Healthcare Insurance In Nj

Healthcare insurance is an essential aspect of life in New Jersey, ensuring residents have access to quality medical care and protection against financial burdens associated with healthcare costs. In this comprehensive guide, we will delve into the world of healthcare insurance in the Garden State, exploring its landscape, key players, coverage options, and the impact it has on the lives of New Jerseyans.

Understanding Healthcare Insurance in New Jersey

New Jersey boasts a robust healthcare insurance market, offering a wide range of plans and options to cater to the diverse needs of its residents. The state’s commitment to healthcare accessibility is evident in its policies and initiatives, making it an ideal case study for understanding the complexities of healthcare insurance.

The Regulatory Environment

The New Jersey Department of Banking and Insurance (DOBI) plays a pivotal role in regulating the healthcare insurance industry within the state. DOBI ensures compliance with state and federal laws, approves insurance rates, and protects consumers from fraudulent practices. Their oversight contributes to a stable and competitive insurance market.

One notable regulation in New Jersey is the Individual Mandate, which requires most residents to have qualifying health insurance coverage. Failure to comply can result in a tax penalty. This mandate encourages wider insurance coverage and helps stabilize the market.

| Regulation | Description |

|---|---|

| Individual Mandate | Requires most residents to have health insurance coverage. |

| Essential Health Benefits | Mandates that all plans cover a set of essential health services, ensuring comprehensive coverage. |

| Rate Review | Insurance companies must submit rate increase requests to DOBI for approval, ensuring transparency and preventing excessive hikes. |

Key Players in the Healthcare Insurance Industry

New Jersey’s healthcare insurance market is dominated by several major providers, each offering a unique set of plans and services. These companies compete to provide the best value and coverage to residents, fostering a dynamic and consumer-friendly environment.

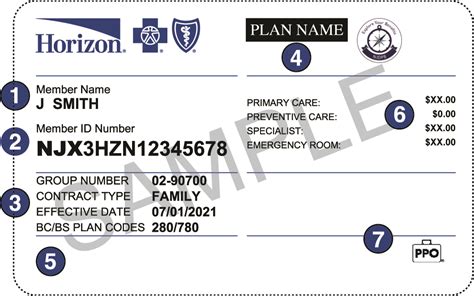

- Horizon Blue Cross Blue Shield of New Jersey - As the state's largest insurer, Horizon BCBSNJ offers a wide range of plans, including individual, family, and Medicare options. They are known for their extensive provider network and innovative wellness programs.

- AmeriHealth New Jersey - AmeriHealth focuses on affordable, high-quality healthcare coverage. They offer a variety of plans, including employer-sponsored and individual market options, with a strong emphasis on preventative care.

- UnitedHealthcare - UnitedHealthcare provides comprehensive healthcare plans in New Jersey, covering various needs. Their plans often include additional benefits like vision and dental coverage.

- Oscar Health - Oscar Health brings a modern approach to healthcare insurance, offering user-friendly plans with a focus on digital accessibility and transparency. They provide individual and family plans with a range of coverage options.

Coverage Options and Plans

New Jersey residents have a plethora of healthcare insurance plans to choose from, each designed to cater to different needs and budgets. Understanding these options is crucial for making informed decisions about healthcare coverage.

Individual and Family Plans

Individual and family plans are designed for those who are self-employed, don’t have access to employer-sponsored coverage, or simply prefer to choose their own healthcare provider. These plans offer flexibility and a range of coverage levels to suit various needs.

- Bronze Plans - These plans typically have lower premiums but higher deductibles and out-of-pocket costs. They are ideal for those who are generally healthy and don't anticipate frequent healthcare needs.

- Silver Plans - Silver plans strike a balance between premiums and out-of-pocket costs. They offer a good value for those who anticipate occasional healthcare expenses.

- Gold and Platinum Plans - Gold and Platinum plans provide the most comprehensive coverage, with lower deductibles and out-of-pocket expenses. These plans are ideal for those with ongoing healthcare needs or those who prefer the peace of mind of extensive coverage.

Employer-Sponsored Plans

Many New Jersey residents receive healthcare coverage through their employers. These plans are often more cost-effective and provide additional benefits tailored to the needs of the workforce. Employers may offer a choice of plans or a single comprehensive option.

Medicare and Medicaid

New Jersey’s Medicare and Medicaid programs provide essential healthcare coverage for seniors, individuals with disabilities, and low-income families. These government-funded programs ensure access to necessary medical services for those who might otherwise face financial barriers.

| Program | Eligibility | Coverage |

|---|---|---|

| Medicare | Seniors aged 65 and above, individuals with certain disabilities | Covers hospital stays, doctor visits, prescription drugs, and more |

| Medicaid | Low-income individuals and families, pregnant women, children | Provides comprehensive healthcare coverage, including dental and vision care |

The Impact of Healthcare Insurance in New Jersey

Healthcare insurance plays a vital role in the lives of New Jersey residents, impacting their health outcomes, financial stability, and overall well-being. Access to quality healthcare coverage can mean the difference between timely treatment and delayed or denied care.

Health Outcomes

With comprehensive healthcare insurance, New Jerseyans are more likely to receive preventive care, manage chronic conditions, and seek timely treatment for illnesses. This leads to improved health outcomes and a higher quality of life.

Financial Protection

Healthcare insurance provides a crucial financial safety net, protecting residents from the often exorbitant costs of medical treatment. With insurance coverage, individuals can access necessary care without facing financial ruin.

Access to Quality Care

A robust healthcare insurance market, as seen in New Jersey, ensures that residents have a wide range of providers and facilities to choose from. This competition drives innovation and improves the overall quality of healthcare services.

Future Implications and Innovations

The healthcare insurance landscape in New Jersey is continuously evolving, driven by technological advancements, changing consumer needs, and policy reforms. Keeping abreast of these developments is essential for residents to make informed decisions about their healthcare coverage.

Telehealth and Digital Innovations

The rise of telehealth services has revolutionized healthcare access, particularly during the COVID-19 pandemic. Many insurance providers now offer telehealth benefits, allowing residents to consult with healthcare professionals remotely. This trend is expected to continue, enhancing convenience and accessibility.

Value-Based Care Models

New Jersey’s healthcare insurance providers are increasingly adopting value-based care models, which focus on the quality and outcomes of care rather than the quantity of services provided. This shift aims to improve patient health while reducing costs, making healthcare more sustainable and efficient.

Policy and Regulatory Changes

The healthcare insurance industry is subject to ongoing policy reforms at both the state and federal levels. New Jersey’s commitment to healthcare accessibility and affordability is evident in its continuous efforts to improve the regulatory environment. Residents should stay informed about these changes to understand their impact on coverage and costs.

FAQs

How do I choose the right healthcare insurance plan for my needs?

+

When selecting a healthcare insurance plan, consider your healthcare needs, budget, and preferences. Assess whether you require extensive coverage for ongoing medical conditions or if a more basic plan with lower premiums suits your needs. Research different providers and their offerings to find the best fit.

What happens if I miss the open enrollment period for healthcare insurance?

+

If you miss the open enrollment period, you may still be able to enroll in a healthcare plan outside of this window if you experience a qualifying life event, such as marriage, birth of a child, or loss of existing coverage. Check with your preferred insurance provider to understand your options.

Are there any discounts or subsidies available for healthcare insurance in New Jersey?

+

Yes, New Jersey offers various discounts and subsidies to make healthcare insurance more affordable. These include premium tax credits for low- and middle-income individuals and families, as well as cost-sharing reductions for those with lower incomes. Check with the DOBI or your insurance provider for more information.