Health Insurance Rates

Health insurance is an essential aspect of modern healthcare systems, providing individuals and families with financial protection and access to necessary medical services. The rates and costs associated with health insurance plans can vary significantly, influenced by various factors such as age, location, pre-existing conditions, and the level of coverage desired. Understanding the dynamics of health insurance rates is crucial for individuals seeking affordable and comprehensive healthcare coverage. In this comprehensive article, we will delve into the factors that impact health insurance rates, explore strategies for obtaining affordable plans, and discuss the future trends and implications in the healthcare insurance landscape.

Understanding Health Insurance Rates: Key Factors and Variables

Health insurance rates are influenced by a multitude of factors, each playing a significant role in determining the overall cost of coverage. Here are some key elements that shape the pricing landscape:

Age and Gender

One of the primary determinants of health insurance rates is age. In general, younger individuals tend to have lower rates as they are statistically less likely to require extensive medical care. Conversely, older adults, particularly those over 60, often face higher premiums due to an increased risk of developing health conditions. Gender can also be a factor, with some insurance providers offering gender-specific plans or adjusting rates based on statistical health risks associated with each gender.

| Age Group | Average Monthly Premium |

|---|---|

| 18-25 | $250 - $350 |

| 26-35 | $300 - $450 |

| 36-45 | $400 - $600 |

| 46-55 | $500 - $800 |

| 56-65 | $650 - $1,200 |

It's important to note that while age and gender are significant factors, they are not the sole determinants of insurance rates. Other variables, such as location and health status, also play crucial roles.

Geographic Location

Health insurance rates can vary significantly based on an individual’s geographic location. Factors such as the cost of living, local healthcare infrastructure, and the prevalence of certain health conditions in a particular region can influence insurance premiums. Urban areas, for instance, often have higher rates due to the concentration of medical facilities and specialists, while rural areas may experience lower rates due to a more dispersed healthcare network.

| Region | Average Annual Premium |

|---|---|

| Urban | $6,000 - $9,000 |

| Suburban | $5,500 - $7,500 |

| Rural | $4,500 - $6,500 |

Health Status and Pre-existing Conditions

An individual’s health status and the presence of pre-existing conditions can significantly impact insurance rates. Insurance providers carefully assess an applicant’s medical history to evaluate the potential risk associated with providing coverage. Those with a history of chronic illnesses, serious medical conditions, or ongoing treatments may face higher premiums or even be denied coverage by certain providers.

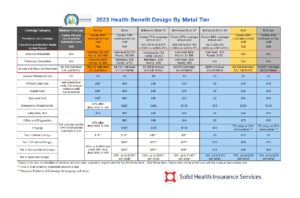

Coverage Level and Deductibles

The level of coverage and the associated deductibles are critical factors in determining insurance rates. Higher coverage plans, such as those with lower deductibles and extensive benefits, typically come with higher premiums. On the other hand, plans with higher deductibles and more limited coverage may offer more affordable monthly premiums.

| Coverage Type | Average Monthly Premium |

|---|---|

| Platinum (Low Deductible) | $550 - $800 |

| Gold (Moderate Deductible) | $400 - $550 |

| Silver (High Deductible) | $300 - $450 |

Provider Networks and Out-of-Pocket Costs

The choice of healthcare providers and the extent of coverage within their networks can affect insurance rates. Plans with narrower provider networks and more limited coverage options may offer lower premiums, while plans with extensive networks and a wide range of covered services often come with higher costs.

Additionally, out-of-pocket costs, such as copayments and coinsurance, can vary significantly between plans. These costs directly impact an individual's financial responsibility for healthcare services, and plans with lower out-of-pocket costs may have higher premiums to offset the increased financial burden on the insurance provider.

Strategies for Obtaining Affordable Health Insurance

Given the complexity of health insurance rates, finding an affordable plan that meets individual needs can be challenging. However, by implementing strategic approaches and considering various options, individuals can navigate the healthcare insurance landscape more effectively.

Utilizing Government Programs and Subsidies

Government-sponsored health insurance programs, such as Medicaid and the Children’s Health Insurance Program (CHIP), offer affordable coverage options for eligible individuals and families. These programs provide financial assistance to ensure access to essential healthcare services, particularly for those with low incomes or specific health needs.

Additionally, the Affordable Care Act (ACA) introduced the Health Insurance Marketplace, allowing individuals to compare and purchase health insurance plans. The ACA also provides subsidies and tax credits to eligible individuals, making health insurance more affordable and accessible.

Employer-Sponsored Health Insurance

Many employers offer health insurance benefits as part of their employee compensation packages. These plans often provide comprehensive coverage at reduced rates due to the large group size and collective bargaining power. By enrolling in employer-sponsored plans, individuals can access affordable healthcare coverage and potentially receive additional benefits, such as wellness programs or discounted services.

Shopping for Individual Plans

For individuals who are not eligible for government programs or do not have access to employer-sponsored insurance, shopping for individual plans is an essential step. Comparing different insurance providers, plan options, and coverage levels can help individuals identify the most suitable and affordable plan for their needs.

When shopping for individual plans, it's crucial to consider factors such as provider networks, out-of-pocket costs, and the overall value of the coverage. Utilizing online comparison tools and seeking guidance from insurance brokers or agents can streamline the process and ensure a more informed decision.

Exploring Alternative Insurance Options

In addition to traditional health insurance plans, there are alternative options that can provide cost-effective coverage for specific healthcare needs. These alternatives include short-term health insurance plans, limited benefit plans, and health sharing ministries.

Short-term health insurance plans offer temporary coverage for individuals between jobs or those who are transitioning between insurance plans. Limited benefit plans focus on specific healthcare needs, such as accident coverage or dental care, and are often more affordable than comprehensive plans. Health sharing ministries are faith-based organizations that provide healthcare coverage through shared financial contributions, offering an alternative to traditional insurance models.

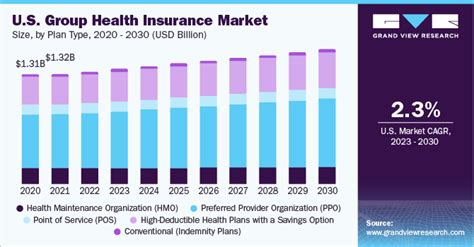

The Future of Health Insurance: Trends and Implications

The healthcare insurance landscape is continually evolving, driven by technological advancements, policy changes, and shifting societal needs. Understanding the future trends and implications can provide valuable insights for individuals and policymakers alike.

Technological Advancements and Digital Health Solutions

The integration of technology into healthcare is revolutionizing the insurance industry. Digital health solutions, such as telemedicine and wearable health devices, are transforming the way healthcare services are delivered and monitored. These advancements can lead to more efficient and cost-effective healthcare delivery, potentially reducing the overall cost of insurance.

Telemedicine, for instance, allows individuals to access medical consultations and treatment remotely, eliminating the need for in-person visits in certain cases. This not only improves access to healthcare but also reduces the administrative burden on insurance providers, potentially lowering insurance rates.

Policy Changes and Healthcare Reform

Policy changes and healthcare reforms can significantly impact the insurance landscape. The implementation of the Affordable Care Act (ACA) in the United States, for example, has expanded access to healthcare and introduced subsidies to make insurance more affordable. Future policy initiatives, such as expanding Medicaid coverage or introducing universal healthcare, could further transform the insurance market.

Additionally, ongoing debates surrounding healthcare policy, such as the expansion of Medicare coverage or the introduction of public insurance options, can shape the future of insurance rates and accessibility.

Shifting Demographics and Health Needs

The aging population and the changing health needs of individuals are influencing the demand for healthcare services and, consequently, insurance rates. As the population ages, the prevalence of chronic illnesses and age-related health conditions increases, impacting the cost of healthcare and insurance premiums.

Furthermore, the rise of lifestyle-related health issues, such as obesity and mental health disorders, is driving the need for specialized healthcare services and treatment options. Addressing these emerging health needs will require innovative insurance models and coverage strategies to ensure affordable and accessible care.

Incentivizing Healthy Lifestyles and Preventive Care

Promoting healthy lifestyles and preventive care can have a significant impact on reducing healthcare costs and, consequently, insurance rates. Insurance providers are increasingly implementing wellness programs and incentives to encourage individuals to adopt healthier habits and seek preventive care.

By focusing on preventive measures, such as regular check-ups, vaccinations, and lifestyle modifications, insurance providers can potentially reduce the need for costly medical interventions and treatments. This shift towards preventive care can lead to more sustainable and affordable insurance models, benefiting both individuals and insurance providers.

Conclusion

Navigating the complexities of health insurance rates requires a comprehensive understanding of the various factors that influence pricing. From age and gender to geographic location and health status, each element plays a role in shaping the cost of coverage. By implementing strategic approaches, utilizing government programs, and exploring alternative insurance options, individuals can access affordable healthcare coverage that meets their unique needs.

Looking ahead, the future of health insurance is poised for significant changes. Technological advancements, policy reforms, and shifting demographic trends will continue to shape the insurance landscape. By embracing these changes and adapting to emerging healthcare needs, insurance providers can develop innovative models that offer affordable and comprehensive coverage to individuals and families.

As we move forward, it is crucial to remain informed about the evolving healthcare insurance landscape. By staying up-to-date with policy changes, technological advancements, and industry trends, individuals can make more informed decisions about their healthcare coverage, ensuring access to quality care at a reasonable cost.

What is the average cost of health insurance in the United States?

+

The average cost of health insurance in the United States can vary significantly based on factors such as age, location, and coverage level. According to recent data, the average monthly premium for an individual health insurance plan is approximately 450, while family plans can cost upwards of 1,500 per month. It’s important to note that these averages can vary greatly depending on the specific plan and region.

Are there ways to reduce health insurance costs without sacrificing coverage?

+

Yes, there are several strategies to reduce health insurance costs while still maintaining adequate coverage. One approach is to consider high-deductible health plans (HDHPs) paired with a Health Savings Account (HSA). HDHPs often have lower premiums, and individuals can save pre-tax dollars in an HSA to cover out-of-pocket expenses. Additionally, utilizing preventive care services and staying up-to-date with recommended screenings can help prevent costly health issues down the line.

How do health insurance rates vary by state in the US?

+

Health insurance rates can vary significantly by state due to factors such as the cost of living, the availability of healthcare providers, and state-specific regulations. For example, states with a higher cost of living, such as California and New York, often have higher insurance premiums. Additionally, states with more comprehensive healthcare mandates may have higher average rates.