Healthcare Insurance California

Healthcare insurance is a vital aspect of modern life, and in the state of California, it plays a significant role in ensuring residents have access to quality healthcare services. With a diverse population and a robust healthcare system, California has implemented various initiatives and programs to make health insurance more accessible and affordable. This article delves into the intricacies of healthcare insurance in California, exploring its unique features, benefits, and the impact it has on individuals and families across the state.

Understanding Healthcare Insurance in California

California’s healthcare insurance landscape is shaped by a combination of federal and state regulations, as well as the state’s commitment to providing comprehensive healthcare coverage. The state has taken proactive measures to expand healthcare access, especially after the implementation of the Affordable Care Act (ACA) in 2010.

The Affordable Care Act (ACA) and Its Impact

The ACA, also known as Obamacare, has had a profound influence on healthcare insurance in California. This landmark legislation introduced several key provisions that have benefited Californians, including the expansion of Medicaid (known as Medi-Cal in California), the establishment of health insurance marketplaces, and the implementation of essential health benefits.

Under the ACA, California has seen a significant increase in the number of residents with health insurance coverage. According to a report by the California Health Care Foundation, the uninsured rate in the state dropped from 17.2% in 2013 (pre-ACA) to 7.5% in 2019. This reduction in the uninsured population has led to improved access to healthcare services and better overall health outcomes.

California’s Health Insurance Marketplace

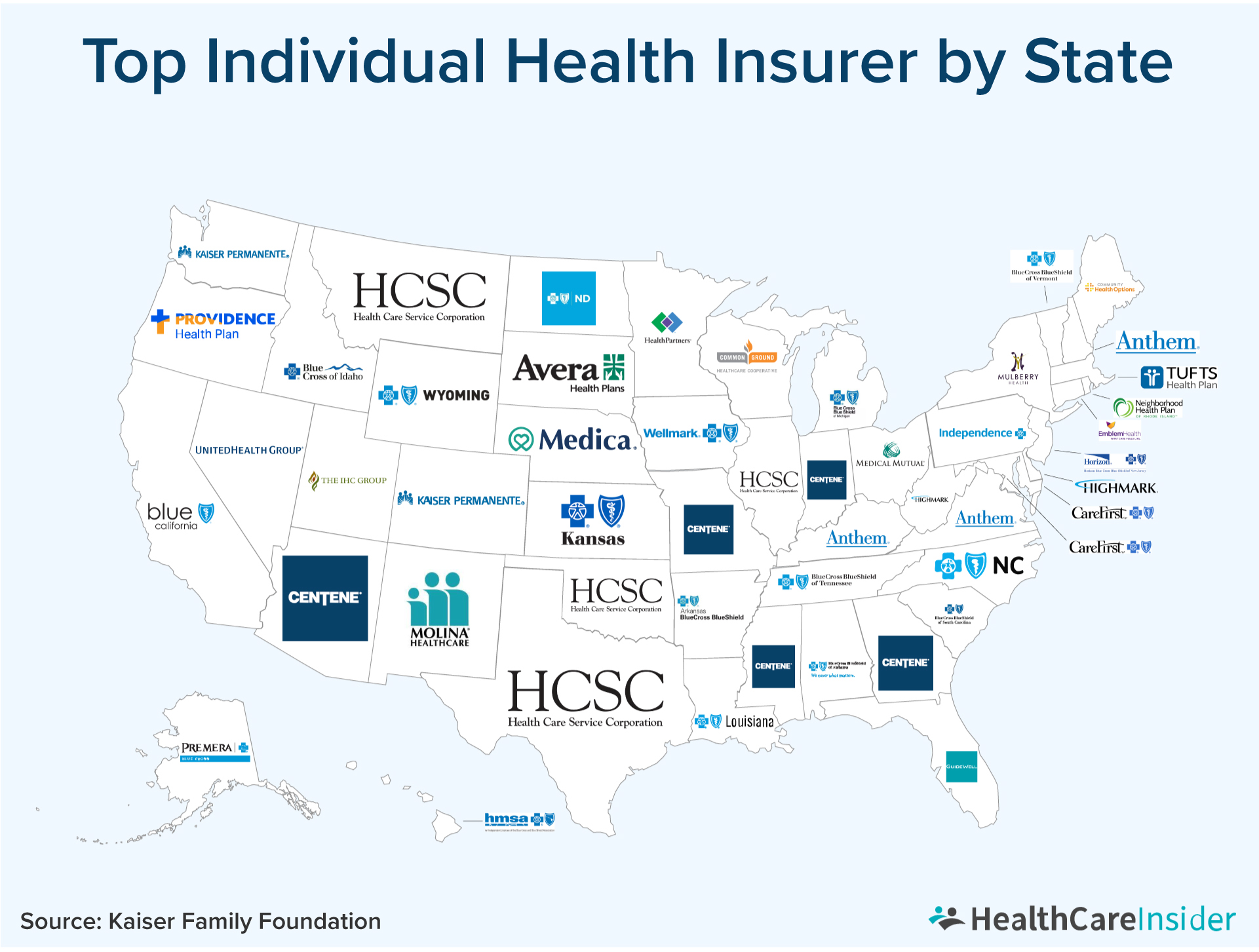

California’s health insurance marketplace, known as Covered California, is a key component of the state’s healthcare insurance system. This online marketplace was established to help individuals and families find and enroll in affordable health insurance plans. Covered California offers a range of plans from various insurance carriers, providing residents with choices based on their specific needs and budgets.

| Health Insurance Carriers on Covered California |

|---|

| Anthem Blue Cross |

| Blue Shield of California |

| Health Net |

| Kaiser Permanente |

| Molina Healthcare |

| Oscar Health |

| Sharp Health Plan |

Covered California also provides financial assistance in the form of premium tax credits and cost-sharing reductions to eligible individuals and families. These subsidies help reduce the cost of insurance premiums and out-of-pocket expenses, making healthcare more affordable for many Californians.

Key Features of Healthcare Insurance in California

Healthcare insurance in California offers a range of benefits and protections that contribute to the overall well-being of its residents. Here are some key features:

Essential Health Benefits

Under the ACA, health insurance plans in California, as well as across the nation, are required to cover a set of essential health benefits. These benefits include:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services

- Laboratory services

- Preventive and wellness services

- Pediatric services, including oral and vision care

These essential health benefits ensure that Californians have access to a comprehensive range of healthcare services, promoting overall health and well-being.

Pre-Existing Condition Coverage

One of the most significant protections offered by healthcare insurance in California is the coverage of pre-existing conditions. Prior to the ACA, individuals with pre-existing health conditions often faced challenges in obtaining affordable health insurance. However, the ACA prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions.

This protection is particularly beneficial for Californians who have chronic illnesses, have survived cancer, or have other health conditions that could otherwise make insurance coverage difficult to obtain. It ensures that everyone has an equal opportunity to access quality healthcare, regardless of their medical history.

Preventive Care Services

Healthcare insurance plans in California often include a wide range of preventive care services at no additional cost to the insured. These services aim to promote early detection, prevent disease, and improve overall health. Some common preventive care services covered include:

- Annual physical exams

- Cancer screenings (e.g., mammograms, colonoscopies)

- Immunizations and vaccines

- Prenatal and postpartum care

- Cholesterol and blood pressure screenings

- Well-child visits and vaccinations

By encouraging individuals to prioritize preventive care, healthcare insurance in California contributes to the early identification and management of health issues, leading to better long-term health outcomes.

Network of Healthcare Providers

Healthcare insurance plans in California typically come with a network of healthcare providers, including doctors, specialists, hospitals, and other medical facilities. These networks ensure that insured individuals have access to a wide range of healthcare professionals and services within their insurance plan’s coverage area.

When choosing a health insurance plan, Californians can review the plan's provider network to ensure that their preferred healthcare providers are included. This allows individuals to maintain continuity of care and choose providers they trust and feel comfortable with.

Healthcare Insurance Options in California

Californians have various healthcare insurance options to choose from, depending on their eligibility and preferences. Here are some of the primary types of insurance plans available in the state:

Individual and Family Plans

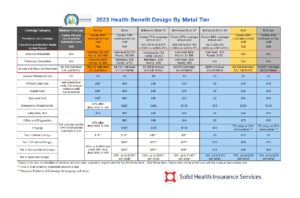

Individual and family plans are purchased by individuals or families directly from insurance carriers or through Covered California. These plans offer a range of coverage options, including different levels of deductibles, copayments, and out-of-pocket maximums. Californians can compare plans based on their healthcare needs and budget to find the best fit.

Employer-Sponsored Plans

Many employers in California offer healthcare insurance as a benefit to their employees. These plans are often more cost-effective for employees, as employers typically contribute a portion of the premium. Employees may have the option to choose from different plans offered by the employer, with varying levels of coverage and cost-sharing.

Medi-Cal (California’s Medicaid Program)

Medi-Cal is California’s Medicaid program, providing healthcare coverage to low-income individuals and families. This program is funded jointly by the state and federal governments and is designed to ensure that vulnerable populations have access to essential healthcare services. Eligibility for Medi-Cal is based on income and certain other criteria, such as pregnancy or disability.

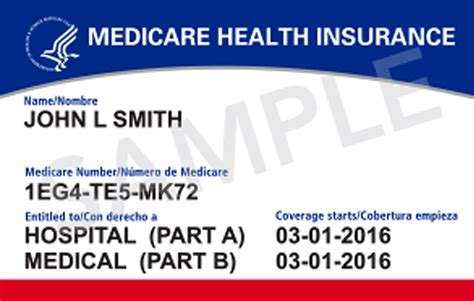

Medicare Advantage Plans

For individuals who are eligible for Medicare (typically those aged 65 and older), Medicare Advantage plans offer an alternative to traditional Medicare. These plans are offered by private insurance companies and provide all the benefits of original Medicare (Parts A and B) and often include additional benefits, such as prescription drug coverage and vision care.

Future Implications and Ongoing Efforts

While California has made significant strides in expanding healthcare insurance coverage, there are ongoing efforts to improve access and affordability. The state continues to advocate for healthcare reform at the federal level and is exploring innovative ways to enhance its healthcare system.

Addressing Rising Healthcare Costs

One of the primary challenges in the healthcare industry is the rising cost of healthcare services. California is actively working to address this issue by implementing strategies to control costs and improve efficiency. This includes initiatives to promote value-based care, where healthcare providers are incentivized to deliver high-quality, cost-effective care.

Expanding Access to Mental Health Services

Mental health is a critical component of overall well-being, and California recognizes the importance of expanding access to mental health services. The state is investing in initiatives to improve mental health coverage, reduce stigma, and increase the availability of mental health professionals, especially in underserved communities.

Promoting Health Equity

California is committed to promoting health equity, ensuring that all residents have equal access to quality healthcare, regardless of their background or socioeconomic status. This includes efforts to address disparities in healthcare outcomes among different racial and ethnic groups, as well as initiatives to improve healthcare access in rural and underserved areas.

Adapting to Technological Advances

The healthcare industry is rapidly evolving with technological advancements, and California is at the forefront of adopting innovative solutions. From telemedicine services to electronic health records, the state is leveraging technology to improve access to healthcare, enhance patient engagement, and streamline administrative processes.

Conclusion

Healthcare insurance in California is a dynamic and ever-evolving landscape, shaped by federal and state regulations, as well as the state’s commitment to ensuring accessible and affordable healthcare for its residents. From the implementation of the ACA to the establishment of Covered California, California has taken significant steps to expand healthcare coverage and improve overall health outcomes.

As the state continues to address ongoing challenges and explore new opportunities, the future of healthcare insurance in California looks promising. With a focus on cost control, mental health, health equity, and technological innovation, California is well-positioned to provide its residents with the healthcare services they need and deserve.

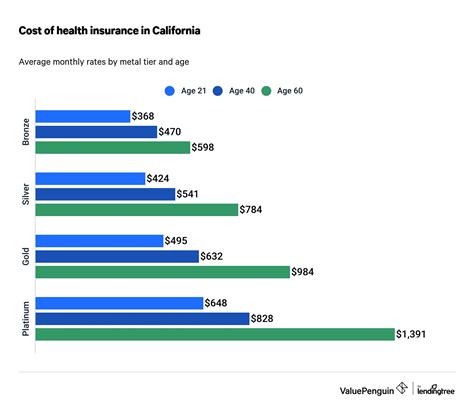

What is the average cost of healthcare insurance in California?

+The average cost of healthcare insurance in California varies based on factors such as age, location, and the level of coverage chosen. According to a 2022 report by the California Health Care Foundation, the average monthly premium for an individual bronze plan on Covered California was around 520, while the average for a silver plan was approximately 610. However, with financial assistance, many Californians pay significantly less.

How can I find out if I’m eligible for Medi-Cal?

+To determine your eligibility for Medi-Cal, you can visit the official Medi-Cal website or use the Covered California eligibility tool. These resources will guide you through the eligibility criteria, which are based on factors such as income, household size, and citizenship status.

Are there any programs to help with healthcare insurance costs for low-income families in California?

+Yes, California offers several programs to assist low-income families with healthcare insurance costs. In addition to Medi-Cal, there are programs like the Healthy Families Program and the Access for Infants and Mothers (AIM) Program. These programs provide affordable healthcare coverage to eligible families, ensuring access to essential medical services.

Can I switch healthcare insurance plans during the year in California?

+In California, you can typically switch healthcare insurance plans during the annual open enrollment period, which usually runs from November to January. However, there may be special enrollment periods if you experience certain life events, such as losing your job or getting married. It’s important to review the specific guidelines and timelines for plan changes.

What resources are available for individuals with limited English proficiency seeking healthcare insurance in California?

+California recognizes the importance of providing language access in healthcare. Covered California offers multilingual support, including a dedicated phone line and written materials in multiple languages. Additionally, many healthcare providers and insurance companies in the state provide language services to assist individuals with limited English proficiency.