Health Insurance Coverage Tax Form

The Health Insurance Coverage Tax Form is an essential component of the healthcare system, playing a crucial role in ensuring individuals and businesses comply with the provisions of the Affordable Care Act (ACA). This comprehensive tax form, often referred to as the 1095-B or 1095-C, serves as a vital document for taxpayers, employers, and insurance providers alike. It provides a detailed account of an individual's or employee's health insurance coverage throughout the year, making it a critical element in the tax filing process and a key tool for verifying compliance with the ACA's individual mandate.

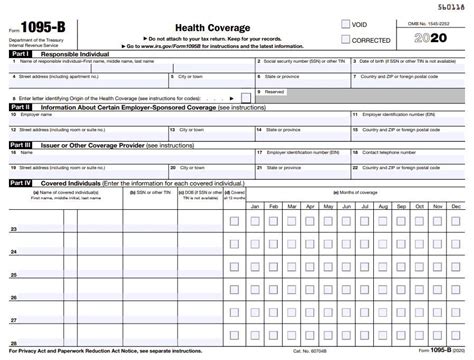

Understanding the Health Insurance Coverage Tax Form

The Health Insurance Coverage Tax Form is a legally binding document that certifies an individual’s or employee’s health insurance status for a given tax year. It is typically issued by insurance providers or employers and contains specific information about the coverage provided, including the duration, type of plan, and any associated costs.

For individuals, this form is crucial as it provides proof of compliance with the ACA's individual mandate, which requires most individuals to have qualifying health insurance coverage for the entire year or face a tax penalty. For employers, it serves as a record of compliance with the employer mandate, which requires certain employers to offer affordable health insurance coverage to their full-time employees.

Key Components of the Health Insurance Coverage Tax Form

The Health Insurance Coverage Tax Form includes several vital sections that provide a comprehensive overview of an individual’s or employee’s health insurance coverage.

- Identification Information: This section includes the taxpayer's name, address, Social Security Number, and other identifying details.

- Coverage Period: It specifies the duration of the health insurance coverage, indicating the months for which the individual or employee was enrolled.

- Type of Coverage: The form indicates whether the coverage is through an individual market plan, employer-sponsored plan, or a government-sponsored program like Medicaid or Medicare.

- Cost and Contributions: It details the costs associated with the coverage, including premiums, out-of-pocket expenses, and any employer contributions.

- Certifying Entity: This section identifies the insurance provider or employer who is certifying the coverage information.

| Form Section | Description |

|---|---|

| Part I | Contains personal information of the insured individual. |

| Part II | Details the coverage period, including months of coverage and any gaps. |

| Part III | Describes the type of coverage, including employer-sponsored, individual market, or government-sponsored. |

| Part IV | Specifies the costs associated with the coverage, including premiums and out-of-pocket expenses. |

| Part V | Provides space for the certifying entity to sign and verify the accuracy of the information. |

These sections, when filled out accurately, provide a clear picture of an individual's or employee's health insurance coverage, making it easier for taxpayers to navigate the tax filing process and for the IRS to verify compliance with the ACA.

The Importance of Accurate Reporting

The accuracy of information on the Health Insurance Coverage Tax Form is of paramount importance. Incorrect or incomplete information can lead to various issues, including:

- Tax Penalties: Inaccurate reporting of health insurance coverage can result in individuals facing tax penalties for non-compliance with the ACA's individual mandate.

- Employer Penalties: Employers who fail to accurately report their employees' health insurance coverage may face significant penalties under the ACA's employer mandate.

- Claim Disputes: Incorrect information on the form can lead to disputes when individuals or employers try to claim tax credits or deductions based on their health insurance coverage.

- IRS Audits: The IRS may select returns for audit if they identify inconsistencies in reported health insurance coverage.

To ensure accuracy, it is essential for individuals and employers to carefully review and verify the information on their Health Insurance Coverage Tax Forms before submitting them to the IRS. This includes checking for errors, ensuring all relevant data is included, and verifying the coverage details with their insurance providers or employers.

Tips for Accurate Reporting

Here are some practical tips to ensure accurate reporting on the Health Insurance Coverage Tax Form:

- Review and understand the form's instructions carefully. These instructions provide guidance on how to accurately complete each section.

- Keep track of all health insurance-related documents throughout the year, including insurance cards, statements, and correspondence from your insurance provider.

- Verify your coverage details with your insurance provider or employer before submitting the form. This ensures that the information on the form aligns with your actual coverage.

- Double-check all personal information, coverage periods, and cost details to ensure they are accurate and complete.

- Consider using tax preparation software or seeking professional assistance to ensure your tax filing, including the Health Insurance Coverage Tax Form, is accurate and compliant.

Filing the Health Insurance Coverage Tax Form

The process of filing the Health Insurance Coverage Tax Form varies depending on whether you are an individual taxpayer or an employer.

Filing for Individuals

If you are an individual taxpayer, you will typically receive the Health Insurance Coverage Tax Form (1095-B or 1095-C) from your insurance provider or employer by mail or through an online portal. This form should be included with your other tax documents when you file your federal income tax return.

When filing your taxes, you will need to reference the information on the Health Insurance Coverage Tax Form to accurately report your health insurance coverage and any associated tax credits or deductions. This form is a critical component of your tax return, as it verifies your compliance with the ACA's individual mandate.

Filing for Employers

For employers, the process of filing the Health Insurance Coverage Tax Form (1095-C) is slightly more complex. Employers must report health insurance coverage information for their employees to both the IRS and their employees.

To file with the IRS, employers must use Form 1094-C to transmit a summary of all 1095-C forms filed for their employees. This summary provides an overview of the employer's compliance with the ACA's employer mandate.

Employers must also provide a copy of the 1095-C form to each of their full-time employees by a specific deadline, usually in early February. This form details the employee's health insurance coverage for the previous tax year and helps them verify their compliance with the ACA's individual mandate.

| Form | Description |

|---|---|

| Form 1095-B | This form is used by insurers and government agencies to report coverage information for individuals and their families. It covers coverage provided through individual market plans, Medicare, Medicaid, and other government programs. |

| Form 1095-C | Issued by employers to report health insurance coverage offered to full-time employees and their families. It includes details about the coverage, such as the months of coverage, the cost of coverage, and any contributions made by the employer. |

| Form 1094-C | This form is used by employers to transmit a summary of all 1095-C forms filed for their employees to the IRS. It provides an overview of the employer's compliance with the ACA's employer mandate. |

The Future of Health Insurance Coverage Tax Forms

As healthcare policies and regulations continue to evolve, the Health Insurance Coverage Tax Form is likely to adapt to meet changing needs. Here are some potential future developments:

- Digital Transformation: With the increasing adoption of digital technologies, we may see a shift towards digital Health Insurance Coverage Tax Forms, making the filing process more efficient and accessible.

- Simplification: Ongoing efforts to simplify tax processes may lead to streamlined versions of the Health Insurance Coverage Tax Form, making it easier for taxpayers and employers to understand and complete.

- Integration with Tax Software: As tax preparation software continues to advance, there may be increased integration of Health Insurance Coverage Tax Forms into these platforms, further simplifying the tax filing process.

- Real-Time Reporting: The concept of real-time reporting, where data is shared instantly between taxpayers, employers, and the IRS, could revolutionize the Health Insurance Coverage Tax Form process, making it more accurate and timely.

While these potential developments are exciting, it's important to remember that the current Health Insurance Coverage Tax Form remains a critical component of the tax filing process and a key tool for verifying compliance with the ACA. Staying informed about any changes or updates to the form is essential for individuals and employers to maintain compliance and avoid penalties.

Frequently Asked Questions

What happens if I don’t receive my Health Insurance Coverage Tax Form on time?

+If you don’t receive your Health Insurance Coverage Tax Form by the expected date, you should contact your insurance provider or employer to request a copy. It’s important to obtain this form as it’s necessary for completing your tax return and demonstrating compliance with the ACA’s individual mandate.

Can I claim a tax credit if I had health insurance coverage for only part of the year?

+Yes, you may be eligible for a tax credit if you had qualifying health insurance coverage for part of the year. The amount of the credit depends on various factors, including your income, the cost of your coverage, and the duration of your coverage. It’s best to consult a tax professional to determine your eligibility and the exact amount of the credit.

What should I do if the information on my Health Insurance Coverage Tax Form is incorrect?

+If you find an error on your Health Insurance Coverage Tax Form, you should contact your insurance provider or employer immediately to request a correction. It’s crucial to have accurate information on this form to avoid potential tax penalties and to ensure you receive any tax credits or deductions you may be entitled to.

Are there any alternatives to the Health Insurance Coverage Tax Form for proving compliance with the ACA’s individual mandate?

+Yes, there are alternative methods to prove compliance with the ACA’s individual mandate. These include submitting Form 8965 with your tax return or providing documentation of a coverage exemption, such as a letter from a health insurance provider or a certification of a qualifying health plan. However, it’s important to consult a tax professional to ensure you’re taking the appropriate steps.