Home Business Insurance

For many individuals, the idea of running a business from the comfort of their own home is an appealing prospect. It offers flexibility, autonomy, and the potential for financial success. However, when it comes to safeguarding your home-based business, the question of insurance often arises. Home business insurance is a critical aspect that requires careful consideration to ensure the protection of your assets, finances, and livelihood.

Understanding Home Business Insurance

Home business insurance is a specialized type of coverage designed to cater to the unique needs of entrepreneurs operating their businesses from home. It provides comprehensive protection, addressing various risks and liabilities that may arise during the course of running a business. Unlike standard home insurance policies, which primarily cover personal property and personal liability, home business insurance extends its scope to include business-related risks.

The coverage offered by home business insurance policies can vary depending on the provider and the specific needs of the business owner. Typically, these policies cover a range of potential losses, including property damage, theft, liability claims, and business interruption. Let's delve deeper into each of these aspects to understand how home business insurance can safeguard your entrepreneurial venture.

Property Coverage

One of the primary concerns for any business owner is the protection of their physical assets. Home business insurance policies often include coverage for damage or loss of business property, such as office equipment, inventory, and even custom-built structures. For instance, if a fire breaks out in your home office, causing damage to your computers and other business essentials, the property coverage under your insurance policy would step in to provide financial assistance for repairs or replacements.

| Covered Property | Description |

|---|---|

| Office Equipment | Computers, printers, furniture, and other tools essential for running your business. |

| Inventory | Products or materials you sell or use in your business operations. |

| Buildings | Custom-built structures on your property specifically for business purposes. |

Liability Protection

Liability coverage is a critical aspect of home business insurance, as it protects you from financial losses resulting from third-party claims. Whether it’s a client tripping on a loose carpet in your home office or a disgruntled customer suing your business for defective products, liability insurance steps in to cover the costs associated with such incidents.

This coverage typically includes legal defense costs, medical expenses for injured parties, and any settlements or judgments resulting from the claim. By having liability protection in place, you can focus on growing your business without the constant worry of potential financial disasters.

| Liability Coverage | Description |

|---|---|

| Premises Liability | Covers injuries or damages that occur on your business premises, including your home office. |

| Product Liability | Protects your business if your products cause harm or damage to others. |

| Professional Liability | Covers claims arising from professional services or advice provided by your business. |

Business Interruption

Business interruption coverage is a vital component of home business insurance, especially for those whose livelihood depends on uninterrupted operations. In the event of a covered loss, such as a fire or severe weather damage, this coverage steps in to provide financial support during the temporary shutdown of your business.

It covers expenses like rent, payroll, and other ongoing costs until your business can resume normal operations. This coverage is particularly crucial for businesses with high overhead costs or those that rely on consistent revenue streams. By having business interruption coverage, you can ensure that a temporary setback doesn't become a permanent roadblock to your success.

Customizing Your Home Business Insurance

Every home-based business is unique, and so are its insurance needs. Fortunately, home business insurance policies can be tailored to meet the specific requirements of your venture. Whether you’re a sole proprietor, a small team, or a growing enterprise, there are options available to provide the right level of protection.

Coverage for Specific Industries

Different industries come with their own set of risks and liabilities. Home business insurance policies often offer specialized coverage for specific industries, ensuring that the unique needs of your business are addressed.

For instance, if you're a consultant or professional service provider, your policy might include professional liability coverage to protect against claims of negligence or errors in your work. On the other hand, if you run an e-commerce business, you may require coverage for cyber liability, safeguarding your business from the risks associated with online transactions and data breaches.

| Industry | Specialized Coverage |

|---|---|

| Consulting | Professional Liability |

| E-commerce | Cyber Liability |

| Manufacturing | Product Recall Insurance |

Additional Coverage Options

Beyond the standard property, liability, and business interruption coverage, home business insurance policies often offer a range of additional options to enhance your protection.

- Business Personal Property: This coverage provides protection for personal items used for business purposes, such as laptops, smartphones, and other portable devices.

- Data Breach Coverage: In today's digital age, safeguarding your business's data is crucial. This coverage helps cover the costs associated with a data breach, including notification expenses and legal fees.

- Hired and Non-Owned Auto: If you use a vehicle for business purposes, this coverage protects you in the event of an accident while driving for work.

Considerations for Home Business Owners

As a home business owner, there are several key considerations to keep in mind when evaluating your insurance needs.

Assessing Your Risks

Take the time to thoroughly assess the risks associated with your business. Consider factors such as the nature of your work, the number of employees, and any potential hazards specific to your industry. By understanding your risks, you can make informed decisions about the coverage you require.

Reviewing Your Existing Insurance

If you already have a standard home insurance policy, it’s essential to review the terms and conditions to understand what is and isn’t covered. Many home insurance policies have limitations when it comes to business-related losses. By comparing your existing coverage with the needs of your business, you can identify any gaps that need to be addressed.

Choosing the Right Provider

Not all insurance providers offer the same level of expertise or coverage for home-based businesses. When selecting a provider, look for companies with a strong track record in the field and a reputation for excellent customer service. Consider factors such as their financial stability, the range of coverage options they offer, and their claims handling process.

Working with an Insurance Professional

Navigating the world of insurance can be complex, especially when it comes to specialized coverage like home business insurance. Working with an experienced insurance professional can be invaluable. They can guide you through the process, helping you understand the intricacies of different policies and ensuring you get the coverage that best suits your needs.

The Importance of Adequate Coverage

Having adequate home business insurance is not just a matter of compliance or financial prudence; it’s a crucial aspect of protecting your entrepreneurial journey. Without the right coverage, a single incident could spell disaster for your business, leaving you with costly repairs, legal fees, or even the complete loss of your livelihood.

Imagine a scenario where a client slips and falls in your home office, resulting in a severe injury. Without liability coverage, you could be facing significant medical expenses and potential legal costs. Or, consider a fire that destroys your entire home office, including all your equipment and inventory. Without property coverage, you'd be left to bear the financial burden of replacing everything out of pocket.

By investing in comprehensive home business insurance, you're taking a proactive approach to risk management. It allows you to focus on growing your business, knowing that you have a safety net in place to protect your assets and your future.

Conclusion

In the world of home-based businesses, where the lines between personal and professional can often blur, having the right insurance coverage is paramount. Home business insurance provides the peace of mind that comes with knowing you’re protected from a wide range of potential risks. Whether it’s safeguarding your physical assets, protecting your reputation, or ensuring business continuity, these policies are tailored to meet the unique needs of entrepreneurs.

As you embark on your entrepreneurial journey, take the time to thoroughly evaluate your insurance needs. By understanding the coverage options available and working with trusted professionals, you can ensure that your home business is well-protected, allowing you to focus on what matters most: building a successful and sustainable venture.

Can I add home business insurance to my existing home insurance policy?

+Yes, many home insurance providers offer endorsements or riders to add business coverage to your existing policy. However, it’s essential to carefully review the terms and limits to ensure they align with your business needs.

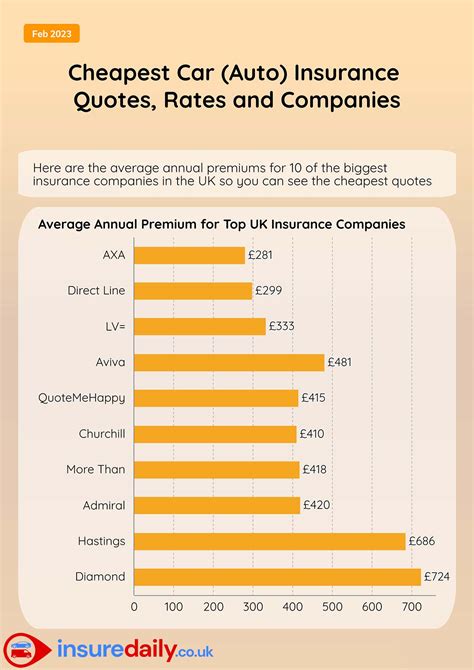

How much does home business insurance cost?

+The cost of home business insurance varies depending on several factors, including the size and nature of your business, the coverage limits you choose, and your location. It’s best to obtain quotes from multiple providers to find the most competitive rates.

What if I operate my business from multiple locations, including my home?

+Home business insurance policies typically cover business activities that occur at your primary residence. If you operate your business from multiple locations, you may need to obtain additional coverage or a separate policy to ensure all your business operations are adequately protected.

Are there any tax benefits associated with home business insurance premiums?

+Yes, home business insurance premiums can often be deducted as a business expense on your tax return. It’s advisable to consult with a tax professional to understand the specific deductions you may be eligible for.