Home Insurance Average Cost Per Month

When it comes to safeguarding your home and belongings, understanding the average cost of home insurance is essential. Home insurance provides financial protection against various risks, including damage to your property, theft, and liability claims. In this comprehensive guide, we will delve into the factors influencing the average monthly cost of home insurance, offering you valuable insights to make informed decisions about your coverage.

Factors Affecting Home Insurance Costs

The cost of home insurance varies significantly depending on numerous factors. By understanding these factors, you can estimate the average monthly cost more accurately and ensure you’re getting the right coverage for your needs.

Location and Regional Differences

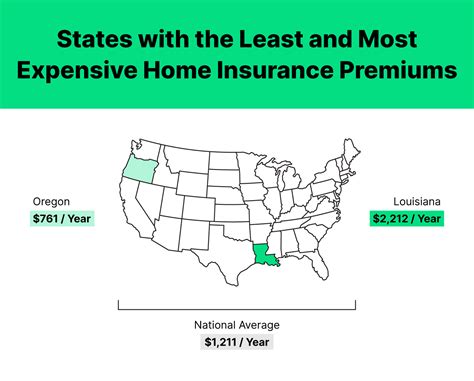

One of the most influential factors is the location of your home. Insurance rates can vary widely between different regions and even neighborhoods. Areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, often command higher insurance premiums. For instance, coastal regions susceptible to hurricanes may face significantly higher costs due to the increased risk of storm damage.

Similarly, regions with a higher incidence of crimes like burglaries or vandalism may also see elevated insurance rates. It's crucial to consider the specific risks associated with your location when estimating average costs.

Type of Home and Construction Materials

The type of home you own and the materials used in its construction play a vital role in determining insurance costs. Generally, homes built with more durable and fire-resistant materials tend to be less expensive to insure. For example, a brick or concrete home may offer better protection against fire and severe weather, resulting in lower insurance premiums compared to a wooden structure.

The size and age of your home also impact insurance rates. Larger homes typically require more coverage, while older homes may have outdated wiring or plumbing, posing higher risks. Additionally, unique architectural features or specialized construction techniques can influence insurance costs.

Coverage Limits and Deductibles

The coverage limits you choose for your home insurance policy have a direct impact on the monthly cost. Higher coverage limits, providing more extensive protection, will result in higher premiums. It’s essential to strike a balance between adequate coverage and affordability.

Similarly, the deductible you select affects the insurance rate. A higher deductible, requiring you to pay more out of pocket before the insurance coverage kicks in, often leads to lower monthly premiums. However, it's crucial to choose a deductible that aligns with your financial capabilities and comfort level.

Policy Add-ons and Endorsements

Additional coverage options, known as add-ons or endorsements, can significantly impact your insurance costs. These options allow you to customize your policy to meet specific needs. For example, if you own valuable jewelry or fine art, you may opt for specialized coverage to protect these items.

Endorsements like flood insurance or earthquake coverage, which are not typically included in standard policies, can substantially increase your monthly premiums. It's important to carefully assess your needs and the potential risks to determine whether these add-ons are necessary.

Claims History and Credit Score

Your insurance company considers your claims history when determining rates. A history of frequent claims may result in higher premiums, as it indicates a higher risk of future claims. On the other hand, a clean claims record can lead to more favorable rates.

Additionally, your credit score can influence insurance costs. Many insurance companies use credit-based insurance scores to assess risk. A higher credit score often translates to lower insurance rates, as it indicates a lower likelihood of filing claims.

Average Monthly Cost of Home Insurance

Now that we’ve explored the factors affecting home insurance costs, let’s delve into the average monthly premiums you can expect. Keep in mind that these averages are estimates and can vary significantly based on your unique circumstances.

According to recent industry data, the average monthly cost of home insurance in the United States is approximately $100. However, this figure can range from as low as $50 to as high as $200 or more, depending on the factors discussed earlier.

| Average Monthly Cost | Coverage Range |

|---|---|

| $50 | For basic coverage with limited add-ons and lower coverage limits. |

| $100 | A common average, offering standard coverage and some additional protections. |

| $200 | Higher-end coverage with extensive add-ons and higher coverage limits. |

Tips for Reducing Home Insurance Costs

While the average monthly cost of home insurance is a useful benchmark, there are strategies you can employ to potentially reduce your premiums. Here are some expert tips to consider:

Bundle Policies

If you have multiple insurance needs, such as auto and home insurance, consider bundling your policies with the same insurer. Bundling often results in significant discounts and can lower your overall insurance costs.

Review Coverage Annually

Regularly review your home insurance policy to ensure it aligns with your current needs. As your circumstances change, so might your insurance requirements. Conduct an annual review to make necessary adjustments and potentially lower your premiums.

Improve Home Security

Investing in home security measures, such as installing a monitored alarm system, reinforced doors, or security cameras, can reduce the risk of theft and vandalism. Many insurance companies offer discounts for homes with enhanced security features, so it’s a win-win situation.

Maintain a Good Credit Score

As mentioned earlier, your credit score plays a role in determining insurance rates. Maintaining a good credit score can lead to lower insurance premiums. Focus on responsible financial practices to keep your credit score healthy and potentially reduce your insurance costs.

Shop Around and Compare Quotes

Insurance rates can vary significantly between different providers. Don’t settle for the first quote you receive. Shop around and compare quotes from multiple insurers to find the best combination of coverage and price. Online comparison tools can be particularly helpful in this process.

Understanding Your Policy’s Value

While cost is an important consideration when choosing home insurance, it’s equally crucial to understand the value of your policy. A comprehensive policy provides peace of mind and financial protection against a wide range of risks. Here’s a breakdown of some key coverage components:

Dwelling Coverage

This coverage protects the physical structure of your home, including walls, roofs, and foundations. It ensures that, in the event of damage or destruction, you can rebuild your home to its pre-loss condition.

Personal Property Coverage

This coverage safeguards the contents of your home, such as furniture, appliances, and personal belongings. It provides financial protection in case of theft, damage, or loss due to covered perils.

Liability Coverage

Liability coverage is a vital component of home insurance, as it protects you from legal claims and financial losses arising from accidents or injuries that occur on your property. It covers medical expenses and potential legal fees, providing crucial financial protection.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered loss, this coverage provides financial assistance for temporary living expenses, such as hotel stays or rental costs, until you can return to your home.

The Future of Home Insurance

As technology advances and insurance companies adapt to changing risks, the home insurance landscape is evolving. Here are some insights into the future of home insurance and how it may impact costs and coverage:

Digital Transformation

Insurance companies are increasingly leveraging digital technologies to streamline processes and enhance customer experiences. Online quoting, policy management, and claims reporting are becoming more efficient and user-friendly. This digital transformation may lead to more competitive pricing and improved customer service.

Risk Assessment and Data Analytics

Advanced data analytics and risk assessment tools are helping insurers better understand and manage risks. By analyzing vast amounts of data, insurers can more accurately predict potential losses and price policies accordingly. This precision in risk assessment may result in more tailored coverage options and potentially lower premiums for low-risk policyholders.

Emerging Risks and Coverage Innovations

As new risks emerge, such as cyber threats and climate change-related disasters, insurance companies are developing innovative coverage solutions. Cyber insurance, for example, is becoming more prevalent to protect against online threats. Additionally, insurers are exploring ways to address climate-related risks, offering specialized coverage for extreme weather events.

Smart Home Technology Integration

The integration of smart home technology is transforming the insurance industry. Insurers are exploring ways to leverage data from smart devices to assess risks and offer customized coverage. For instance, insurers may offer discounts to policyholders who use smart home systems for security or energy efficiency.

Conclusion

Understanding the average monthly cost of home insurance is just the beginning. By considering the factors that influence rates and exploring strategies to reduce costs, you can make informed decisions about your coverage. Remember, the value of a comprehensive home insurance policy extends far beyond the monthly premium, providing essential financial protection for your most valuable asset.

How can I find the best home insurance rates for my needs?

+To find the best rates, it’s advisable to obtain quotes from multiple insurers. Compare coverage options, deductibles, and premiums to identify the most suitable and affordable policy for your needs. Online comparison tools can be a valuable resource in this process.

Are there any discounts available for home insurance policies?

+Yes, insurers often offer discounts for various reasons. Common discounts include bundling multiple policies, having a good claims history, installing home security systems, and maintaining a good credit score. Check with insurers to explore available discounts.

What factors influence the cost of home insurance deductibles?

+The cost of home insurance deductibles can vary based on factors such as the level of coverage, the insurer’s risk assessment, and the policyholder’s claims history. Higher deductibles generally result in lower premiums, while lower deductibles can provide more financial protection but at a higher cost.

Can I customize my home insurance policy to suit my specific needs?

+Absolutely! Most insurers offer a range of policy add-ons and endorsements to tailor your coverage to your specific needs. Whether you have valuable jewelry, fine art, or unique home features, you can enhance your policy to provide the right level of protection.

How often should I review and update my home insurance policy?

+It’s recommended to review your policy annually or whenever your circumstances change. Life events like marriage, home renovations, or the purchase of high-value items may impact your insurance needs. Regular reviews ensure your coverage remains adequate and up-to-date.