Help With Insurance Claim

Filing an insurance claim can be a complex and daunting process, especially when unexpected events occur. Whether it's a car accident, property damage, or a health-related issue, understanding the claims process and knowing how to navigate it effectively is crucial to ensuring a smooth and successful outcome. This comprehensive guide will walk you through the steps, providing expert insights and practical tips to help you navigate the insurance claim process with confidence.

Understanding the Basics: A Comprehensive Guide to Insurance Claims

Insurance claims are the very foundation of the insurance industry. When an insured individual experiences a covered loss or incident, they have the right to file a claim with their insurance provider. This process allows them to seek financial compensation or assistance to cover the costs associated with the loss. From vehicle accidents to medical emergencies and property damage, insurance claims provide a safety net to help individuals and businesses recover and rebuild.

The Claims Process: A Step-by-Step Breakdown

Navigating the insurance claims process can be smoother with a clear understanding of the steps involved. Here's a step-by-step guide to help you through the journey:

-

Notification of Loss: The first step is to promptly notify your insurance company about the incident or loss. This notification can be made via phone, email, or through your insurer's online platform. Provide as much detail as possible about the event, including the date, time, location, and any relevant circumstances.

-

Initial Assessment: Once you've reported the claim, the insurance company will assign a claims adjuster to handle your case. The adjuster's role is to evaluate the extent of the loss and determine whether it's covered by your insurance policy. They may request additional information, such as photos, police reports, or medical records, to facilitate their assessment.

-

Policy Review: The claims adjuster will carefully review your insurance policy to understand the scope of coverage. This step is crucial, as it determines whether your specific loss is covered and to what extent. It's essential to have a clear understanding of your policy's terms and conditions to ensure a smooth claims process.

-

Claim Investigation: The adjuster will conduct a thorough investigation to gather all the necessary facts and evidence related to your claim. This may involve inspecting the damaged property, interviewing witnesses, and reviewing relevant documents. The investigation helps the adjuster assess the validity and extent of your claim.

-

Settlement Offer: Based on the findings of the investigation and the terms of your policy, the insurance company will make a settlement offer. This offer represents the amount they believe is appropriate to cover your losses. It's important to carefully review the offer and consider whether it adequately addresses your needs.

-

Negotiation and Agreement: If you believe the settlement offer is insufficient or requires clarification, you have the right to negotiate. Engaging in a respectful and open dialogue with the adjuster can help reach a mutually beneficial agreement. It's crucial to provide supporting evidence and be prepared to justify your requested amount.

-

Payment and Resolution: Once an agreement is reached, the insurance company will process the payment. This typically involves issuing a check or transferring funds to your designated account. At this stage, the claims process is considered resolved, and you can focus on rebuilding and moving forward.

Maximizing Your Claim: Tips and Strategies

To ensure a successful insurance claim, consider these expert tips and strategies:

-

Prompt Reporting: Notify your insurance company as soon as possible after an incident. Delays can impact the claims process and may even result in denied claims.

-

Gather Evidence: Collect all relevant documentation, photos, and evidence related to your claim. This can significantly strengthen your case and support your request for compensation.

-

Understand Your Policy: Take the time to carefully review your insurance policy. Familiarize yourself with the coverage limits, exclusions, and any specific requirements for filing claims. This knowledge will empower you to navigate the process more effectively.

-

Keep Records: Maintain a detailed record of all communications, including dates, times, and the names of individuals you interact with during the claims process. This documentation can be invaluable if any disputes arise.

-

Seek Professional Advice: If your claim is complex or involves significant losses, consider consulting with an insurance claims professional or legal expert. They can provide specialized guidance and support throughout the process.

-

Negotiate with Confidence: When negotiating a settlement, approach the conversation with confidence and preparedness. Present your case clearly and provide supporting evidence to justify your requested amount. Remember, you have the right to seek a fair and reasonable outcome.

Real-Life Examples: Success Stories and Case Studies

To illustrate the impact of effective insurance claims, let's explore a few real-life success stories:

| Scenario | Outcome |

|---|---|

| A car accident resulted in significant vehicle damage and medical expenses. The insured individual promptly reported the claim and provided detailed evidence. The insurance company processed the claim efficiently, resulting in a fair settlement that covered all expenses. | Full coverage of vehicle repairs and medical bills, allowing the insured to resume their daily activities without financial strain. |

| A homeowner experienced extensive water damage due to a burst pipe. They immediately contacted their insurance provider and provided photos and documentation. The insurer's prompt response and thorough investigation led to a successful claim, covering the cost of repairs and preventing further damage. | The homeowner was able to restore their property to its pre-damage condition, ensuring their home remained a safe and comfortable space. |

| A small business owner suffered a cyberattack, resulting in data loss and financial fraud. They filed a claim with their cyber insurance policy, providing detailed reports and evidence. The insurance company's specialized team worked diligently to resolve the claim, providing financial support and helping the business owner recover from the incident. | The business owner received the necessary funds to mitigate the financial impact of the cyberattack, allowing them to continue operations and rebuild their online presence. |

The Future of Insurance Claims: Innovations and Trends

The insurance industry is continuously evolving, and the claims process is no exception. Here's a glimpse into the future of insurance claims:

Technological Advancements

The integration of technology is revolutionizing the insurance claims landscape. From digital claim forms to AI-powered assessments, technology is streamlining the process and enhancing efficiency. Insurers are leveraging mobile apps and online platforms to enable policyholders to report claims quickly and conveniently. Additionally, drones and virtual reality are being utilized for remote inspections, reducing the need for physical visits and expediting the claims process.

Enhanced Customer Experience

Insurance companies are prioritizing the customer experience, recognizing the importance of a seamless and empathetic approach. Personalized claim support and dedicated claim specialists are becoming standard, ensuring policyholders receive the guidance and assistance they need. Real-time claim tracking and transparent communication are also enhancing the overall experience, providing policyholders with peace of mind and a sense of control throughout the process.

Data-Driven Decisions

The insurance industry is harnessing the power of data analytics to make more informed decisions. By analyzing vast amounts of data, insurers can identify trends, predict risks, and optimize their claims handling processes. This data-driven approach enables insurers to offer more accurate coverage and tailored solutions, benefiting both policyholders and the industry as a whole.

Frequently Asked Questions

How long does the insurance claims process typically take?

+

The duration of the claims process can vary depending on the complexity of the claim and the insurer’s workload. Simple claims may be resolved within a few days or weeks, while more complex cases can take several weeks or even months. It’s essential to maintain open communication with your insurance company to stay updated on the progress of your claim.

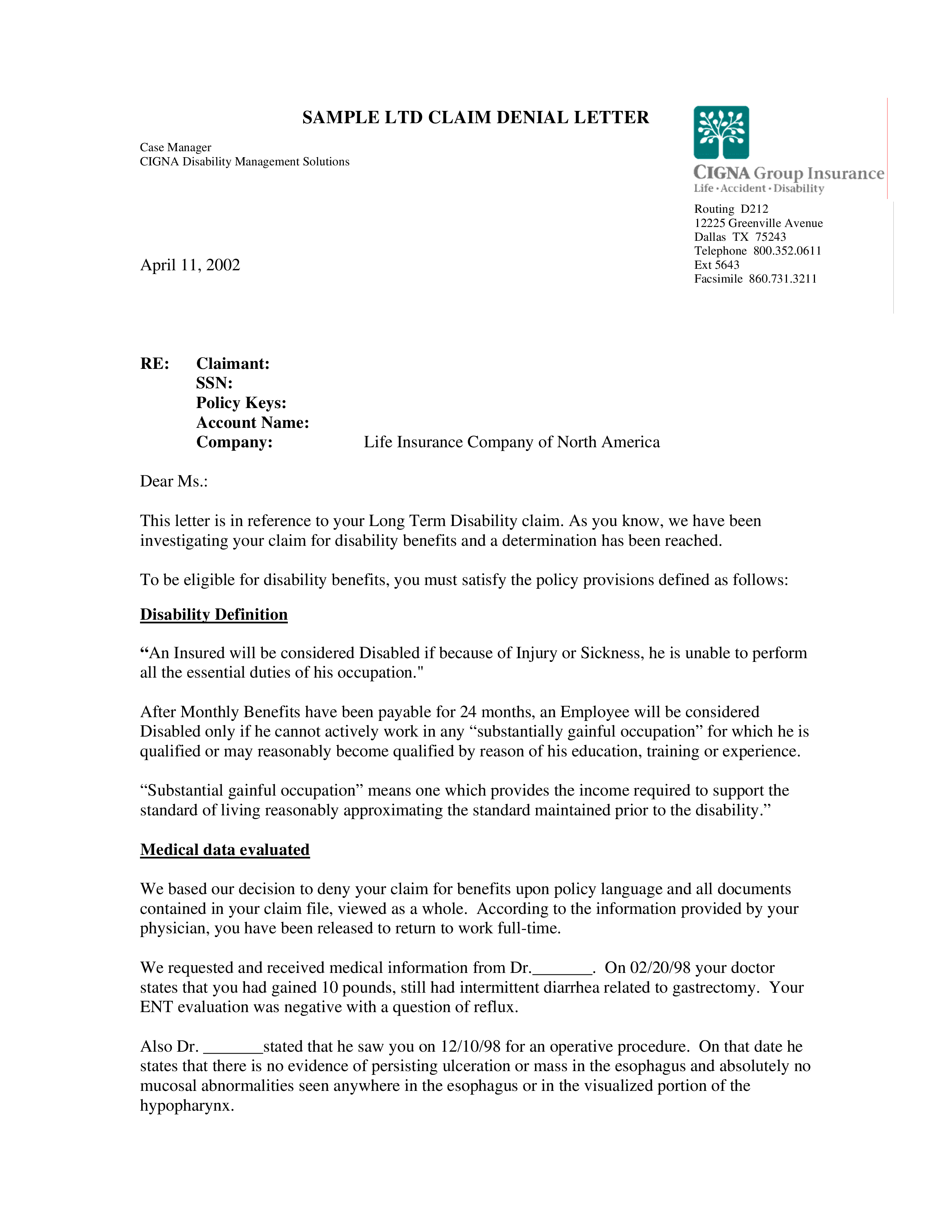

What should I do if my insurance claim is denied?

+

If your insurance claim is denied, carefully review the denial letter to understand the reasons for the decision. Consider seeking professional advice to assess the validity of the denial and explore your options. You may have the right to appeal the decision or negotiate further with the insurance company. It’s crucial to act promptly and gather supporting evidence to strengthen your case.

Can I choose my own repair shop or medical provider when filing a claim?

+

The ability to choose your own repair shop or medical provider depends on your insurance policy and the specific circumstances of your claim. Some policies offer flexibility in selecting service providers, while others may have preferred networks or approved vendors. Review your policy terms or consult with your insurance company to understand your options and any potential restrictions.

What happens if I need to file multiple claims within a short period?

+

Filing multiple claims within a short period can impact your insurance coverage and future premiums. Insurance companies may review your claim history and assess the frequency and severity of your claims. It’s essential to maintain open communication with your insurer and provide accurate information. In some cases, multiple claims may result in increased premiums or even policy cancellation. Consider discussing alternative coverage options with your insurance provider.

Are there any common mistakes to avoid when filing an insurance claim?

+

Yes, there are a few common mistakes to avoid when filing an insurance claim. These include failing to promptly report the claim, providing incomplete or inaccurate information, not gathering sufficient evidence, and assuming coverage without thoroughly reviewing your policy. Additionally, it’s important to avoid exaggerating or misrepresenting the extent of your losses. Being honest, thorough, and proactive can help ensure a smooth and successful claims process.