Health Insurance Rates By State

In the United States, health insurance rates can vary significantly from state to state due to various factors such as population demographics, healthcare infrastructure, and state-specific regulations. Understanding these variations is crucial for individuals, families, and businesses when selecting the most suitable and cost-effective health coverage options.

This comprehensive guide aims to delve into the intricate landscape of health insurance rates across different states, offering an in-depth analysis of the factors influencing these rates and providing valuable insights to help navigate the complex world of healthcare coverage.

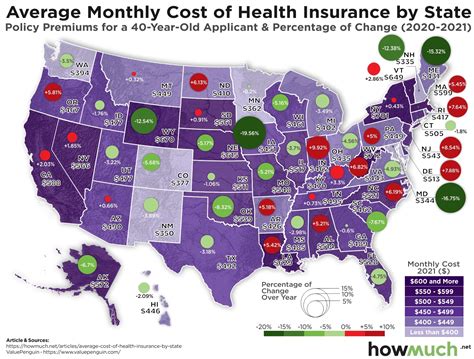

State-by-State Breakdown of Health Insurance Rates

The cost of health insurance is influenced by a multitude of factors, including the state's demographic makeup, prevalence of chronic illnesses, and the availability and cost of healthcare services. Let's explore some key insights into health insurance rates state by state.

California: A Diverse Market

California boasts the largest population in the U.S., which contributes to a diverse healthcare landscape. The Golden State offers a range of health insurance options, from major providers like Blue Shield and Anthem to smaller, local carriers. According to recent data, the average monthly premium for a single policy in California is $529, while family plans average $1,594.

However, it's important to note that these rates can vary significantly based on the region within the state. For instance, the San Francisco Bay Area tends to have higher premiums due to the concentration of tech industries and higher-income residents, while more rural areas may offer more affordable options.

Texas: A Complex Market

Texas, known for its diverse geography and population, presents a complex market for health insurance. The state has a large population of uninsured individuals, which can drive up rates for those seeking coverage. Additionally, Texas has a high number of residents with pre-existing conditions, further impacting insurance rates.

The average monthly premium for a single policy in Texas is $425, while family plans average $1,275. It's worth noting that the state's unique healthcare landscape, with its mix of urban and rural areas, can result in wide variations in rates within different regions.

New York: High Costs, Comprehensive Coverage

New York is renowned for its high cost of living, and this extends to healthcare. The state's average monthly premium for a single policy is $620, one of the highest in the nation. Family plans average a steep $1,980 per month.

Despite the high costs, New York offers some of the most comprehensive health insurance coverage in the country. The state's robust regulations ensure that insurance providers offer a wide range of benefits, including coverage for pre-existing conditions and essential health services.

Florida: Affordable Options for Seniors

Florida is a popular retirement destination, which has led to a unique health insurance market. The state has a high concentration of Medicare plans, catering to its large senior population. As a result, Florida offers some of the most affordable Medicare options in the country.

For younger individuals, however, the average monthly premium for a single policy is $480, which is slightly higher than the national average. Family plans in Florida average $1,440 per month.

Massachusetts: A Leader in Healthcare Reform

Massachusetts has been at the forefront of healthcare reform, implementing some of the most progressive policies in the nation. The state's average monthly premium for a single policy is $560, while family plans average $1,680.

One of the key features of Massachusetts' healthcare system is its robust individual mandate, which requires all residents to have health insurance. This has led to a significant reduction in the number of uninsured individuals and has contributed to more stable insurance rates.

Comparative Analysis: State-Specific Factors

When comparing health insurance rates across states, it's crucial to consider the unique factors that influence these rates. Here's a breakdown of some key considerations:

- Population Demographics: States with a higher proportion of young, healthy individuals may offer more affordable rates. Conversely, states with an older population or a high prevalence of chronic illnesses may have higher premiums.

- Healthcare Infrastructure: The availability and cost of healthcare services can vary significantly across states. States with a higher concentration of hospitals, specialists, and advanced medical facilities may experience higher insurance rates.

- State Regulations: Each state has its own set of insurance regulations, which can impact the cost and coverage of health insurance plans. Some states, like Massachusetts, have implemented progressive policies that can stabilize rates, while others may have more lenient regulations that can lead to higher costs.

| State | Average Monthly Premium (Single) | Average Monthly Premium (Family) |

|---|---|---|

| California | $529 | $1,594 |

| Texas | $425 | $1,275 |

| New York | $620 | $1,980 |

| Florida | $480 | $1,440 |

| Massachusetts | $560 | $1,680 |

The Impact of Healthcare Reform on Insurance Rates

Healthcare reform has been a significant driver of change in the insurance landscape. Let's explore how federal and state-level reforms have influenced health insurance rates and coverage.

The Affordable Care Act (ACA)

The ACA, often referred to as Obamacare, was a landmark healthcare reform law passed in 2010. It aimed to increase the quality and affordability of health insurance for all Americans. The law introduced several key provisions, including:

- Individual Mandate: Requiring most Americans to have health insurance or face a penalty.

- Expansion of Medicaid: Providing coverage to low-income individuals and families.

- Guaranteed Issue: Ensuring that insurance companies cannot deny coverage based on pre-existing conditions.

- Essential Health Benefits: Mandating that all plans cover a set of basic health services.

The ACA has had a significant impact on insurance rates. While it has made coverage more accessible for many, it has also contributed to rising premiums in some states. The individual mandate, in particular, has played a role in stabilizing the insurance market by reducing the number of uninsured individuals, which can help prevent adverse selection and keep rates more consistent.

State-Level Reforms

In addition to federal reforms, many states have implemented their own healthcare initiatives. For instance, Massachusetts' healthcare reform law, passed in 2006, served as a model for the ACA. The state's reforms have resulted in a significant reduction in the uninsured rate and have helped stabilize insurance rates.

Other states, like New York, have focused on expanding access to healthcare and improving coverage. New York's Essential Plan, for example, provides low-cost coverage to individuals earning up to 200% of the federal poverty level. These state-level initiatives can have a direct impact on insurance rates within their respective states.

Strategies for Finding Affordable Health Insurance

Navigating the complex world of health insurance can be daunting, especially when rates vary so significantly across states. Here are some strategies to help you find the most affordable and comprehensive coverage for your needs.

Shop Around and Compare Plans

Don't settle for the first plan you find. Take the time to research and compare different insurance options. Many states have insurance marketplaces, like Healthcare.gov, where you can browse and compare plans. Look for plans that offer the coverage you need at a price that fits your budget.

Understand Your Coverage Needs

Before selecting a plan, assess your healthcare needs. Consider your regular medical expenses, prescription costs, and any specific health concerns you or your family may have. Choose a plan that covers these needs without unnecessary extras that could drive up your premium.

Take Advantage of Subsidies and Tax Credits

If you're eligible, take advantage of the subsidies and tax credits available through the ACA. These can significantly reduce your insurance costs. The amount of subsidy you receive is based on your income and the cost of insurance in your area. You can apply for these credits when you purchase your insurance plan.

Consider Short-Term or Catastrophic Plans

If you're generally healthy and don't anticipate significant medical expenses, you may want to consider a short-term or catastrophic plan. These plans offer basic coverage at a lower cost but may not cover all essential health benefits. They can be a good option for those who are between jobs or who are looking for temporary coverage.

The Future of Health Insurance Rates

The landscape of health insurance rates is constantly evolving, influenced by ongoing healthcare reforms, technological advancements, and shifting demographics. Let's explore some potential trends and developments that could shape the future of health insurance rates.

Telehealth and Digital Innovations

The COVID-19 pandemic has accelerated the adoption of telehealth services, which allow patients to receive medical care remotely. This trend is likely to continue, offering more convenient and cost-effective healthcare options. Insurance providers may adjust their rates to accommodate these digital innovations, potentially leading to more affordable coverage for routine care.

Focus on Preventive Care

Preventive care, which aims to prevent illness and promote health, is gaining increasing attention in the healthcare industry. Insurance providers may incentivize policyholders to engage in preventive measures, such as regular check-ups and screenings, by offering discounts or other benefits. This shift towards preventive care could help control healthcare costs and potentially reduce insurance premiums over time.

Embracing Value-Based Care

Value-based care models, which focus on delivering high-quality healthcare outcomes while controlling costs, are becoming more prevalent. These models incentivize providers to deliver efficient, coordinated care, which can lead to better health outcomes and potentially lower healthcare costs. As value-based care gains traction, insurance rates may adjust to reflect the shift towards more cost-effective healthcare delivery.

FAQs

What is the average cost of health insurance in the U.S.?

+The average cost of health insurance in the U.S. varies depending on several factors, including the state, the type of plan (individual or family), and the level of coverage. As of recent data, the average monthly premium for an individual policy is around 450, while family plans average approximately 1,350 per month.

How do I find the most affordable health insurance plan for my needs?

+To find the most affordable plan, start by assessing your healthcare needs and budget. Then, compare plans from different insurance providers, taking into account the coverage offered and any additional benefits or discounts. You can also explore options like short-term or catastrophic plans, which may offer lower premiums for those with fewer healthcare needs.

Are there any programs or subsidies available to help with insurance costs?

+Yes, there are several programs and subsidies available to help make health insurance more affordable. The Affordable Care Act (ACA) offers tax credits and subsidies to eligible individuals and families. Additionally, many states have their own programs to assist with insurance costs, particularly for low-income residents. It’s worth researching these options to see if you qualify.

How do I know if I’m eligible for Medicaid or other government-assisted programs?

+Eligibility for Medicaid and other government-assisted programs varies by state and depends on factors such as income, family size, and age. You can check your eligibility through your state’s Medicaid agency or by using online tools provided by government healthcare websites. These resources will guide you through the process and help you understand your options.

What impact has the Affordable Care Act had on insurance rates and coverage?

+The Affordable Care Act (ACA) has had a significant impact on insurance rates and coverage. It introduced reforms such as the individual mandate, Medicaid expansion, and guaranteed issue, which have made insurance more accessible and affordable for many. While the ACA has contributed to rising premiums in some states, it has also helped stabilize the insurance market and ensure more comprehensive coverage.