how you can get a quote:

- Visit the Hartford Insurance Website: Start by accessing the official Hartford Insurance website. The homepage typically features a prominent "Get a Quote" button or a similar option.

- Choose Your Insurance Type: Select the type of insurance you're interested in. Hartford offers various options, including auto, home, business, and life insurance. Choose the one that aligns with your needs.

- Provide Basic Information: You'll be prompted to enter your personal details, such as your name, contact information, and date of birth. This information is necessary for the quote process.

- Select Coverage Options: Based on your chosen insurance type, you'll be presented with a range of coverage options. Carefully review and select the coverage limits and additional benefits that suit your requirements.

- Enter Additional Details: Depending on the type of insurance, you may need to provide specific details. For example, if you're quoting for auto insurance, you'll need to input information about your vehicle, driving history, and any additional drivers.

- Review and Submit: Carefully review all the information you've provided to ensure accuracy. Once you're satisfied, submit your quote request. Hartford's system will process your request and generate a personalized quote.

- Receive Your Quote: Within a short period, you should receive your Hartford Insurance quote via email or through your online account. The quote will outline the estimated cost of your coverage, allowing you to make an informed decision.

Benefits of Choosing Hartford Insurance

Hartford Insurance is a trusted name in the insurance industry, known for its comprehensive coverage, competitive pricing, and exceptional customer service. Here are some key benefits of choosing Hartford for your insurance needs:

- Comprehensive Coverage Options: Hartford offers a wide range of insurance products to meet various needs. Whether you require auto, home, business, or life insurance, Hartford provides tailored coverage options to ensure you're adequately protected.

- Competitive Pricing: Hartford strives to offer competitive rates without compromising on coverage quality. By obtaining a quote, you can compare Hartford's pricing with other insurance providers and make an informed decision based on value.

- Personalized Approach: Hartford understands that every customer has unique insurance needs. Their quote process allows you to customize your coverage, ensuring you receive a personalized plan that fits your requirements and budget.

- Expertise and Experience: With a rich history in the insurance industry, Hartford has a wealth of expertise and experience. Their knowledgeable team can provide valuable insights and guidance to help you navigate the complexities of insurance.

- Excellent Customer Service: Hartford prioritizes customer satisfaction and aims to provide exceptional service. Their dedicated customer support team is readily available to assist with any inquiries or concerns you may have throughout the quote and policy process.

- Flexible Payment Options: Hartford understands the importance of financial flexibility. They offer various payment options, allowing you to choose the one that best suits your needs, whether it's monthly, quarterly, or annual payments.

- Digital Convenience: Hartford embraces digital innovation to enhance the customer experience. Their online platform and mobile app provide convenient access to your insurance information, allowing you to manage your policy, make payments, and file claims with ease.

Hartford Insurance: A Trusted Partner

When it comes to insurance, having a reliable and trusted partner is essential. Hartford Insurance has established itself as a leading provider, offering a comprehensive range of insurance products and services. By understanding the factors that influence insurance quotes and following the simple quote process, you can take control of your insurance needs and make informed decisions.

With Hartford Insurance, you can rest assured that you're protected by a reputable and experienced insurer. Their commitment to providing competitive pricing, personalized coverage, and exceptional customer service makes them a top choice for individuals and businesses seeking comprehensive insurance solutions.

Don't wait; take the first step towards securing your future by obtaining a Hartford Insurance quote today. Explore the wide range of coverage options, compare prices, and discover the peace of mind that comes with knowing you're adequately protected. Choose Hartford Insurance and experience the benefits of a trusted partner in the insurance industry.

How accurate are Hartford Insurance quotes?

+Hartford Insurance quotes are based on the information you provide during the quote process. While they aim to be as accurate as possible, the final cost of your insurance coverage may vary slightly based on additional factors assessed during the underwriting process.

Can I customize my Hartford Insurance policy after receiving a quote?

+Yes, Hartford Insurance understands that your insurance needs may evolve. You can customize your policy by adding or removing coverage options, adjusting coverage limits, or selecting additional endorsements to suit your changing requirements.

What happens if I need to file a claim with Hartford Insurance?

+Hartford Insurance is committed to providing a seamless claims experience. You can file a claim online, over the phone, or through their mobile app. Their dedicated claims team will guide you through the process, ensuring prompt and fair resolution.