Health Insurance International Travel

International travel has become increasingly popular, offering individuals the chance to explore diverse cultures, immerse themselves in new environments, and create lasting memories. However, with the excitement of travel comes the responsibility of ensuring adequate healthcare coverage. Health insurance for international travel is a crucial aspect that should not be overlooked, as it provides essential protection and peace of mind during one's journey.

The Importance of Health Insurance for International Travelers

When venturing beyond one’s home country, unexpected medical emergencies can occur, ranging from minor ailments to more serious health issues. These incidents can lead to significant financial burdens, especially when medical costs in foreign countries are often much higher than at home. Health insurance specifically designed for international travel is tailored to cover these unexpected healthcare expenses, ensuring travelers receive the necessary medical attention without incurring substantial out-of-pocket costs.

Additionally, health insurance for international travel provides crucial access to medical services. In unfamiliar territories, locating suitable healthcare facilities and qualified medical professionals can be challenging. With international health insurance, travelers have the benefit of pre-vetted networks of medical providers, ensuring they receive quality care when needed. Furthermore, many international health insurance plans offer additional benefits such as medical evacuation coverage, which can be life-saving in certain situations.

Understanding the Coverage Options

International health insurance plans vary widely in terms of coverage and benefits. It is essential for travelers to carefully evaluate their options and choose a plan that aligns with their specific needs and travel itinerary. Here is a breakdown of some key coverage aspects to consider:

Medical Expense Coverage

This is the cornerstone of any international health insurance plan. It covers a wide range of medical expenses, including doctor visits, hospital stays, prescription medications, and emergency treatments. Some plans may also offer coverage for preventive care services.

| Plan Type | Medical Expense Coverage |

|---|---|

| Comprehensive Plan | Provides extensive coverage for various medical situations, including specialized treatments and long-term care. |

| Basic Plan | Offers more limited coverage, suitable for shorter trips or less risky travel activities. |

Emergency Medical Evacuation

In the event of a serious medical emergency, this coverage ensures the traveler can be transported to a more suitable medical facility, either within the country or back home. It covers the cost of air ambulance services, ground transportation, and even the necessary medical personnel.

Repatriation of Remains

A somber but necessary coverage, it provides for the return of the traveler’s remains to their home country in the unfortunate event of their passing during the trip.

Pre-existing Condition Coverage

Some health insurance plans for international travel offer coverage for pre-existing medical conditions. This is crucial for travelers with ongoing health issues, as it ensures they are not left vulnerable during their journey.

Travel Assistance Services

Many international health insurance plans include travel assistance services, which offer additional support during the trip. This can include help with locating medical facilities, arranging doctor appointments, and even providing language interpretation services.

Choosing the Right Plan

Selecting the appropriate international health insurance plan involves careful consideration of several factors. Here are some key aspects to keep in mind:

- Travel Duration: Determine the length of your trip and choose a plan that aligns with your travel timeline. Some plans offer coverage for short-term trips, while others are designed for long-term stays.

- Destination: Research the healthcare system and costs in your intended travel destinations. Certain countries may have higher medical expenses, so choosing a plan with adequate coverage is essential.

- Activity Level: Consider the activities you plan to engage in during your trip. If you're participating in extreme sports or adventure activities, ensure your plan covers these specific risks.

- Pre-existing Conditions: If you have any pre-existing medical conditions, verify that your chosen plan provides coverage for them. Some plans may require additional documentation or have specific exclusions.

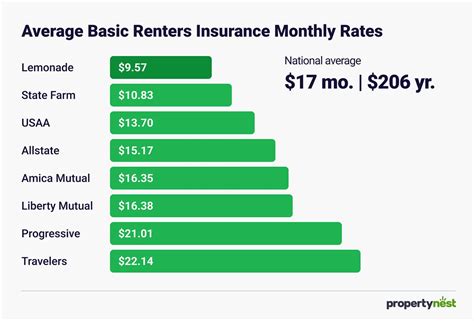

- Budget: International health insurance plans come with varying price tags. Assess your financial capabilities and choose a plan that offers the necessary coverage without straining your budget.

It is advisable to consult with insurance experts or travel agents who specialize in international health insurance. They can provide valuable insights and guide you through the process of selecting the most suitable plan for your needs.

Real-Life Examples of International Health Insurance in Action

To better understand the significance of international health insurance, let’s explore a couple of real-life scenarios where it made a crucial difference:

Scenario 1: Adventure Traveler’s Emergency

John, an avid adventure traveler, was hiking in the Swiss Alps when he suffered a severe ankle injury. With no local medical facilities nearby, an air ambulance was dispatched to transport him to a specialized hospital in Zurich. John’s international health insurance plan covered the entire cost of the emergency evacuation and his subsequent treatment, saving him from a potentially devastating financial burden.

Scenario 2: Long-Term Expatriate’s Health Issue

Sarah, an expatriate living in Singapore, was diagnosed with a chronic health condition shortly after her arrival. Her international health insurance plan, which included coverage for pre-existing conditions, allowed her to access specialized medical care and receive the necessary treatments without any financial strain. She was able to manage her condition effectively and continue her life abroad with peace of mind.

The Future of International Health Insurance

As international travel continues to evolve and become more accessible, the demand for comprehensive and affordable health insurance options is expected to rise. The industry is responding by developing innovative plans that cater to the diverse needs of travelers. Here are some potential future developments to look out for:

- Digital Health Solutions: The integration of digital health technologies, such as telemedicine and wearable devices, could revolutionize international health insurance. These advancements can enhance remote medical care and provide travelers with real-time access to healthcare professionals, regardless of their location.

- Personalized Coverage: Insurance providers may start offering more personalized plans that take into account individual health profiles and travel preferences. This customization can ensure travelers receive the specific coverage they require, without paying for unnecessary benefits.

- Expanded Networks: As the industry grows, insurance companies may work towards expanding their networks of medical providers worldwide. This would provide travelers with a broader range of options for accessing quality healthcare during their journeys.

- Incentivized Wellness Programs: To encourage healthier lifestyles among travelers, insurance providers could introduce incentivized wellness programs. These initiatives may offer discounts or rewards for travelers who maintain healthy habits and engage in preventive care measures.

Frequently Asked Questions

Can I use my domestic health insurance for international travel?

+

Domestic health insurance plans often have limited or no coverage outside the home country. It’s crucial to check your specific plan’s terms and conditions to understand its international coverage. In most cases, a separate international health insurance plan is recommended for comprehensive protection during travel.

What happens if I don’t have health insurance for international travel and face a medical emergency?

+

Without international health insurance, you may be responsible for paying all medical expenses out of pocket. This can lead to significant financial strain, especially if the medical emergency requires extensive treatment or hospitalization. It’s always advisable to have adequate coverage to protect yourself financially during travel.

Are there any international health insurance plans that cover COVID-19 related expenses?

+

Yes, many international health insurance plans now include coverage for COVID-19 related medical expenses. However, it’s essential to carefully review the plan’s terms and conditions to understand the specific coverage provided. Some plans may have exclusions or limitations, so it’s crucial to choose a plan that offers comprehensive COVID-19 coverage.