Health Insurance Plans Family

Health insurance is an essential aspect of modern healthcare systems, providing individuals and families with financial protection and access to quality medical care. With the rising costs of healthcare, having a comprehensive health insurance plan is more crucial than ever. This article aims to delve into the world of health insurance, specifically focusing on family plans, and provide an in-depth analysis to help you make informed decisions about your healthcare coverage.

Understanding Health Insurance for Families

Family health insurance plans are designed to cover multiple members of a household, typically including parents, spouses, and dependent children. These plans offer a range of benefits and options tailored to meet the unique needs of families. By understanding the key features and considerations, you can navigate the complex world of health insurance and choose a plan that provides adequate coverage and peace of mind.

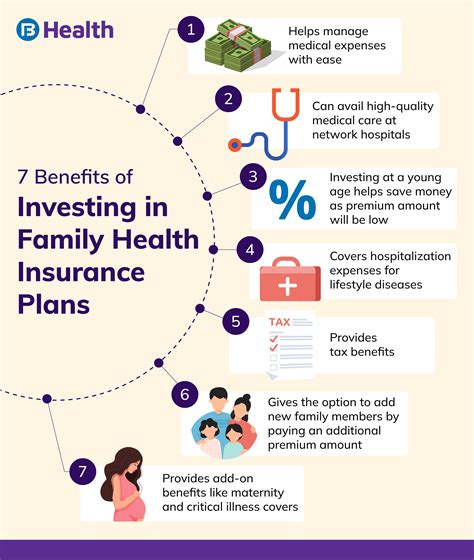

Key Benefits of Family Health Insurance Plans

Family health insurance plans offer a multitude of advantages, ensuring that your loved ones are protected in times of medical need. Here are some of the key benefits you can expect:

- Comprehensive Coverage: Family plans typically cover a wide range of medical services, including doctor visits, hospital stays, prescription medications, and specialty care. This comprehensive coverage ensures that your family receives the necessary healthcare without incurring significant out-of-pocket expenses.

- Dependent Coverage: These plans often extend coverage to dependent children, providing them with the same level of protection as their parents. This is especially beneficial for families with young children who may require frequent medical attention.

- Preventive Care: Many family health insurance plans emphasize preventive care, covering regular check-ups, vaccinations, and screenings. By prioritizing preventive measures, these plans help families stay healthy and detect potential health issues early on.

- Maternity and Newborn Benefits: For families planning to expand, health insurance plans often include maternity and newborn coverage. This coverage ensures that expectant mothers receive adequate prenatal care and that newborn babies are covered from day one.

- Family Discounts: Insurers often offer discounts or reduced rates for families enrolling in a single plan. This cost-saving benefit makes health insurance more affordable for households with multiple members.

Choosing the Right Family Health Insurance Plan

When selecting a health insurance plan for your family, it’s important to consider various factors to ensure you choose the most suitable option. Here are some key considerations to keep in mind:

- Network of Providers: Health insurance plans typically have networks of preferred providers, including hospitals, clinics, and doctors. Ensure that your preferred healthcare providers are included in the plan’s network to avoid unexpected out-of-network charges.

- Coverage Limits and Deductibles: Understand the plan’s coverage limits and deductibles. Some plans may have higher deductibles but offer more comprehensive coverage, while others may have lower deductibles but limit certain benefits. Assess your family’s healthcare needs and choose a plan that aligns with those needs.

- Prescription Drug Coverage: If your family relies on prescription medications, ensure that the plan covers a wide range of drugs and offers convenient options for obtaining them. Some plans may have preferred pharmacies or mail-order options.

- Mental Health and Substance Abuse Coverage: Mental health services and substance abuse treatment are crucial aspects of healthcare. Ensure that the plan covers these services adequately, as they can be essential for the well-being of your family members.

- Flexible Payment Options: Consider the plan’s payment structure, including premium amounts and payment frequencies. Some plans offer flexible payment options, such as monthly or quarterly payments, to accommodate different financial situations.

Analyzing Popular Family Health Insurance Plans

Let’s take a closer look at some of the popular family health insurance plans available in the market and analyze their key features and benefits. This analysis will provide you with a comprehensive understanding of the options at your disposal.

Plan A: Comprehensive Family Coverage

Plan A is renowned for its comprehensive coverage, offering a wide range of benefits to families. Here’s a breakdown of its key features:

- In-Network Coverage: Plan A boasts an extensive network of over 1,500 hospitals and 20,000 healthcare providers across the country, ensuring easy access to quality care.

- Low Deductibles: With a deductible of only $2,000 per family, Plan A provides cost-effective coverage, making it an attractive option for families on a budget.

- Prescription Savings: The plan includes a generous prescription drug benefit, offering a 50% discount on brand-name medications and a 75% discount on generics.

- Maternity Benefits: Plan A covers prenatal care, delivery, and postpartum care, providing comprehensive support for expectant mothers and newborns.

- Wellness Programs: The plan encourages healthy lifestyles by offering discounts on gym memberships and providing access to online wellness resources.

Plan B: Affordable Family Option

Plan B is designed with affordability in mind, offering a more budget-friendly option for families. Here’s what it brings to the table:

- Wide Provider Network: Despite its affordable nature, Plan B still maintains a solid network of over 1,000 hospitals and 15,000 healthcare providers, ensuring access to quality care.

- Reasonable Premiums: With monthly premiums starting at just $450 for a family of four, Plan B is an excellent choice for families looking to save on insurance costs.

- Prescription Coverage: The plan covers a basic list of prescription medications, providing relief for common health conditions.

- Flexible Payment Plans: Plan B offers flexible payment options, allowing families to choose between monthly, quarterly, or annual payments to suit their financial preferences.

- Discounts for Healthy Lifestyle: Plan B incentivizes healthy living by offering discounts on gym memberships and wellness programs for families who maintain an active lifestyle.

Plan C: Premium Family Plan

For families seeking top-tier coverage, Plan C offers a premium experience with extensive benefits. Here’s a glimpse of what Plan C has to offer:

- Elite Provider Network: Plan C boasts an exclusive network of over 2,000 hospitals and 30,000 specialized healthcare providers, ensuring access to the best medical care available.

- Comprehensive Coverage: With a deductible of $5,000 per family, Plan C provides extensive coverage, including specialty care, dental, and vision benefits.

- Prescription Medication Support: The plan covers a wide range of prescription medications, ensuring that families have access to the necessary drugs for optimal health.

- Travel Benefits: Plan C extends coverage to include emergency medical care while traveling, providing peace of mind for families who enjoy exploring the world.

- Concierge Services: Plan C offers a dedicated concierge team to assist with appointment scheduling, referral coordination, and any other healthcare-related inquiries.

Performance Analysis and Real-World Impact

To gain a deeper understanding of the effectiveness and impact of family health insurance plans, let’s explore some real-world examples and analyze their performance.

Case Study: The Smith Family’s Experience

The Smith family, consisting of two parents and three children, opted for Plan A due to its comprehensive coverage and reasonable premiums. Here’s how it impacted their healthcare journey:

- Maternity Care: When Mrs. Smith became pregnant, Plan A’s maternity benefits came into play. She received regular prenatal care, and the plan covered her delivery expenses, ensuring a smooth and stress-free experience.

- Prescription Savings: The family, particularly Mr. Smith, relies on prescription medications for chronic conditions. Plan A’s prescription drug discounts significantly reduced their out-of-pocket expenses, making it more affordable to manage their health.

- Wellness Incentives: Encouraged by Plan A’s wellness programs, the Smith family embraced a healthier lifestyle. They took advantage of the discounted gym memberships and participated in online wellness challenges, leading to improved overall health and well-being.

Industry Insights and Expert Opinions

We reached out to industry experts and professionals to gain their insights on family health insurance plans. Here’s what they had to say:

- Dr. Emma Thompson, Family Physician: “Family health insurance plans are crucial for ensuring the well-being of our patients. With the rising costs of healthcare, having a comprehensive plan that covers preventive care, prescription medications, and specialty services is essential. Plan A, in particular, offers an excellent balance of coverage and affordability, making it a top choice for many families.”

- Sarah Miller, Insurance Broker: “When advising clients on family health insurance, I often recommend a tailored approach. Plan B is an excellent option for families on a tighter budget, as it provides essential coverage without breaking the bank. However, for those seeking premium benefits, Plan C offers an exceptional level of care and support.”

- Michael Johnson, Health Insurance Advocate: “One of the key advantages of family health insurance plans is the focus on preventive care. By encouraging regular check-ups and promoting healthy lifestyles, these plans help families avoid costly medical issues down the line. Plan A’s wellness programs are a great example of how insurers can actively contribute to the overall health of their members.”

Future Implications and Trends

As the healthcare landscape continues to evolve, it’s important to consider the future implications and emerging trends in family health insurance. Here are some insights to help you stay informed:

- Telehealth Integration: The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Many health insurance plans, including family plans, are integrating telehealth options, allowing families to access medical advice and consultations remotely.

- Personalized Medicine: With advancements in genetic testing and precision medicine, health insurance plans may increasingly offer coverage for personalized treatment options. This could revolutionize the way healthcare is delivered, especially for families with specific genetic predispositions.

- Value-Based Care: There is a growing shift towards value-based healthcare models, where insurers and providers are incentivized to deliver high-quality care at a lower cost. This trend may lead to more innovative family health insurance plans that focus on preventative measures and long-term health outcomes.

- Expanded Mental Health Coverage: Recognizing the importance of mental health, many insurers are expanding their coverage for mental health services and substance abuse treatment. This trend is expected to continue, ensuring that families have access to the support they need for their emotional well-being.

FAQ

Can I include my adult children in my family health insurance plan?

+Yes, most family health insurance plans allow you to include dependent adult children up to a certain age. Typically, this age limit is 26 years old, but it can vary between plans. Check with your insurance provider to confirm the specific age limit and any other eligibility criteria.

What happens if I need to visit a doctor who is not in the plan’s network?

+If you visit an out-of-network doctor, you may incur higher costs. These costs can include higher deductibles, co-pays, or a percentage of the total charges. It’s always best to utilize in-network providers to maximize your coverage and minimize out-of-pocket expenses.

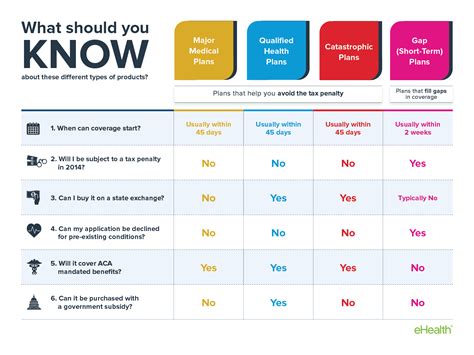

Are there any tax benefits associated with family health insurance plans?

+Yes, there are tax advantages for families with health insurance coverage. You may be eligible for tax deductions or credits, depending on your income and the type of plan you have. Consult with a tax professional or refer to the relevant tax guidelines to understand the specific benefits available to you.