Health Insurance Annual Enrollment

It's that time of year again—annual enrollment season! This period is crucial for individuals and families to review their health insurance options and make informed decisions for the upcoming year. With the right coverage, you can ensure peace of mind and access to quality healthcare services. In this comprehensive guide, we will delve into the world of health insurance annual enrollment, exploring the key considerations, navigating the process, and understanding the impact of your choices.

Understanding the Health Insurance Annual Enrollment Period

The annual enrollment period is a designated timeframe when individuals have the opportunity to evaluate and modify their health insurance plans. It typically occurs once a year, offering a chance to review the current plan, assess changing needs, and explore new options. This period is essential for staying updated with the latest healthcare trends, benefiting from improved coverage, and managing costs effectively.

During annual enrollment, insurance providers present their updated plan offerings, including any changes in premiums, deductibles, and covered services. It is a critical time for individuals to assess their healthcare needs, considering factors such as family size, medical conditions, and prescription requirements. By understanding the enrollment process and available options, individuals can make informed decisions to secure the best coverage for themselves and their loved ones.

Key Considerations for Annual Enrollment

When navigating the annual enrollment process, there are several crucial factors to consider. First, it is essential to assess your healthcare needs accurately. Consider any recent medical changes, such as new prescriptions, chronic conditions, or anticipated medical procedures. Understanding your specific requirements will guide you in choosing a plan that provides adequate coverage.

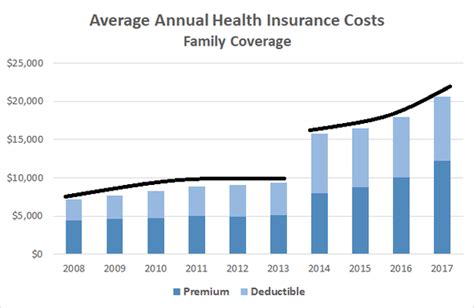

Additionally, evaluating the cost-effectiveness of different plans is vital. While premiums are an essential consideration, it is also crucial to analyze deductibles, copayments, and out-of-pocket maximums. Some plans may offer lower premiums but have higher out-of-pocket costs, so it is essential to strike a balance that aligns with your budget and healthcare needs.

Another critical aspect is understanding the network of healthcare providers covered by each plan. Ensuring that your preferred doctors, specialists, and hospitals are in-network can significantly impact your healthcare experience. It is beneficial to research and compare provider networks to find a plan that offers convenient access to quality healthcare services.

| Consideration | Key Factors |

|---|---|

| Healthcare Needs | Assess medical conditions, prescriptions, and anticipated procedures. |

| Cost Analysis | Compare premiums, deductibles, copayments, and out-of-pocket maximums. |

| Provider Network | Ensure access to preferred doctors and hospitals. |

Navigating the Annual Enrollment Process

The annual enrollment process can be simplified by following a systematic approach. Start by gathering all relevant information, including current plan details, recent medical records, and a list of preferred healthcare providers. This step ensures that you have a comprehensive understanding of your healthcare needs and the services you require.

Research and Compare Plan Options

With your needs assessment in hand, it's time to research and compare the available plan options. Insurance providers typically offer a range of plans, each with unique features and benefits. Consider factors such as coverage levels, network flexibility, and any additional benefits like vision or dental coverage.

Utilize online resources, such as insurance company websites and comparison tools, to explore different plans. These tools often provide detailed plan summaries, allowing you to compare premiums, deductibles, and covered services side by side. Reading reviews and testimonials from current plan holders can also offer valuable insights into the quality of coverage and customer satisfaction.

Evaluate Plan Benefits and Coverage

When evaluating plan benefits and coverage, pay close attention to the specific services and treatments covered. Look for plans that align with your healthcare needs, ensuring that essential procedures, prescriptions, and specialist visits are included. Consider any additional benefits, such as wellness programs, telemedicine services, or mental health support, which can enhance your overall healthcare experience.

It is also crucial to understand any limitations or exclusions in the plan. Some plans may have restrictions on certain procedures or treatments, so it is essential to review these carefully. Understanding these limitations will help you make an informed decision and avoid any unexpected gaps in coverage.

Seek Professional Guidance

Navigating the complex world of health insurance can be challenging, especially when comparing multiple plans. Consider seeking professional guidance from insurance brokers or healthcare advisors who specialize in health insurance. These experts can provide personalized recommendations based on your specific needs and help you understand the intricacies of different plans.

Insurance brokers often have access to exclusive plan options and can negotiate better rates on your behalf. They can also assist with understanding the enrollment process, ensuring that you meet all the necessary requirements and deadlines. Their expertise can be invaluable in making the right coverage choices for you and your family.

Maximizing Your Health Insurance Coverage

Once you have selected your health insurance plan, it's essential to understand how to maximize its benefits. Here are some strategies to ensure you get the most out of your coverage:

Understanding Your Plan's Features

Familiarize yourself with the key features of your chosen plan. Understand the coverage limits, any deductibles or copayments, and the specific services included. Knowing these details will help you utilize your plan effectively and avoid any surprises when accessing healthcare services.

Review the plan's summary of benefits, which provides a comprehensive overview of covered services, exclusions, and any required prior authorizations. Understanding these details will empower you to make informed decisions about your healthcare and navigate the system confidently.

Utilizing Preventive Care Services

Most health insurance plans offer preventive care services at little to no cost. These services, such as annual physical exams, vaccinations, and screening tests, are designed to maintain your overall health and detect potential issues early on. Taking advantage of these preventive care services can help you stay proactive about your well-being and potentially avoid more significant health issues down the line.

Check your plan's coverage for specific preventive care services and schedule regular appointments with your healthcare providers. Many insurance companies also provide online tools and resources to help you locate in-network providers who offer these services. By utilizing preventive care, you can stay on top of your health and potentially reduce future healthcare costs.

Managing Prescription Costs

Prescription medications can be a significant expense, so it's essential to understand how to manage these costs effectively. Many insurance plans offer prescription drug coverage, but the specific medications covered and the associated costs can vary.

Review your plan's formulary, which lists the medications covered by the plan and their respective tiers. Understanding the formulary will help you choose the most cost-effective medications for your needs. Some plans offer generic alternatives or preferred brand medications at a lower cost, so exploring these options can save you money.

Additionally, consider using mail-order pharmacies for long-term prescriptions. These pharmacies often offer discounts and free shipping, making it a more affordable option for managing your prescription needs.

Future Implications and Considerations

As you navigate the health insurance landscape, it's essential to consider the long-term implications of your annual enrollment decisions. Here are some key factors to keep in mind:

Plan Flexibility and Life Changes

Life is full of unexpected changes, and it's crucial to select a health insurance plan that can adapt to your evolving needs. Consider whether the plan you choose offers flexibility in terms of adding or removing dependents, changing coverage levels, or adjusting benefits. A plan that allows for these adjustments can provide peace of mind and ensure you have the necessary coverage when life takes an unexpected turn.

Long-Term Cost Management

Managing healthcare costs is an ongoing concern, and it's essential to select a plan that aligns with your long-term financial goals. While it may be tempting to choose a plan with lower premiums, consider the potential out-of-pocket expenses, such as deductibles and copayments. A plan with higher premiums but lower out-of-pocket costs may be more cost-effective in the long run, especially if you anticipate frequent medical visits or require specialized care.

Additionally, explore the availability of health savings accounts (HSAs) or flexible spending accounts (FSAs) offered by your insurance provider. These accounts allow you to set aside pre-tax dollars for qualified medical expenses, providing an effective way to manage and save on healthcare costs.

Emerging Healthcare Trends

The healthcare industry is constantly evolving, and it's crucial to stay informed about emerging trends that may impact your coverage and healthcare experience. Keep an eye on advancements in telemedicine, digital health technologies, and innovative treatment options. Understanding these trends can help you select a plan that incorporates the latest advancements and ensures access to cutting-edge healthcare services.

Additionally, pay attention to any changes in healthcare regulations and policies that may affect your coverage. Stay informed about updates to the Affordable Care Act (ACA) or any state-specific healthcare reforms. Being aware of these changes will help you make informed decisions during annual enrollment and ensure you remain compliant with the latest healthcare requirements.

Frequently Asked Questions (FAQ)

When is the annual enrollment period for health insurance?

+The annual enrollment period typically occurs once a year and varies depending on the insurance provider and the specific plan. It is essential to check with your insurance company or review their website for the exact dates. In general, the enrollment period often falls between late fall and early winter, allowing individuals to make changes or select new plans for the upcoming year.

Can I change my health insurance plan outside of the annual enrollment period?

+Changing your health insurance plan outside of the annual enrollment period is generally not possible unless you qualify for a special enrollment period. Special enrollment periods are triggered by specific life events, such as marriage, divorce, birth or adoption of a child, loss of other coverage, or moving to a new area. It is important to understand the eligibility criteria and timelines for special enrollment to ensure you can make necessary changes to your coverage.

How do I know if a health insurance plan is right for me and my family?

+Choosing the right health insurance plan involves assessing your family's specific healthcare needs. Consider factors such as chronic conditions, prescription requirements, and anticipated medical procedures. Evaluate the plan's coverage, including deductibles, copayments, and out-of-pocket maximums. It is beneficial to compare multiple plans and seek professional guidance to ensure you select a plan that provides comprehensive and cost-effective coverage for your family's unique circumstances.

What happens if I miss the annual enrollment deadline?

+Missing the annual enrollment deadline can result in being locked into your current plan for another year or potentially facing a penalty. It is crucial to mark the enrollment period on your calendar and ensure you meet the deadline. If you miss the deadline and do not qualify for a special enrollment period, you may need to wait until the next annual enrollment period to make any changes to your coverage.

Are there any resources available to help me understand health insurance plans better?

+Absolutely! There are various resources available to help you navigate the complex world of health insurance. Insurance providers often offer comprehensive plan summaries, comparison tools, and educational materials on their websites. Additionally, seeking guidance from insurance brokers or healthcare advisors who specialize in health insurance can provide personalized recommendations and support throughout the enrollment process.

Annual enrollment for health insurance is a critical period that empowers individuals to take control of their healthcare coverage. By understanding the process, evaluating plan options, and maximizing the benefits of their chosen plan, individuals can ensure access to quality healthcare services and manage costs effectively. Stay informed, seek professional guidance when needed, and make the most of your annual enrollment period to secure the best possible health insurance coverage for yourself and your loved ones.