Health Care Insurance Tennessee

Health care insurance is an essential aspect of life, ensuring that individuals have access to necessary medical services without incurring overwhelming financial burdens. In Tennessee, the health insurance landscape is diverse, catering to the unique needs of its residents. This comprehensive guide aims to explore the intricacies of health care insurance in Tennessee, shedding light on various options, coverage details, and strategies to navigate the complex world of medical insurance.

Understanding Health Care Insurance in Tennessee

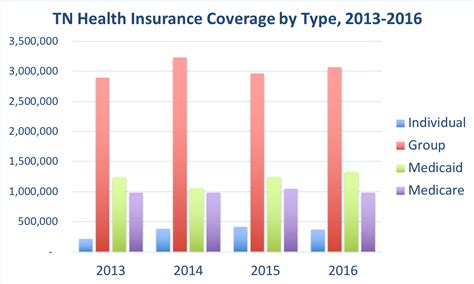

Tennessee, like many other states, offers a range of health insurance plans to cater to its diverse population. These plans can be broadly categorized into individual and family plans, small group plans, and Medicare and Medicaid options. Each category serves a specific segment of the population, providing tailored coverage to meet their unique healthcare requirements.

Individual and family plans are designed for self-employed individuals, part-time workers, and those who do not receive health insurance through their employers. These plans offer flexibility in coverage, allowing individuals to choose the level of protection they need based on their health status and financial capacity. Tennessee residents have access to a variety of individual plans, including Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), and Exclusive Provider Organizations (EPOs), each with its own network of healthcare providers and varying levels of coverage.

For small businesses with typically 2-50 employees, Tennessee offers small group health insurance plans. These plans provide comprehensive coverage for both the employer and their employees, often at more affordable rates compared to individual plans. Small group plans in Tennessee typically offer a choice between PPO and HMO networks, with the option to customize the plan to fit the specific needs of the business and its workforce.

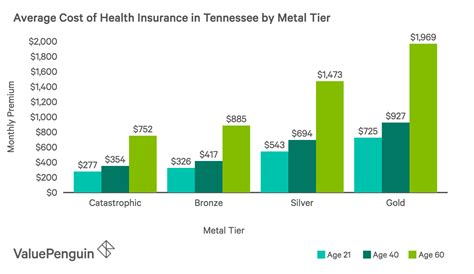

Tennessee also participates in the federal Affordable Care Act (ACA), which has expanded access to health insurance for many residents. Through the ACA's Health Insurance Marketplace, individuals and families can shop for and enroll in qualified health plans, with the potential to receive premium tax credits and cost-sharing reductions to make insurance more affordable. The Marketplace offers a range of metal plans, from Bronze to Platinum, each with varying levels of coverage and cost.

Key Coverage Elements of Tennessee Health Insurance Plans

Health insurance plans in Tennessee, as mandated by state and federal laws, must cover a set of essential health benefits. These benefits include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and chronic disease management. Additionally, pediatric services, including oral and vision care, are also covered.

Tennessee's health insurance plans also offer a range of optional benefits, allowing policyholders to customize their coverage. These optional benefits can include dental and vision coverage, which are often provided as separate plans, and long-term care insurance, which can provide financial support for individuals requiring extended care due to chronic illnesses or disabilities.

One unique aspect of Tennessee's health insurance landscape is the TennCare program, the state's Medicaid expansion plan. TennCare provides health coverage to low-income individuals and families, including pregnant women, children, the elderly, and people with disabilities. The program covers a comprehensive range of services, including primary care, specialist care, prescription drugs, mental health services, and long-term care. TennCare is a vital safety net for many Tennessee residents, ensuring they have access to necessary medical services regardless of their financial situation.

Navigating the Enrollment Process in Tennessee

Enrolling in a health insurance plan in Tennessee can be done through various avenues, depending on the type of plan and the individual’s eligibility. For individual and family plans, enrollment can be done directly through insurance carriers, brokers, or the Health Insurance Marketplace. Small businesses can work with insurance brokers or carriers to find the right small group plan for their employees.

The enrollment process typically involves filling out an application, providing personal and health-related information, and selecting a plan that best fits the individual's or family's needs. It's important to note that open enrollment periods exist for both individual and small group plans, outside of which enrollment is only possible under certain qualifying life events, such as marriage, divorce, birth of a child, or loss of other health coverage.

For TennCare enrollment, individuals can apply online, by phone, or in person at a local office. The application process involves providing income and household information to determine eligibility. TennCare also offers a range of services to assist with the enrollment process, including application assistance and enrollment events in various communities across the state.

Maximizing Benefits and Minimizing Costs: Strategies for Tennessee Residents

Navigating the complexities of health insurance can be daunting, but with the right strategies, Tennessee residents can maximize their benefits while keeping costs manageable. Here are some tips to consider:

- Understand Your Coverage: Review your plan's benefits and exclusions thoroughly. Familiarize yourself with your network of providers and any requirements for referrals or prior authorizations. Understanding your coverage can help you make informed decisions about your healthcare and avoid unexpected costs.

- Utilize Preventive Care: Most health insurance plans in Tennessee cover a range of preventive services, such as annual check-ups, vaccinations, and screenings, at no additional cost. Taking advantage of these services can help detect potential health issues early on, potentially preventing more serious and costly health problems down the line.

- Compare Prescription Drug Costs: Prescription drug costs can vary significantly between pharmacies and even between different drugstores within the same pharmacy chain. By comparing prices and utilizing generic alternatives when possible, individuals can save on their medication expenses.

- Consider Health Savings Accounts (HSAs): HSAs are tax-advantaged accounts that allow individuals to save for current and future medical expenses. These accounts are typically paired with high-deductible health plans, offering a cost-effective way to manage healthcare expenses. Contributions to HSAs are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- Shop Around for Specialists: If you require specialist care, it's worth exploring your options within your network. Different specialists may have varying fees and treatment approaches. Shopping around can help you find the best fit for your needs and potentially save on out-of-pocket costs.

By implementing these strategies and staying informed about their health insurance options, Tennessee residents can make the most of their coverage while keeping healthcare costs under control.

The Future of Health Care Insurance in Tennessee

The health insurance landscape in Tennessee is continuously evolving, driven by changes in federal and state policies, advancements in healthcare technology, and shifting consumer preferences. As the state works towards improving access to quality healthcare and reducing healthcare costs, several key trends are shaping the future of health insurance in Tennessee.

One notable trend is the increasing focus on value-based care models. These models aim to improve the quality of healthcare while controlling costs by rewarding healthcare providers for delivering efficient, effective, and patient-centric care. Value-based care is expected to gain momentum in Tennessee, with more healthcare providers and insurance companies adopting these models to enhance patient outcomes and reduce unnecessary healthcare spending.

Telehealth services are also poised to play a significant role in the future of health insurance in Tennessee. With the advancements in technology and the increasing acceptance of remote healthcare services, telehealth is expected to become an integral part of the healthcare system. This shift towards virtual care can improve access to healthcare services, particularly for individuals in rural or underserved areas, and reduce the burden on in-person healthcare facilities.

Additionally, there is a growing emphasis on preventative care and wellness programs. Health insurance companies in Tennessee are recognizing the importance of promoting healthy lifestyles and preventing diseases before they occur. As a result, many insurance plans are offering incentives and rewards for policyholders who engage in healthy behaviors, such as regular exercise, healthy eating, and participation in wellness programs. This shift towards preventative care can help reduce the burden of chronic diseases and improve the overall health of Tennessee's population.

Furthermore, the integration of health insurance with other sectors, such as technology and pharmaceuticals, is expected to shape the future of healthcare in Tennessee. Collaborative efforts between insurance companies, healthcare providers, and technology innovators can lead to the development of innovative solutions that improve patient care, enhance the patient experience, and streamline administrative processes. This integration can also facilitate the use of advanced technologies, such as artificial intelligence and machine learning, to improve healthcare outcomes and reduce costs.

As Tennessee continues to navigate the complex healthcare landscape, it is crucial for residents to stay informed about their health insurance options and the evolving trends in the industry. By understanding the latest developments and actively participating in their healthcare journey, Tennessee residents can make informed decisions, access quality care, and contribute to the overall improvement of the state's healthcare system.

What is the average cost of health insurance in Tennessee?

+

The average cost of health insurance in Tennessee can vary depending on factors such as age, location, and the type of plan. According to recent data, the average monthly premium for an individual plan in Tennessee is around 400, while family plans can cost upwards of 1,000 per month. However, these costs can be reduced with the help of subsidies and tax credits available through the Affordable Care Act.

Are there any unique benefits or programs offered by Tennessee’s health insurance plans?

+

Yes, Tennessee’s health insurance plans often offer unique benefits tailored to the state’s population. For example, some plans provide access to specialized networks for specific conditions, such as cancer or cardiovascular care. Additionally, Tennessee has implemented programs like TennCare, which offers comprehensive coverage to low-income residents, and the CoverKids program, which provides affordable health insurance for children.

How can I find the best health insurance plan for my needs in Tennessee?

+

To find the best health insurance plan for your needs in Tennessee, it’s important to compare different plans and consider factors such as coverage, cost, network of providers, and any additional benefits or programs offered. You can start by visiting the Health Insurance Marketplace, where you can browse through various plans and filter them based on your preferences. Additionally, seeking advice from insurance brokers or consulting with healthcare professionals can provide valuable insights tailored to your specific health needs.