Health Insurance Ppo Plans

Welcome to this comprehensive guide exploring the intricacies of Preferred Provider Organization (PPO) health insurance plans, a popular choice for individuals and families seeking flexibility and control over their healthcare decisions. With a PPO plan, you gain access to a broad network of healthcare providers while enjoying the freedom to visit specialists without a referral, making it a favored option for those who value convenience and personalized care. In this article, we will delve into the key features, benefits, and considerations of PPO plans, providing you with the insights you need to make informed decisions about your health coverage.

Understanding PPO Health Insurance Plans

A PPO health insurance plan is a type of medical coverage that offers a unique blend of flexibility and cost-saving opportunities. Unlike health maintenance organizations (HMOs), which often require you to choose a primary care physician and obtain referrals for specialist visits, PPOs provide you with more freedom to access healthcare services directly from a wide range of providers within their network.

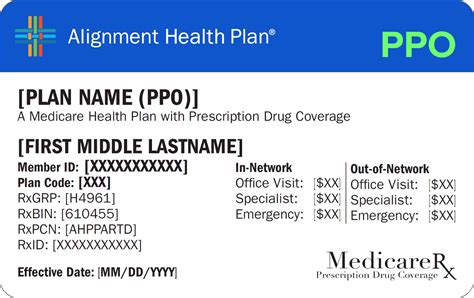

The cornerstone of a PPO plan is its provider network, which consists of healthcare professionals, facilities, and specialists who have agreed to offer their services at negotiated rates. This network is a key advantage, as it typically includes a large number of providers, giving you more options for receiving care. You can visit any provider within the network without a referral, providing you with the convenience of direct access to specialists.

One of the notable features of PPO plans is their cost-sharing structure. This means that you and your insurance provider share the financial responsibility for your healthcare expenses. Your out-of-pocket costs typically include a monthly premium, which you pay regardless of whether you use healthcare services, and other costs like deductibles, coinsurance, and copayments. These costs can vary based on the specific plan you choose and the services you utilize.

A key benefit of PPO plans is their out-of-network coverage. While utilizing in-network providers is often more cost-effective, PPOs also provide coverage for out-of-network services, albeit usually at a higher cost. This flexibility can be advantageous if you prefer a specific provider who is not part of the network or if you need to seek urgent care while traveling.

Key Features and Benefits of PPO Plans

Flexibility in Choosing Providers

One of the most appealing aspects of PPO plans is the freedom to choose your healthcare providers. With a PPO, you can directly access specialists without the need for a referral, a significant advantage over HMOs. This flexibility allows you to build a healthcare team that aligns with your specific needs and preferences.

Broad Network of Providers

PPO plans typically boast an extensive network of healthcare providers, including doctors, hospitals, and specialists. This network is carefully curated to offer a diverse range of healthcare services, ensuring that you can find the right care, regardless of your location or medical needs.

Direct Access to Specialists

A unique feature of PPO plans is the ability to visit specialists directly. This means you can schedule appointments with specialists, such as cardiologists or dermatologists, without the hassle of obtaining a referral from your primary care physician. This direct access can be particularly beneficial for individuals with specific medical conditions or those who require ongoing specialized care.

Out-of-Network Coverage

PPO plans offer coverage for out-of-network providers, although at a higher cost. This feature provides peace of mind, especially for individuals who travel frequently or prefer specific healthcare providers outside the network. It ensures that you have access to a broader range of healthcare options without worrying about being left uninsured.

Lower Out-of-Pocket Costs for In-Network Care

Utilizing in-network providers often results in lower out-of-pocket expenses. This is because PPO plans have negotiated rates with these providers, which can lead to reduced costs for you. Whether it’s a lower deductible, coinsurance, or copayment, choosing in-network care can significantly impact your overall healthcare expenses.

Considerations and Potential Drawbacks

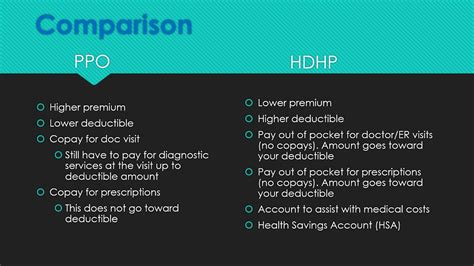

Higher Premiums and Out-of-Pocket Costs

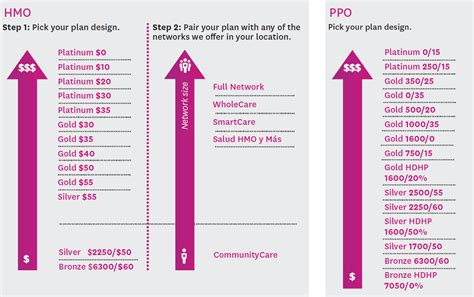

While PPO plans offer numerous benefits, they often come with higher monthly premiums compared to other types of health insurance plans. Additionally, out-of-pocket costs, such as deductibles and coinsurance, can be substantial, especially if you frequently utilize healthcare services.

Limited Provider Network

Despite the extensive network of providers, PPO plans may still have restrictions on certain specialists or facilities. This means that while you have a wide range of options, there may be specific providers or services that are not included in the network, potentially limiting your choices.

Potential for Higher Costs with Out-of-Network Care

While out-of-network coverage is a significant advantage, it’s essential to understand that utilizing out-of-network providers can result in higher costs. These costs are typically not covered at the same level as in-network care, and you may be responsible for a larger portion of the expenses. It’s crucial to carefully review your plan’s out-of-network coverage and consider the potential financial implications.

Choosing the Right PPO Plan

When selecting a PPO health insurance plan, it’s crucial to consider your specific healthcare needs and financial situation. Here are some key factors to keep in mind:

- Network of Providers: Ensure that the plan's network includes your preferred healthcare providers and facilities. This is especially important if you have ongoing medical conditions or require specialized care.

- Cost-Sharing Structure: Carefully review the plan's cost-sharing arrangement, including premiums, deductibles, coinsurance, and copayments. Consider your anticipated healthcare expenses and choose a plan that aligns with your budget.

- Out-of-Network Coverage: Assess your travel plans and preferences for specific providers. If you anticipate needing out-of-network care, ensure that the plan offers adequate coverage to avoid unexpected expenses.

- Benefits and Coverage: Review the plan's benefits, such as prescription drug coverage, mental health services, and preventive care. Ensure that the plan provides comprehensive coverage for your specific healthcare needs.

Performance Analysis and Real-World Examples

To illustrate the practical application of PPO plans, let’s consider a real-world scenario. Imagine a family with a history of cardiovascular issues. They opt for a PPO plan due to the flexibility it offers in accessing cardiology specialists without referrals. This allows them to build a comprehensive healthcare team, including cardiologists, primary care physicians, and other specialists, all while managing their out-of-pocket costs through the plan’s cost-sharing structure.

In this scenario, the family benefits from the PPO plan's extensive network, which includes top-rated cardiology centers and specialists. They can schedule appointments directly with these providers, ensuring timely and specialized care. The plan's out-of-network coverage also provides peace of mind, as it covers emergency care should they need it while traveling.

Furthermore, by choosing a PPO plan with a cost-sharing structure that aligns with their budget, the family can effectively manage their healthcare expenses. They can make informed decisions about their care, knowing that their out-of-pocket costs are predictable and within their means.

| PPO Plan | Provider Network | Out-of-Network Coverage | Cost-Sharing Structure |

|---|---|---|---|

| Plan A | Large network of providers, including specialists | Good coverage for out-of-network care | Higher premiums, moderate deductibles |

| Plan B | Extensive network with a focus on primary care | Limited coverage for out-of-network services | Lower premiums, higher coinsurance |

| Plan C | Network includes top-rated hospitals and facilities | Full coverage for out-of-network providers | Moderate premiums, high deductibles |

Future Implications and Industry Insights

As the healthcare industry continues to evolve, PPO plans are expected to remain a popular choice for individuals and families seeking flexibility and control over their healthcare decisions. The focus on patient-centric care and the ability to directly access specialists without referrals align with the modern healthcare landscape.

Looking ahead, we can anticipate further innovations in PPO plans, driven by advancements in technology and changing consumer preferences. The integration of digital health solutions, such as telemedicine and remote monitoring, may become more prevalent, offering convenient and cost-effective alternatives to traditional in-person visits.

Additionally, as the industry moves towards value-based care models, PPO plans may evolve to include incentives and rewards for maintaining good health and actively managing chronic conditions. This shift towards preventative care and patient engagement could lead to more affordable and accessible healthcare options for PPO plan members.

In conclusion, PPO health insurance plans offer a compelling blend of flexibility, provider choice, and cost-saving opportunities. By understanding the key features, benefits, and considerations of PPO plans, individuals and families can make informed decisions about their healthcare coverage, ensuring access to quality care while managing their financial well-being.

How do PPO plans differ from HMOs?

+PPO plans offer more flexibility in choosing providers and accessing specialists without referrals, while HMOs typically require you to choose a primary care physician and obtain referrals for specialist visits.

What is the cost-sharing structure in PPO plans?

+Cost-sharing in PPO plans involves sharing financial responsibility with the insurance provider. This includes monthly premiums, deductibles, coinsurance, and copayments.

Can I visit any provider with a PPO plan?

+Yes, PPO plans typically allow you to visit any provider within their network without a referral. However, out-of-network providers may be covered at a higher cost.