Health Insurance Open Enrollment 2025

Navigating the 2025 Health Insurance Open Enrollment: A Comprehensive Guide

As we approach the annual health insurance open enrollment period, it’s crucial to be well-informed and prepared to make the best decisions for your healthcare needs. The 2025 open enrollment season brings new opportunities and challenges, and understanding the latest trends, plan options, and potential savings strategies is key to a successful enrollment. This comprehensive guide aims to provide you with expert insights and practical advice to navigate the 2025 health insurance landscape.

Understanding the Open Enrollment Period

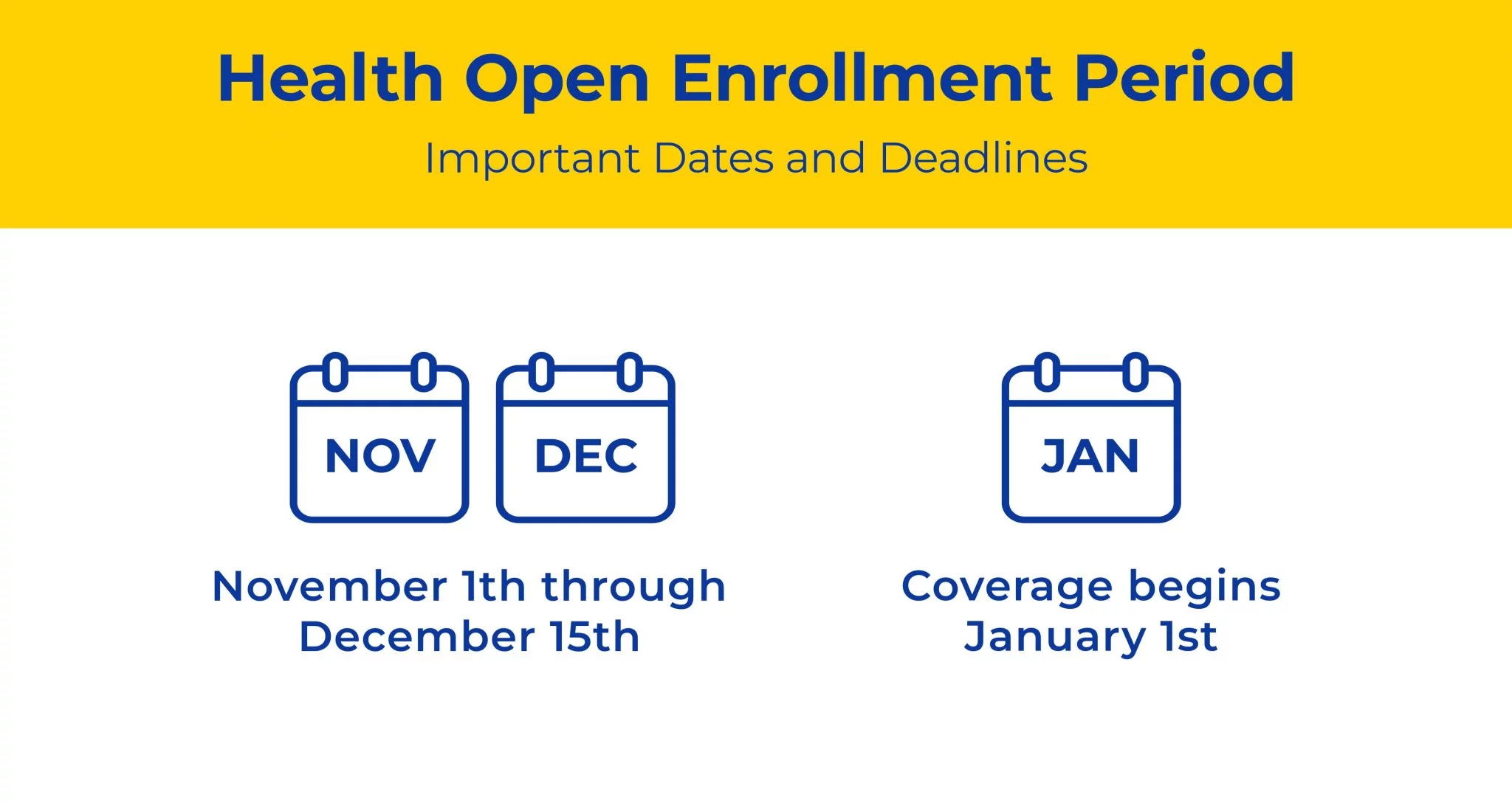

The open enrollment period for health insurance is a designated time frame when individuals and families can enroll in or make changes to their health insurance plans. It’s a crucial opportunity to review your current coverage, assess your healthcare needs for the upcoming year, and explore alternative plans that better suit your circumstances. For 2025, the open enrollment period typically runs from November 1st, 2024, to January 15th, 2025, allowing ample time for research and decision-making.

During this period, insurance providers offer a range of plans, including Bronze, Silver, Gold, and Platinum options, each with varying levels of coverage and premiums. Additionally, catastrophic plans are available for those under 30 or with a hardship exemption, providing a more affordable alternative for basic coverage.

Key Trends and Insights for 2025

The 2025 open enrollment season presents some notable trends and changes in the health insurance landscape:

Increased Focus on Preventive Care: Many insurance providers are emphasizing the importance of preventive care, offering incentives and reduced costs for members who prioritize wellness and early detection. This shift aligns with the growing understanding of the value of preventive measures in overall healthcare.

Expansion of Telehealth Services: With the lessons learned from the pandemic, telehealth services are here to stay. Many plans now offer expanded coverage for virtual doctor visits, mental health counseling, and remote monitoring, providing convenient and accessible healthcare options.

Rising Premiums: Unfortunately, health insurance premiums are expected to increase for the 2025 enrollment period. This rise is attributed to various factors, including inflation, changing healthcare costs, and the ongoing impact of the COVID-19 pandemic.

Enhanced Consumer Education: Recognizing the complexity of health insurance plans, insurance providers and government agencies are investing in consumer education initiatives. This includes simplified plan summaries, interactive tools for comparing plans, and increased access to knowledgeable support staff to guide consumers through the enrollment process.

Choosing the Right Plan: A Step-by-Step Guide

Selecting the right health insurance plan involves careful consideration of your unique healthcare needs and financial situation. Here’s a step-by-step approach to help you make an informed decision:

Step 1: Assess Your Healthcare Needs

Start by evaluating your current and anticipated healthcare needs for the upcoming year. Consider factors such as:

- Regular Medications: Ensure your plan covers the medications you rely on, including any brand-name or specialty drugs.

- Chronic Conditions: If you have a chronic illness, choose a plan that offers specialized care and reduced costs for managing your condition.

- Preventive Services: Look for plans that prioritize preventive care and offer incentives for wellness programs.

- Specialist Visits: Assess your need for specialist care and choose a plan with an extensive network of providers to avoid out-of-network costs.

Step 2: Understand Your Coverage Options

Familiarize yourself with the different types of health insurance plans available:

- Health Maintenance Organizations (HMOs): These plans typically offer lower premiums but require you to choose a primary care physician (PCP) and may have limited provider networks.

- Preferred Provider Organizations (PPOs): PPOs provide more flexibility, allowing you to see any in-network provider without a referral. They often come with higher premiums.

- Exclusive Provider Organizations (EPOs): EPOs are similar to PPOs but typically do not cover out-of-network care, except in emergencies.

- Point-of-Service (POS) Plans: POS plans combine elements of HMOs and PPOs, allowing you to choose between in-network and out-of-network care, with varying cost-sharing arrangements.

Step 3: Compare Plan Costs and Benefits

Once you’ve narrowed down your plan options, it’s essential to compare the costs and benefits of each:

- Premiums: Consider the monthly premium cost, which is the amount you pay to maintain your coverage. Choose a plan that fits your budget while providing adequate coverage.

- Deductibles: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Lower deductibles may result in higher premiums, so find a balance that suits your financial situation.

- Copayments and Coinsurance: Understand the copayments (fixed amounts) and coinsurance (percentage of costs) you’ll be responsible for when accessing healthcare services. These vary by plan and service type.

- Out-of-Pocket Maximum: Review the out-of-pocket maximum, which is the most you’ll pay for covered services in a year. Plans with lower out-of-pocket maximums can provide significant financial protection.

Step 4: Evaluate Provider Networks

The provider network is a critical aspect of your health insurance plan. Ensure that your preferred doctors, specialists, and hospitals are included in the plan’s network to avoid unexpected out-of-network costs.

Step 5: Explore Additional Benefits and Services

Some health insurance plans offer additional benefits and services that can enhance your coverage:

- Dental and Vision Coverage: Consider plans that include dental and vision benefits, especially if you have regular needs in these areas.

- Mental Health Services: Look for plans that prioritize mental health coverage, including therapy sessions and medication management.

- Wellness Programs: Choose plans that encourage wellness with incentives for healthy lifestyle choices, such as gym memberships or weight management programs.

Saving Strategies for 2025

In the face of rising health insurance costs, it’s important to explore strategies to keep your healthcare expenses manageable:

Utilize Tax Credits and Subsidies: Depending on your income, you may be eligible for tax credits or subsidies to offset the cost of your health insurance premiums. Be sure to research and apply for these benefits during the open enrollment period.

Consider High-Deductible Health Plans (HDHPs): HDHPs often come with lower premiums, making them an attractive option for those who prioritize cost savings. These plans are often paired with Health Savings Accounts (HSAs), allowing you to set aside pre-tax funds for healthcare expenses.

Review Your Coverage Annually: Don’t assume that your current plan remains the best fit for your needs year after year. Regularly assess your healthcare needs and explore alternative plans during each open enrollment period.

Prioritize Preventive Care: Taking advantage of preventive services can help you avoid more costly treatments down the line. Many insurance plans offer incentives for preventive care, so be sure to schedule regular check-ups, screenings, and immunizations.

Negotiate Your Medical Bills: If you receive a medical bill that seems excessive, don’t hesitate to negotiate. Many healthcare providers are willing to work with patients to reduce costs or set up payment plans.

Navigating the Enrollment Process

The enrollment process can vary depending on your state and the insurance provider, but here’s a general guide to help you navigate the steps:

Research and Compare Plans: Utilize online tools, insurance broker websites, and government resources to compare plans and understand your options.

Gather Necessary Documents: Have your income and household information ready, as well as any necessary identification documents.

Create an Account: If you’re enrolling online, create an account with the insurance provider’s website to access your application and manage your plan.

Complete the Application: Fill out the application accurately and completely. Be sure to review and understand the plan’s benefits and costs before submitting.

Make Your Selection: Once you’ve found the plan that best suits your needs, select it and proceed with the enrollment process.

Review and Verify: After enrolling, carefully review your plan summary and benefits to ensure accuracy. Contact your insurance provider if you have any questions or concerns.

Special Considerations for 2025

The 2025 open enrollment period may present unique challenges or opportunities for certain individuals or groups:

Young Adults: If you’re a young adult, consider the catastrophic plans offered for those under 30. These plans provide basic coverage at a lower cost, but they may not cover all your healthcare needs. Assess your individual circumstances and decide if a catastrophic plan is right for you.

Small Business Owners: If you own a small business, you may be eligible for Small Business Health Options Program (SHOP) plans. These plans offer group coverage for small businesses and their employees, providing a range of benefits and cost-saving opportunities.

Individuals with Pre-Existing Conditions: The Affordable Care Act (ACA) continues to protect individuals with pre-existing conditions from being denied coverage or charged higher premiums. Be sure to review your options and choose a plan that provides adequate coverage for your specific condition.

Conclusion: Empowering Your Healthcare Decisions

The 2025 health insurance open enrollment period is an opportunity to take control of your healthcare future. By staying informed, researching your options, and making thoughtful decisions, you can ensure that your health insurance plan aligns with your unique needs and financial situation. Remember, health insurance is a critical aspect of your overall well-being, and a well-chosen plan can provide peace of mind and access to quality healthcare when you need it most.

FAQ

When is the 2025 health insurance open enrollment period?

+

The 2025 health insurance open enrollment period typically runs from November 1st, 2024, to January 15th, 2025. This is the designated time frame for individuals and families to enroll in or make changes to their health insurance plans.

What are the key trends for the 2025 open enrollment season?

+

Key trends for the 2025 open enrollment season include an increased focus on preventive care, the expansion of telehealth services, rising premiums, and enhanced consumer education initiatives to simplify plan comparisons and support decision-making.

How do I choose the right health insurance plan for my needs?

+

Choosing the right health insurance plan involves assessing your healthcare needs, understanding your coverage options, comparing plan costs and benefits, evaluating provider networks, and exploring additional benefits and services. It’s a multi-step process that requires careful consideration of your unique circumstances.

Are there any savings strategies I can employ during the 2025 open enrollment period?

+

Yes, there are several strategies to save on health insurance costs during the 2025 open enrollment period. These include utilizing tax credits and subsidies, considering high-deductible health plans (HDHPs) with health savings accounts (HSAs), reviewing your coverage annually, prioritizing preventive care, and negotiating medical bills.

What should I do if I have a pre-existing condition?

+

If you have a pre-existing condition, you are protected by the Affordable Care Act (ACA), which prohibits insurance providers from denying coverage or charging higher premiums based on your health status. Be sure to review your options and choose a plan that provides adequate coverage for your specific condition.