Healthy Indiana Insurance

In the ever-evolving landscape of healthcare, finding the right insurance plan can be a daunting task. With numerous options available, understanding the nuances of each plan is crucial to making an informed decision. This article aims to delve into the specifics of Healthy Indiana Insurance, a program designed to provide affordable healthcare coverage to residents of Indiana. By exploring its unique features, eligibility criteria, and benefits, we aim to offer a comprehensive guide to help individuals navigate this essential aspect of their well-being.

The Evolution of Healthy Indiana Insurance

Healthy Indiana Insurance, often referred to as HII, is a state-based healthcare program that was introduced in 2007 as a result of a collaborative effort between the state government and private healthcare providers. The primary objective of this initiative was to bridge the gap in healthcare coverage for low-income individuals and families who did not qualify for Medicaid but still faced challenges in affording private insurance plans.

The program has undergone significant transformations over the years, adapting to the changing needs of the community and the evolving healthcare landscape. One of the most notable changes occurred in 2015 when Healthy Indiana Plan 2.0 was launched, incorporating new features and expanded eligibility criteria. This update aimed to further enhance accessibility and provide more comprehensive coverage to residents.

Key Features of Healthy Indiana Insurance

Healthy Indiana Insurance stands out among healthcare programs due to its innovative design and unique features. One of its most distinctive aspects is the personal health account (PHA) that each enrollee receives. This account acts as a flexible spending account, allowing individuals to manage their healthcare expenses effectively. Enrollees receive a monthly contribution from the state, which they can use to pay for eligible healthcare services and prescription drugs.

Another notable feature is the premium assistance component. Healthy Indiana Insurance provides enrollees with the option to contribute to their PHA through premium payments. These payments can be made on a monthly or annual basis, offering flexibility to individuals based on their financial circumstances. The program also offers a premium credit feature, where enrollees who pay their premiums on time receive a credit that can be used to reduce their out-of-pocket costs.

| Feature | Description |

|---|---|

| Personal Health Account (PHA) | A flexible spending account that receives monthly contributions from the state to cover healthcare expenses. |

| Premium Assistance | Enrollees can contribute to their PHA through premium payments, offering flexibility in managing their healthcare costs. |

| Premium Credit | Timely premium payments result in credits that can be used to reduce out-of-pocket expenses. |

Eligibility and Enrollment

Understanding the eligibility criteria is essential for individuals seeking coverage under Healthy Indiana Insurance. The program is designed for residents of Indiana who meet specific income and citizenship requirements. As of the latest updates, the eligibility criteria are as follows:

- Individuals must be residents of Indiana and be citizens or lawfully present in the United States.

- The program is primarily aimed at adults between the ages of 19 and 64 who are not eligible for Medicare or Medicaid.

- The income requirements are based on the Federal Poverty Level (FPL). To qualify, an individual's income must be within a certain percentage of the FPL, which is adjusted annually. As of 2023, the income limit for a single person is $18,762 (138% of FPL), while for a family of four, the limit is $41,664 (138% of FPL).

Enrollment for Healthy Indiana Insurance typically opens during the annual Open Enrollment Period, which usually occurs in the fall. However, individuals who experience certain life events, such as losing their job or getting married, may qualify for a Special Enrollment Period, allowing them to enroll outside of the standard timeline.

The Enrollment Process

To enroll in Healthy Indiana Insurance, individuals can follow these steps:

- Visit the official Healthy Indiana Plan website or contact the program's helpline to obtain an application form.

- Complete the application, providing accurate and detailed information about your income, household size, and citizenship status.

- Submit the application through the online portal, by mail, or in person at a designated enrollment center.

- Once your application is processed, you will receive a notification regarding your eligibility and coverage details.

- If eligible, you will need to select a healthcare plan and begin your coverage by paying the required premiums (if applicable) and setting up your personal health account.

Covered Services and Benefits

Healthy Indiana Insurance offers a comprehensive range of healthcare services and benefits, ensuring that enrollees receive the necessary care. The program covers essential health benefits, including:

- Doctor visits and outpatient care

- Hospitalization and emergency services

- Prescription drug coverage

- Mental health and substance abuse treatment

- Preventive care, including vaccinations and screenings

- Maternity and newborn care

- Dental and vision services (with some limitations)

Additionally, Healthy Indiana Insurance provides access to a network of healthcare providers, ensuring that enrollees can receive care from a wide range of specialists and facilities. The program also offers a case management service, where enrollees with chronic conditions or complex healthcare needs can receive personalized support to navigate their healthcare journey effectively.

Cost-Sharing and Out-of-Pocket Expenses

While Healthy Indiana Insurance aims to provide affordable coverage, enrollees may still incur certain out-of-pocket expenses. These expenses typically include:

- Premiums: Depending on the plan chosen and the enrollee's income, premiums may be required. These premiums contribute to the overall cost of the insurance plan and are typically paid on a monthly basis.

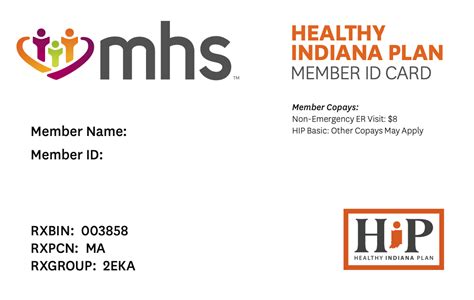

- Copayments: Enrollees may be required to pay a fixed amount for certain services, such as doctor visits or prescription drugs. These copayments are usually a set fee and are outlined in the plan's benefits summary.

- Deductibles: Some plans may have an annual deductible, which is the amount an enrollee must pay out of pocket before the insurance coverage kicks in. Deductibles vary based on the plan chosen and can be higher for certain types of care.

- Coinsurance: In some cases, enrollees may be required to pay a percentage of the cost for certain services. This is known as coinsurance and is typically a percentage of the total cost of the service.

It's important to note that Healthy Indiana Insurance offers a cost-sharing reduction feature, where enrollees with lower incomes may qualify for reduced cost-sharing amounts. This ensures that individuals with limited financial means do not face excessive out-of-pocket expenses.

The Impact and Future of Healthy Indiana Insurance

Since its inception, Healthy Indiana Insurance has had a significant impact on the healthcare landscape of Indiana. The program has provided coverage to thousands of residents who were previously uninsured, improving access to essential healthcare services and promoting overall community well-being.

Looking ahead, the future of Healthy Indiana Insurance is promising. With ongoing efforts to enhance the program's accessibility and coverage, it is expected to continue serving as a vital resource for low-income individuals and families. The program's innovative features, such as the personal health account and premium assistance, have set a precedent for other states to follow, potentially leading to more comprehensive and affordable healthcare options nationwide.

Expanding Access and Enhancing Coverage

Healthy Indiana Insurance is continuously evolving to meet the changing needs of its enrollees. The program is exploring ways to expand its network of healthcare providers, ensuring that residents have access to a diverse range of specialists and facilities. Additionally, efforts are being made to streamline the enrollment process, making it more user-friendly and accessible for individuals who may face barriers to accessing healthcare.

Furthermore, the program is committed to improving the overall experience of its enrollees. This includes enhancing the efficiency of claims processing, reducing administrative burdens, and providing more comprehensive educational resources to help individuals navigate the healthcare system effectively.

Can I enroll in Healthy Indiana Insurance if I have a pre-existing condition?

+Absolutely! Healthy Indiana Insurance does not discriminate based on pre-existing conditions. The program is designed to provide coverage to individuals regardless of their health status, ensuring that everyone has access to the care they need.

Are there any age restrictions for enrollment in Healthy Indiana Insurance?

+Yes, Healthy Indiana Insurance primarily targets adults between the ages of 19 and 64 who are not eligible for Medicare or Medicaid. However, there are specific programs within the Healthy Indiana Plan that cater to children and seniors, ensuring comprehensive coverage for all age groups.

How can I find out if I qualify for Healthy Indiana Insurance?

+You can visit the official Healthy Indiana Plan website, where you can find detailed information about the eligibility criteria and income requirements. The website also provides a pre-enrollment tool that allows you to estimate your eligibility based on your income and household size.