Health Group Insurance

In today's fast-paced world, ensuring comprehensive healthcare coverage is not just a luxury but a necessity. Health Group Insurance plans have emerged as a vital component of modern healthcare systems, offering a range of benefits and peace of mind to individuals and their families. This article delves into the intricacies of Health Group Insurance, exploring its various facets, from the advantages it provides to the challenges it addresses in the realm of healthcare accessibility and affordability.

Understanding Health Group Insurance: A Comprehensive Overview

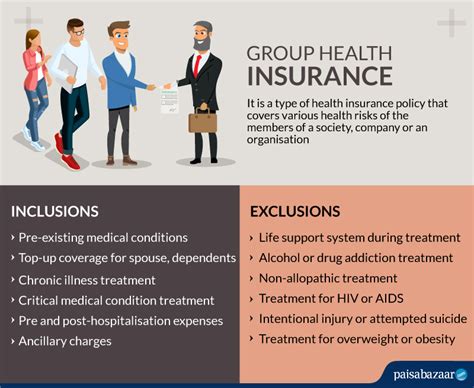

Health Group Insurance, also known as Group Health Insurance or Employee Health Insurance, is a type of medical coverage plan designed to provide comprehensive healthcare benefits to a group of individuals, typically employees of a company or members of an organization. Unlike individual health insurance plans, which are tailored to the specific needs of an individual, group insurance plans offer standardized coverage to a collective group, making it an efficient and cost-effective solution for employers and employees alike.

The concept of Health Group Insurance revolves around the principle of shared risk. By pooling resources and premiums from a large group, the insurance provider can offer extensive coverage at a lower cost per person. This collective approach not only benefits the individuals by providing access to essential healthcare services but also helps employers attract and retain talented employees, fostering a culture of health and wellness within the organization.

Key Features and Advantages of Health Group Insurance Plans

Health Group Insurance plans offer a multitude of features and advantages that make them an attractive option for both employers and employees. Here’s an in-depth look at some of the key benefits:

- Affordability and Cost-Sharing: One of the primary advantages of Health Group Insurance is its affordability. By leveraging the principle of risk-sharing, insurance providers can offer competitive premiums that are often lower than individual plans. This shared cost structure ensures that employees can access quality healthcare without straining their finances.

- Comprehensive Coverage: Group insurance plans are renowned for their comprehensive nature. They typically cover a wide range of medical services, including hospitalization, outpatient care, prescription medications, preventive care, and even specialized treatments. This holistic approach ensures that individuals receive the necessary care without having to navigate complex insurance networks.

- Employee Wellness Programs: Many Health Group Insurance plans come bundled with employee wellness initiatives. These programs focus on promoting healthy lifestyles, offering incentives for employees to adopt healthier habits. This not only improves the overall well-being of the workforce but also reduces healthcare costs in the long run.

- Flexible Coverage Options: Group insurance plans often provide flexibility in terms of coverage options. Employers can choose from various plan designs, allowing them to tailor the insurance package to their specific needs and budget. This customization ensures that the plan aligns with the unique healthcare requirements of the organization and its employees.

- Administrative Efficiency: For employers, Health Group Insurance plans offer streamlined administration. The insurance provider handles the majority of the administrative tasks, including enrollment, claims processing, and member support. This frees up valuable time and resources for employers to focus on their core business operations.

| Plan Type | Coverage Highlights |

|---|---|

| Standard Group Plan | Covers hospitalization, surgery, outpatient care, and prescription drugs. |

| Enhanced Group Plan | Includes additional benefits like dental, vision, and mental health coverage. |

| Customizable Group Plan | Offers employers the flexibility to choose specific coverage areas based on their needs. |

The Impact of Health Group Insurance on Healthcare Accessibility

One of the most significant contributions of Health Group Insurance is its role in enhancing healthcare accessibility. In regions where healthcare costs are high and insurance coverage is sparse, group insurance plans emerge as a beacon of hope, ensuring that individuals have access to necessary medical services without facing financial barriers.

Addressing Healthcare Disparities

In many parts of the world, access to quality healthcare is unequal, with certain demographics facing significant challenges. Health Group Insurance plans play a pivotal role in mitigating these disparities. By providing comprehensive coverage to a diverse workforce, these plans ensure that individuals from various socioeconomic backgrounds can receive the care they need, regardless of their financial standing.

For instance, consider the case of small businesses that might not have the financial capacity to offer individual health insurance plans to their employees. Health Group Insurance plans become a lifeline for such businesses, allowing them to provide essential healthcare coverage to their workforce, thereby fostering a sense of loyalty and commitment among employees.

Expanding Healthcare Reach

Health Group Insurance plans also have the potential to expand the reach of healthcare services. By partnering with a diverse network of healthcare providers, insurance companies can ensure that insured individuals have access to a wide range of medical facilities, including specialty clinics and hospitals. This network effect not only enhances the availability of healthcare services but also promotes competition, driving down costs and improving the overall quality of care.

Challenges and Considerations in Implementing Health Group Insurance

While Health Group Insurance plans offer a plethora of benefits, their implementation and management come with certain challenges and considerations. Understanding these aspects is crucial for both employers and insurance providers to ensure a smooth and effective rollout.

Employee Education and Engagement

One of the key challenges in Health Group Insurance is ensuring that employees understand the intricacies of their coverage and how to maximize its benefits. Effective communication and education programs are essential to ensure that employees are aware of their plan’s features, coverage limits, and how to access care without unnecessary delays or complications.

Insurance providers and employers should collaborate to develop comprehensive educational materials and conduct regular workshops or webinars to keep employees informed. This proactive approach not only empowers employees to make informed healthcare decisions but also reduces the administrative burden on both parties by minimizing misunderstandings and unnecessary claims.

Managing Cost Fluctuations

Health Group Insurance plans are subject to the dynamics of the healthcare market, which can lead to fluctuations in costs. As medical expenses rise due to inflation, changing treatment protocols, or advancements in medical technology, insurance providers may need to adjust their premiums to maintain financial sustainability.

To mitigate the impact of cost fluctuations, insurance providers often employ various strategies, such as negotiating favorable rates with healthcare providers, implementing cost-saving measures like generic drug initiatives, or introducing wellness programs to encourage healthy behaviors and reduce overall healthcare costs. Employers, too, play a role in managing costs by actively engaging with their insurance providers and advocating for competitive rates.

Adherence to Regulatory Requirements

Health Group Insurance plans must comply with a myriad of regulatory requirements, which vary depending on the jurisdiction. These regulations cover aspects such as coverage mandates, benefit design, and consumer protections. Non-compliance can lead to significant penalties and legal complications, making it essential for insurance providers and employers to stay abreast of the latest regulatory developments.

Regular audits and reviews of the insurance plan's compliance with relevant laws and regulations are crucial. This ensures that the plan remains viable and protects the interests of both the insurance provider and the insured individuals. By proactively addressing regulatory requirements, insurance providers can maintain a positive relationship with regulators and avoid potential disruptions to the plan's operations.

The Future of Health Group Insurance: Trends and Innovations

As the healthcare landscape continues to evolve, so too does the nature of Health Group Insurance plans. The future of group insurance is shaped by emerging trends and innovative approaches, which aim to enhance the overall experience for both employers and employees.

Embracing Digital Health Solutions

The integration of digital health technologies is revolutionizing the way healthcare is delivered and accessed. Health Group Insurance plans are increasingly incorporating digital tools and platforms to streamline administrative processes, improve member engagement, and enhance the overall member experience.

Telemedicine, for instance, has gained prominence as a convenient and efficient way to access medical care. Group insurance plans that integrate telemedicine services enable members to consult with healthcare professionals remotely, reducing the need for in-person visits and improving access to care, especially in rural or underserved areas. Additionally, digital platforms can facilitate secure data sharing, enabling members to easily access their health records and insurance claims information, thereby empowering them to take a more active role in managing their health.

Focus on Preventive Care and Wellness

The shift towards a more holistic approach to healthcare is driving the emphasis on preventive care and wellness initiatives within Health Group Insurance plans. By prioritizing preventive measures and early intervention, insurance providers can reduce the burden of chronic diseases and promote healthier lifestyles among members.

Group insurance plans are increasingly incorporating wellness programs that offer incentives for members to engage in healthy behaviors. These programs may include fitness challenges, nutrition counseling, stress management workshops, and even financial incentives for achieving specific health goals. By encouraging members to take proactive steps towards their health, these initiatives not only improve overall well-being but also contribute to long-term cost savings by reducing the incidence of costly chronic conditions.

Personalized Medicine and Precision Health

Advancements in medical technology and data analytics are paving the way for personalized medicine and precision health approaches. Health Group Insurance plans are exploring ways to incorporate these innovative strategies to provide tailored healthcare solutions to members.

By leveraging genetic testing, advanced diagnostics, and data-driven algorithms, insurance providers can offer members personalized treatment plans and preventive strategies based on their unique genetic makeup and health history. This approach not only improves the accuracy and effectiveness of healthcare interventions but also empowers members to take a more active role in their own healthcare journey, leading to better health outcomes and increased satisfaction.

How does Health Group Insurance differ from individual health insurance plans?

+Health Group Insurance plans differ from individual health insurance plans in several key aspects. Group insurance plans are designed to provide coverage to a collective group, typically employees of a company or members of an organization. They offer standardized coverage options and are often more affordable due to the principle of risk-sharing. Individual health insurance plans, on the other hand, are tailored to the specific needs of an individual and may offer more flexibility in terms of coverage options but at a potentially higher cost.

What are the benefits of Health Group Insurance for employers?

+Health Group Insurance plans offer a range of benefits for employers. Firstly, they help attract and retain talented employees by providing a valuable employee benefit. Additionally, group insurance plans offer administrative efficiency, as the insurance provider handles most administrative tasks. Employers can also customize coverage options to align with their specific needs and budget. Moreover, by promoting employee wellness, these plans contribute to a healthier and more productive workforce.

How can employees maximize the benefits of Health Group Insurance plans?

+Employees can maximize the benefits of Health Group Insurance plans by actively engaging with their coverage. This includes understanding the plan’s features, coverage limits, and how to access care. Employees should utilize the plan’s wellness initiatives and preventive care services to maintain good health and reduce the risk of costly medical conditions. Additionally, staying informed about any changes or updates to the plan can help employees make the most of their coverage.

What role do insurance providers play in the success of Health Group Insurance plans?

+Insurance providers play a critical role in the success of Health Group Insurance plans. They are responsible for designing comprehensive coverage options, negotiating favorable rates with healthcare providers, and managing the administrative aspects of the plan. Insurance providers also contribute to the overall member experience by implementing innovative solutions, such as digital health platforms and personalized medicine approaches. Additionally, they must ensure compliance with regulatory requirements and provide ongoing support to both employers and employees.