Health Insurance For Childbirth

When it comes to planning for childbirth, one of the essential aspects to consider is health insurance coverage. Ensuring that you have adequate insurance can provide peace of mind and help manage the financial aspects associated with prenatal care, delivery, and postnatal care. In this comprehensive guide, we will delve into the world of health insurance for childbirth, covering various aspects to help you make informed decisions.

Understanding Health Insurance Coverage for Childbirth

Health insurance plays a crucial role in managing the costs associated with pregnancy and childbirth. It provides financial protection by covering a range of medical services and procedures related to bringing a new life into the world. Understanding the specifics of your insurance plan is vital to navigate this process effectively.

Prenatal Care and Coverage

Prenatal care is a critical component of a healthy pregnancy. Most health insurance plans cover a wide range of prenatal services, including:

- Regular Check-ups: These visits allow healthcare providers to monitor the health of both the mother and the fetus, ensuring timely identification of any potential issues.

- Diagnostic Tests: Insurance plans often cover essential tests such as blood work, ultrasounds, and genetic screenings, which are vital for assessing the health of the baby and the mother.

- Nutritional Counseling: Many insurance providers recognize the importance of proper nutrition during pregnancy and may cover sessions with registered dietitians.

- Mental Health Support: Prenatal depression and anxiety are not uncommon. Some insurance plans offer coverage for counseling or therapy sessions to address these concerns.

Delivery and Hospitalization

The costs associated with delivery and hospitalization can be significant. Health insurance coverage typically includes:

- Hospital Stays: Most plans cover the cost of a hospital stay during delivery, including labor and postpartum care. The length of stay may vary depending on the type of delivery (vaginal or cesarean) and the specific insurance policy.

- Medical Procedures: Whether it’s a routine vaginal delivery or a C-section, insurance plans cover the medical procedures and medications required during the process.

- Anesthesia: If epidural or spinal anesthesia is administered during labor, it is generally covered by insurance.

- Newborn Care: Insurance providers often cover the initial assessment and care of the newborn, including necessary tests and vaccinations.

Postpartum Care and Follow-up

The journey doesn’t end with delivery. Postpartum care is essential for both the mother’s recovery and the baby’s well-being. Insurance coverage for postpartum care may include:

- Follow-up Appointments: These visits allow healthcare providers to monitor the mother’s health and address any concerns related to healing, breastfeeding, or postpartum depression.

- Pediatric Visits: Insurance plans often cover the initial well-baby check-ups and vaccinations to ensure the newborn’s health is on track.

- Breastfeeding Support: Some insurance providers offer coverage for lactation consultants or breastfeeding support groups to assist new mothers in this aspect of care.

Out-of-Pocket Costs and Deductibles

While insurance coverage can significantly reduce financial burdens, it’s important to be aware of potential out-of-pocket costs. These may include deductibles, copayments, and coinsurance, which can vary based on your insurance plan and the specific services received. Understanding your plan’s out-of-pocket maximum can help you budget effectively.

Choosing the Right Health Insurance Plan

Selecting the appropriate health insurance plan is a critical decision when planning for childbirth. Consider the following factors:

- Network of Providers: Ensure that your preferred healthcare providers, including obstetricians and hospitals, are in-network to minimize out-of-pocket expenses.

- Coverage Limits: Review the plan’s coverage limits for pregnancy-related services to ensure they align with your anticipated needs.

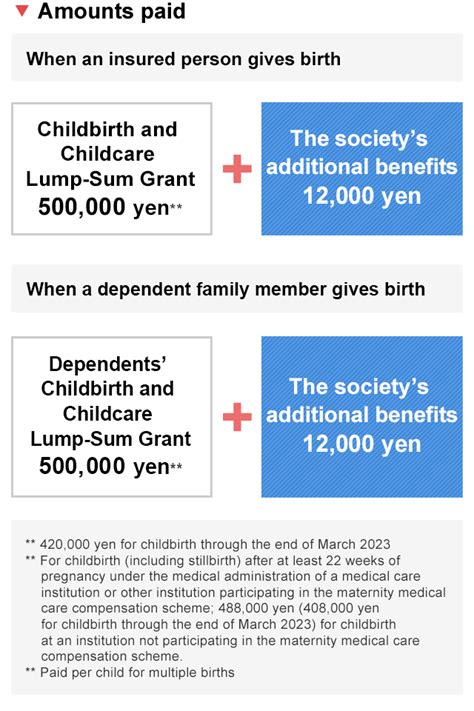

- Maternity Benefits: Some insurance plans offer additional maternity benefits, such as pregnancy-specific wellness programs or access to childbirth education classes.

- Flexible Payment Options: Consider plans that offer flexible payment options or the ability to set up health savings accounts to help manage out-of-pocket expenses.

Navigating Insurance Challenges

While health insurance for childbirth is designed to provide coverage, challenges may arise. Here are some tips to navigate potential issues:

- Pre-authorization: Certain procedures or tests may require pre-authorization from your insurance provider. Stay informed and initiate the authorization process promptly to avoid delays.

- Appealing Denied Claims: If a claim is denied, don’t hesitate to appeal. Insurance companies can make mistakes, and providing additional supporting documentation may help reverse the decision.

- Understanding Exclusions: Review your plan’s exclusions to avoid surprises. Some plans may have limitations on certain procedures or services, so being aware of these can help you make informed choices.

The Impact of Insurance on Childbirth Decisions

Health insurance coverage can influence various aspects of childbirth, including the choice of healthcare providers, birthing methods, and even the location of delivery. Understanding your insurance plan’s coverage and limitations can empower you to make decisions that align with your preferences and financial situation.

Choosing Healthcare Providers

Insurance networks often dictate the range of healthcare providers available to you. Consider factors such as the provider’s reputation, experience, and alignment with your birthing philosophy when making your choice.

Birthing Methods and Preferences

Different birthing methods, such as natural childbirth, water birth, or epidural-assisted delivery, may have varying levels of insurance coverage. Understanding your plan’s coverage for these methods can help you make informed decisions about the birth experience you desire.

Delivery Location

The choice between delivering in a hospital, birthing center, or at home can be influenced by insurance coverage. Some insurance plans may offer more comprehensive coverage for hospital births, while others may provide benefits for out-of-hospital births. Researching and understanding your plan’s coverage for different delivery locations can guide your decision-making process.

Performance Analysis: Real-World Experiences

To provide a comprehensive perspective, let’s delve into some real-world experiences and analyze how health insurance has impacted childbirth journeys.

Case Study 1: In-Network Benefits

Sarah’s Story

Sarah, a first-time mom, chose an insurance plan with an extensive network of providers. Her preferred obstetrician and the hospital she selected for delivery were both in-network. As a result, she experienced minimal out-of-pocket expenses throughout her pregnancy and childbirth. The seamless integration of her healthcare providers and insurance coverage allowed her to focus on the excitement of becoming a mother without financial concerns.

Case Study 2: Navigating Pre-authorization

Michael and Emma’s Journey

Michael and Emma, expecting their second child, faced a challenge when Emma’s doctor recommended a specific prenatal test. Their insurance plan required pre-authorization for this test, which they promptly initiated. However, the authorization process took longer than expected, causing some anxiety. They learned the importance of staying proactive and advocating for their healthcare needs to ensure timely access to necessary services.

Case Study 3: Exploring Out-of-Network Options

Sophia’s Experience

Sophia, an expectant mother, had her heart set on a specific birthing center that offered a holistic approach to childbirth. Unfortunately, the center was out-of-network for her insurance plan. She explored the option of paying out-of-pocket for the birthing center services, weighing the potential financial impact against her desire for a personalized birth experience. Ultimately, she decided to pursue her preferred birthing method, accepting the financial trade-off.

Future Implications and Industry Insights

The landscape of health insurance for childbirth continues to evolve, influenced by advancements in healthcare and changing industry trends. Here are some insights to consider:

Expanding Coverage for Prenatal Wellness

There is a growing recognition of the importance of prenatal wellness in ensuring healthy pregnancies and births. Insurance providers may increasingly offer coverage for wellness programs, nutritional counseling, and mental health support to promote holistic care during pregnancy.

Telehealth and Virtual Prenatal Care

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Insurance plans may increasingly cover virtual prenatal care appointments, offering convenience and accessibility to expecting parents.

Value-Based Care Models

Value-based care models focus on providing high-quality healthcare while controlling costs. These models may incentivize healthcare providers to offer comprehensive prenatal and postpartum care, leading to improved outcomes and reduced healthcare costs over time.

Frequently Asked Questions

How do I choose the right health insurance plan for childbirth?

+

When selecting a health insurance plan for childbirth, consider factors such as the network of providers, coverage limits, maternity benefits, and flexible payment options. Ensure that your preferred healthcare providers and birthing locations are in-network to minimize out-of-pocket expenses. Review the plan’s coverage for prenatal care, delivery, and postpartum services to ensure it aligns with your anticipated needs.

What are some common challenges when using health insurance for childbirth?

+

Common challenges include navigating pre-authorization processes for certain procedures, understanding insurance exclusions, and dealing with denied claims. Staying informed, initiating pre-authorization promptly, and appealing denied claims with supporting documentation can help overcome these challenges.

Can I use my health insurance for out-of-network providers during childbirth?

+

While it is possible to use your health insurance for out-of-network providers during childbirth, it may result in higher out-of-pocket costs. Some insurance plans offer limited coverage for out-of-network services, while others may require prior authorization or have specific rules for out-of-network care. It’s essential to review your plan’s details and consider the financial implications before choosing an out-of-network provider.

What are some tips for managing out-of-pocket expenses during childbirth?

+

To manage out-of-pocket expenses during childbirth, consider the following tips: Stay informed about your insurance plan’s coverage and limitations, choose in-network providers whenever possible, explore flexible payment options offered by your insurance plan or healthcare providers, and consider setting up a health savings account (HSA) to save for pregnancy-related expenses.