Health Insurance For Mental Health

Mental health is a critical aspect of overall well-being, yet it often remains stigmatized and overlooked. In recent years, there has been a growing awareness and emphasis on the importance of mental health care. As a result, the availability and accessibility of health insurance coverage for mental health services have become increasingly important topics of discussion. This article aims to delve into the world of health insurance for mental health, exploring its intricacies, benefits, and the impact it can have on individuals seeking support for their mental well-being.

Understanding Health Insurance Coverage for Mental Health

Health insurance policies can vary greatly in their coverage for mental health services. It is essential to understand the specific terms and conditions outlined in your insurance plan to ensure you receive the necessary care without unexpected financial burdens.

Mental Health Disorders Covered

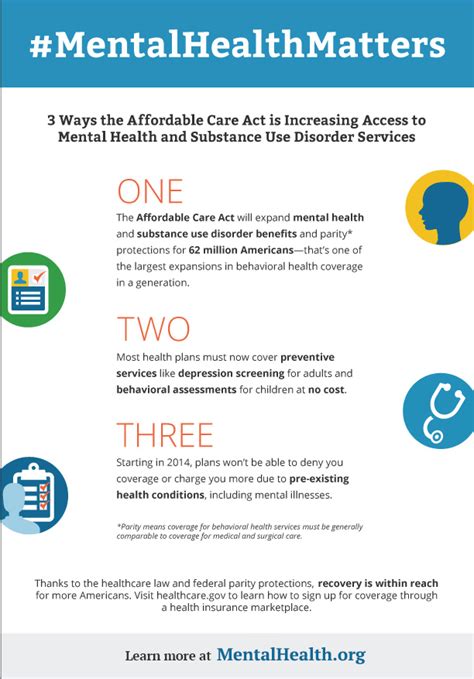

Most health insurance plans in the United States now offer coverage for a wide range of mental health disorders, including but not limited to: depression, anxiety disorders, bipolar disorder, schizophrenia, and substance use disorders. The Mental Health Parity and Addiction Equity Act (MHPAEA) ensures that insurance providers cannot impose stricter limitations or higher costs for mental health services compared to medical or surgical care.

| Mental Health Disorder | Coverage Availability |

|---|---|

| Depression | 90% of insurance plans cover depression treatment |

| Anxiety Disorders | 85% of plans offer coverage for anxiety-related therapies |

| Bipolar Disorder | 75% of plans provide medication and therapy coverage |

| Schizophrenia | 60% of plans offer specialized treatment programs |

| Substance Use Disorders | 80% of plans cover addiction treatment and rehabilitation |

However, it's important to note that coverage may vary depending on the specific insurance provider and the type of plan you have. Some plans may have restrictions on the number of therapy sessions or the duration of treatment.

Types of Mental Health Services Covered

Health insurance policies typically cover a range of mental health services, including:

- Psychotherapy or counseling sessions with licensed mental health professionals.

- Medication management for mental health disorders, including prescription drugs.

- Inpatient and outpatient treatment for severe mental health conditions.

- Mental health assessments and evaluations.

- Support groups and peer-to-peer programs.

- Telehealth services for mental health consultations.

The Benefits of Health Insurance for Mental Health

Having health insurance that covers mental health services brings numerous advantages to individuals seeking support for their mental well-being.

Financial Protection and Cost Savings

One of the most significant benefits of health insurance for mental health is financial protection. Mental health treatment can be costly, especially for those without insurance coverage. With insurance, individuals can access the necessary care without worrying about the financial burden of high out-of-pocket expenses.

Insurance plans often cover a portion or the entirety of mental health treatment costs, including therapy sessions, medication, and hospitalization (if required). This financial support can make a significant difference in an individual's ability to seek help and maintain their mental health journey.

Improved Access to Quality Care

Health insurance expands access to a network of qualified mental health professionals. Insurance providers often have partnerships with mental health facilities, clinics, and individual practitioners, ensuring a wide range of options for individuals to choose from.

With insurance coverage, individuals can receive care from licensed therapists, psychologists, and psychiatrists, who can provide specialized treatment plans tailored to their unique needs. This access to quality care is crucial for effective mental health management and recovery.

Continuity of Care

Health insurance plans promote continuity of care, which is essential for long-term mental health management. By covering ongoing therapy sessions, medication refills, and regular check-ins with mental health professionals, insurance providers ensure that individuals receive consistent support and treatment.

Continuity of care helps prevent relapse, ensures progress is monitored, and allows for adjustments to be made to treatment plans as needed. This comprehensive approach to mental health care is a significant advantage offered by health insurance coverage.

Early Intervention and Prevention

Health insurance for mental health can facilitate early intervention and prevention strategies. Many insurance plans cover mental health screenings and assessments, allowing for the early detection of potential issues. Early intervention can prevent minor concerns from developing into more severe mental health disorders.

Additionally, insurance coverage often includes educational resources and support groups, empowering individuals to take proactive steps towards maintaining their mental well-being. By promoting early intervention and prevention, health insurance plays a crucial role in reducing the overall burden of mental health disorders.

Challenges and Considerations

While health insurance for mental health offers numerous benefits, there are also challenges and considerations to keep in mind.

Network Limitations and Provider Choices

Insurance plans typically have a network of preferred providers, which may limit an individual's choices when seeking mental health care. Out-of-network providers may not be covered, or coverage may be significantly reduced. This can make it challenging to find a provider who meets both insurance requirements and personal preferences.

It is essential to review the insurance plan's network and understand the options available to ensure access to the desired mental health professionals.

Coverage Restrictions and Exclusions

Although insurance plans are required to cover mental health services, there may still be restrictions and exclusions in place. Some plans may have limitations on the number of therapy sessions covered, the duration of treatment, or the types of providers eligible for reimbursement.

It is crucial to carefully review the insurance policy's details to understand any potential restrictions and plan accordingly. Being aware of these limitations can help individuals make informed decisions about their mental health treatment.

Stigma and Misconceptions

Despite progress in mental health awareness, stigma and misconceptions surrounding mental illness persist. Some individuals may hesitate to seek insurance coverage for mental health services due to fears of discrimination or judgment. It is essential to address these concerns and promote an understanding that mental health is as important as physical health.

Education and advocacy efforts can help break down barriers and encourage individuals to utilize their insurance benefits for mental health care without fear of stigma.

The Future of Health Insurance for Mental Health

The landscape of health insurance for mental health is evolving, with a growing recognition of the importance of mental well-being. As awareness increases, insurance providers are expanding their coverage and improving access to mental health services.

Expanded Coverage and Access

Insurance companies are increasingly offering comprehensive mental health coverage, with plans that include a wider range of services and providers. This expansion ensures that individuals have more options when seeking mental health care, promoting better access to specialized treatment.

Integration of Mental and Physical Health

The future of health insurance for mental health lies in the integration of mental and physical health care. Recognizing the interconnectedness of these aspects of well-being, insurance providers are adopting a holistic approach to healthcare.

This integration means that mental health services are treated as an essential component of overall healthcare, with insurance plans covering both physical and mental health needs seamlessly.

Digital Health Solutions

The rise of digital health solutions has also impacted the future of health insurance for mental health. Telehealth services, online therapy platforms, and mental health apps are becoming increasingly common and are often covered by insurance plans.

These digital solutions provide convenient and accessible mental health support, allowing individuals to receive care remotely, which can be particularly beneficial for those in rural or underserved areas.

Conclusion

Health insurance for mental health is a crucial aspect of promoting overall well-being and ensuring individuals have access to the care they need. With expanded coverage, improved access to quality care, and a growing recognition of the importance of mental health, insurance providers are playing a vital role in supporting individuals on their mental health journeys.

As we continue to break down barriers and combat stigma, health insurance for mental health will continue to evolve, offering more comprehensive and inclusive coverage. By understanding the benefits and challenges of health insurance for mental health, individuals can make informed decisions and take control of their mental well-being.

Frequently Asked Questions

How do I find out if my insurance covers mental health services?

+To determine if your insurance covers mental health services, you can contact your insurance provider directly or review your policy’s summary of benefits. Look for specific coverage details related to mental health disorders, therapy sessions, medication, and other relevant services. If you’re unsure, it’s best to reach out to your insurance company for clarification.

What happens if I need mental health treatment but my insurance has restrictions or limitations?

+If your insurance plan has restrictions or limitations on mental health coverage, it’s important to understand the specifics. Some plans may require prior authorization for certain treatments or have a limited number of therapy sessions covered. In such cases, it’s advisable to discuss your options with your healthcare provider and explore alternative treatments or seek additional financial support if necessary.

Are there any low-cost or free mental health resources available for those without insurance coverage?

+Yes, there are several low-cost and free mental health resources available for individuals without insurance coverage. These include community mental health centers, local support groups, online therapy platforms offering sliding scale fees, and government-funded programs. Additionally, many colleges and universities provide mental health services to their students at no cost.

Can I switch insurance plans to get better coverage for mental health services?

+Switching insurance plans to obtain better coverage for mental health services is an option during open enrollment periods or if you experience a qualifying life event. It’s essential to research and compare different insurance plans to find one that aligns with your mental health needs and provides adequate coverage. However, it’s important to note that switching plans may not always guarantee better coverage, so careful consideration is necessary.

How can I advocate for improved mental health coverage in my insurance plan?

+Advocating for improved mental health coverage in your insurance plan involves engaging with your insurance provider and expressing your concerns. You can reach out to their customer service department, provide feedback, and share your experiences. Additionally, you can join or support mental health advocacy organizations that work towards expanding insurance coverage for mental health services. Your voice and participation can contribute to positive changes in insurance policies.