Home Insurance Companies Quotes

Navigating the World of Home Insurance: A Comprehensive Guide to Getting the Best Quotes

Securing adequate home insurance is a crucial step for any homeowner, offering financial protection and peace of mind. However, with numerous insurance companies vying for your business, finding the right policy and the best quote can be a daunting task. This comprehensive guide aims to demystify the process, providing you with the knowledge and tools to navigate the world of home insurance quotes effectively.

Understanding Home Insurance Policies

Home insurance policies, also known as homeowners insurance, are designed to protect homeowners from financial losses related to their property. These policies typically cover a range of risks, including damage to the structure of the home, its contents, and liability coverage for injuries that occur on the property. The level of coverage and the specific risks insured can vary significantly between policies, which is why understanding your needs and comparing quotes is essential.

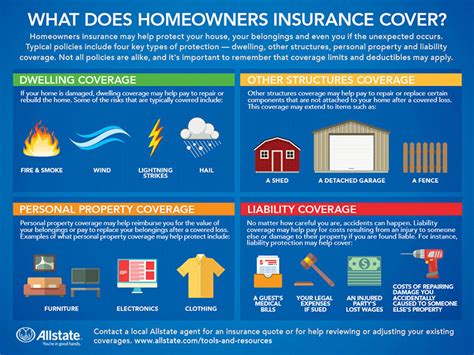

A standard home insurance policy typically includes the following types of coverage:

- Dwelling Coverage: This covers the physical structure of your home, including the walls, roof, and permanent fixtures. It also covers detached structures like garages and sheds.

- Personal Property Coverage: This covers the contents of your home, including furniture, appliances, clothing, and other personal belongings. Some policies may offer actual cash value (ACV) coverage, while others may provide replacement cost coverage, which is generally more comprehensive.

- Liability Coverage: This protects you from financial liability if someone is injured on your property or if you're found legally responsible for causing property damage or bodily injury to others.

- Additional Living Expenses (ALE): In the event that your home becomes uninhabitable due to a covered loss, this coverage helps cover the costs of temporary housing and other necessary expenses.

Additionally, some policies may offer optional coverages, such as:

- Personal Liability Coverage: This provides broader liability protection beyond what's typically included in standard policies.

- Medical Payments Coverage: This covers medical expenses for visitors who are injured on your property, regardless of fault.

- Water Backup Coverage: This covers damage caused by water backup from drains, sump pumps, or septic systems.

Factors Affecting Home Insurance Quotes

Home insurance quotes are influenced by a multitude of factors, each playing a role in determining the cost and coverage of your policy. Understanding these factors can help you make informed decisions when comparing quotes.

Location and Climate

The geographical location of your home is a significant factor in determining your insurance quote. Areas prone to natural disasters like hurricanes, tornadoes, or wildfires often result in higher premiums. Additionally, regions with high crime rates may also see increased insurance costs due to the risk of theft or vandalism.

Home Value and Size

The value and size of your home are key considerations for insurance providers. Larger homes or those with expensive materials and finishes may require more coverage, which can result in higher premiums. The age and condition of your home can also impact quotes, as older homes may be more susceptible to damage or require more frequent repairs.

Risk Factors

Insurance companies assess various risk factors when calculating quotes. These can include the proximity of your home to fire hydrants or fire stations, the presence of security systems or fire suppression systems, and the type of roof on your home. For example, homes with wood shingle roofs may be considered higher risk due to their flammability.

Claim History

Your personal claim history can significantly impact your insurance quotes. If you've had multiple claims in the past, especially for costly or frequent incidents, it may result in higher premiums or even difficulty in securing coverage. Some insurance companies may offer discounts for claim-free periods, so maintaining a clean claim history can be beneficial.

Credit Score

Believe it or not, your credit score can also influence your insurance quotes. Many insurance companies use credit-based insurance scores to assess risk, with the assumption that individuals with lower credit scores may be more likely to file claims. While this practice is controversial, it's important to note that your credit score can impact not only the cost of your insurance but also your ability to secure coverage.

Tips for Getting the Best Home Insurance Quotes

Now that we've covered the basics, here are some expert tips to help you navigate the home insurance quote process and secure the best coverage at the most competitive price.

Shop Around

Don't settle for the first quote you receive. Shopping around and comparing quotes from multiple insurance companies is crucial to finding the best deal. Online quote comparison tools can be a great starting point, but it's also beneficial to speak directly with insurance agents or brokers to get a personalized assessment of your needs.

Understand Your Coverage Needs

Before requesting quotes, take the time to understand your specific coverage needs. Consider the replacement cost of your home and its contents, and assess the level of liability coverage you require. Having a clear idea of your needs will help you evaluate quotes more effectively and ensure you're not overpaying for unnecessary coverage.

Consider Bundling Policies

If you're in the market for other types of insurance, such as auto or life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you purchase multiple policies from them, which can significantly reduce your overall insurance costs.

Review Your Policy Annually

Your insurance needs and the market rates for home insurance can change over time. It's a good practice to review your policy annually, especially if you've made significant home improvements or renovations. Regular policy reviews can help you ensure you're always getting the best value for your insurance dollar.

Utilize Discounts

Insurance companies offer a variety of discounts that can help reduce your premiums. These may include discounts for:

- Home security systems

- Senior citizens or retirees

- Loyalty or long-term customer discounts

- Certain occupations or professional affiliations

- Payment methods (e.g., automatic payments or annual payments)

Ask your insurance provider about the discounts they offer and ensure you're taking advantage of any that apply to you.

Comparing Home Insurance Quotes: A Step-by-Step Guide

Comparing home insurance quotes can be a complex process, but with a systematic approach, you can ensure you're making an informed decision. Here's a step-by-step guide to help you through the process.

Step 1: Identify Your Coverage Needs

Start by assessing your specific coverage needs. Consider the value of your home, its contents, and the level of liability coverage you require. Don't forget to factor in any optional coverages you may need, such as water backup or personal liability coverage.

Step 2: Gather Quotes

Collect quotes from multiple insurance providers. You can use online quote comparison tools, but it's also beneficial to reach out to insurance agents or brokers directly. This will give you a more personalized assessment of your needs and the option to ask questions about specific policies.

Step 3: Analyze the Quotes

Once you have a collection of quotes, it's time to analyze them. Compare the coverage limits, deductibles, and premiums. Look for any exclusions or limitations in the policies, and ensure you understand what's covered and what's not. Consider the financial stability and reputation of the insurance companies offering the quotes.

Step 4: Assess the Insurer's Claims Handling

The claims handling process is a critical aspect of home insurance. Research the insurer's claims handling reputation and customer service record. Look for reviews and ratings from independent sources, and consider reaching out to friends or family for personal recommendations.

Step 5: Negotiate and Finalize

If you've identified a policy that meets your needs and offers a competitive premium, it's time to negotiate and finalize the details. Don't be afraid to ask for a better rate or additional coverage. Many insurance companies are willing to negotiate, especially if you've been a loyal customer or if you're bundling multiple policies.

The Future of Home Insurance: Technological Innovations and Emerging Trends

The home insurance industry is evolving, with technological advancements and changing consumer needs driving innovation. Here's a glimpse into the future of home insurance and how it may impact your insurance experience.

Smart Home Technology and Insurance

The rise of smart home technology is transforming the way homeowners interact with their homes and, subsequently, the way insurance companies assess risk. Smart home devices, such as security cameras, smart locks, and water leak detection systems, can provide valuable data to insurance companies, potentially leading to more accurate risk assessments and personalized insurance rates.

Data-Driven Insurance

Insurance companies are increasingly leveraging data analytics to better understand risk and personalize insurance policies. By analyzing vast amounts of data, insurers can offer more precise coverage and pricing, taking into account individual factors such as home maintenance, occupancy patterns, and even the materials used in home construction.

On-Demand Insurance

The traditional annual insurance policy may soon be a thing of the past, as on-demand insurance models gain traction. These models allow homeowners to purchase insurance coverage for specific periods, such as during a renovation project or when hosting an event. This flexible approach to insurance can be particularly appealing to those with varying insurance needs throughout the year.

Blockchain and Insurance

Blockchain technology is revolutionizing various industries, and insurance is no exception. Blockchain's secure and transparent nature can streamline insurance processes, from policy issuance to claims handling. It can also facilitate the sharing of data between insurance companies and policyholders, potentially leading to more efficient and accurate insurance experiences.

Conclusion: Empowering Homeowners with Knowledge

The world of home insurance can be complex, but with the right knowledge and tools, you can navigate it confidently. Understanding your coverage needs, shopping around for quotes, and staying informed about the latest trends in the industry are all essential steps in securing the best home insurance policy for your needs. Remember, your home is one of your most valuable assets, and having the right insurance coverage is crucial to protecting it.

How often should I review my home insurance policy?

+

It’s recommended to review your home insurance policy annually, especially after significant life events or home improvements. This ensures your coverage remains up-to-date and aligns with your changing needs.

Can I switch insurance companies if I find a better quote?

+

Absolutely! Shopping around for insurance is a normal part of being a homeowner. If you find a better quote that meets your coverage needs, switching insurance companies can be a wise financial decision.

What should I do if I have multiple claims on my record?

+

Having multiple claims on your record can make it more challenging to find affordable insurance. Consider reviewing your home maintenance practices and taking steps to prevent future claims. You may also benefit from speaking with an insurance broker who specializes in high-risk policies.

Are there any ways to lower my home insurance premiums besides shopping around?

+

Yes, there are several strategies to lower your premiums. These include increasing your deductible, maintaining a claim-free record, improving your home’s security features, and ensuring your home is well-maintained. Regular policy reviews can also help you identify opportunities to save.

What is the role of an insurance broker in the home insurance process?

+

An insurance broker acts as an intermediary between you and insurance companies. They can provide expert advice, help you understand your coverage needs, and shop around for the best quotes on your behalf. Brokers can be particularly useful for complex insurance situations or for those with unique coverage requirements.