Health Insurance Coverage For Small Business Owners

In the realm of small business ownership, health insurance coverage is a critical aspect that significantly impacts the well-being and financial stability of entrepreneurs and their employees. While providing health benefits can be a challenge for small businesses due to cost considerations, it is an essential investment for attracting and retaining talented employees. This comprehensive guide aims to explore the various facets of health insurance coverage for small business owners, offering insights, strategies, and real-world examples to navigate this complex landscape effectively.

Understanding the Importance of Health Insurance for Small Businesses

Small businesses are the backbone of many economies, employing a substantial portion of the workforce. Offering health insurance coverage is not just a legal requirement in many regions; it’s also a strategic move that demonstrates a commitment to employee welfare. A robust health insurance plan can boost morale, enhance productivity, and foster a positive work environment, contributing to the long-term success of the business.

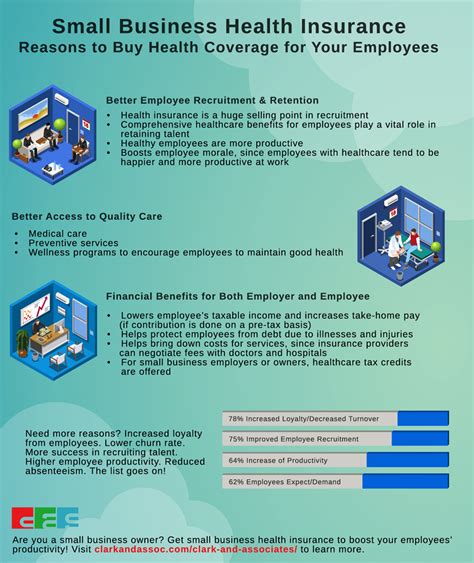

The Benefits of Providing Health Insurance

- Attracts Top Talent: A comprehensive health insurance package is a powerful incentive for prospective employees, especially in a competitive job market.

- Retains Valuable Employees: Offering health benefits can significantly reduce employee turnover, as individuals are more likely to stay with a company that cares for their well-being.

- Improves Employee Morale and Productivity: Knowing that their health and that of their families is protected can lead to increased job satisfaction and commitment, resulting in higher productivity.

- Reduces Financial Stress: Health insurance coverage alleviates the financial burden of unexpected medical expenses, allowing employees to focus on their work without the worry of potential health-related costs.

Navigating Health Insurance Options for Small Businesses

Choosing the right health insurance plan for a small business involves careful consideration of various factors, including the business’s budget, the needs of employees, and compliance with legal requirements. Here’s a guide to help small business owners navigate this process effectively.

Assessing Business and Employee Needs

The first step in selecting a health insurance plan is understanding the unique needs of your business and your employees. Consider the following factors:

- Budget Constraints: Evaluate the financial health of your business and determine how much you can allocate towards health insurance premiums.

- Employee Demographics: Assess the age, health status, and family situations of your employees. A diverse workforce may require a more comprehensive plan.

- Industry Standards: Research the health insurance benefits offered by similar businesses in your industry. This can provide a benchmark for your own offerings.

- Employee Preferences: Conduct surveys or hold focus groups to understand what health insurance benefits your employees value the most.

Exploring Health Insurance Plan Types

Small business owners have a variety of health insurance plan options to choose from. Each type has its own advantages and considerations. Here’s a breakdown of the most common plans:

- HMO (Health Maintenance Organization): HMO plans typically offer lower premiums but have a more restricted network of healthcare providers. Employees must choose a primary care physician (PCP) who coordinates their care.

- PPO (Preferred Provider Organization): PPO plans offer more flexibility, allowing employees to see any healthcare provider without a referral. However, premiums and out-of-pocket costs may be higher.

- EPO (Exclusive Provider Organization): Similar to PPOs, EPOs have a network of preferred providers. The key difference is that EPOs don’t cover out-of-network care except in emergencies.

- POS (Point of Service): POS plans combine features of HMOs and PPOs. Employees choose a PCP but can also access out-of-network care with higher out-of-pocket costs.

| Plan Type | Premium Cost | Flexibility | Network |

|---|---|---|---|

| HMO | Lower | Restricted | In-network only |

| PPO | Higher | More flexible | In and out-of-network |

| EPO | Varies | Flexible | In-network only (except emergencies) |

| POS | Moderate | Some flexibility | In-network preferred |

Legal Requirements and Compliance

Small business owners must also ensure they comply with legal requirements regarding health insurance. In the United States, the Affordable Care Act (ACA) mandates that businesses with 50 or more full-time equivalent employees offer minimum essential coverage or face penalties. However, small businesses with fewer than 50 employees are exempt from this requirement but may still benefit from offering health insurance to attract and retain talent.

Implementing and Communicating Health Insurance Benefits

Once a small business owner has selected a health insurance plan, effective implementation and communication are crucial. Employees need to understand their benefits and feel valued by the company’s investment in their well-being.

Onboarding and Education

During the onboarding process, ensure that new hires are thoroughly informed about their health insurance benefits. Provide clear and concise materials, and consider hosting educational sessions or webinars to answer questions and ensure employees understand their coverage.

Open Enrollment Periods

Most health insurance plans have an annual open enrollment period where employees can make changes to their coverage. Communicate these periods well in advance, and consider offering incentives or rewards for employees who actively engage in reviewing and updating their benefits.

Promoting a Culture of Wellness

Beyond just offering health insurance, small businesses can promote a culture of wellness by encouraging healthy lifestyles. This can include organizing wellness programs, providing resources for stress management, and offering incentives for employees who participate in health-related activities.

Addressing Challenges and Future Trends

While health insurance coverage is a critical aspect of small business ownership, it’s not without its challenges. Small business owners must stay informed about changing regulations, evolving healthcare trends, and the unique needs of their employees.

Managing Rising Healthcare Costs

One of the most significant challenges for small businesses is managing the rising cost of healthcare. To mitigate this, consider cost-saving strategies such as implementing wellness programs, negotiating with insurance providers, and exploring alternative funding methods like Health Reimbursement Arrangements (HRAs) or Health Savings Accounts (HSAs)

Adapting to Technological Advancements

The healthcare industry is rapidly embracing technology, and small businesses can leverage this to their advantage. Utilize digital platforms for streamlined enrollment processes, employee education, and real-time benefit updates. Stay updated on the latest health apps and technologies that can enhance employee health and well-being.

The Future of Small Business Health Insurance

Looking ahead, the future of health insurance for small businesses is promising. With ongoing reforms and innovations, small businesses may have access to more affordable and comprehensive plans. Additionally, the rise of telemedicine and digital health solutions offers new opportunities for cost-effective healthcare delivery.

What are the tax implications of offering health insurance to employees?

+Offering health insurance to employees can have significant tax benefits for small businesses. Under the Affordable Care Act (ACA), businesses may be eligible for tax credits if they meet certain criteria. Additionally, providing health insurance can reduce payroll taxes, as a portion of the premium may be tax-deductible.

How can small businesses afford health insurance for their employees?

+Affording health insurance is a challenge for many small businesses. Strategies to manage costs include pooling resources with other small businesses, negotiating group rates with insurance providers, and exploring government-sponsored programs like the SHOP Marketplace. Additionally, offering high-deductible plans with Health Savings Accounts (HSAs) can help reduce premiums.

Are there any government programs to assist small businesses with health insurance costs?

+Yes, several government programs aim to assist small businesses with health insurance costs. The Small Business Health Options Program (SHOP) Marketplace offers tax credits to eligible small businesses. Additionally, state-based programs and insurance exchanges may provide options for affordable coverage. It's advisable to consult with a healthcare advisor or insurance broker to explore all available options.

In conclusion, health insurance coverage is a vital aspect of small business ownership, impacting both the success of the business and the well-being of employees. By understanding the options, navigating the legal landscape, and effectively communicating benefits, small business owners can provide a valuable incentive that attracts and retains top talent while fostering a healthy and productive workforce.