Health Insurance Family Plans

Health insurance family plans are a crucial aspect of healthcare coverage, offering comprehensive protection and peace of mind to families across the globe. With rising healthcare costs and the importance of accessible medical services, these plans have become an essential consideration for many households. This article aims to delve into the intricacies of health insurance family plans, exploring their benefits, coverage options, and the factors to consider when choosing the right plan for your family's unique needs.

Understanding Health Insurance Family Plans

Health insurance family plans are designed to cover multiple family members under a single policy, ensuring that everyone receives the necessary medical care without financial strain. These plans typically include coverage for the primary policyholder, their spouse, and dependent children. The benefits and coverage extend beyond the basic medical expenses, often encompassing a wide range of healthcare services.

Benefits of Health Insurance Family Plans

One of the primary advantages of health insurance family plans is the cost-effectiveness they offer. By combining multiple family members under one policy, families can often secure more affordable premiums compared to individual plans. Additionally, family plans provide a comprehensive safety net, ensuring that all members are covered for a wide array of medical needs, from routine check-ups and preventive care to more complex procedures and emergency treatments.

Furthermore, health insurance family plans promote family wellness by encouraging regular health check-ups and preventive measures. Many plans offer wellness programs and incentives that motivate families to stay healthy and active, thereby reducing the likelihood of future health complications. This holistic approach to healthcare not only benefits the overall well-being of the family but also helps manage healthcare costs in the long run.

Coverage Options and Customization

Health insurance family plans come in various forms, offering a range of coverage options to cater to different family structures and needs. Some key coverage areas include:

- Medical Expenses: This is the foundation of any health insurance plan, covering costs associated with hospitalization, surgery, and outpatient treatments.

- Preventive Care: Many family plans include coverage for routine check-ups, vaccinations, and screenings to detect potential health issues early on.

- Maternity and Newborn Care: Comprehensive plans often provide coverage for pregnancy-related expenses, including delivery and postnatal care, ensuring a safe and healthy journey for expecting mothers and their newborns.

- Dental and Vision Care: Some family plans extend coverage to dental and vision services, ensuring that the entire family's oral and eye health needs are met.

- Prescription Drugs: Coverage for prescription medications is a vital component of many health insurance plans, helping families manage the costs of essential drugs.

- Mental Health Services: With growing awareness about mental health, some family plans now include coverage for counseling, therapy, and psychiatric care, ensuring holistic well-being.

It's important to note that the extent of coverage can vary significantly between different health insurance providers and plans. When choosing a family plan, it's crucial to assess your family's specific needs and prioritize the coverage areas that are most relevant to your circumstances.

Factors to Consider When Choosing a Family Plan

Selecting the right health insurance family plan involves careful consideration of several factors. Here are some key aspects to evaluate:

- Premium Costs: Assess your family's financial capacity and choose a plan that offers the right balance between coverage and affordability. Consider the potential long-term savings and the impact on your overall household budget.

- Coverage Limits and Exclusions: Carefully review the plan's coverage limits and any exclusions or restrictions. Ensure that the plan covers the specific medical services your family is likely to require, including any pre-existing conditions or chronic illnesses.

- Network of Healthcare Providers: Check the plan's network of hospitals, clinics, and specialists. Ensure that your preferred healthcare providers are included in the network to avoid unexpected out-of-pocket expenses.

- Deductibles and Co-payments: Understand the deductibles and co-payments associated with the plan. Consider whether the out-of-pocket expenses are manageable for your family's financial situation.

- Renewability and Portability: Look for plans that offer long-term renewability and portability. This ensures that your family's coverage remains stable and can be carried over to new locations or employment situations.

- Additional Benefits: Some family plans offer extra perks like health and wellness programs, discounts on fitness memberships, or access to telemedicine services. Evaluate these additional benefits to determine their value for your family.

Remember, health insurance is a long-term investment in your family's well-being. Take the time to research and compare different plans, seeking expert advice if needed, to make an informed decision that aligns with your family's healthcare needs and financial capabilities.

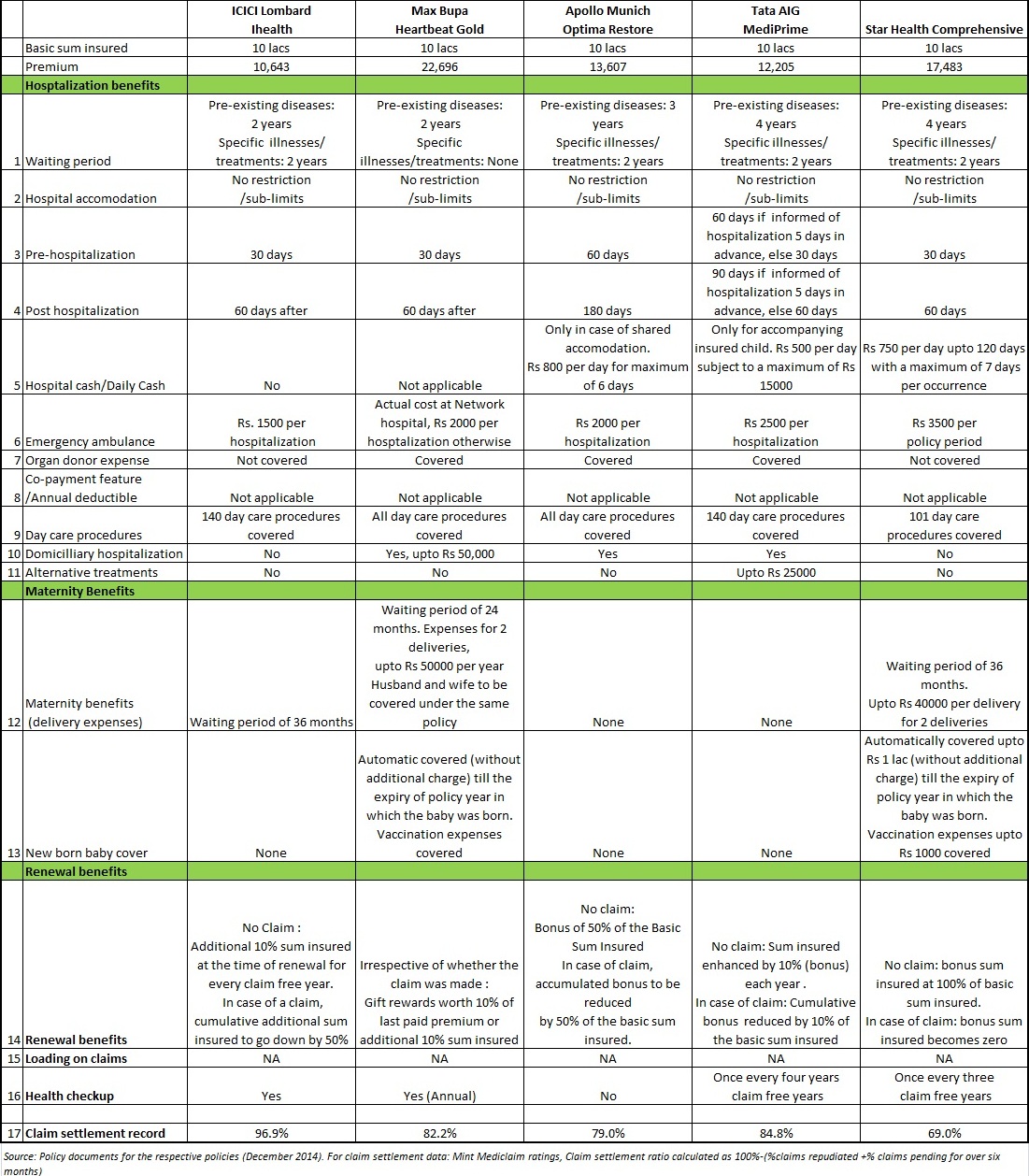

Real-World Examples of Health Insurance Family Plans

To illustrate the practical application of health insurance family plans, let’s explore a few case studies that highlight the benefits and considerations in different family scenarios.

The Young Family’s Journey

Imagine a young couple, Sarah and John, who recently welcomed their first child, Emily. As they navigate the joys and challenges of parenthood, they understand the importance of having comprehensive health insurance coverage for their growing family.

Sarah and John opt for a health insurance family plan that includes coverage for maternity and newborn care. This plan covers the costs associated with Sarah's pregnancy, including regular prenatal visits, ultrasound scans, and delivery expenses. Additionally, the plan provides coverage for Emily's well-baby visits, vaccinations, and any necessary pediatric care during her early years.

With the peace of mind that their family's health is protected, Sarah and John can focus on their new responsibilities and enjoy the precious moments of parenthood without financial worries.

Caring for an Aging Parent

Now, let’s consider the story of Jane, a working professional with an aging parent, Mr. Williams, who lives with her. As Mr. Williams’ health needs increase with age, Jane wants to ensure that he has access to the best possible care without straining her finances.

Jane opts for a health insurance family plan that includes coverage for older adults. This plan provides comprehensive coverage for Mr. Williams' medical expenses, including regular check-ups, medications for his chronic conditions, and any necessary specialist consultations. The plan also offers discounts on senior-friendly fitness programs, encouraging Mr. Williams to stay active and maintain his overall well-being.

By choosing a family plan that accommodates her parent's specific needs, Jane can provide the necessary care and support, knowing that her family's health is a top priority.

Managing a Chronic Condition

In another scenario, we have the Smith family, who includes a teenage son, David, who has been diagnosed with a chronic illness. Managing David’s condition requires regular medical attention and specialized treatments.

The Smith family selects a health insurance family plan that offers extensive coverage for chronic conditions. This plan covers David's regular doctor visits, medications, and any necessary procedures related to his condition. Additionally, the plan provides access to a network of specialists who can provide the specialized care David requires. The family also benefits from the plan's coverage for mental health services, ensuring that David receives the emotional support he needs during this challenging time.

With the right health insurance family plan, the Smith family can focus on David's well-being, knowing that his medical needs are well-managed and supported by their comprehensive coverage.

Future Implications and Trends

As the healthcare landscape continues to evolve, health insurance family plans are likely to adapt and innovate to meet the changing needs of families. Here are some future implications and trends to watch out for:

Digitalization and Telemedicine

The rise of digital technology and telemedicine is expected to play a significant role in health insurance family plans. With the convenience and accessibility offered by digital platforms, families may increasingly turn to telemedicine services for routine consultations and minor ailments. Health insurance providers are likely to integrate telemedicine options into their family plans, providing families with efficient and cost-effective healthcare solutions.

Personalized Medicine and Genetic Testing

Advancements in personalized medicine and genetic testing are opening up new avenues for preventative healthcare. Health insurance family plans may start incorporating coverage for genetic testing and personalized treatment plans. This approach could help identify potential health risks early on and allow for more targeted and effective interventions, ultimately improving the overall health outcomes for families.

Wellness and Lifestyle Programs

The focus on wellness and lifestyle is gaining momentum, and health insurance providers are recognizing the value of promoting healthy habits among families. Future family plans may include more comprehensive wellness programs, offering incentives for healthy lifestyle choices, fitness tracking, and nutritional guidance. By encouraging families to adopt healthier lifestyles, these programs can help prevent chronic diseases and promote overall well-being.

Mental Health Awareness

With growing awareness about mental health, health insurance family plans are expected to continue expanding their coverage for mental health services. This includes access to counseling, therapy, and psychiatric care, ensuring that families have the necessary support to address mental health concerns. By normalizing mental health discussions and providing adequate coverage, health insurance providers can play a vital role in destigmatizing mental health issues and promoting overall family wellness.

FAQ - Frequently Asked Questions

Can I add my parents to my health insurance family plan if they live with me but are not my legal dependents?

+Adding your parents to your health insurance family plan may depend on the specific terms and conditions of your policy. Some plans allow for the inclusion of non-dependent family members, such as parents or grandparents, if they reside with you. However, this is typically subject to certain eligibility criteria and additional premium charges. It’s best to review your policy details or consult with your insurance provider to determine if this option is available to you.

What happens if a family member develops a pre-existing condition after enrolling in a health insurance family plan?

+If a family member develops a pre-existing condition after enrolling in a health insurance family plan, the coverage for that condition may be subject to certain limitations or exclusions. Most health insurance plans have waiting periods or exclusions for pre-existing conditions, which means that coverage for these conditions may be delayed or not covered at all during the initial period of the policy. However, it’s important to note that the specific terms and conditions regarding pre-existing conditions can vary between different plans and providers. It’s advisable to carefully review the policy documents and consult with your insurance provider to understand the coverage options and any potential limitations.

Are there any tax benefits associated with health insurance family plans?

+Yes, there can be tax benefits associated with health insurance family plans. In many countries, the premiums paid for health insurance coverage, including family plans, are eligible for tax deductions or credits. These tax incentives aim to encourage individuals and families to purchase health insurance and help offset the cost of premiums. However, the specific tax benefits and eligibility criteria can vary depending on the jurisdiction and the tax laws in place. It’s recommended to consult with a tax professional or refer to the relevant tax guidelines in your region to understand the potential tax advantages of health insurance family plans.